Covid-19 continues to unsettle boardrooms around the world, with the pandemic ranked as the number one concern for business executives in 2022, followed by environmental, social and governance (ESG) issues, according to a global study by analytics firm GlobalData.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

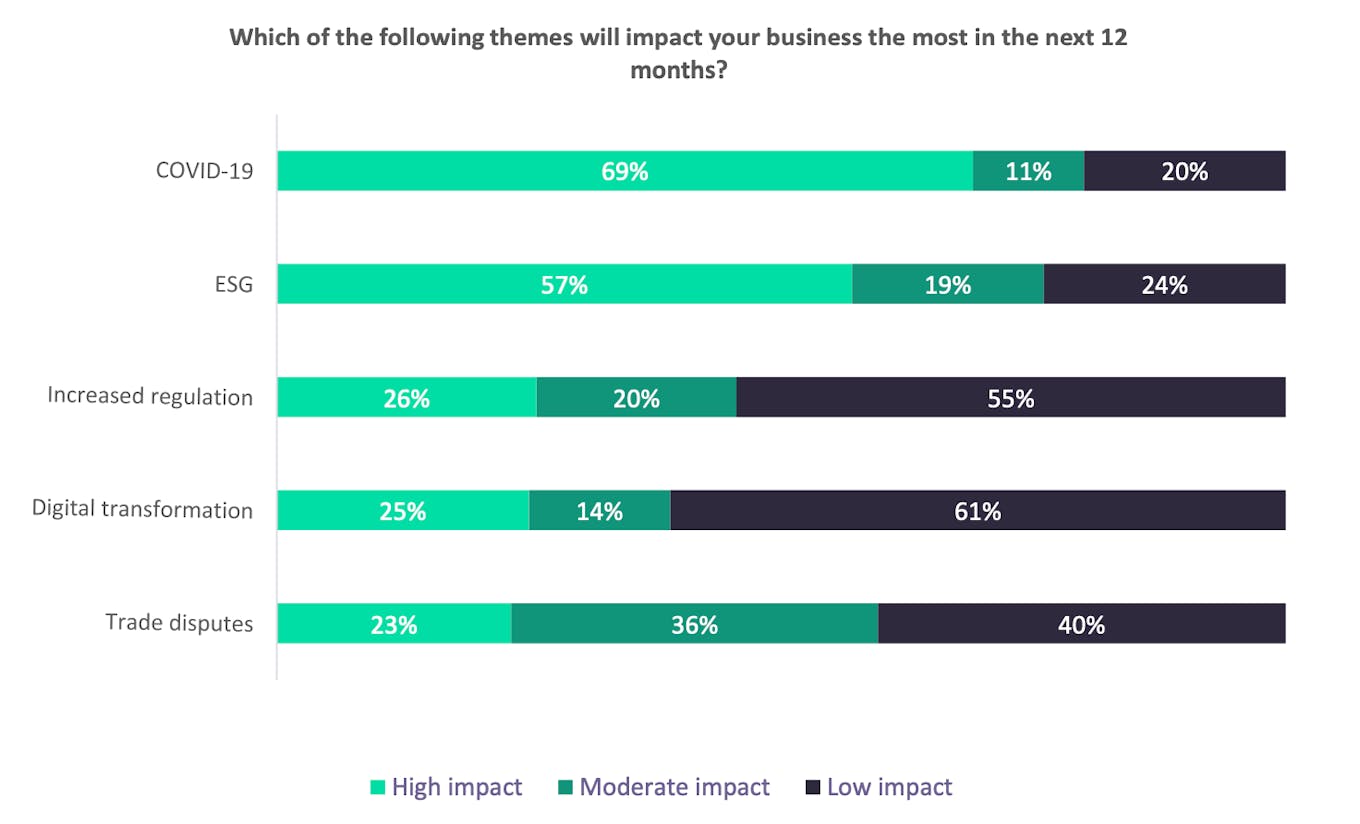

More than two-thirds (69 per cent) of executives feel that the pandemic will have a high impact on their business over the next 12 months, compared to 57 per cent for ESG.

In comparison, digital transformation, increased regulation and trade disputes are themes that matter a lot less to corporate leaders, the survey of 1,500 executives conducted in October 2021 found.

More than a fifth (22 per cent) of the survey respondents were from Asia Pacific.

“Once Covid-19 recedes or becomes endemic, ESG will be front of mind. However, we are not yet at that point,” the report noted, adding that Covid-19, which was declared a pandemic in March 2020, has functioned as a “catalyst” for ESG issues in the minds of business executives.

Business are more concerned about Covid than environmental, social or governance (ESG} issues over the next 12 months. Source: GlobalData’s ESG Strategy Survey 2021

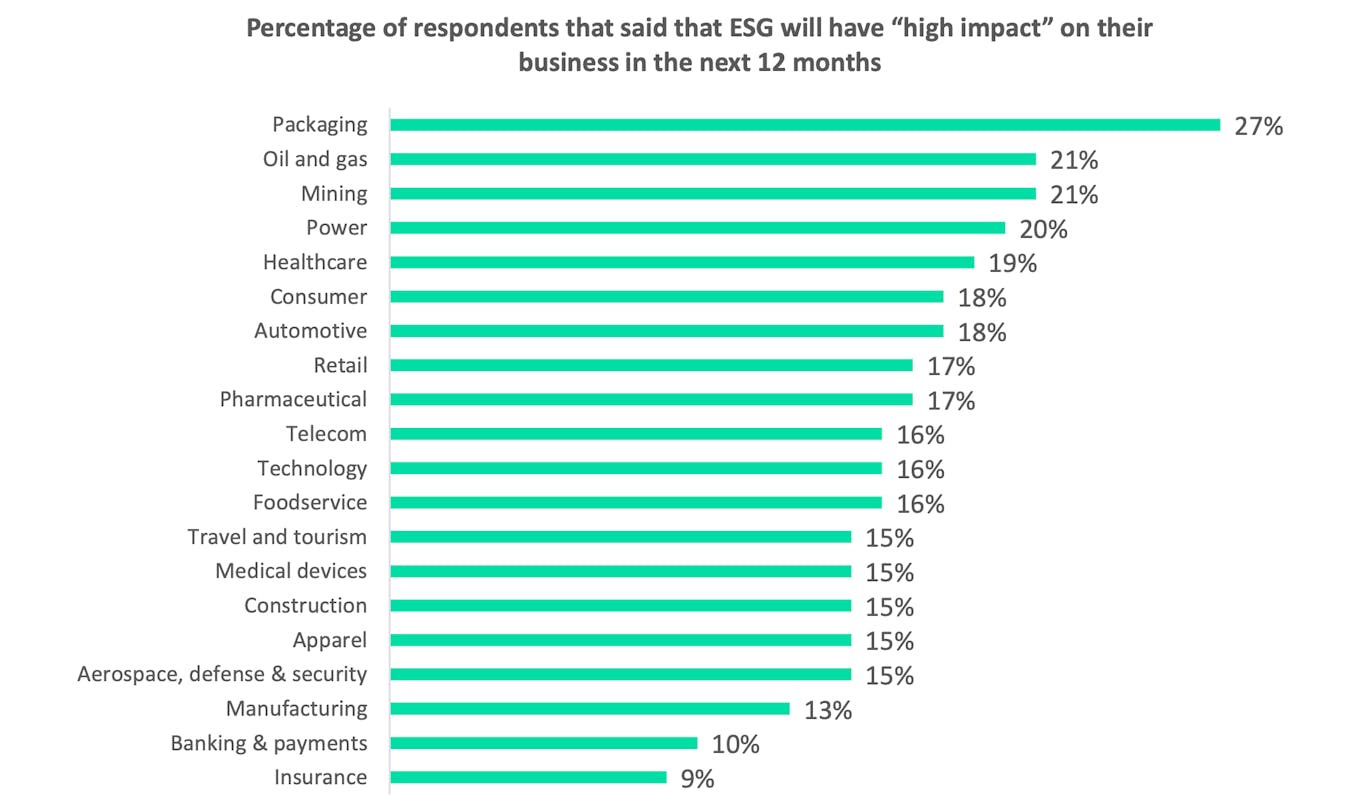

Big polluters are the most likely to believe in the importance of ESG issues, with the packaging industry — which is heavily implicated in the plastic crisis that has been aggravated by the pandemic — being most concerned about environmental and social issues, followed by oil and gas, mining and power.

“These sectors are more impacted by actions to slow down climate change,” the report noted.

Among all sectors, banks and insurance companies are the least likely to believe that ESG will have a high impact on their business, the study finds. These companies, however, are often eager to communicate their sustainability credentials, said GlobalData. In a separate survey last year, the analytics firm found that the finance sector uses the word “sustainability” more than any other in corporate filings.

The packaging industry is the sector that appears to be most concerned about ESG impacts on their business — more the fossil fuels and mining. The financial services sector is the least concerned about ESG over the next 12 months. Source: GlobalData’s ESG Strategy Survey 2021

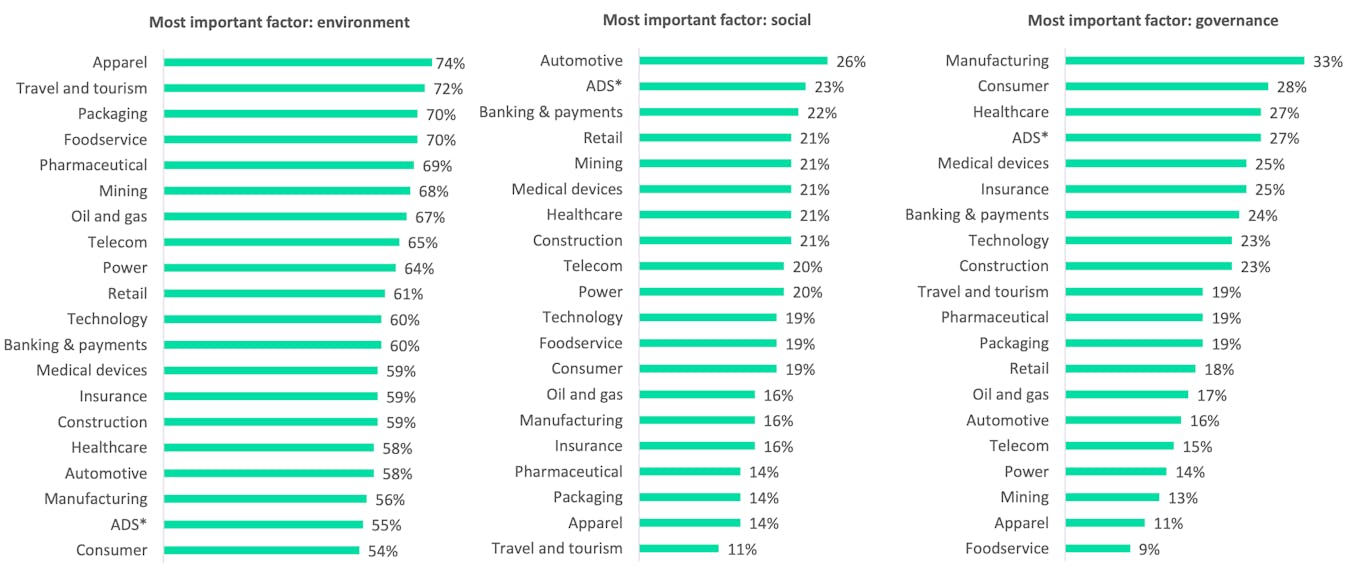

The most carbon-intensive sectors, particularly packaging, mining and automotive, also showed a greater willingness for ESG to be integrated into their investment decisions, and said that they plan to increase investment to meet ESG goals.

Concern for environmental issues far outweighs concern for social issues. Climate change emerged as the most pressing environmental issue for businesses — although oil and gas and power firms rated climate as the least important issue — followed by pollution, biodiversity and natural resources.

The apparel and tourism sectors showed the least concern for social issues, which the report’s authors noted with concern. Both industries have struggled with poor social performance — apparel due to inhumane working conditions in factories in developing countries, and tourism due to the mismanagement of popular spots and overtourism.

Respondents were asked: what are the most important ESG factors for your sector? Source: GlobalData’s ESG Strategy Survey 2021

The factor that companies show the least concern for, and are least likely to provide investment for, is governance — that is, corporate ethics, corruption and bribery, and risk management — the report highlighted, adding that this threatens the credibility of corporate sustainability targets.

“Given the existential threat posed by climate change, it is understandable that the environment is prioritised. However, inadequate governance practices make it more likely that companies will fail to meet ESG goals, including those that would improve their social and environmental records,” said the report’s lead author, Cyrus Mewawalla, head of thematic research at GlobalData.