Mandatory disclosure and reporting of ESG data is becoming a requirement in an increasing number of countries and jurisdictions. As at the end of 2022, 29 countries – including Hong Kong, the Philippines, Malaysia, Singapore – maintained some degree of mandatory ESG disclosure regulation.

In October last year, the International Sustainability Standards Board (ISSB) voted unanimously for reporting companies to disclose their Scope 1, 2 and 3 greenhouse gas emissions (GHG), with rules likely to be finalised by early this year.

However, even without mandatory reporting regulations, the demand for transparent sustainable and socially responsible practices is becoming greater, due to stakeholders – including investors, customers, employees and regulators – looking for more information on a company’s impact on the planet.

For instance, the annual shareholder meeting of Procter & Gamble, one of the world’s biggest fast-moving consumer goods (FMCG) companies, was held virtually in October 2022, with the live webcast and transcript made accessible to all media and investors.

There was public disclosure of the company’s financial metrics and measures; the board and general counsel were present to answer the pre-submitted enquiries of the shareholders and investors. Prior to the meeting, environmental groups had attempted to influence the direction of shareholders’ voting of leadership, citing the company’s reputed “over farming” of cornfields and encroachment on land belonging to the indigenous community in Brazil.

“A company needs data and analytics not just to track how well it is selling their products – they need a feedback loop with technical analytics to see how well they’re performing over time in their circular economy initiatives,” says Elisha Harrington, senior director of ServiceNow’s chief innovation office.

“To manage circular economy initiatives for the manufacturing and supply chain, and the operations team, data is really important so that the company can be informed of the progress around that initiative, and how well the product is performing when they are using new, more sustainable materials,” she adds.

Data drives the circular economy

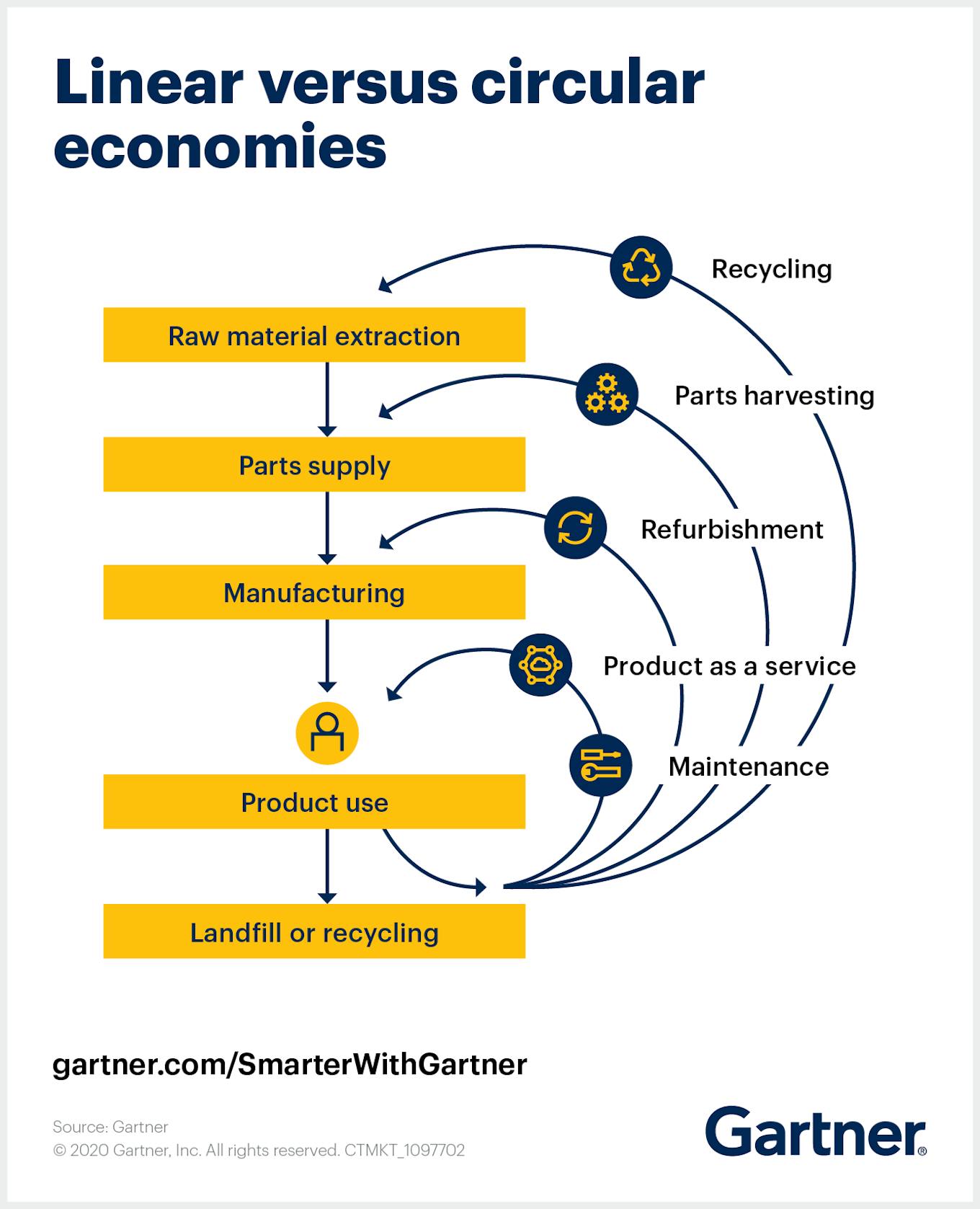

Linear versus circular economies. Image: Gartner.

In a circular economy, an organisation works to reduce their environmental impact by using their resources as best as they possibly can. They can start by using recyclable materials upfront in their production and design processes, rather than using brand-new raw materials.

Strategies for reducing waste can include using reusable parts in the future of the product. Raw materials that are left over from production can be used to create new products or sold to other suppliers and manufacturers, rather than sent straight to the landfill. Whatever cannot be used should be disposed of responsibly.

Organisations may even be able to create new revenue streams through the resale of different products or services, or offer products in a different model.

“This will not just reduce the impact on the environment, but also help a company save on operational costs,” explains Harrington.

“It’s very easy to track Scope 1 and Scope 2 emissions,” she adds, referring to the direct emissions of a company and the indirect emissions from bought electricity, heat or steam. Scope 3 emissions, which include financed and supply chain emissions, and cover indirect emissions related to goods and services that a reporting company produces or uses, are much more “complex and challenging for most organisations” to track, because the company must look at the ecosystem in which it operates and monitor the emissions of the suppliers and third parties that it works with, she explains.

Workflow suites such as those from ServiceNow provide command and control centres to manage data for the manufacturing and supply chain, as well as for the operations team to track how well a product is performing over time within the company’s circular economy initiatives. The collection of data is simplified and streamlined, and then automated for internal audiences and for external disclosure requirements.

Data helps companies avoid greenwashing

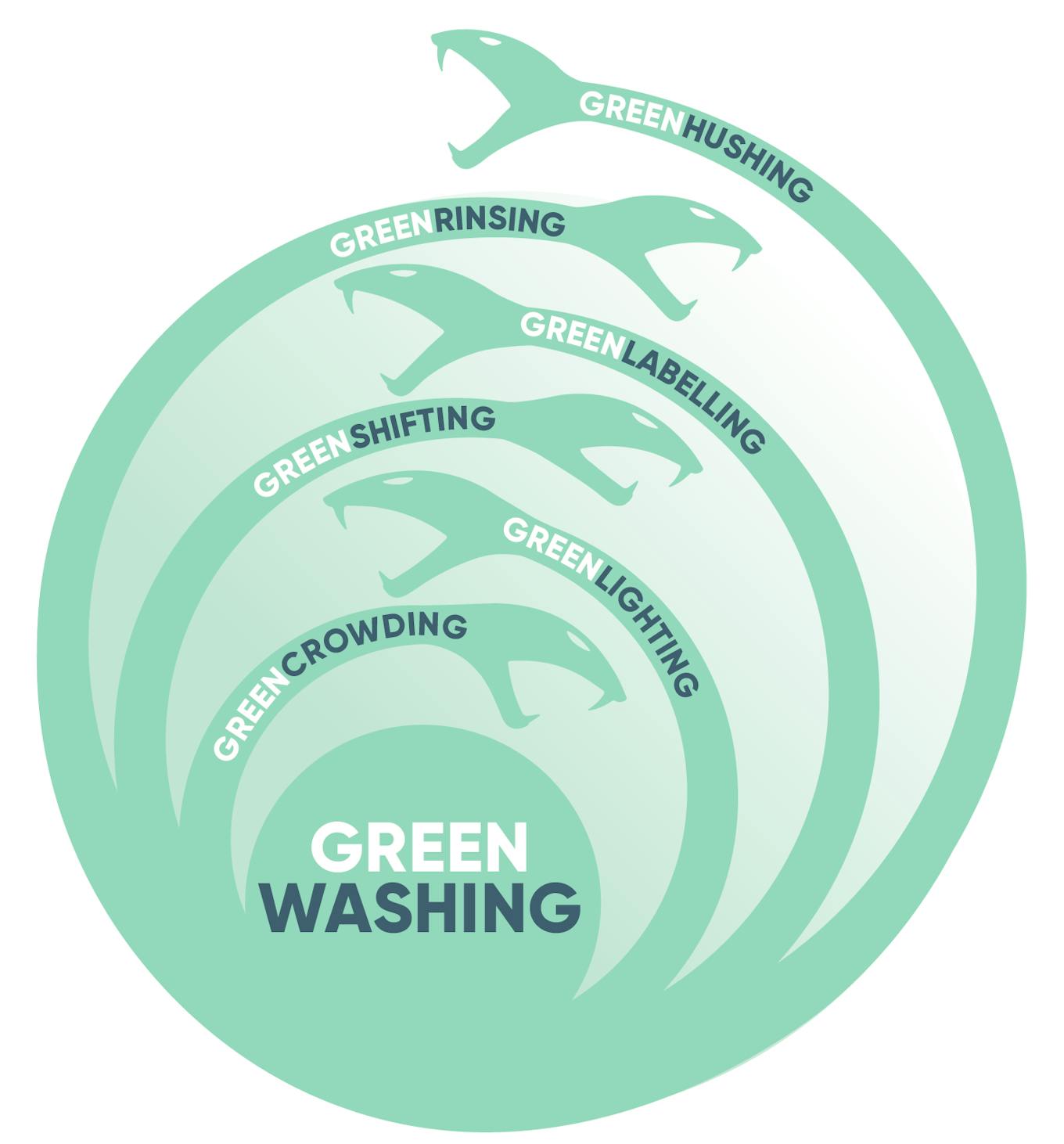

The greenwashing “hydra”, with some of the misleading – but not illegal – tactics used to mislead consumers and investors. Image: Planet Tracker.

Greenwashing occurs when companies market themselves as being more environmentally friendly than they are. A recent report by Planet Tracker notes that greenwashing involves increasingly sophisticated techniques used to mislead investors and consumers about the company’s true environmental impact.

Companies may use greenwashing tactics to make their products more attractive to consumers and thus increase sales. Furthermore, “companies with strong ESG credentials can attract a valuation premium relative to their peers as investment into sustainable and ESG funds increase,” the report explains.

This may result in a misallocation of ESG-related funding, perpetuate poor ESG practices, and hinder the transition to a sustainable economy. But companies are less likely to engage in greenwashing when there is an expectation or a regulation for companies to disclose their data, says Harrington. Companies can use the data and analytics they have gathered over time to track whether they can meet their net zero target. In other words, companies are discouraged from doing the bare minimum and then pushing their emissions reductions to the last minute.

If the company has purchased carbon credits or invested in a carbon project to offset their emissions, the data collected will be able to prove if those credits are both active and valid.

When companies can prove their carbon accounting with accompanying data, they will be able to avoid the worst consequences of greenwashing, such as the loss of reputation, or even class action suits in which they are accused of misrepresentation.

Data also helps companies to avoid green-hushing, a phenomenon in which an increasing number of companies that have set net-zero emissions targets have not communicated their goals for fear of being accused of greenwashing or making exaggerated sustainability claims.

“There are a few categories on their sustainability report that new investors will look at before they invest in a company,” Harrington explains. “If companies do not share [those] numbers – and their competitors do – investors will more likely invest in those other companies.”

Data accelerates innovation

Over the course of the 20th century, there has been a rise of consumerism, with the mass production of cheap end products that don’t necessarily last. The tech industry, especially, has been accused of planned or built-in obsolescence of their products, i.e. deliberately producing consumer goods that quickly become outdated and require replacing, usually in a linear economy.

Harrington believes that while this consumerist sentiment is not about to end any time soon, consumers are beginning to change their preferences. They are starting to look for recycled or recyclable versions of products or choosing to buy from brands that have a reputation for being sustainable.

There is a growing number of car owners who are concerned about the environment and switching from vehicles with combustion engines to electric vehicles (EVs), for example. Tesla, the world’s biggest manufacturer of EVs, caters to the preferences of the “green” demographic by using vegan leather derived from mushrooms, while their recycled batteries reuse almost 92 per cent of the raw materials collected.

Employees are also choosing to work for companies that take initiatives to reduce their carbon footprint.

Companies that track their ESG data are more driven to transition from carbon intensive sources of fuel to more renewable and cleaner energy sources to reduce their operating and production costs. The key to finding new sources of energy, and more water and energy efficient products, is innovation.

Governments can – and do – fund many sandbox and pilot initiatives that promote innovation and sustainability. Competitions such as The Liveability Challenge, presented by Temasek Foundation and organised by Eco-Business, can help to crowdsource and financially support solutions that create a significant impact on society and the planet.

“Scientists will have to partner with businesses and enterprises more than ever before. Businesses will want to get ahead of the game and get early adopter insights into new innovations so that they can be the first ones to capitalise on them and get a competitive advantage early on,” Harrington says.

The collection of ESG data and the need for companies to transparently disclose it for public and investor scrutiny will push organisations to shift to cleaner energy sources and reduce their emissions, to avoid running the risk of falling behind on their sustainability journey.