Asia’s natural gas ambitions could take a hit following the European Union’s (EU) decision to cut its reliance on Russian gas, potentially causing global gas prices to further climb as the bloc looks to source energy elsewhere, analysts said.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The move may serve a financial blow to emerging economies in Asia, which are fast building up natural gas capacity for baseload energy generation. Consumers will also feel the pinch of higher electricity prices. The resultant inflation may make it harder for markets to advance clean energy, even as renewables present themselves favourably amid the crisis.

The EU, which opposes Russia’s invasion of Ukraine, wants to cut dependency on natural gas imports from the energy major by two-thirds this year, and completely wean off the petrostate before 2030, it said on Tuesday. Russia currently provides about 45 per cent of EU’s total gas imports.

By 2021 figures, the shortfall this year could be around 100 billion cubic metres of natural gas, which the EU said would be partly compensated through higher liquefied natural gas (LNG) imports from other parts of the world — setting up a direct contest with Asia for the commodity.

The EU’s shortfall equates to roughly a fifth of Asia’s 350 megatonnes of LNG imports in 2020, based on a simple conversion of natural gas and LNG units.

Asian markets already compete with China for gas imports, after the economic titan accelerated its shift from coal to gas heating to cut emissions and air pollution in 2017. Asian LNG prices are now influenced by China’s spike in demand for gas during its winter months.

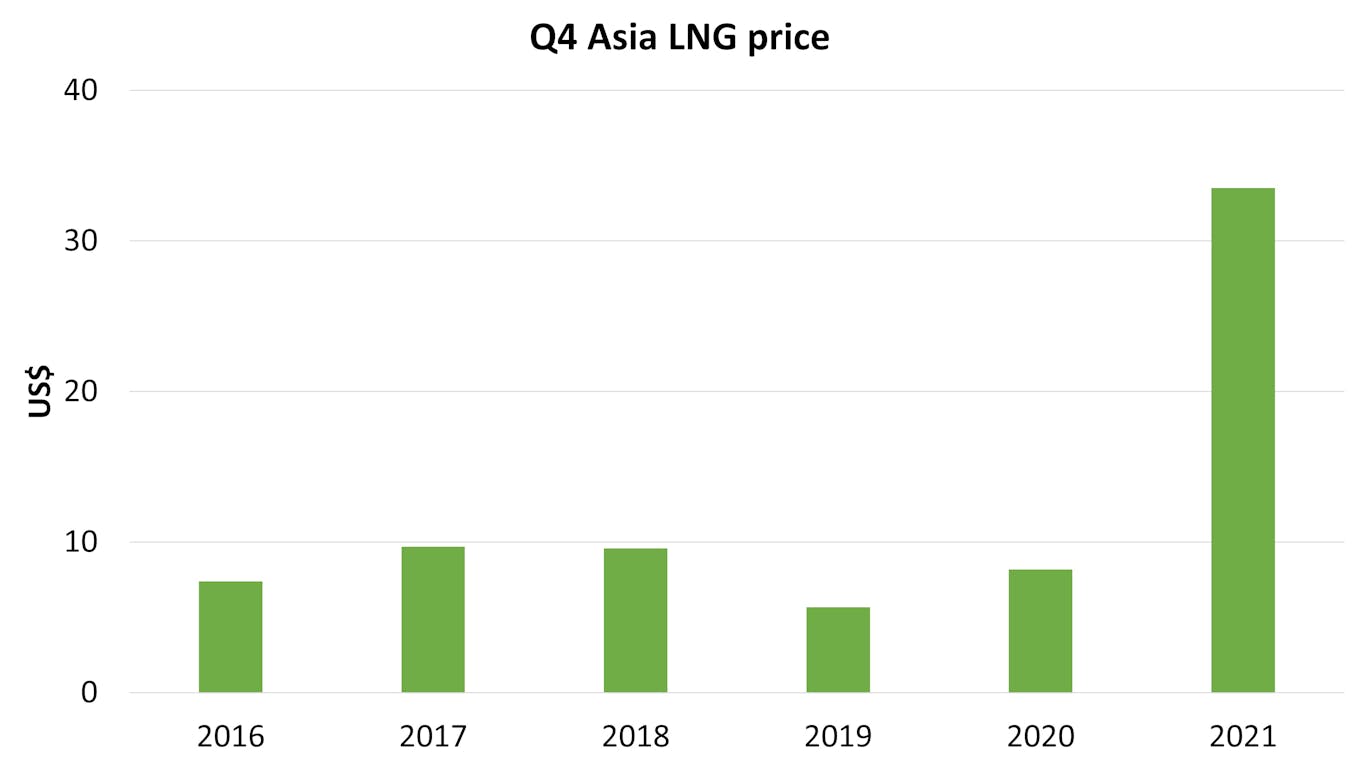

Average fourth quarter LNG prices for Asia, 2016-2021. For Q4 2021, only October and November prices are available. Data source: FRED, International Monetary Fund. [click to expand]

“Now, the EU will bulldoze into the world market,” said Henning Gloystein, director of energy, climate and resources at political risk consultancy Eurasia Group. “In terms of outright demand growth it will probably outperform China, not because of its health of industry, but because it has to replace all that Russian gas.”

LNG prices in Asia logged a record high of US$59 per million British thermal units last week, due to the uncertainty caused by the Ukraine crisis.

“For emerging markets, particularly Vietnam, Thailand, South and Southeast Asia, these prices are totally disruptive for LNG imports. The economics of power generation with that price is catastrophic,” Gloystein said.

The problem is set to grow in the next few years, as developing Asian countries upsize their gas facilities to feed its rising domestic energy demand.

Vietnam has plans to build 65 megatonnes of LNG import capacity, while Thailand wants to add 35 gigawatts of gas power capacity — roughly 70 per cent of its total electricity generation capacity today, according to research by US think-tank Institute for Energy Economics and Financial Analysis (IEEFA).

A price spike late last year, as countries tried to kickstart their post-pandemic economic recovery, had already sparked questions about the economics of some of the projects.

How China responds to the shift in gas markets could be impactful too, said Peter Godfrey, managing director for Asia Pacific at UK non-profit Energy Institute. China signed a 30-year piped gas deal last month with Russia, and is reportedly considering investing into Russia’s state-owned energy firms that the West are now shunning. More Chinese purchases for Russian gas could ease the competition for LNG imports in Asia.

“The Chinese will gain in the short term, by probably taking the Russian supplies that were going into Europe,” Godfrey said. “This is going to have a major impact. But how that plays out in terms of overall market dynamics is not yet clear.”

Momentum for energy transition

Other fossil fuels aren’t spared either. Oil, which Russia also dominates, soared to US$139 a barrel on Monday, more than double the price this time last year. Coal hit its own record of US$418 a tonne this week, up from US$82 a year ago, as countries in Europe and Asia scoured the market for alternative sources of supply.

The latest surge in oil and gas prices will result in a sharp rise in costs, particularly for energy-intensive industries.

Thailand, Taiwan and South Korea could be some of the worst hit in the region, with their energy sector having trade balances 5 to 7 per cent in the red, according to Dutch financial services firm ING. India, which imports 85 per cent of its crude oil, could find itself spending a lot more too.

“Sky-high oil, gas and coal prices, if you’re an importer, send a very clear message to invest as much as possible into domestic clean energy supply,” Gloystein said.

“The energy security risk is important for many of the Asian economies because most of them, except for Indonesia, Malaysia and Australia, are net importers of fossil fuels,” said Junyu Tan, an economist at Natixis. “Their supply of energy will be exposed to any supply shock or even the geopolitical tensions.”

While high fossil fuel prices are a headache, the sharp price swings since last year could be an even bigger challenge for Asian governments, according to Godfrey.

“

Central banks will be looking at stabilising growth and inflation targets. Clearly, volatile oil and gas prices don’t do very much to stabilise those targets.

Peter Godfrey, Asia Pacific managing director, Energy Institute

“Central banks will be looking at stabilising growth and inflation targets. Clearly, volatile oil and gas prices don’t do very much to stabilise those targets,” Godfrey said.

Fossil fuels have largely been a reliable driver of Asia’s growth in the past decades. Even with the growing global momentum towards zero-carbon solar and wind energy, many Asian countries have opted to switch between fossil fuels instead, from coal to natural gas.

Wind and solar energy could be considered as more stable options, as they are largely shielded from global geopolitical headwinds, according to Godfrey. Fixed pricing mechanisms have been developed by both governments and private players. Better energy storage technologies are also on the horizon.

“I think we are going to see increased moves towards renewables and making infrastructure more amenable to bringing in renewables, which means structural change in most Asian countries,” said Godfrey. Countries like Indonesia and Vietnam are already planning for electricity grid upgrades to better integrate renewables in the next few years.

However, the green momentum could be stymied by the gloomy economic outlook due to the Ukraine crisis.

“The economic fallout of this slows investments in general, and that could also impact green investments,” Henning said, adding that emerging economies will feel the impact more because of pronounced bread-and-butter issues. History also shows that sharp increases in oil prices is a harbinger for global recessions.

Feet-dragging on the part of governments could be another issue, according to IEEFA analyst Sam Reynolds.

“

Although many countries recognise the economic and energy security risks of LNG, official policy priorities still envision a large buildout of natural gas and LNG infrastructure.

Sam Reynolds, analyst, IEEFA

“Although many countries recognise the economic and energy security risks of LNG, official policy priorities still envision a large buildout of natural gas and LNG infrastructure,” he said. “National energy plans should be revamped with an eye towards cheaper, more financially sustainable technologies that can help improve self-sufficiency and protect energy security.”

APAC fossil fuel exporters profiting

Australia, the world’s largest LNG exporter, has offered to sell more gas to Europe. Indonesia’s coal association said the coal major stands ready to increase supply. Malaysia’s oil and gas firms saw their stocks rise when Russia invaded Ukraine.

“Fossil fuel prices will be high for quite a long time,” Henning said, explaining that the pivot away from Russian energy will have consequences lasting for years. He added that the upshot is that with the greater attention on sustainability, fossil fuel exporters are more likely to invest their windfall into their green transition down the road.

Godfrey said that coal producers may benefit less due to the existing momentum against the highly polluting fuel. All countries agreed to start moving away from coal at COP26, the latest global climate conference. Over forty countries have also pledged to phase it out of their energy mix in the next twenty years or so.

Despite this, Asia’s appetite for coal remains. Coal use surged over the winter amid the post-Covid recovery causing emissions to rise. China is still constructing new coal plants. But the resurgence is likely to be a short-term trend, analysts reckon.

“I don’t think as a result of the [Ukraine crisis], any countries are going to build new coal fired power plants,” he said.

Germany did raise the possibility of reopening mothballed coal plants, as it scrapped a new gas pipeline with Russia in a political move. However, it also set a target to be fully powered by renewables by 2035 to achieve greater energy self-sufficiency.

Reynolds said that the huge price swings in recent months means that even energy exporters may fare better planning for a faster exit from fossil fuels. He added that the global market has also shifted towards more flexible contracts and stricter legal terms which disadvantage sellers.

“Volatility is good for no one,” he said. “A greater share of domestically-sourced renewables can help improve long-term economic and financial stability for both energy importers and exporters.”

Eco-Business #StandsWithUkraine. Donate to the UN crisis relief efforts in Ukraine.