What is the Global Shield?

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The Global Shield Initiative was formally launched by the G7 and Vulnerable Twenty (V20) countries earlier this Monday at the COP27 in Sharm El-Sheikh, and is expected to start immediately after the conference. According to a concept plan released by Germany’s Federal Ministry for Economic Cooperation and Development (BMZ), the Global Shield initiative aims to provide and facilitate more and better pre-arranged disaster financing to climate vulnerable developing nations so that they can more cost-efficiently and effectively minimise and address loss and damage caused by climate change.

So far, Germany is the largest contributor to Global Shield, having provided US$172 million to kickstart the initiative. France, Canada, Ireland and Denmark have also pledged a total of US$42 million to the cause, and further contributions are expected in the future.

Though any country listed on the OECD Development Assistance Committee’s list of countries eligible for official development assistance may apply for support, the first beneficiaries of Global Shield will be Bangladesh, Costa Rica, Fiji, Ghana, Pakistan, the Philippines and Sengal.

“

We cannot allocate resources as if the climate crisis was an abstract war in some faraway place. The fate of the most vulnerable will be the fate of the world.

Henry Kokofu, Special Envoy of the Climate Vulnerable Forum

Why is it important?

According to the 2021 report by the World Meteorological Organisation (WMO) which investigated mortality and economic losses from weather, climate and water-related extremes, storms and floods were and remain Asia’s most common and damaging natural disasters. Between 1970 - 2019, storms and floods accounted for 81 per cent of natural disasters and caused 91 per cent and 96 per cent of the associated economic losses and deaths respectively.

Furthermore, though developing nations contribute the least to climate change, they often bear the brunt of its effects. To recover from these events, these countries often must take out loans at high interest rates, thereby increasing their debt burden and impoverishing them further. For example, unprecedented flooding in August inundated nearly a third of Pakistan’s land area, affected nearly 33 million lives and caused damages amounting to 10 per cent of the country’s GDP, even though they only contributed to 0.9 per cent of the world’s greenhouse gas emissions last year.

During the Global Shield launch event at COP27, Ghana finance minister and V20 chairman Kenneth Nana Yaw Ofori-Atta highlighted the initiative’s crucial role in addressing climate injustice and helping the affected countries obtain the timely and effective relief necessary to avoid long-term economic and societal impacts.

“The Global Shield is long overdue. It has never been a question of who pays for loss and damage because we are paying for it. Our economies pay for it in lost growth prospects, our enterprises pay for it in business disruption and our communities pay for it in lives and livelihoods lost,” he said.

In a press statement, Special Envoy of the Climate Vulnerable Forum Henry Kokofu also urged developed countries to contribute their fair share towards mitigating climate change.

“We cannot allocate resources as if the climate crisis was an abstract war in some faraway place. The fate of the most vulnerable will be the fate of the world,” he warned.

Who’s in charge?

To ensure that its objectives are achieved in an efficient manner, the concept plan stated the initiative will focus on building on existing institutions like the InsuResilience Global Partnership for Climate and Disaster Risk Finance and Insurance Solutions (IGP), a similar programme which was launched in COP23.

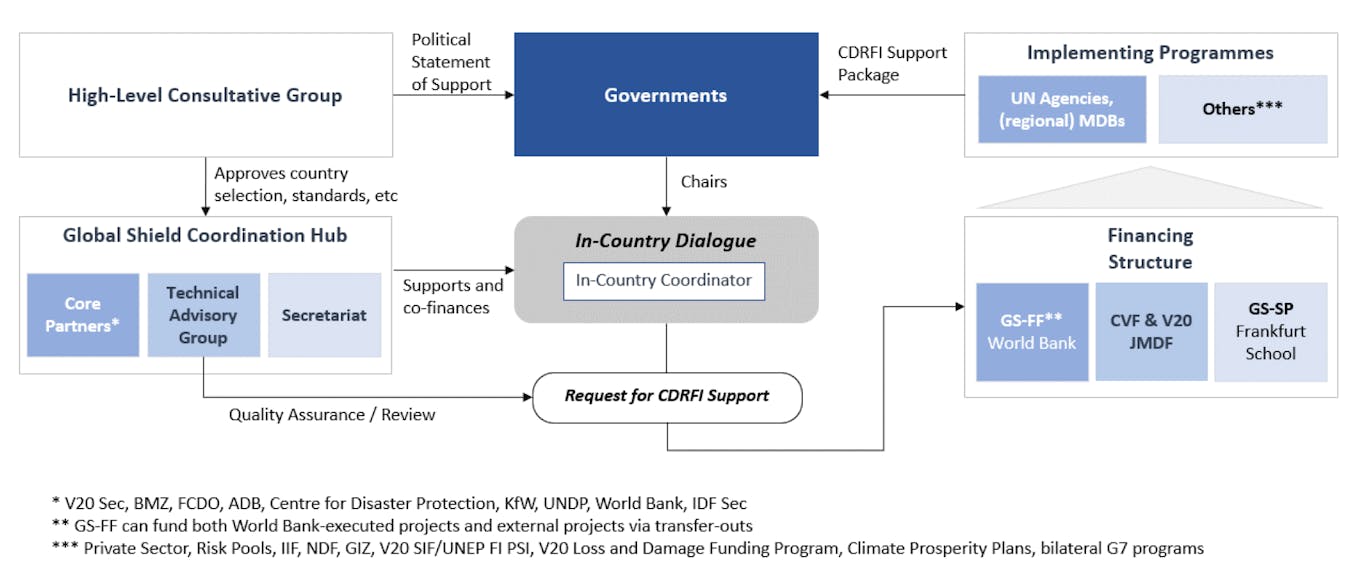

The proposed organisation structure for the Global Shield initiative. Image: Federal Minisry for Economic Cooperation and Development.

Global Shield will be led by a High-Level Consultative Group (HLCG) which is an expansion of IGP’s HLCG, and is expected to provide political and strategic guidance and oversight to the project. Some of their core duties include selecting beneficiary countries, sending political statements of support and soliciting further donations and help from governments, philanthropists and non-state partners.

The Coordination Hub is expected to consist of existing IGP partners, which include institutions such as BMZ and the Asian Development Bank, new IGP partners like the V20 Secretariat and Insurance Development Forum (IDF) Secretariat as well as a Technical Advisory Group. Some of their main responsibilities include advising the HLCG’s decision-making process and overseeing technical work and international-level cooperation.

To identify country-specific gaps in climate and disaster risk financing and insurance architecture (CDRFI) and the instruments required to address them, the project also intends to hold regular in-country dialogues, which they hope builds upon existing national platforms and working groups.

Lastly, the Global Shield Financing Structure plans to work with governments, NGOs, humanitarian agencies, private sector companies, existing CDRFI programmes and service providers to address country-specific needs and to design and implement support packages. This body comprises of the Solutions Platform, which builds on the InsuResilience Solutions Fund hosted by the Frankfurt School of Finance and Management, the Financing Facility, which is reformed from the World Bank-hosted Global Risk Financing Facility and the Climate Vulnerable Forum (CVF) and V20 Joint Multi-Donor Fund (JMDF).

How does it intend to achieve its goals?

Nearly 1.5 billion people in the V20 lack any insurance, further hampering their ability to recover from natural disasters. The Global Shield concept plan announced its intention to address this protection gap and ensure coherency amongst its many partners by coordinating the CDRFI of G7, V20 and other climate-vulnerable economies.

The document further elaborated that Global Shield will also involve setting up a flexible and collaborative financing structures. They hope that this will provide the financial instruments and assistance households, businesses, governments, humanitarian agencies and NGOs need for disaster preparedness and insurance. On the household and business level, this could mean livestock, crop, property or business interruption insurance.

On the govenrmental level, this could mean setting up “money-in” schemes like pre-arranged financing which ensures there is sufficient money to distribute in the event of loss and damage, and “money-out” schemes like anticipatory action protocols to ensure money is spent effectively.

In the future, Global Shield also expressed its hope to scale successful programmes in an affordable way through smart premiums and capital support to ensure beneficiary countries have the sustained support they require to address growing climate threats.

“

I’m not against insurance, but it is being projected as a silver bullet.

Harjeet Singh, head, global political strategy, Climate Action Network

Will it really work?

Since its announcement, many NGOs have expressed scepticism about Global Shield, especially its emphasis on developing insurance vehicles for low-income, climate-vulnerable countries. Harjeet Singh, head of global political strategy at Climate Action Network criticised the initiative’s lack of detail on how the received funds will be spent, and how investment could benefit affected communities.

Furthermore, according to a 2018 paper published by scientists at the Basque Centre for Climate Change, a research centre, loss and damage from climate change could cost developing countries a total of US$290 billion - 580 billion by 2030, and US$1 trillion - 1.8 trillion by 2050. Singh questioned whether the initiative could provide adequate compensation, if at all.

“In responding to climate disasters, the role of insurance is very, very limited, [and yet] it takes a huge space in their discussions. I’m not against insurance, but it is being projected as a silver bullet,” he said.

In an interview with Eco-Business, associate professor at the National University of Singapore and deputy director of the Sustainable and Green Finance Institute, Zhang Weina, agreed that the wording was “very general and vague”, but also wanted to highlight the initiative’s diverse offerings and that it was still early days.

“It is too early to make any specific judgement. The announcement is just a general idea, and Global Shield can involve many different forms of financial aid or financial products and services. It is not just about insurance,” she elaborated.