Rising rates of obesity and malnourishment indicate that a global nutrition crisis is mounting, but the world’s largest food and beverage (F&B) companies are not doing enough to solve it, a new study says.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Released on Thursday in London, the Global Access to Nutrition Index report found that while leading food firms have made some progress towards improving consumers’ diets, there is much more the sector can do to tackle these widespread issues.

The index, which was first launched by the Netherlands-based non-profit Access to Nutrition Foundation (ANF) in 2013 and is now in its second edition, assesses the 22 largest food companies on how well their corporate strategy, product offering and marketing efforts address obesity and under-nutrition.

According to ANF, one in three people today is either overweight or lacks proper nutrition. Almost 2 billion people today fall into the former category, and are at a higher risk of heart disease, diabetes, and some cancers.

Meanwhile, close to 800 million people do not have enough to eat, and 2 billion others have micronutrient deficiencies. Micronutrients are vitamins and minerals which the body requires in very small amounts; examples include iron, zinc, Vitamin A, and folic acid.

Inge Kauer, executive director, ANF, noted in a statement that the F&B firms in the index operate across the globe, and therefore have a critical role to play in tackling the growing health and nutrition crisis.

Keith Bezanson, chairman of the Foundation’s board, added that the index “is increasingly being embraced as an accountability tool by companies and investors to measure – and ultimately improve – their performance on promoting better nutrition”.

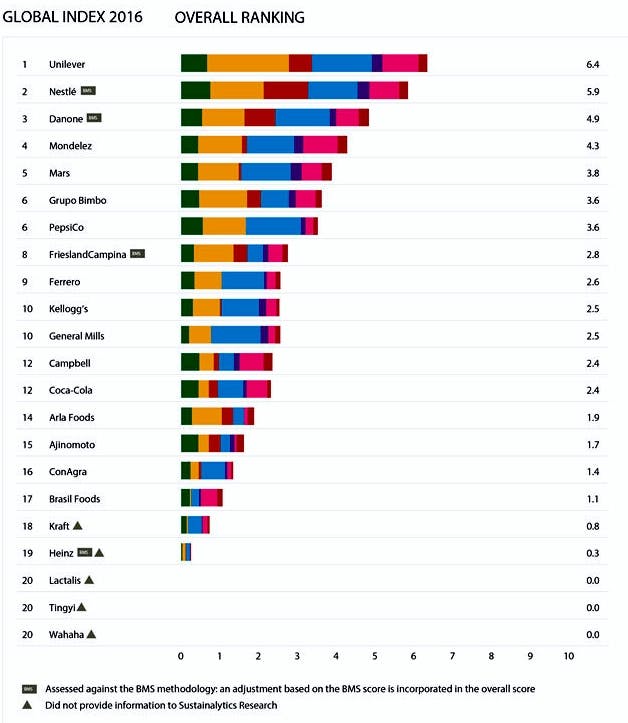

The Index ranks companies on their contribution to tackling these challenges by scoring them on seven criteria: governance, products, accessibility, marketing, lifestyles, labelling, and engagement.

2016 Access to Nutrition Index. Image: Access to Nutrition Foundation

Anglo-Dutch multinational Unilever, Swiss food giant Nestle, and French outfit Danone topped the rankings for their efforts to make products more nutritious and affordable, while American companies Kraft and Heinz, along with Brazilian food manufacturer Brasil Foods, had the lowest scores.

French dairy multinational Lactalis and two Chinese firms - Tingyi and Wahaha - did not provide any information to the Index, which was researched by environmental analysis firm Sustainalytics.

Unilever, the top performer in the ranking, owns food brands such as Lipton tea, Streets ice cream and Flora sunflower oilspread. It was recognised for integrating nutrition issues into its core business strategy, strong reporting on its activities related to the topic, and reformulating its whole product range to be healthier.

It also develops products micronutrient-rich products for low-income people in developing countries, and prices them low enough to ensure consumers can afford them.

Amanda Sourry, president of Unilever’s Foods category, said in a separate statement that the firm was “extremely pleased to receive this independent recognition of our efforts to improve nutrition”.

US chocolatier Mars and Dutch dairy giant FrieslandCampina made the biggest improvements on the 2016 Index. Mars rose from 16th place to the fifth spot and FrieslandCampina from 19th to eighth from their 2013 positions.

But despite the strong performance of some companies, no firm scored more than 6.4 out of a maximum 10 on the assessment. This, said ANF, shows that “the industry as a whole is moving far too slowly”.

To enhance efforts to tackle obesity, ANF called on companies to improve the way they measure and report the nutritional value of products, make food labelling clearer to help consumers choose healthier options, and market them more responsibly to children.

The industry must also address under-nutrition, especially in lower-income countries, by providing affordable and nutritious food for consumers with lower incomes. ANF also urged firms also develop specially fortified products which contains the nutrients that these communities lack.

In a separate sub-ranking, the researchers studied how six baby food manufacturers marketed their breast-milk substitutes, to check if they obeyed rules that ban them from undermining the value of breastfeeding. None of them were fully compliant with the guidelines.

Firms across the F&B sector must improve the quality and marketing of their food not only to help end the global nutrition crisis, but because it makes good economic sense, said the Foundation.

“While companies have a social responsibility to tackle global nutrition challenges, doing so also presents a business opportunity as consumers worldwide demand healthier foods,” said Kauer.