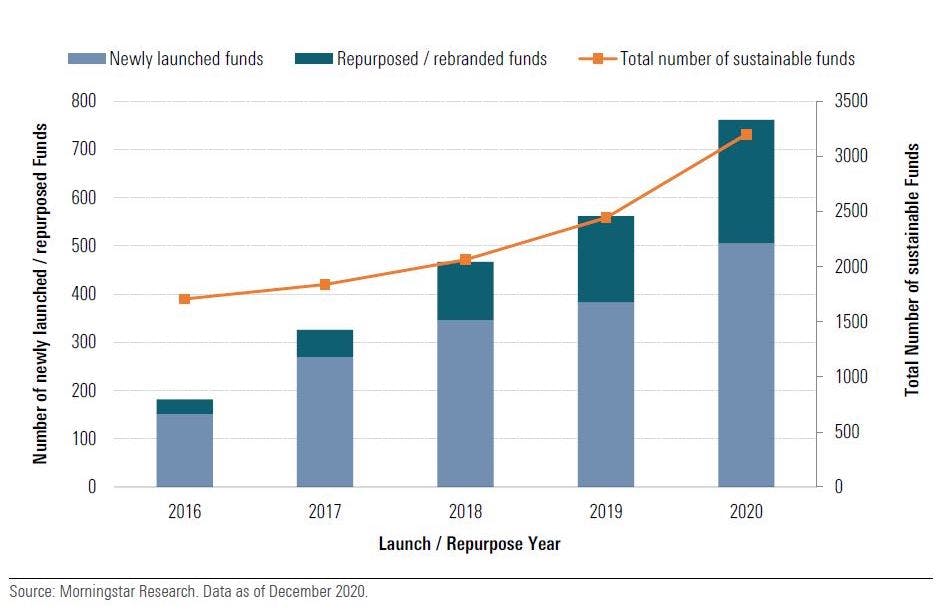

It has been a lucrative year for sustainable investing with environmental, social and governance (ESG) funds attracting unprecedented levels of cash. Record demand to invest in sustainable funds saw the sector’s total assets rise 19 per cent to a new high of nearly US$2 trillion in the first quarter of this year, according to data from industry tracker Morningstar.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

However, greenwashing — when funds are marketed to have better ESG credentials that they actually possess — is a rising problem, particularly as sustainability becomes part of the investment mainstream.

The popularity of ESG funds has driven the proliferation of initiatives to define disclosure standards, including the voluntary Task Force on Climate-related Financial Disclosures, which has helped to provide a foundational framework for climate-related disclosure.

Nevertheless, companies and investors, exasperated with the “alphabet soup” of rival ESG standards and terminology are demanding greater alignment and simplification.

Standardisation of some kind would help guard against greenwashing, according to IOSCO, a global umbrella body for securities regulators which is looking to harmonise the medley of rules governing how companies disclose sustainability risks.

“The number of ESG investing and sustainability-related products has risen significantly in recent years, magnifying some crucial challenges, including concerns about the consistency and comparability of sustainability-related information and greenwashing,” said Ashley Alder, IOSCO chair and chief executive of the Hong Kong Securities and Futures Commission.

IOSCO’s Sustainable Finance Taskforce (STF) reiterated the urgent need to improve the consistency, comparability and reliability of sustainability reporting for investors in a 28 June report on issuers’ sustainability-related disclosures.

Regulators have been drawing attention to problems with consistency, availability and reliability of the information needed for investors to incorporate climate concerns into their decisions.

Meanwhile, some industry figures have raised concerns about funds being repurposed and rebranded as ‘sustainable’, allowing asset managers to leverage existing assets to build their green-business, or reinvigorate ailing funds, to avoid starting from scratch. According to IOSCO, greenwashing can occur where a product’s name refers to sustainability but its investment objectives do not, or its use of ESG strategies is limited.

Newly launched and repurposed funds. According to Morningstar data published in February, 256 funds repurposed or rebranded as sustainable in 2020, up from 179 the year before. In Q1 this year alone, the number was already at 127.

Guard against greenwash

IOSCO is also probing greenwashing in the asset management industry. The global market watchdog issued a consultation paper on 30 June which sets out five recommendations for asset managers to improve sustainability practises, including more disclosure about sustainability-related financial products and developing common industry terminology.

“This includes encouraging asset managers to take sustainability-related risks and opportunities into account in their investment decision-making and risk management processes and addressing the risk of greenwashing through improving transparency, comparability and consistency in sustainability-related disclosure,” IOSCO said.

“

The number of ESG investing and sustainability-related products has risen significantly in recent years, magnifying some crucial challenges, including concerns about the consistency and comparability of sustainability-related information and greenwashing.

Ashley Alder, IOSCO chair and chief executive of the Hong Kong Securitiies and Futures Commission

Fund houses have increasingly found themselves under the spotlight for overstating their green credentials. To tackle this, the body is crafting recommendations to address the issues arising from the proliferation of and “systemic over-reliance” on “third party” data and ESG ratings providers that have stepped in to provide the information to investors, including asset managers.

“Asset managers are at the heart of the investment chain and play a central role in the ecosystem of sustainability-related information. Sustainability-related policies and frameworks can therefore help ensure that asset managers take sustainability-related risks and opportunities into consideration and integrate them into their decision-making process,” said Erik Thedéen, chairman of IOSCO’s sustainable finance task force and director general of Sweden’s Finansinspektionen.

The paper also recommends that regulators ensure they can competently oversee asset managers and have the sufficient enforcement and know-how to address breaches of regulatory requirements.

“The recommendations aim to address various challenges, such as existing gaps in skills and expertise and the risk of fragmentation caused by divergent regulatory approaches,” IOSCO said in a statement.

Common standards

IOSCO has been engaging with the International Financial Reporting Standards (IFRS) Foundation’s efforts to develop a common set of global sustainability standards to help meet investor needs and to establish a baseline for jurisdictions to consider when setting or implementing their disclosure requirements.

“Many on the buy and sell sides have signalled how confusing the multiplicity of different ESG ratings choices can be, once again raising serious questions about relevance, reliability and greenwashing. So we are now working on ways to ensure better transparency and clearer definitions,” Alder said in June.

The IFRS is looking to establish an International Sustainability Standards Board (ISSB) to sit alongside the International Accounting Standards Board (IASB) by November this year, launching at the United Nation’s COP26 climate summit.

IOSCO is mulling its endorsement of future standards issued by the ISSB to use for cross-border—and potentially domestic—purposes to guide issuers’ sustainability related reporting in their jurisdictions recognising that standards may need to be applied in a “flexible” way.

“It will be important for individual jurisdictions to consider how the common global baseline of standards might be adopted, applied or otherwise utilised within the context of these arrangements and wider legal and regulatory frameworks, in a way that promotes consistent, comparable and reliable sustainability disclosures across jurisdictions,” according to an IOSCO statement.

Potential endorsement will require that IOSCO’s expectations regarding strong governance and decision-useful content are satisfied.

“Full, timely and comprehensive corporate level reporting, including of sustainability-related information, is absolutely foundational for the proper functioning of markets and for investor protection,” Alder said. “It is imperative that the ISSB establish strong governance, proven independence and rigorous due process.”