As awareness around climate change and its impacts on businesses grows, companies can choose to own their narratives about how they’re preparing for the future through climate risk reporting, said sustainability professionals at a recent event in Singapore.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Ranjit Ajit Singh, chairman of the Securities Commission Malaysia, warned that climate change presents risks such as resource disruptions, changes in the value of assets and loss of customers—often with measurable financial implications.

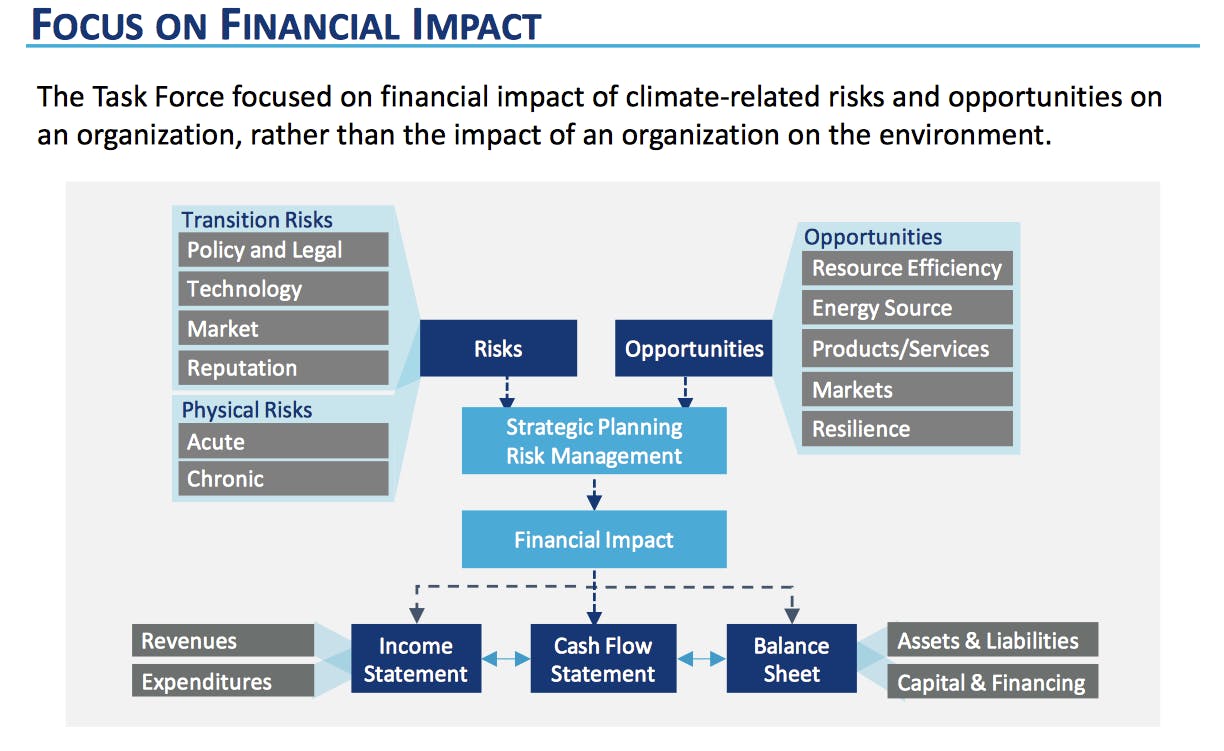

Climate risk reporting, a formal way of assessing how climate change will impact businesses financially, is one way for companies and investors to preempt how climate developments will affect businesses. It is also an opportunity for companies to improve corporate performance, operational efficiency, and develop new revenue streams and technology, said Ranjit.

“Investors are shifting their mind-sets away from financial short-termism towards greater focus on long term corporate strategies,” added Ranjit, explaining why a growing group of younger generation investors are placing greater importance on the positive impacts of invested funds over profits.

Labelling climate change a “tragedy of the horizon”, Curtis Ravanel, global sustainability head at Bloomberg and Task Force on Climate-related Financial Disclosures (TCFD) secretariat, urged businesses to not just consider material financial considerations but the future impacts of climate change.

Financiers need to integrate sustainability considerations in everything that they do. But sustainability [advocates] also need to be more financially educated. These worlds need to merge.

Curtis Ravanel, global sustainability head of Bloomberg and TCFD secretariat

This means growth cannot be measured purely quantitatively, or in terms of financial materiality, which puts huge emphasis on cost-related factors. Rather, it must also deliver on social and environmental value to present and future generations, which is why there is a need for climate risk reporting, said Ranjit.

Both were speaking at the “Asean conference on the recommendations of the TCFD”, hosted by Singapore Exchange (SGX) and the TCFD last week, where business leaders discussed how companies and markets can assess climate risks and incorporate them in financial reports.

The global task force developed in 2015—which provides a voluntary framework for companies to disclose the finances of climate-related risks and opportunities—brings the conversation to Asean, pitching regional firms to adopt proposed recommendations.

A visual guide of the financial impacts of climate risks and opportunities on companies. Image: Task Force on Climate-related Financial Disclosures

Curtis likened climate disclosures to the disclosure of revenue in the United States before the Securities Exchange Act. “Revenue was once considered confidential information,” said Curtis, wondering if climate disclosure can likewise be mainstreamed.

Curtis emphasised that climate disclosure is not about calculating the probability of climate risks, but to futureproof corporate strategies.

The four strategies the TCFD focuses on—governance, strategy, risk and metrics & targets—are “good business in general”, said Curtis. “If you take the word climate out of it, [TCFD] could be a 101 manual on how you run and operate businesses.”

Over 250 companies have expressed support for TCFD, which have frameworks that are completely voluntary and will remain so. “We want to identify progress; we don’t want to punish people who are early on the journey, there is no value in that,” said Curtis.

However, the responsibility goes both ways. “Financiers need to integrate sustainability considerations in everything that they do. But sustainability [advocates] also need to be more financially educated. These worlds need to merge,” he added.