While Singapore, Malaysia, Thailand, and Indonesia wait for skies to clear from the haze pollution that has enveloped the region for the second consecutive month, there are growing calls from the public demanding clarity of a different kind - transparency on concession maps of palm oil and paper firms in Indonesia.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Experts have long maintained that in order to resolve the problem of uncontrolled forest and peat burning in Indonesia - a cheap way clear land for palm oil and timber plantations - there has to be definitive information on land ownership.

Jonathon Porritt, founder director of non-profit Forum for the Future, who is leading an industry study on stored carbon in forests, told Eco-Business: “You cannot carry out proper forest protection, agricultural development, and setting land aside for community rights without proper mapping; it’s just not possible.”

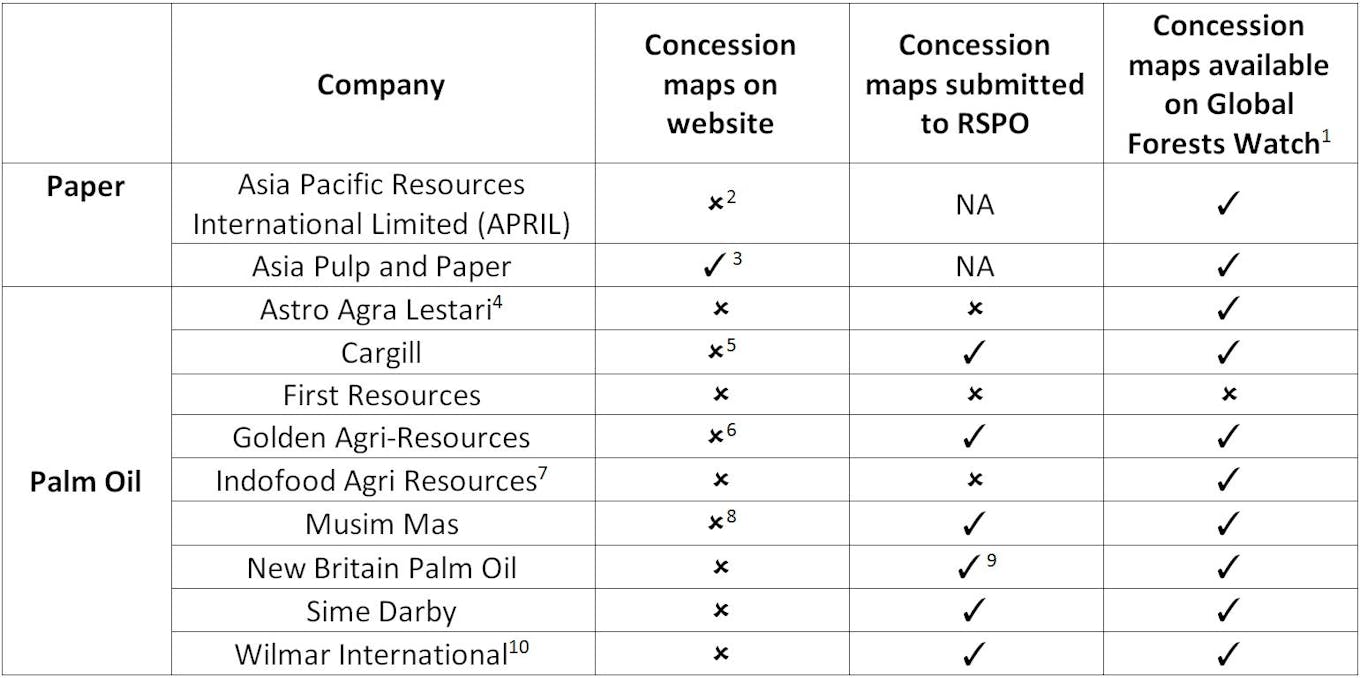

So just how transparent are the major players in Indonesia’s forestry sector? Eco-Business shows how they stack up on transparency when it comes to concession maps.

Availability of company concession maps on various web platforms. Refer to the end of this article for footnotes. Image: Eco-Business

This table has been verified by both the Roundtable on Sustainable Palm Oil - the industry association for responsibly grown palm oil - and the World Resources Institute, a Washington-headquartered environmental think tank which runs the Global Forest Watch tool. It maps, among other things, agribusiness concession boundaries, patterns of forest loss and regrowth, and protected land areas.

Singapore-listed palm oil firm First Resources fares the worst; while Asia Pulp and Paper leads the pack on making information readily available to the public.

Stefano Savi, global outreach and engagement director, RSPO, noted that transparency allows observers to identify exactly who owns the concessions where burning has occurred.

“Making more information publicly available is an empowering act that bridges the trust relationship between the growers and the public, consumers and government,” he added.

Many non-government organisations and research institutes have tried to develop tools to accurately outline concession boundaries, but their efforts have been stymied by the fact that existing Indonesian laws potentially prohibits the government from sharing maps publicly.

While the government is working on a programme called the OneMap initiative, which will provide a comprehensive land use map for the whole country, this will only be completed in the next two to three years.

Currently, industry players widely reference WRI’s Global Forest Watch, but WRI said a lot of the information comes from an outdated 2011 database.

Andika Putraditama, outreach officer, WRI Indonesia, said: “We understand (this) is not the most accurate and up-to-date information, but it is currently the only data available to public on companies concessions”.

In a parallel effort to increase transparency, RSPO last June shared the concession maps submitted by its members in 2013 to Global Forest Watch. These maps accounted for 12 per cent of total global palm oil production.

RSPO at the time said it expected to publish maps from all member companies by the end of 2014, and in July last year passed a resolution which requires member companies to make their existing concession boundaries publicly available in digital format known as shapefiles via the RSPO website.

But these plans have not been implemented as members voiced concerns that publishing their maps was in potential violation of Indonesian and Malaysian law, which prohibits sharing concession maps with any third party international organisation, said RSPO.

Hence, even though RSPO continues to collect maps from its members - 62 out of 102 members have submitted updated shapefiles in 2014 - none of this is reflected on GFW, which only has data from 2013.

No new maps will be published until the legal situation is resolved, said Savi, adding that “RSPO has since been reviewing the situation with a team of advisors from Malaysia and Indonesia”.

Despite the legal roadblock to making maps public, the benefits of doing so are clear, said Savi. “When a company becomes transparent, potential issues can be resolved much quicker.”

“It will also set a precedent for other members where they are able to learn more about one another and can work towards solutions faster,” he added.

Table footnotes:

1: Most GFW concession maps are based on data from the Indonesian Ministry of Forestry (now subsumed under the Ministry of Environment and Forestry). These maps were last released in 2011.

2: APRIL is in the process of building an online dashboard which will make this information available to stakeholders who enlist for the service. It also submits its concession data to GFW.

3: APP’s maps can be viewed on its Forest Conservation Monitoring Portal (no login required).

4: Astro Agra Lestari is the only palm oil company in the table that is not an RSPO member.

5: Members of the public may request in writing to view concession maps. Cargill also shares daily updates of its hotspot maps here.

6: Locations of processing facilities (mills, crushing plants, refineries) are available on GAR’s sustainability dashboard (login required).

7: Only two subsidiaries - PT Salim Ivomas Pratama Tbk and London Sumatra Indonesia TBK – are RSPO members. RSPO did not receive the mandatory ‘Annual Communication of Progress’ report from both companies last year.

8: Locations of refinery and kernel crushing facilities are available on Musim Mas dashboard (login required).

9: Also submits shapefiles to the Zoological Society of London to include on their Sustainable Palm Oil Transparency Toolkit, and has provided them to the Papua New Guinea Office of Climate Change and Development (OCCD) as part of the PNG UN REDD (Reducing emissions from deforestation and forest degradation) Programme for inclusion in a soon to be launched publicly accessible web-portal.

10: Locations of processing facilities are available on Wilmar’s dashboard (login required).