The forecast – a significant upwards revision of the IEA’s renewables projections last year – is largely driven by increasing expansion of solar energy in China and India, says the Paris-based organisation.

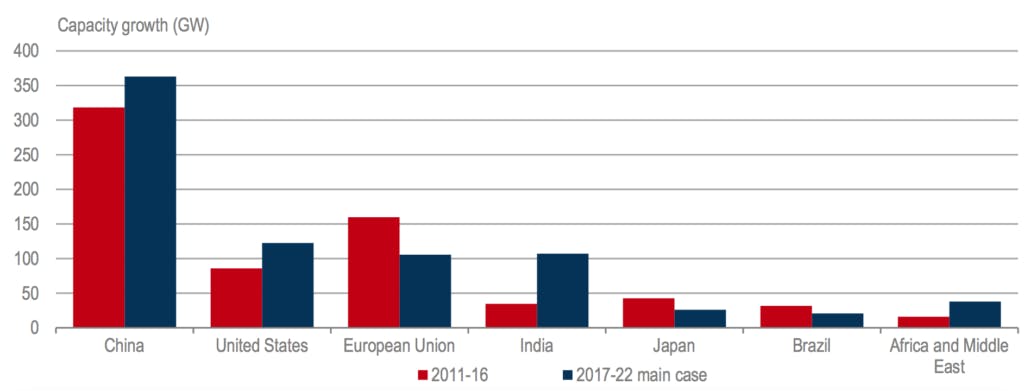

The global dynamics of renewables expansion will also shift over this five-year period, with capacity growth in India overtaking that of the EU for the first time.

Renewables accounted for almost two-thirds of net capacity additions in 2016, with almost 165 gigawatts (GW) coming online, the IEA adds. A further 920GW of renewable capacity will be installed by 2022, according to its forecasts.

Carbon Brief breaks down the IEA’s numbers for 2016 and the main elements of its renewables forecasts for the next five years.

Solar king

The revised IEA forecast comes after additions of solar PV capacity last year topped those of any other fuel, surpassing coal for the first time.

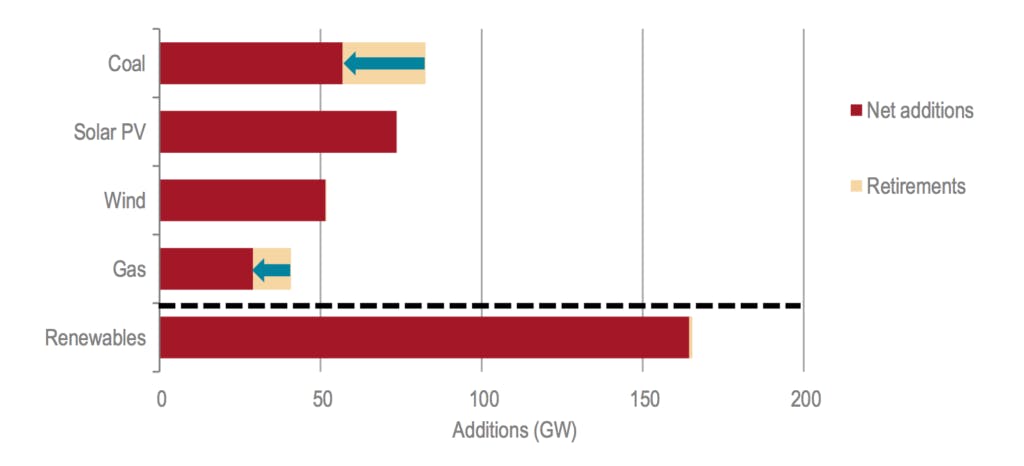

As the graph below shows, newly added capacity reached 74GW in 2016 – up almost 50 per cent from the amount added a year earlier. In total, renewables provided a record two-thirds of global net capacity additions.

Electricity capacity additions by fuel 2016. Source: Renewables 2017 Pre-launch Media Webinar.

The sector has also seen record-low auction prices of $30 megawatts per hour (MWh), the IEA notes.

Over the next five years, the IEA expects solar to represent by far the largest yearly capacity additions for renewables – well above wind and hydro.

Worldwide, solar PV capacity will hit a total of 740GW by 2022, more than the combined total power capacities of India and Japan today, it says, driven by continuous technology cost reductions and unprecedented market dynamics in China due to policy changes.

It’s worth noting that this new projection for solar PV revises forecasts up by over a third compared to the IEA’s forecasts last year (see below for more on this).

“Undisputed leader”

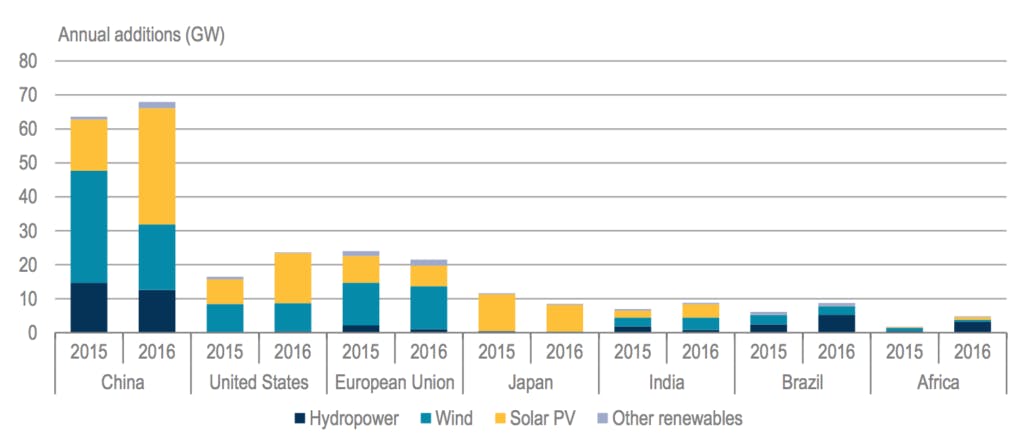

China accounted for almost half of the solar PV expansion in 2016, the IEA says. As the chart below shows, this was a large increase on its annual additions in 2015.

Renewable capacity additions in 2015 and 2016 by country/region and technology. Source: Renewables 2017, IEA.

Chinese companies now account for 60 per cent of the world’s solar cell manufacturing capacity. This means market and policy developments in China will have global implications on the deployment and prices of solar around the world, the IEA says.

China has already surpassed its 2020 solar PV target. The IEA expects it to exceed its wind target in 2019. (It’s also worth noting that the IEA said in 2015 that China would likely be two years late in meeting its wind energy goal.)

Writing in the foreward of the report, Dr Fatih Birol, executive director of the IEA, says China has increased its solar PV capacity almost 800-fold over the past decade and is now the “undisputed leader” in several renewables sectors. He writes:

“

Along with new policies that spur competition in several other countries, this Chinese dynamic has led to record-low announced prices of solar PV and onshore wind, which are now comparable or even lower than new-built fossil fuel alternatives.

Dr Fatih Birol, executive director, IEA

Accelerated forecast

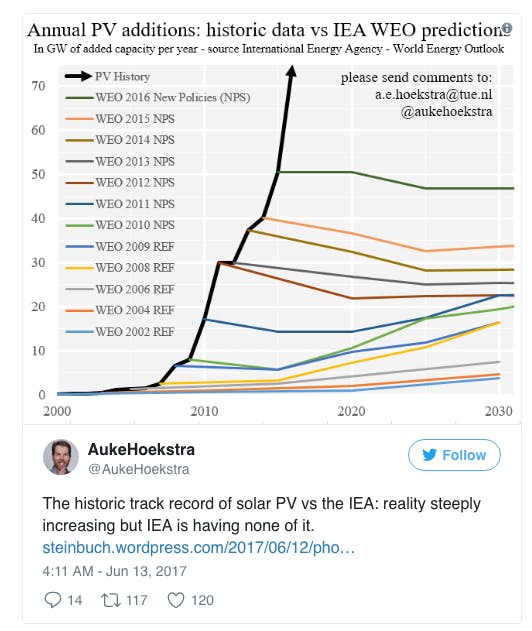

It is important to note that the IEA’s yearly five-year-forecasts have consistently underestimated the growth of renewable energy. The graph tweeted below shows how solar PV forecasts have been revised upwards each year.

In a recent article, Bloomberg New Energy Finance (BNEF) founder Michael Liebreichargued that the self-reinforcing nature of bad forecasts from authoritative agencies, such as the IEA, can have significant consequences for markets. He wrote:

“When the IEA and EIA [the US Energy Information Administration] say – as they did for many years after I founded New Energy Finance – that modern renewable energy will produce less than 1 per cent of the world’s electricity many decades into the future, that deters serious politicians, investors or business people from backing them.”

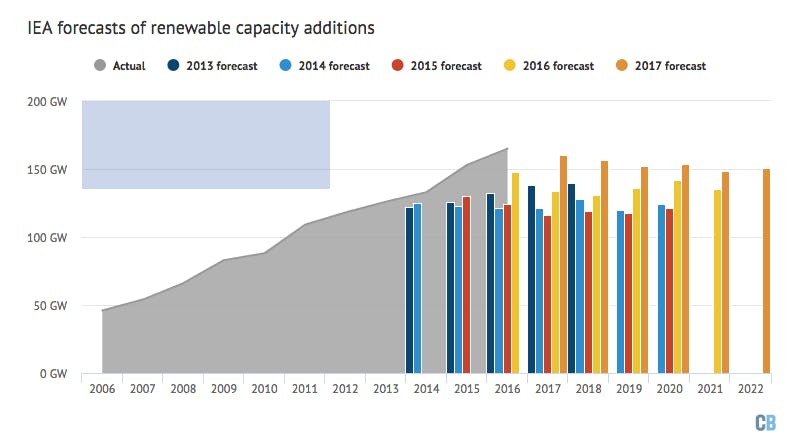

Last year, Carbon Brief took an in-depth look at how the IEA’s forecasts had have been revised upwards over the past four years. Carbon Brief has updated the chart below, which compares IEA forecasts versus actual growth, to include 2017.

IEA forecasts of annual renewable energy capacity additions versus actual growth. Source: Carbon Brief analysis of IEA Medium Term Renewable Market Reports 2013-2017. Chart by Carbon Brief using Highcharts.

Since 2015, the IEA has tried to address these shortcomings by adding an “accelerated” deployment path to its forecasts, whereby governments address policy challenges and lift barriers to deployment.

In this year’s forecast, total renewable capacity growth increases by an extra 30 per cent under this scenario, totalling an added 1,150GW by 2022.

In particular, if challenges in China around the cost of renewable subsidies and grid integration are addressed, its solar PV could reach a total of 320GW by 2022, equivalent to the total capacity of all power in Japan.

If these occurred along with possible policy and regulatory improvements in other key countries, such India, Japan and the US, world solar PV cumulative capacity could almost triple to 880GW by 2022 under this accelerated scenario.

China is in the process of a policy transition in this direction, the IEA says; for instance, through its move away from feed-in-tariffs (FiTs), although the timing and implementation of this remains uncertain.

EU overtaken

While China and the US remains the world’s first- and second-fastest growing renewables markets, respectively, over the forecasted (main case scenario) period, growth in India surpasses the EU for the first time, as the chart below shows.

Net additions to renewable power capacity by selected countries and regions. Source: Renewables 2017, IEA.

By 2022, the IEA expects India to have more than doubled its current renewable electricity capacity, with 90 per cent of this from wind and solar.

This will be driven by moves in India to address the financial health of its utilities and tackle grid-integration issues, the IEA says.

Meanwhile, in the IEA’s “accelerated case” – where India’s grid integration and infrastructure challenges are addressed, and policy and regulatory uncertainties reduced – renewable capacity expansion is increased by another third above this level. This would make India the joint second-largest growth market with US after China.

In the main-case forecast, the EU sees its renewables growth fall by 40 per cent between 2017 and 2022 compared with the previous five-year period, due to weaker electricity demand and overcapacity.

Limited visibility on the amount of capacity in upcoming auctions in some markets present a forecast uncertainty, the IEA adds. The new EU Renewable Energy Directivefor the post-2020 period, if adopted, would address this by providing market predictability for investors. (In the UK, the government has yet to set out plans for renewables auctions, following the most recent auction last month where offshore wind emerged as the biggest winner.)

The US remains in second place despite the current political uncertainty, the IEA says. This is because the main drivers for new onshore wind and solar capacities, including state level policies for distributed solar PV and federal tax incentives, remain strong

However, it notes that the current uncertainty over proposed federal tax reforms, international trade, and energy policies could have implications for the relative economics of renewables and their expansion.

Windfall

While wind energy continued to expand in 2016, its annual growth in capacity declined by almost a fifth compared to 2015 (a year which saw a developer rush in China).

Hydropower capacity expansion was also lower than in 2015. The Chinese market declined for a third year in a row, although there was strong growth in Brazil. Despite this, hydropower will remain the largest source of renewable electricity generation in 2022 under the IEA’s forecast, followed by wind, solar PV and bioenergy.

Coal will remain the largest source of electricity generation, however growth in renewable generation will be twice as large as that of gas and coal combined over the next five years.

This will help renewables will close in on coal’s lead, the IEA says in 2016, renewable generation was 34% less than coal, but by 2022 this will be halved to just 17 per cent.

Overall, the share of renewables in power generation will reach 30 per cent in 2022, up from 24 per cent in 2016, reaching over 8,000TWh.

Falling costs

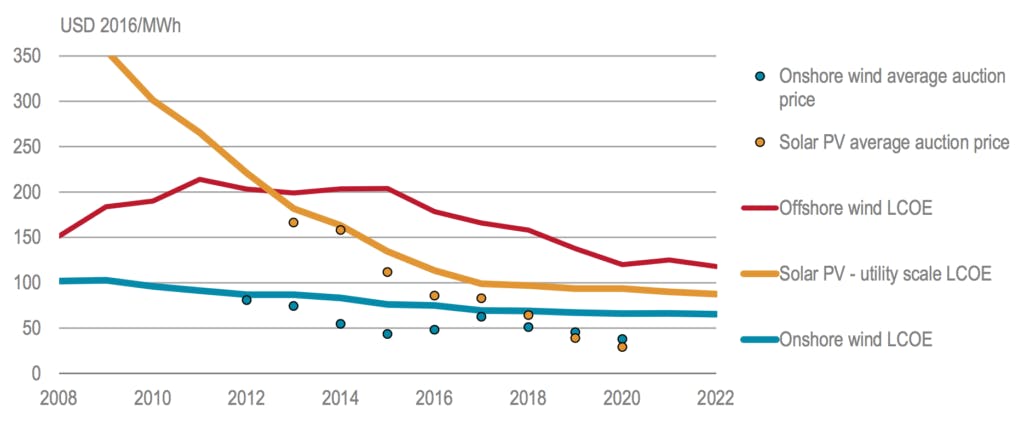

A changing policy environment will support more cost-effective deployment of wind and solar, the IEA says.

Global average generation costs fall by a quarter for utility-scale solar PV, almost 15 per cent for onshore wind, and by a third for offshore wind by 2022, as competition drives down costs.

The most significant policy development in recent years has been the shift from government-set Feed-in-Tariffs (FiTs) to competitive auctions with long-term Power Purchase Agreements (PPAs), the IEA adds. This is set to continue.

Almost half of renewable electricity capacity expansion will come from competitive auctions with PPAs over the next five years. This compares to just over 20 per cent in 2016.

Average levelised costs of energy (LCOEs) for wind and solar are expected to continue decreasing, but to remain higher than auction prices, as the chart below shows.

Global average levelised cost of energy (LCOE) and auction results for projects by commissioning date. Source: Renewables 2017, IEA.

System integration

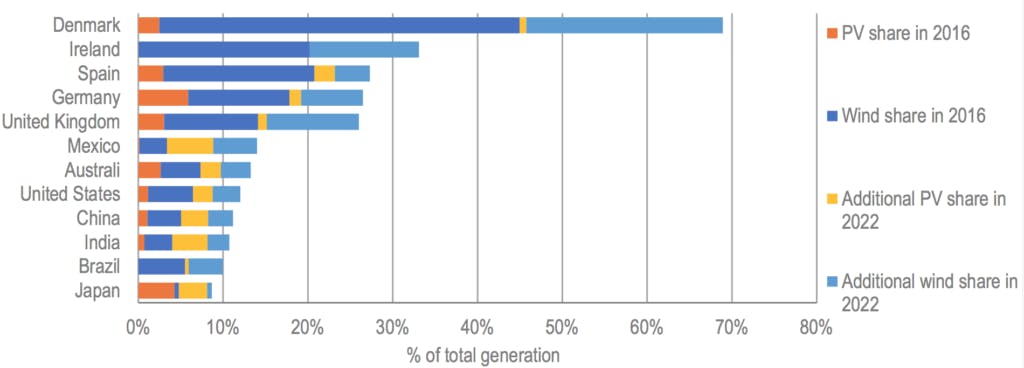

The IEA forecasts show wind and solar together representing more than 80 per cent of global renewable capacity growth in the next five years.

Denmark will likely be the world leader in variable renewables in 2022 with a 70 per cent share, largely from wind, as the chart below shows.

The IEA expects the share of wind and solar in total generation to surpass 25 per cent in a number of other European countries, including the UK and Germany. (The UK currently gets 25 per cent of its power from all renewables, including hydro and bioenergy).

In China, India and Brazil, the share of variable generation is expected to double to more than 10 per cent by 2022.

These higher proportions of renewables in electricity generation will make integration of these variable renewables into electricity system critical, the IEA says.

This means policymakers will need to put in place ways to increase system flexibility – such as grid interconnections, electricity storage and demand-side response.

Market and policy frameworks will also need to put other measures in place, such as long-term price signals to attract investment, pricing negative externalities, and fostering a portfolio of dispatchable renewable technologies, such as hydropower and bioenergy.

As the IEA notes, variable renewables are more exposed by losing system value as their proportion in the system increases. This is because their wholesale prices will fall exactly at the moments when their production is high and demand is low.

(An article by Michael Liebrich of Bloomberg New Energy Finance (BNEF) earlier this year looked at the policy options for integrating higher amounts of renewables into electricity networks in a cost competitive way.)

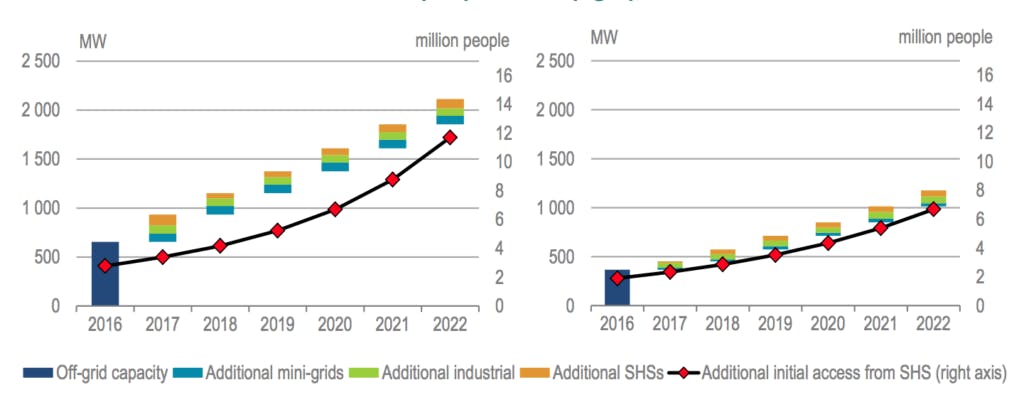

Off-grid

For the first time, the IEA’s forecasts have taken a closer look at how off-grid solar PV applications are developing in Asia and sub-Saharan Africa. This includes industrial applications, solar home systems and mini-grids driven by government electrification programmes.

Off-grid PV capacity additions and additional initial access per year from solar home systems from 2016-22 in Asia (left) and SSA (right). Source: Renewables 2017, IEA.

While such off-grid expansion will remain a small share of capacity total, it can have significant socio-economic impact by helping to bridge the electrification gap.

The IEA finds that off-grid capacity in these regions will almost triple by 2022 to more than 3,000 MW. In particular, solar home systems will bring basic electricity services to 65 million additional people in Asia and sub-Saharan Africa, the IEA says.

Slow moving

As well as penetration of renewables into the electricity grid, the IEA’s forecasts also look at the future of renewables in heat and transport.

Decarbonisation of transport remains a major policy challenge, it says, while the next chapter in the rise of renewables will also require more work on multiplying their applications in buildings and the industrial sector.

In its scenario, the share of renewables in road transport (including biofuels and renewable electricity for electric vehicles) is expected to increase only marginally, from 4.2 per cent in 2016 to 4.8 per cent in 2022.

The use of renewable energy in electric vehicles (EVs) remains limited. While the IEA expects EV sales to increase strongly on their current level, biofuels still represent more than 90 per cent of total renewable energy consumption in road transport in 2022 in the forecast, down from 96 per cent in 2016.

(It’s worth noting that renewables only account for 26 per cent of global electricity consumption by EVs today; the IEA expects this to increase to 30 per cent by 2022.)

Biofuel production increases modestly by 16 per cent by 2022, with most growth in Asia and Brazil. Advanced biofuel production remains low, at just over 1 per cent of total biofuel production.

(In the IEA’s accelerated scenario – which sees added policy focus and investment put on biofuels in India, Brazil and the US – biofuel production is 16 per cent higher again. However, renewables share of road transport fuel demand still only reaches just over 5 per cent by 2022.)

Heat

Bioenergy will also lead in renewable heat consumption growth, the IEA says. It’s worth noting that almost two fifths of energy-related CO2 emissions come from providing heating and hot water to buildings and industrial processes.

.png?auto=format&dpr=2&fit=max&ixlib=django-1.2.0&q=45&w=680)

Share of renewables in heat consumption from 2015-22. Source: Renewables 2017 Pre-launch Media Webinar.

But the IEA expects the overall share of renewables in heat consumption to increase only slowly, rising from 9 per cent in 2015 to 11 per cent in 2022. The EU’s binding Renewable Energy Directive targets will make it the second largest growth market after China, as well as remaining the global leader in terms of absolute renewable heat consumption.

This story was published with permission from Carbon Brief.