There are now over 200 “globally significant” financial institutions with coal exit policies, almost double the number in 2019 – a “positive development which showcases that global capital is shunning coal”, according to United States-based think-tank Institute for Energy Economics and Financial Analysis (IEEFA).

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

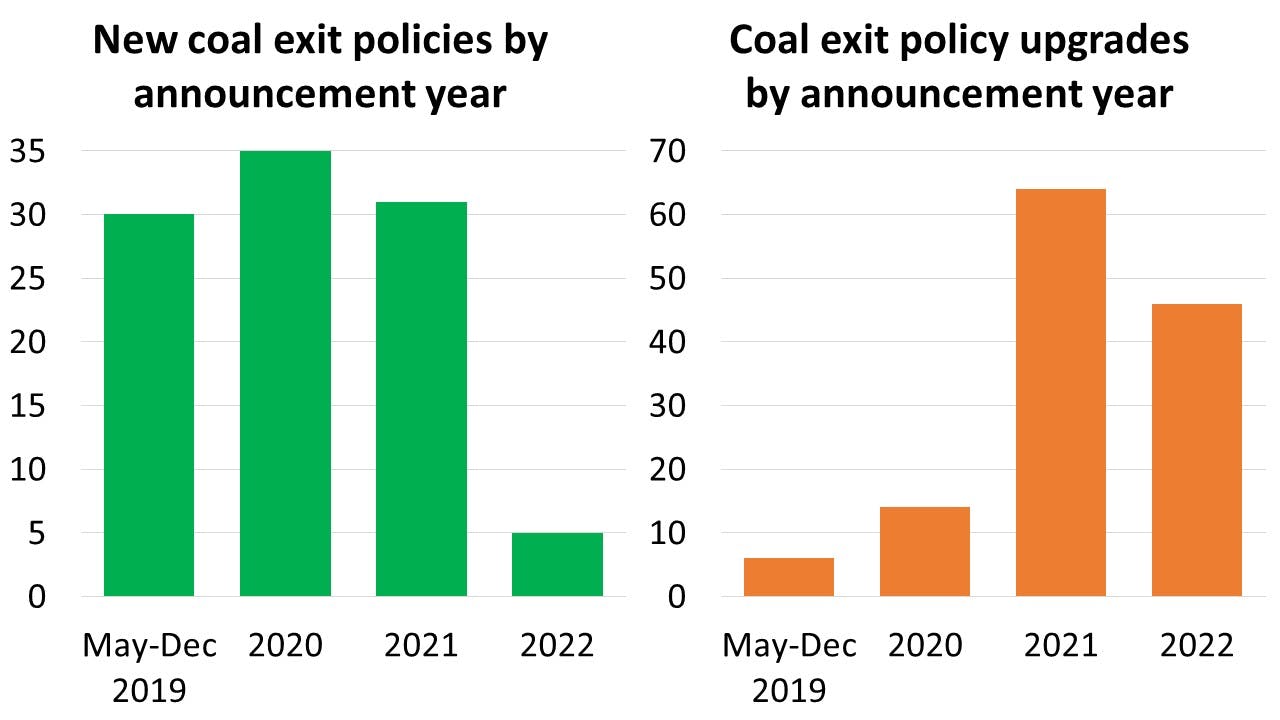

But new announcements from banks, insurers, pension funds and asset managers quitting coal slumped in 2022, a year that saw significant economic headwinds and continued energy market volatility. Only five firms holding assets of at least US$10 billion made coal exit pledges. Three are insurers: Japan’s Sompo Holdings, South Korea-based Korean Re and US-based AIG. Two are banks: Brazil’s Itau Unibanco and Sweden’s Swedbank.

There were over 30 new commitments made 2020 and also in 2021. Thirty pledges were made in the second half of 2019 alone.

Christina Ng, research and stakeholder engagement lead for debt markets at IEEFA, said that financiers’ commitment to exit coal is “strong”, when looking at new and revised policies in 2021 and 2022. Forty-six institutions beefed up their existing policies with details on geographical coverage, investment thresholds and coal exit timelines last year. The figure is lower than 2021’s 64, but higher than 14 in 2020.

“It went from a market that was establishing coal exclusion policies for the first time [before 2021], to a market [that asks] how do we make coal exclusion policies more effective,” Ng said.

Data: IEEFA.

The IEEFA report also noted that the momentum for coal exclusion remains “intact” amid rising fossil fuel returns in recent years.

Coal prices and demand have surged since 2021, driven by the global industrial rebound after Covid-19 lockdowns, and fuel export restrictions from major extractor Russia after its Ukraine invasion. Large coal mining companies tripled their profits in 2022 to over US$97 billion, according to a Financial Times tally.

IEEFA said financial institutions’ move away from coal financing stems from the increased viability of clean energy technologies, better understanding of how climate risks impact the global financial system and stakeholder activism.

Government climate moves, such as the Inflation Reduction Act in the United States, the “Fit for 55” package in the European Union, Japan’s “Green Transformation” programme and clean energy targets in China and India, point towards “gloomy days ahead for coal as investment opportunities in low carbon assets are encouraged”, the report added.

IEEFA said a robust coal exit strategy should include mining, power generation, and where feasible, when coal is used as feedstock, such as in steelmaking. Exclusions should also cover work around coal projects, such as if roads are being laid towards thermal plants. There should be clear timelines that follow science-based pathways for where investments are tapered down, IEEFA said.

Against such criteria, some of the financiers’ pledges fall short. The report noted, for instance, that US-based Metlife and Singapore-based OCBC Bank restrict funding for firms earning a certain portion of their revenue from coal, but do not specify how this threshold would reduce over time.

“The ultimate test for [financial institutions] is whether they implement a comprehensive coal exit policy and remain committed,” the report said, adding that they need to manage “conflicting views” from stakeholders which could lead to stated policies winding back.

Asia moves

Asia Pacific financiers introduced 15 coal exit policies in 2021 and 2022, the highest number compared to other parts of the world. Europe followed with 11; then North America with four.

There are now 53 financiers with exit plans in Asia Pacific. Most of them are based in wealthier nations – Japan houses 14, South Korea 13, Australia 12, and Singapore three. Within emerging economies, China and Malaysia have three such institutions each; India and the Philippines have one each. Many coal policies in this region do not commit to a complete phase-out, IEEFA noted.

The think tank said divestment policies are generally more stringent in Europe, where – 114 – over half of firms with coal exit policies, are based. North America has 27 such financial institutions.

Divest or engage?

Large finance groups have in recent years said that coal players should be supported in their decarbonisation journey, instead of being ditched via divestment. Such sales would clean up financial record books, but end up putting coal assets in the hands of more opaque private investors, they say.

Last year, the United Nations’ Race to Zero, a group that had set standards for a US$130 trillion climate finance coalition, softened its wording on coal phase-out after members reportedly threatened to quit over draft rules calling for an end to funding new coal projects.

Regulators are also supportive of engagement with coal players. Last month, Singapore’s central bank said it would widen its scope of sustainable funding to include “transition finance” for polluting industries in the region, but with safeguards in place against greenwashing.

But IEEFA said divesting from coal will eventually help to shrink available capital for the sector. It added that the movement also helps to stigmatise fossil fuels, just as similar campaigns did to gambling, tobacco and controversial weapons.

Financiers not divesting from coal may be using engagement with coal players as an excuse for continued investments, the IEEFA report said, pointing to research showing that firms with exit policies engage more with their coal assets.