South Korea’s biggest electricity distribution company said on Friday (16 October) it will not invest in further new overseas coal power ventures and would either cancel or convert two out of four remaining projects in the pipeline to gas-powered ones.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Korea Electric Power Corporation (Kepco) “and its subsidiaries will not be pursuing new overseas coal power projects”, said the firm’s chief executive Kim Jong-gap at an annual governmental audit hearing by the Korean National Assembly.

The two planned projects affected by the turnaround are the 1,000-megawatt (MW) Sual 2 coal venture in the Philippines and the 630-MW Thabametsi coal-fired power plant in South Africa, which have both been targeted by green groups over their environmental impacts.

However, Kepco still intends to proceed with the acquisition of a US$189 million stake in the controversial Vung Ang 2 coal-fired power project in Vietnam, which its board of directors approved only last week, and its participation in the Jawa 9 & 10 coal power venture in Indonesia.

Activists welcomed the move but urged Kepco to reconsider the two projects approved recently, stressing there is still time to back away or redirect finance to cleaner energy sources.

“It is not too late for Kepco to take the same approach for its recent investment in Jawa 9 & 10 in Indonesia and Vung Ang 2 in Vietnam. Both of these countries have adopted ambitious renewable energy plans, and converting these coal projects into gas or renewables will be far more beneficial for all parties involved,” said Sejong Youn, director of the overseas coal finance programme at Seoul-based climate policy group Solutions for Our Climate.

Lidy Nacpil, coordinator at Philippine non-governmental organisation Asian Peoples’ Movement on Debt and Development, said it hopes Kepco will “show real commitment to shift away from unwise and dirty investments immediately. We ask that Kepco reverse its decision on Vung Ang 2 and halt its financing for Jawa 9 and 10 because the climate crisis is worsening”.

The Korean government has been heavily criticised in recent months over its ongoing support for coal power—the largest contributor to human-caused climate change—despite green pledges made earlier this year and the country’s recent adoption of a climate emergency declaration.

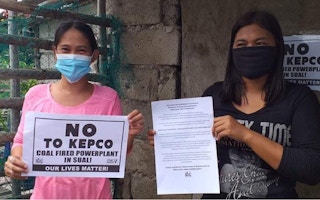

In the run-up to Friday’s meeting in Seoul, Philippine climate activists from several groups including the Save Sual Movement, the Philippine Movement for Climate Justice, and the Asian Peoples’ Movement on Debt and Development held a series of rallies at the Korean embassy in Manila to voice their opposition to the Sual 2 coal project.

Kepco has also come under fire from shareholders over the environmental and financial risks linked to its coal-fired power generation assets, as more stringent carbon emission regulations take hold and clean energy costs continue to drop.

Investors that have challenged the utility include APG, Legal & General Investment Management, the Church Commissioners for England, and the world’s top asset manager BlackRock. The latter is getting tough on firms that fail to make progress on tackling the climate crisis following its vow in January that it would divest from thermal coal.

As climate scientists sound increasingly dire warnings about climate change, politicians and activists have cautioned that South Korea’s coal investments risk damaging its image on the world stage. The nation remains one of the world’s top three public financiers of overseas coal power, providing approximately US$10 billion to overseas coal power projects between 2008 and 2018, according to Solutions for Our Climate.

Other government-owned companies that have heavily invested in the fossil fuel, including Export-Import Bank (Kexim) and Korea Trade Insurance Corporation (Ksure), have yet to back away from coal, while new legislation proposed in July that would prohibit public firms from pouring money into coal ventures overseas has not been passed into law.