Following two years of engagement with over 1,200 institutions and four draft releases, the Taskforce on Nature-related Financial Disclosures (TNFD) published its finalised framework today.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The set of recommendations – built on the widely-adopted Taskforce for Climate-related Disclosures (TCFD) framework and consistent with International Sustainability Standards Board (ISSB)’s inaugural standards – is expected to be the baseline standard for nature-related risk reporting. It is also aligned with the impact materiality approach used by the Global Reporting Initiative (GRI) that companies are familiar with.

British pharmaceutical group GSK, one of the 40 taskforce members representing over US$20 trillion in assets management, is the first company to announce its commitment to publish its first TNFD-aligned disclosures from 2026, based on 2025 data.

The taskforce anticipates more companies will follow suit in the coming weeks. It said it will reveal a list of early adopters who have indicated their intention to adopt the new recommendations at the World Economic Forum at Davos in January next year.

“We invite other early adopters to signal their intentions and start following the recommendations,” said David Craig, TNFD co-chair, in a statement.

TNFD said it will encourage and support voluntary market adoption of the recommendations, which it will track through an annual status update report beginning in 2024.

First announced in July 2020, the global initiative sought to enable organisations to report on their impacts on nature while redirecting financial flows toward nature-positive outcomes. Its founding members include data-driven non-profit Global Canopy, the United Nations Development Programme (UNDP), the UN Environment Programme Finance Initiative (UNEP FI) and WWF.

The final TNFD framework comes amid mounting pressure from shareholders, regulators and customers for companies to disclose the impact of biodiversity and nature-related loss on their business and to begin to address these risks.

More than half of the world’s economy – equivalent to about US$58 trillion – is at risk from nature and biodiversity loss, according to consulting firm PwC’s latest analysis.

“Nature-risk is sitting in company cash flows and capital portfolios today. The costs of inaction are mounting quickly. Businesses and financial institutions now have the tools they need to take action,” said Craig.

“Building on the language, structure and approach of the TCFD and consistent with the ISSB’s sustainability reporting baseline, the adoption of the TNFD Recommendations represent a step-change in the momentum and capacity for business and finance to identify, assess and disclose their exposure to nature-related issues in a manner consistent with climate-related-reporting.”

Elizabet Mrema, also TNFD co-chair and executive secretary of the Convention on Biological Diversity Secretariat that oversaw COP15 negotiations, said that nature degradation is increasing, yet businesses have “mostly considered nature to be an unlimited and free provider of critical inputs into their operations and value chains”. “With six of the nine planetary boundaries already breached, nature risk is financial risk,” she reminded.

The COP15 biodiversity conference held in December last year had concluded with a landmark deal to protect 30 per cent of the planet by 2030.

“

With six of the nine planetary boundaries already breached, nature risk is financial risk.

Elizabeth Mrema, TNFD co-chair and deputy executive director of UNEP

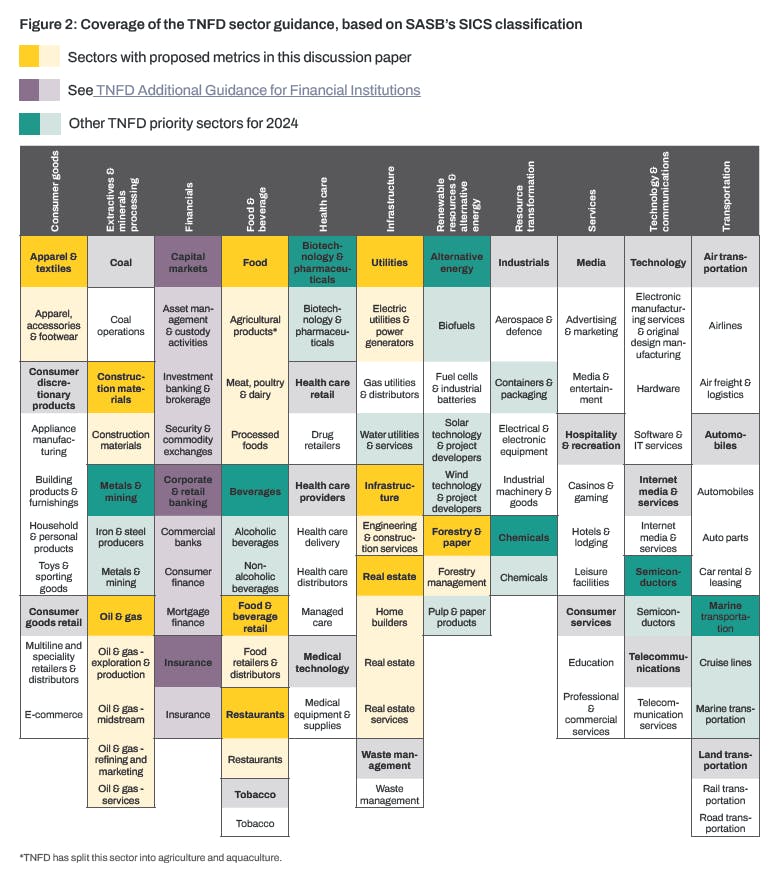

In addition to the final recommendations, TNFD released a discussion paper on sector disclosure metrics for public consultation until 29 February 2024. The taskforce is also preparing a guidance document for sectors that have been identified to have significant dependencies and impacts on nature. This will be released before the COP28 summit in December this year.

Sectors with proposed metrics in the Taskforce for Nature-related Disclosures (TNFD)’s discussion paper include apparel & textiles, construction materials, oil and gas, food and beverage, utilities, infrastructure, real estate, as well as forestry and paper. Source: TNFD’s discussion paper on proposed sector disclosure metrics

In the discussion paper, TNFD recommended organisations in sectors not yet covered, like coal, healthcare providers and air transportation, to seek guidance from organisations like GRI and the Sustainability Accounting Standards Board (SASB) as well as adopt industry best practices.

The TNFD framework has been welcomed by major standards bodies and market participants. 15 consultation groups in 12 countries and three regions, including regional grouping Asean, have been established to mobilise market participation through capacity-building on nature-related reporting.

Eelco Van Der Enden, GRI’s chief executive, congratulated TNFD on the launch of its final recommendations, which are “to a high extent consistent with the GRI Standards, just as the GRI Biodiversity Standard is informed by the work of TNFD.”

ISSB vice chair Sue Lloyd noted the “high-level of consistency within the finalised TNFD recommendations an the ISSB Standards, which both incorporate the architecture of the TCFD recommendations.”

Nicolette Bartlett, chief impact officer at carbon disclosure non-profit CDP, added that its current disclosure system includes forests and water, and many questions in its questionnaires align with metrics within the TNFD framework.

“The TNFD also covers key areas such as oceans, which CDP has committed to expanding to alongside all other environmental topics. The TNFD framework will enable CDP to further accelerate our incorporation of more environmental topics by providing a robust set of good practice indicators on areas such as oceans and land,” said Bartlett.

There are also criticisms from civil society of the new framework. In a pre-emptive response to the final version of the TNFD, the Rainforest Action Network (RAN) accused the taskforce of failing to address ongoing fears of greenwashing.

“Our experience of tracking TNFD is that not only will it be ineffective, but that its framework will allow companies to write reports that actually amplify and legitimise corporate greenwashing and misinformation,” said Shona Hawkes, an advisor at RAN, in a statement.

RAN found issue with the reputations of corporations that the taskforce members represent – including Bank of America, which it says is among the top five bankers of fossil fuels, Dow and Bayer, which continues to wrack up fines for environmental violations and BlackRock, which it pointed out has been kicked out of a UN Women partnership after mass outcry, given its social and environmental record.