THE FUTURE OF

DATA CENTRES

Looking at Asean’s next generation of

data centres from a lifecycle lens

By Holly Naylor | Editors: Junice Yeo, Zhaoying Ng

The burgeoning digital economy of Southeast Asia, fuelled by relentless advancements in artificial intelligence (AI), cloud computing, and the integration of high-density digital technologies, places the region at a critical juncture in data centre development.

As these facilities become central to digital infrastructure, it has become an imperative to balance their environmental impact with the economic growth they enable. Singapore, Malaysia, and Indonesia, pivotal in this endeavour, all face distinct sustainability challenges in their journey towards greener data centre operations.

This white paper by Eco-Business, commissioned by Tai Sin Electric, explores the challenges and potential solutions to enhance energy efficiency, reduce carbon emissions and ensure that data centre growth aligns with the global drive towards decarbonisation.

We address the complete lifecycle of data centres—from construction through operation to decommissioning—and highlight innovative practices that can mitigate their environmental footprint.

Introduction

As Southeast Asia's digital economy surges, the region's data centre industry stands at a critical tipping point. With an unprecedented wave of investments in digital infrastructure driven by the insatiable demands of AI, cloud computing, and edge computing, data centres are grappling with the urgent need to balance rapid growth with sustainability.

The path to a sustainable digital future is complex. Inconsistencies in reporting, raw material sourcing, and e-waste management highlight the need for comprehensive strategies that address the entire data centre lifecycle. While data centres often focus on energy efficiency, truly achieving decarbonisation goals requires examining the broader impact across the value chain. A data centre's Scope 1, 2, and 3 emissions will face increasing scrutiny.

According to the International Energy Agency (IEA), estimated global data centre electricity consumption in 2022 was 240-340 terawatt-hours (TWh) or around 1-1.3 per cent of global final electricity demand. The advancement of AI and machine learning has accelerated cloud computing demands far more rapidly. Singapore's consumption needs are expected to enter the gigawatt (GW) range in 2024, while Malaysia, with 189 megawatts (MW) of operational capacity, is projected to grow by 600 per cent in the next 5 years.

As Scope 2 emissions from purchased electricity for operations and cooling continue to swell, data centre operators face the critical challenge of limited clean energy sources. An expanding Scope 3 carbon footprint from activities upstream (suppliers) and downstream (customers) is a looming problem.

Meanwhile, hyperscalers and niche players are rapidly expanding their operations in Southeast Asia's data centre market, driven by AI and the region's booming digital economy. However, these companies are increasingly cognisant of growing sustainability pressures from multiple fronts: financial institutions implementing stricter ESG criteria, government regulations pushing for greener practices, corporate clients demanding sustainable solutions, the need to reduce operational costs through energy efficiency and growing public awareness about environmental impacts. Consequently, data centre operators are actively seeking to balance their expansion with sustainability initiatives, including improving energy efficiency, seeking renewable energy sources and exploring innovative cooling technologies suited to the region's tropical climate. However, the resultant e-waste generated upon equipment upgrading or data centre decommissioning, gains less attention in comparison.

Governments are improving infrastructure and clean energy support but often neglect Scope 3 emissions in procurement, construction and e-waste. As decarbonisation pressures rise, sectors reliant on data centres face mounting challenges. To make significant progress, circular economy principles must be integrated from the start of the data centre lifecycle, and all data centres should consider cradle-to-grave strategies.

Our research interviews point to the need for stakeholders across the value chain to unite to address the pressing skills gap in the industry, as well as to further innovation and share knowledge. It is only through a coordinated effort that the Asean region can pioneer a sustainable future for the global digital infrastructure sector.

"The growth in data centres, fueled by AI, is potentially immense. AI has been advancing rapidly, and the market is expected to accelerate further."

Wandrille Doucerain

Managing Director – Power & Sustainability at DDSP

AI fuels demand

The AI revolution is fuelling data centre expansion in Singapore, Malaysia and Indonesia, resulting in an even larger emissions footprint for the sector.

As AI-powered applications become more prevalent, the need for specialised data centres and higher rack densities is expected to increase significantly, particularly in Asia Pacific. Globally, data centre storage capacity is anticipated to increase from

10.1 zettabytes (ZB) in 2023 to 21.0 ZB by 2027, representing a compound annual growth rate (CAGR) of 18.5 per cent over five years.

However, this surge in demand puts additional strain on already struggling power grids, which may find it a challenge to support the global shift towards electrification and the expansion of critical digital infrastructure. More energy is required for tropical data centres due to cooling demands.

Despite these challenges, rising power demands have the potential drive the adoption of clean energy and more efficient operations in data centres. Although still in the early stages, shifting to cleaner energy can ease grid pressure and cut carbon footprints. Global reporting and regulatory demands are also pushing data centres to rethink their operations and energy usage, positioning hyperscalers in particular to lead the way in sustainable energy consumption.

"The challenges are multifaceted, involving supply constraints and the consistent push towards decarbonisation"

Market Focus:

Singapore

Unique market opportunity

Singapore's mature data centre market is characterised by high demand, with major cloud service providers and hyperscalers dominating the landscape. Despite being highly regulated, sourcing clean power remains a significant challenge. The nation's comprehensive regulatory framework ensures data security, privacy, and sustainability.

Regulatory framework and incentives

The Infocomm Media Development Authority (IMDA) of Singapore has unveiled a Green Data Centre Roadmap and other initiatives to ensure the sustainable growth of the country's data centre industry while supporting its digital economy ambitions. The roadmap aims to provide at least 300MW of additional data centre capacity in the near term, with the potential for more through green energy deployments by partnering with the industry.

This will be achieved through a two-pronged approach: improving energy efficiency at both hardware and software levels, and accelerating data centres’ use of low-carbon energy sources. The government will support this transition by co-developing enhanced standards and certifications, refreshing the BCA-IMDA Green Mark for data centres, introducing standards for IT equipment energy efficiency and liquid cooling, and providing incentives such as grants for resource efficiency and energy efficiency.

Clean energy profile

As of the first half of 2023, Singapore's energy profile relies heavily on natural gas (94.3 per cent), with a small proportion of other energy products such as municipal waste, biomass, and solar (4.4 per cent). The government aims to import up to 4GW of low-carbon electricity by 2035 and is exploring clean alternatives to enhance energy security and decarbonise in line with its 2050 net zero goal. Initiatives like the SolarNova programme, which aggregates public sector demand for solar panel installation and the exploration of hydrogen fuel development highlight Singapore's commitment to increasing its clean energy mix.

Local challenges

Singapore faces significant challenges due to limited domestic clean energy capacity, high land and facility costs and stringent regulatory requirements. The high cost of building and maintaining data centres, combined with land accounting for 62.5 per cent of the total cost, poses scalability issues. Despite lifting a previous moratorium on new data centre projects, capacity for ongoing expansion remains limited.

Innovation and collaboration

Government initiatives like the Digital Connectivity Blueprint encourage operating data centres at higher temperatures to save cooling energy. The Sustainable Tropical Data Centre Testbed at the National University of Singapore (NUS), a collaboration between industry, government and academia, aims to revolutionise cooling technologies for tropical climates. Singapore's data centre industry exemplifies a balanced approach to growth and sustainability, placing Singapore as a global leader in tropical data centre sustainability.

Market Focus:

Malaysia

Unique market opportunity

Malaysia is emerging as a critical data centre hub in Southeast Asia due to its strategic location, competitive advantages, and government support. Its proximity to Singapore and lower operational costs have attracted significant investments. However, concerns arise about prioritising market growth over decarbonisation. Malaysia's digital economy is projected to represent 25.5 per cent of the country's gross domestic product (GDP) by 2025, indicating substantial growth potential in the sector.

Ethical sourcing of clean power

Malaysia faces the challenge of ethically sourcing clean energy at scale for data centres. While there is a focus on improving power efficiency and adopting clean energy to mitigate environmental impacts, these solutions have been linked to environmental damage, governance problems, and human rights risks in Asia, including Malaysia.

"Regulatory frameworks play a crucial role in shaping the sustainability landscape. As these regulations evolve and adapt to the changing needs of the industry, there is significant potential for progress in the realm of sustainable energy purchasing.

By addressing the current complexities and inconsistencies in the regulatory environment across the region, particularly in these three countries, we can create a more conducive framework that encourages and supports the adoption of sustainable practices in the data centre industry"

Scope 3 Challenges and E-Waste Management

The focus on clean energy in data centre construction often overshadows the importance of sustainable material sourcing and decommissioning. Managing electronic waste sustainably remains a significant challenge despite implementing various laws and regulations. Informal recycling activities and inadequate infrastructure lead to improper disposal and treatment of hazardous materials, posing risks to human health and the environment.

Developing a skilled data centre workforce

The rapid expansion of data centres has led to a shortage of skilled professionals. Addressing this talent shortage involves leveraging the gig economy, recognising the significance of transferable talents from non-traditional backgrounds, and enhancing mentorship programs.

Towards a holistic regional approach

The Malaysian data centre market is heating up due to its strategic location, but dedicating land to data centres must be meticulously planned. This often involves taking land earmarked for homes or agriculture, presenting a dilemma for policymakers. Proactive planning and regulatory oversight are key to addressing energy needs and ensuring the development of scalable, sustainable, and green data centres, a requirement for businesses seeking sustainability and scalability. Robust cybersecurity measures are also crucial.

Singapore's headstart in its approach of implementing a cohesive national strategy and putting in place a clear policy framework that supports renewable energy with careful socio-environmental considerations may provide a useful reference. To capitalise on opportunities, the industry must focus on environmental assessments, adopt green technologies and AI-driven efficiencies, and invest in research and development, as well as academic collaboration. Strategic planning should prioritise sustainability, explore innovative solutions and adopt advanced cooling technologies.

Notable developments

Malaysia is well-positioned as a regional data centre hub due to cost-effective development, reliable power, and reasonably-priced land. The country's commitment to sustainability, its plan to reach aiming for 40 per cent clean energy by 2035, and its strategic location in Southeast Asia, enhanced by extensive connectivity, strengthen its position as an attractive data centre hub. Malaysia is also leading in pioneering energy projects, such as green hydrogen production, demonstrating its capability to lead in innovative decarbonisation approaches.

Strategic partnerships and future outlook

Microsoft's establishment of an Azure data centre in Malaysia underscores the country's untapped potential within the region. This development highlights significant growth opportunities and positions Malaysia as a key player in the rapidly evolving technology landscape. Malaysia’s data centre industry offers a complementary solution to Singapore's constraints, encouraging a symbiotic relationship that benefits both nations.

“…An approach incorporating cross-functionality and integration, awareness through education is imperative in ensuring an effective direction and action towards achieving the overarching sustainability goals and ambition.”

Market Focus:

Indonesia

Unique market opportunity

Indonesia is Southeast Asia's most populous nation, with 279 million people. Its huge digital economy represents a vastly underserved market for data centres. The archipelago could potentially absorb thousands more megawatts of new data centre capacity. Indonesia hosts around 94 data centres and six planned data centres in Batam, with a combined capacity of 291MW. The government's continued investment in the digital economy and the Green Data Standard 2024 position Indonesia as a significant growth market.

Regulatory and government incentives

Indonesia actively supports the data centre industry through various regulatory and financial incentives. Key initiatives include upcoming amendments to data regulations, new energy regulations focused on sustainability, and the government's plan to build a "green" national data centre. Additionally, the government facilitates investment permits, offers tax relief, and improves ICT infrastructure to promote green technology. New data centres in Indonesia must also use locally sourced materials and power.

Clean energy profile

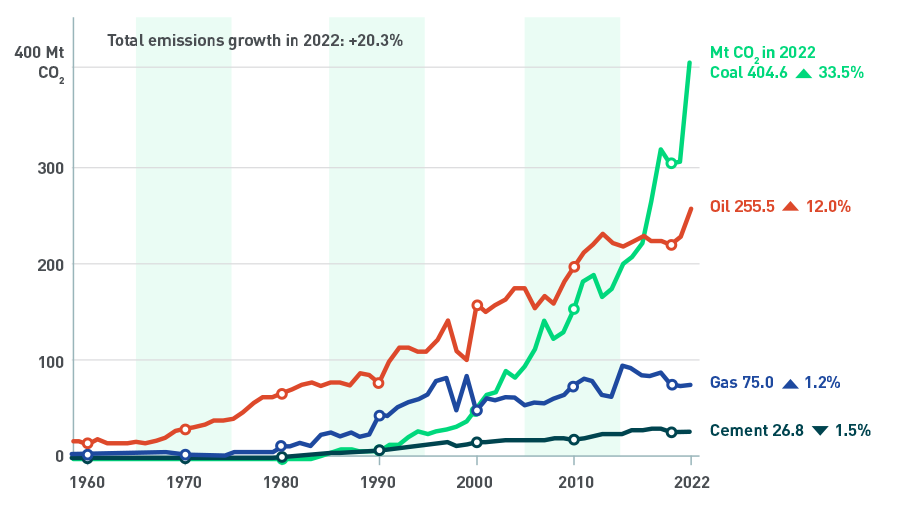

Indonesia's energy profile in 2019 showed a heavy reliance on fossil fuels, with coal use at 37.3 per cent of the total energy mix, oil at 35 per cent, and gas at 18.5 per cent, while non-renewable energy (NRE) accounted for only 9.2 per cent. Efforts like the Just Energy Transition Partnership (JETP) aim to retire coal-fired power plants and promote clean energy, targeting carbon neutrality by 2050. The government has unveiled a $20 billion investment plan to reduce grid emissions and boost the share of clean energy in its energy mix to 44 per cent by 2030.

Figure 1: Annual fossil fuel emissions in Indonesia

Source: Mongabay

Source: Mongabay

Key developments

Indonesia's data centre sector is poised for significant expansion, with projections indicating a compound annual growth rate (CAGR) of 14 per cent from 2023 to 2028. Its market value is anticipated to rise from $2.06 billion in 2023 to $3.98 billion by 2028. These growth prospects have attracted major international cloud service providers, including Amazon Web Services, Google, Microsoft, and Alibaba, to set up data centres in Indonesia.

Provisions for Scope 3 emissions

Indonesia has several regulations addressing Scope 3 emissions, including the Hazardous and Toxic Waste Management Regulation. However, the infrastructure for e-waste recycling is limited, particularly in remote locations. Most e-waste ends up in landfills or the informal waste management sector.

"In Indonesia, the government has recognised lifecycle assessment as a crucial tool for quantifying environmental impact. This emphasises the importance of a comprehensive approach to sustainability, where circularity isn't just an option but a fundamental component of operational strategies in the tech industry, aiming to reduce environmental footprints comprehensively."

Local challenges

The slow growth of renewable energy, heavy reliance on fossil fuels, and limited strategies for alternative fuels hinder the country's progress towards climate change mitigation and sustainable energy practices. Developing low-carbon alternatives such as bioenergy and hydrogen faces various socio-environmental and financial obstacles. Indonesia's decarbonisation strategy for the transportation sector involves electrification and low-carbon fuel alternatives, but further steps are needed to accelerate the energy transition and meet the country's targets.

Notable developments

Due to Indonesia's geographical advantages, efforts are being made to harness geothermal and biomass energy. The government's initiatives, such as building four national data centres and improving digital infrastructure, aim to accelerate the digital economy. However, the country's reliance on coal and the need for significant investment in clean energy remain critical challenges.

Scope 2 emissions:

The critical hurdle

Scope 2 emissions resulting from purchased electricity are a primary concern for data centres and constitute a major portion of their carbon footprint. As data storage and processing power demands grow, transitioning to clean energy sources is critical to address this challenge.

Although there are growing demands for more rigorous energy reporting in grid infrastructure and data centres, there is still a lack of clarity and agreement on which specific aspects of AI's energy-related impacts should be tracked, particularly concerning computing operations. Moreover, much of this information is not readily available, making it difficult to understand the situation comprehensively.

Power Usage Effectiveness (PUE), a fundamental metric for measuring data centre energy efficiency, is calculated as the ratio of total energy consumed to the energy used specifically by IT equipment. The ideal PUE is 1.0, but due to various factors, most data centres fall within the range of 1.2 to 1.4. Improving PUE offers benefits such as cost savings, environmental sustainability, enhanced reliability and capacity optimisation. PUE is one of over 30 sustainability metrics which can potentially be used to provide a holistic perspective of data centre sustainability.

“There is a necessity for data centre operators and investors to make strategic capital expenditure (CAPEX) decisions that prioritise sustainability. This involves considering innovative cooling solutions and onsite clean energy generation from the planning phase, ensuring that initial investments align with long-term decarbonisation goals. This is further illustrated in the decline in PUE staying closer to the theoretical optimum level of 1 over the years as efficiencies have been implemented.”

Beyond Scope 2:

Value chain considerations

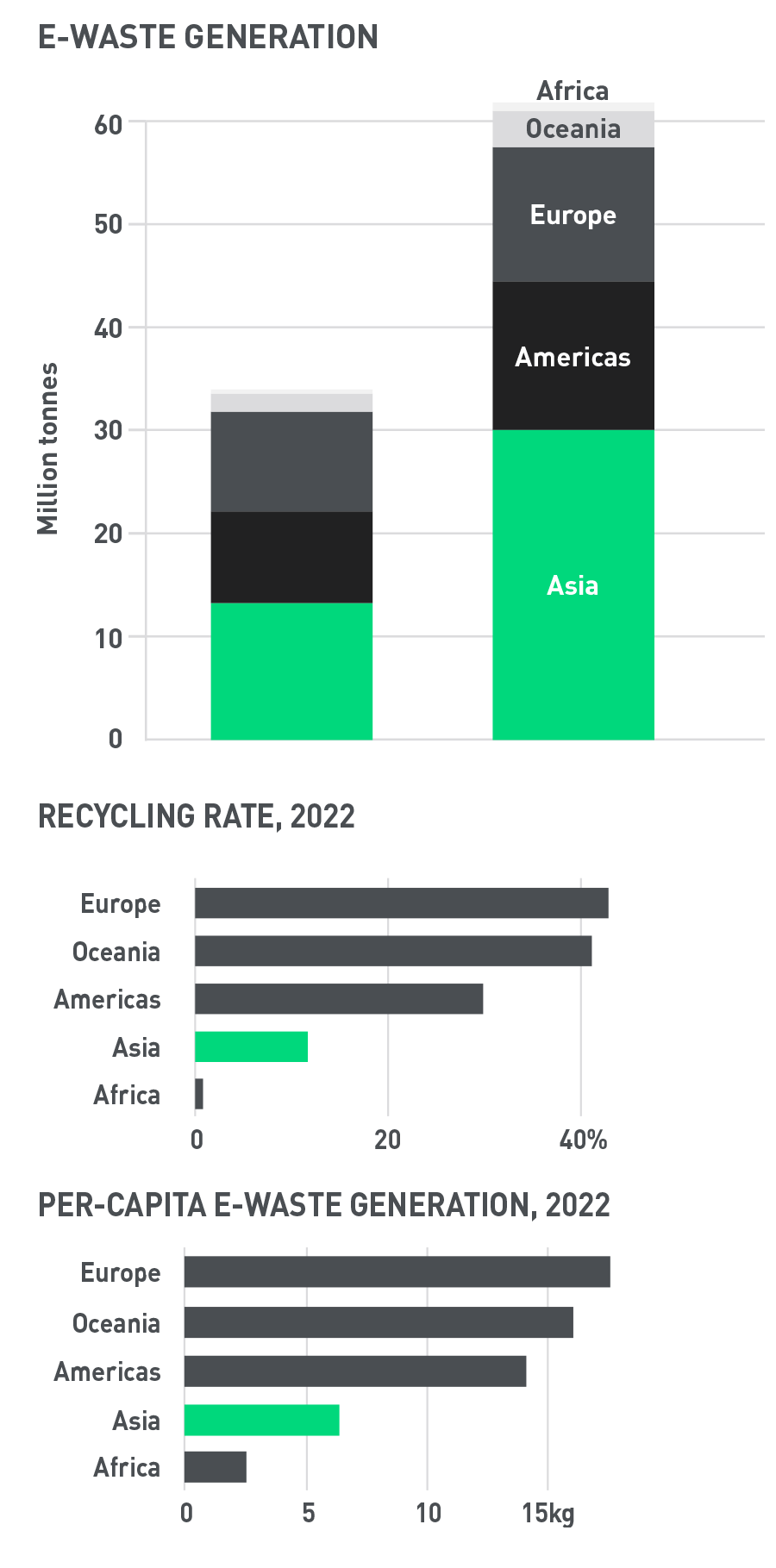

Southeast Asia's rapidly growing data centre industry faces an impending e-waste crisis, potentially undermining sustainability efforts and exacerbating material shortages. According to the World Economic Forum, the amount of e-waste generated worldwide has significantly risen, nearly doubling over the last 12 years. Only 22.3 per cent of the world's e-waste was properly collected and recycled in 2022, resulting in the loss of $62 billion worth of recoverable resources and heightened environmental risks.

Asia generated 30 million tonnes of e-waste in 2022, with recycling rates varying significantly across the region, with some countries having rates as low as zero. Southeast Asia also receives increasing volumes of e-waste from East Asia and North America. E-waste will exponentially increase with data centres' proliferation and equipment obsolescence speed every two to three years. Southeast Asia receives growing e-waste volumes from East Asia and North America, often exceeding the region's recycling infrastructure capacity.

Figure 2: Global e-waste generation and recycling rates

Eco-Business graphics. Data: United Nations Institute for Training and Research

Eco-Business graphics. Data: United Nations Institute for Training and Research

Embodied carbon considerations must also be integrated into the data centre construction process, with owners setting targets and making informed design decisions. Understanding Scope 3 emissions should be on par with cost and PUE. Collaboration across academia, business and governments at a regional level is required to develop best practices and share knowledge on the necessary infrastructure. Data centre decommissioning can no longer remain a secondary concern.

"I think it's important to not neglect the area of embodied carbon... It's not just about choosing to decarbonise Scope 2 [emissions] and not Scope 3; it should be all three. ”

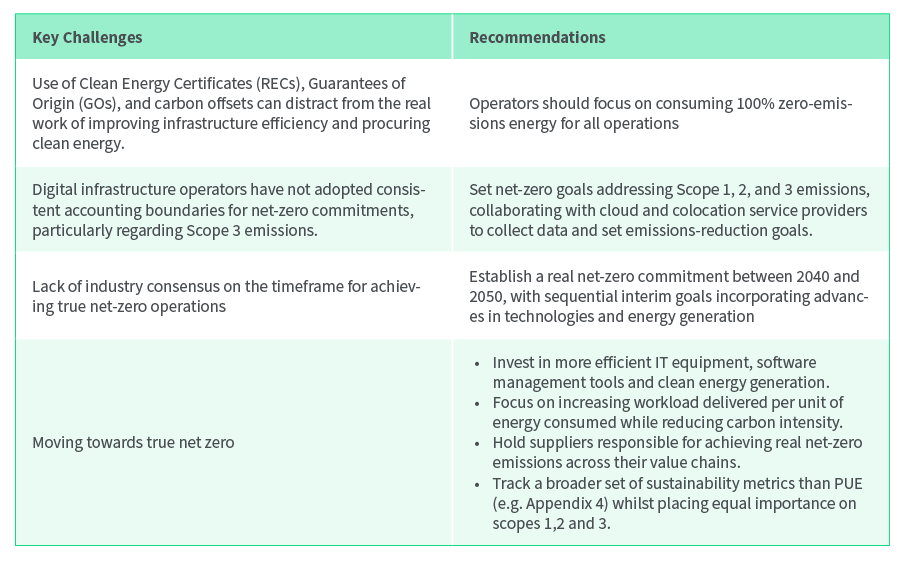

Figure 3: Key challenges on the path towards net zero

Source: Uptime Institute

Source: Uptime Institute

Towards enhanced collaboration and transparency in data centres

As the digital economy in Southeast Asia continues to grow, driven by advancements in AI, cloud computing, and high-density digital technologies, the need for a holistic approach to data centre development at a regional level becomes increasingly important. Collaboration among industry stakeholders is crucial to meet user demands for cross-market services, with Asean data centres setting shared standards rather than competing.

"It's really about adopting a collaborative mindset... if we can form partnerships between operators, technology providers, as well as the relevant government agencies, we can bring about industry-wide improvement in the area of sustainability and decarbonisation."

Regional collaboration, such as through the Asia-Pacific Data Centre Association (APDCA), is key to delivering a positive impact and advocating for the industry's interests. To effectively reduce carbon emissions and energy consumption, a collaborative lifecycle approach and a Total Cost of Ownership mindset are essential. Sustainability considerations should be present from the start, and emissions must be minimised across Scopes 1 to 3.

Tools like the BCA's Green Mark embodied carbon calculator are helpful, but further development is needed to address Scope 3 emissions and ensure regional applicability. The application of comprehensive and standardised data centre metrics across the industry could be beneficial at regional, governmental and industry levels.

Survey: Attitudes towards sustainability in data centres

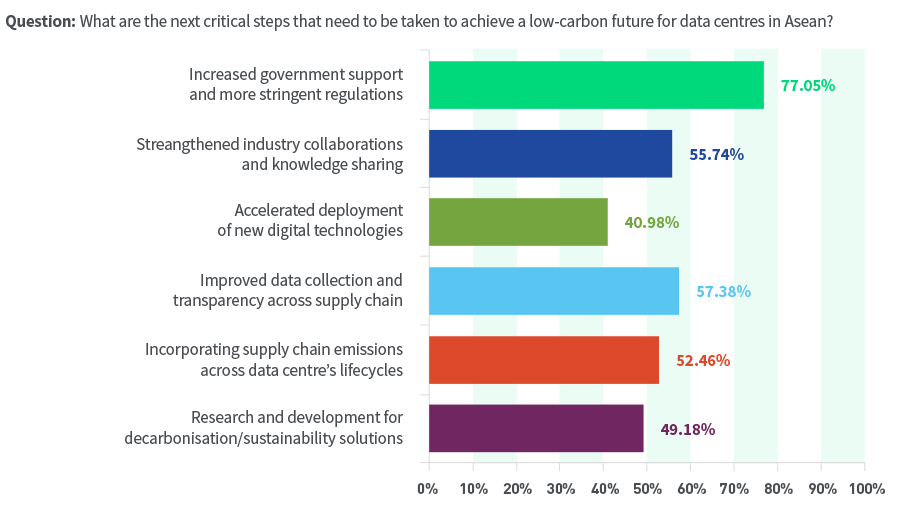

According to an Eco-Business survey conducted between February and April 2024 with 61 respondents primarily from Singapore, Malaysia, and Indonesia:

- 57 per cent of respondents stated that improved data collection and transparency across the supply chain are critical for achieving a low-carbon future for data centres in Asean, whilst almost 80 per cent indicated government support and stringent regulations were key.

Figure 4: Survey highlights – Critical steps to achieve a low-carbon future for data centres in Asean

Source: Eco-Business online survey “Asean’s data centre decarbonisation roadmap in the face of climate change” February 2024-April 2024, 61 respondents.

Source: Eco-Business online survey “Asean’s data centre decarbonisation roadmap in the face of climate change” February 2024-April 2024, 61 respondents.

- 77 per cent cited increased government support and more stringent regulations as key requirements.

- 51 per cent indicated that sustainability and decarbonisation credentials are important factors when choosing a third-party data centre provider, with an additional 38 per cent considering them a contributing factor.

- The most sought-after sustainability strategies included using renewable energy or sustainable alternatives (65 per cent) and implementing energy-efficient technologies (67 per cent).

- Respondents identified the lack of clean energy, lack of government incentives, insufficient governmental support, and lack of governmental alignment with sustainability as the top barriers to progress.

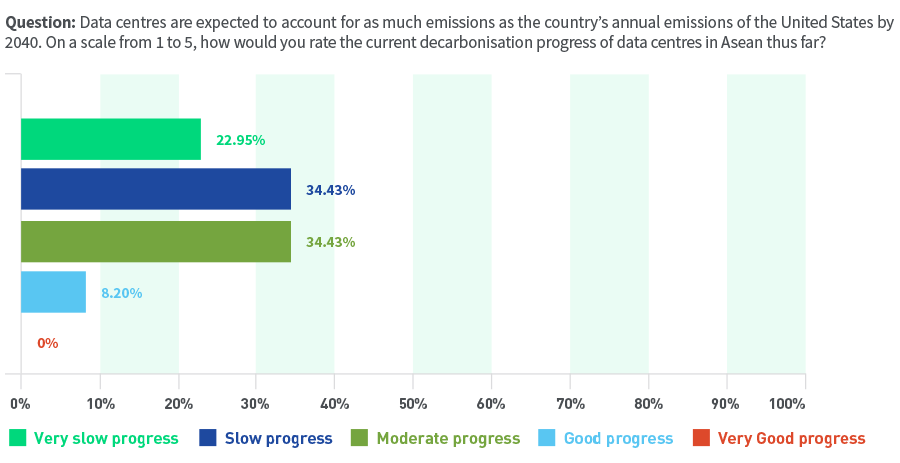

Figure 5: Asean data centres’ decarbonisation progress rating

Source: Eco-Business online survey “Asean’s data centre decarbonisation roadmap in the face of climate change” February 2024-April 2024, 61 respondents.

Source: Eco-Business online survey “Asean’s data centre decarbonisation roadmap in the face of climate change” February 2024-April 2024, 61 respondents.

Conclusion

Southeast Asia's data centre industry faces a critical challenge: balancing rapid growth with environmental sustainability. As digital transformation accelerates, the region's key players must navigate diverse regulations and limited clean energy resources and address the entire lifecycle of data centres.

To ensure a sustainable future, the industry must prioritise collaboration, transparency, and a holistic approach to reducing carbon emissions. Governments play a central role in providing incentives and aligning with sustainability goals. As businesses consider sustainability when choosing data centre providers, adopting renewable energy, energy-efficient technologies, and circular economy principles will be critical.

The path ahead is complex, but with regional cooperation, data-driven decision-making, and innovation, Southeast Asia's data centre industry can become a global leader in sustainable digital infrastructure.

Eco-Business wishes to credit the following people who contributed to the development of this report:

Wandrille Doucerain (DDSP), Andrew Young (EnviroSolutions & Consulting Pte Ltd.), Sharmel Ali (ST Telemedia Global Data Centres), Dr. Jessica Hanafi (PT Life Cycle Indonesia), Nils Warburg (APROVIS Energy Systems GmbH), PS Lee (National University of Singapore).

This report was developed and written by Holly Naylor, with support from Junice Yeo and Ng Zhao Ying. It is commissioned and brought to you by Tai Sin Electric.