The deal, which effectively has Bosch paying the buyer to take over its financially wracked solar unit, could be a major opportunity for Taiwan’s Sunrise Global Solar Energy.

A consortium consisting of three Asian solar companies has acquired the main assets of Bosch’s troubled photovoltaic manufacturer aleo solar in Germany for a symbolic €1.00 ($1.35) in a negative purchase deal that will cost aleo €10 million for the takeover.

The buyers, Taiwan’s Sunrise Global Solar Energy, its UK-Hong Kong parent group Pan Asia Solar and CHOSHU Industry from Japan, formed the joint Hamburg-based SPC Solar GmbH, which will acquire aleo solar’s main assets.

As part of the agreement, announced on Wednesday, aleo will pay SCP Solar €10 million while receiving the €1 purchase price for its module production facility in the city of Prenzlau, including fixed assets, inventories, trademarks and intellectual property rights as well as its shares in an aleo subsidiary.

Bosch, aleo’s main shareholder, has agreed to pay a compensation of €31 million to aleo in connection with the sale of the operative business.

The deal remains subject to the approval of antitrust authorities and aleo’s annual general meeting. Aleo’s management board will convene an extraordinary general meeting for a vote on the matter.

The consortium partners, meanwhile, will contribute €13.5 million in equity capital to SCP Solar, which intends to offer jobs to approximately 200 of aleo’s current 730 employees. Aleo said it had agreed to framework social plans with the works councils at its sites in the cities of Oldenburg and Prenzlau, although a reconciliation of interests still has to be negotiated. As part of the acquisition deal, a transfer company will be set up for the Prenzlau operation, subject to the agreement of the local works council.

Bosch said it was committed to provide additional funds to aleo “in the course of liquidation if there is a concrete need for liquidity in order to enable an orderly liquidation without filing for insolvency.”

“

The acquisition of aleo solar will close the gap between ourselves as cell manufacturers and the end customer, as we will be acquiring a proven premium supplier with expertise in the missing links in our value chain, namely module production and sales

Sunrise cofounder Ted Szpitalak

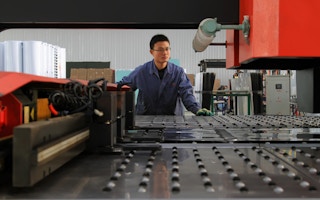

Aleo said its buyer’s business plan was based on the production and sale of aleo’s monocrystalline high-performance modules. Sunrise Global Solar Energy, which formed in 2007, designs, manufactures and markets high-efficiency solar cells worldwide; its main 350 MW production plant is located in Yilan, Taiwan. Aleo already builds Sunrise’s high-performance cells into its new 290 watt module.

“With our high-performance cells and the production expertise of aleo in Prenzlau we will be able to market high-performance modules in the premium segment,” said Sunrise cofounder Ted Szpitalak.

“The acquisition of aleo solar will close the gap between ourselves as cell manufacturers and the end customer, as we will be acquiring a proven premium supplier with expertise in the missing links in our value chain, namely module production and sales,” Szpitalak added. “It will turn us into a potent, integrated solar manufacturer capable of offering attractive prices to global markets.”

York zu Putlitz, aleo’s chief executive and financial officer, added, “In SCP Solar we have found an investor with a viable concept and a long-term focus. I regret that we were unable to save more jobs. However, with production in Prenzlau, a large number of the sales team and the aleo brand, we are retaining important sections of the company.

Aleo added that its sale and liquidation would not affect any of the warranties or guarantees it had issued.

Bosch announced in March 2013 that it would exit the crystalline solar sector and cease production of photovoltaic ingots, wafers and cells after losing billions of euros due to decreasing prices stemming from a glut of solar equipment. In November the company agreed to a deal with SolarWorld for the main assets of its Bosch Solar Energy unit in Arnstadt, Germany, including cell production capacity of 700 MW as well as module production capacity of 200 MW.