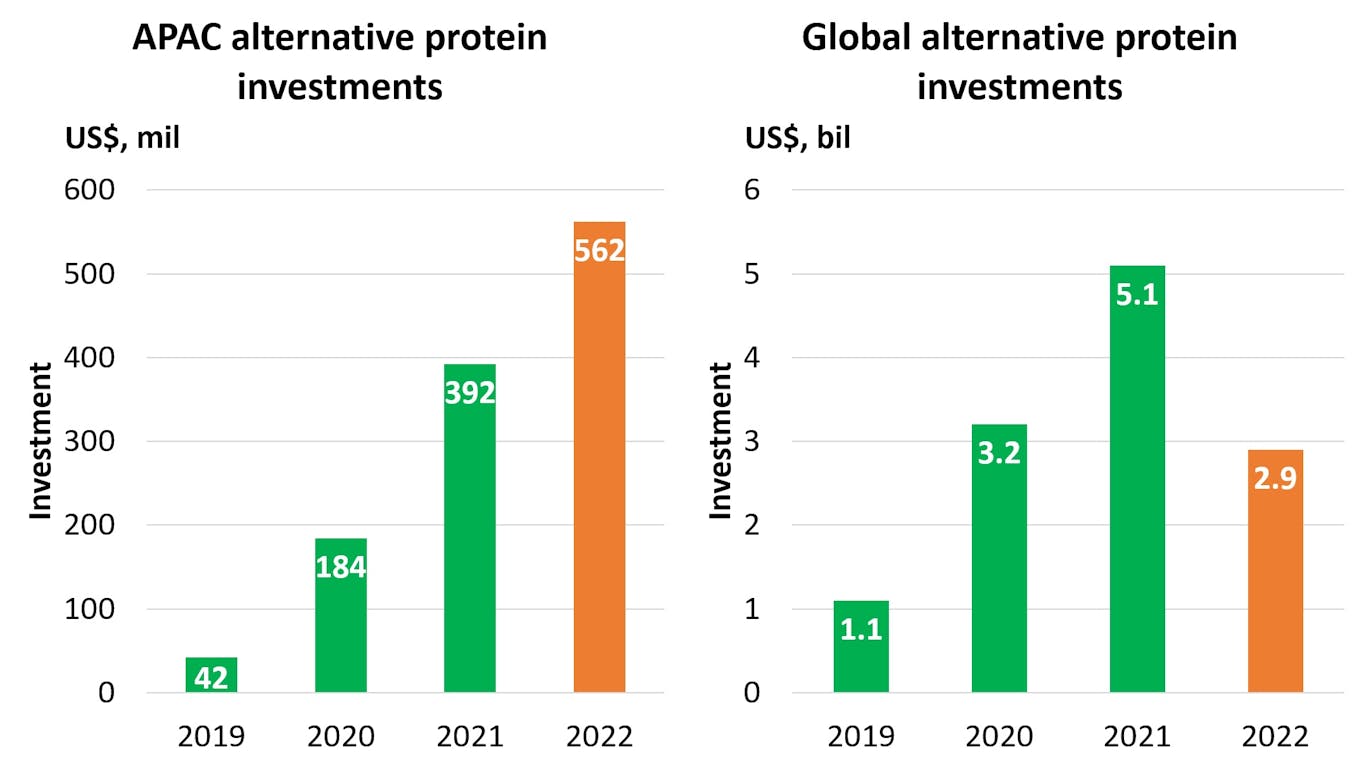

Investors poured a record US$562 million into Asia Pacific’s alternative protein companies, a 43 per cent increase compared to 2021, according to analysis released Thursday (16 February) by Good Food Institute (GFI) APAC, a think tank.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The trend extends the novel foods’ capital run in the region, where investments climbed rapidly amid food security, pandemic and climate concerns in recent years. GFI APAC said that the trend is especially encouraging given the growth is “both broad and deep, and not isolated to a single country or company”.

But investments globally plunged an equal 43 per cent last year, as investors lost interest amid rising inflation and supply chain snags. Taking away Asia Pacific’s roughly 20 per cent share, investments dropped close to 50 per cent in the rest of the world. It is only the second time annual investments have fallen since at least 2011.

Data: GFI APAC.

Supply chain issues have an “outsized impact” on nascent novel food sectors, causing products to be even more expensive and less appealing, the GFI APAC report said.

The trend mirrors financing droughts in other industries as funders pull back on “bold investments” seen in the recent past, it said, noting that global venture funding, a key source of seed money for food science start-ups, dropped 35 per cent in 2022.

Lab-grown meat leads APAC growth

Investments in Asia Pacific rose the sharpest for cultivated meats, where animal cells are extracted and reproduced en masse in bioreactors. The nascent sector received US$95 million in funding, up 96 per cent from the US$48 million in 2021.

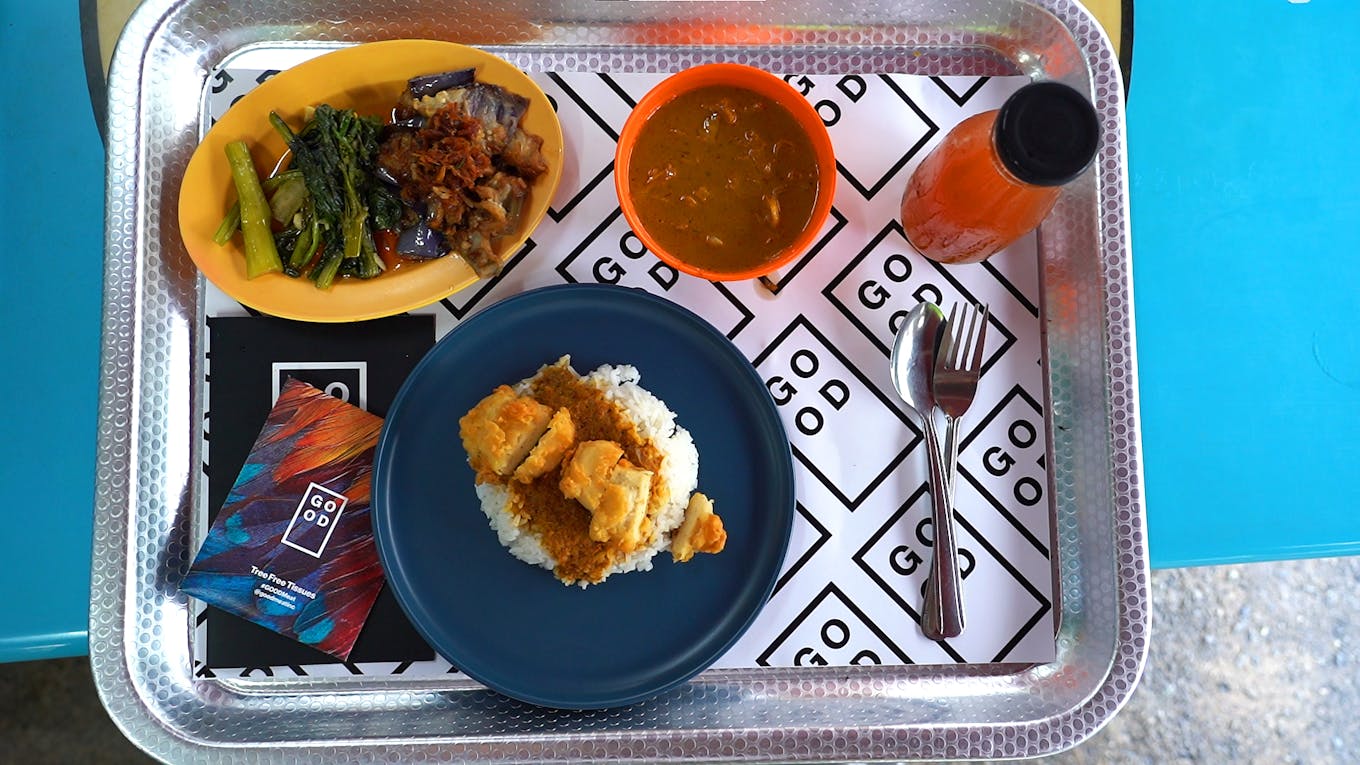

Curry rice topped with Eat Just’s cell-based chicken bites. Image: Eco-Business/ Liang Lei.

Currently, Singapore remains the only market where cultivated meat products can be sold commercially, though such foods also cleared a major regulatory hurdle in the United States late last year.

Meanwhile, investment into fermentation technologies that use microbes to produce proteins and other nutrients rose 67 per cent, also to US$95 million, while the most mature plant-based sector climbed 30 per cent to US$372 million. Both forms of meat analogues are allowed to be sold in many countries worldwide.

There were 67 new deals signed in Asia Pacific last year, up one from 66 in 2021. Those involving plant-based proteins dropped from 38 to 33, but more deals in fermentation and cultivated foods made up for the deficit.

GFI APAC noted that the two largest investments in 2022 were both closed in the first quarter of the year, “which suggests that they were the spillover result of negotiations during the late-2021 investment exuberance”.

The two deals, each worth US$100 million, were secured by Chinese plant-based meat start-up Starfield and Singapore’s Next Gen Foods. GFI APAC said investment in the rest of the year remained “stable” amid economic headwinds.

Singapore and China experienced especially large gains in 2022, which GFI APAC attributed in part to strong government support. Investments in Singapore more than doubled year on year to US$170 million, while that in China rose six times to US$153 million.

Singapore has been providing millions of dollars in grants for alternative protein businesses, while China referenced “future foods manufacturing” in its latest Five-Year Plan, the country’s top development directive.

“Public sector support and private investment often go hand in hand,” GFI APAC said.

While investment in Singapore has been steadily increasing, funding has been more volatile in China, with investments crossing the US$100 million mark in 2020 before crashing in 2021.

“Asia is the manufacturing engine that powers many of the world’s most important industries, but engines don’t just start themselves,” said Matthew Spence, managing director and global head of venture capital banking at British bank Barclays. He said “deep institutional investments” from both public and private sources are needed in the alternative protein industry.

Mirte Gosker, GFI APAC managing director, said there is a “huge opportunity” for investors in Asia as the global economic downturn makes deals more affordable.

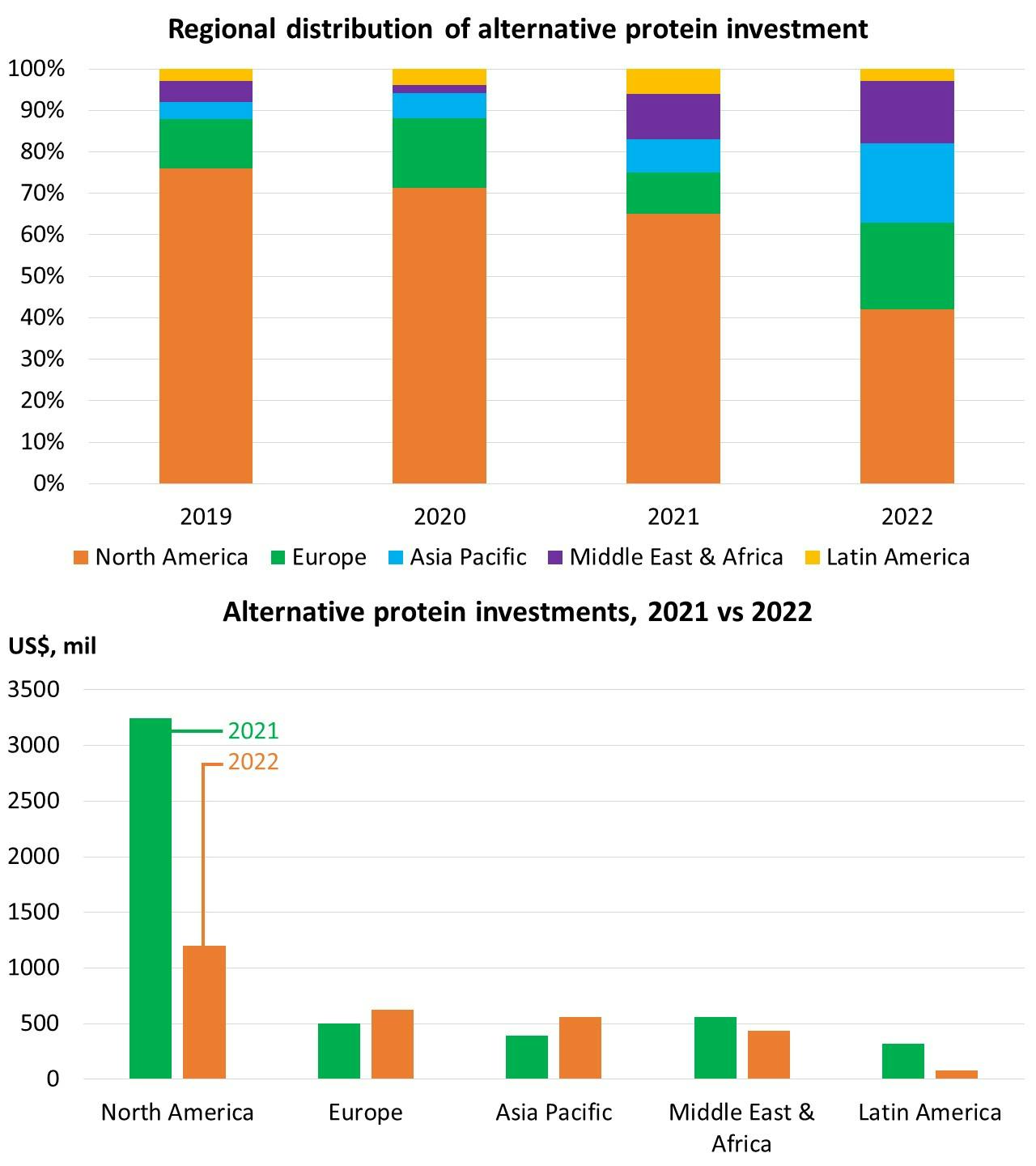

North America markets plunge

For the first time in at least a decade, the mature North America market received less than 50 per cent of global alternative protein investments, with more money flowing into Europe, Asia Pacific, Middle East and Africa.

The downturn comes as private funding in North America fell 63 per cent, from US$3.2 billion in 2021 to US$1.2 billion last year. Plant protein markets in the West have seen slower sales, with fewer than expected returning customers, largely due to cost and taste.

Data: GFI APAC.

Duleesha Kulasooriya, managing director for consultancy firm Deloitte’s Centre for the Edge, said that the downward trend in markets like the United States could also come to Asia, a relatively younger market, in the coming years.

Investors would be looking for “signals” before putting more money into alternative proteins, such as higher consumer uptake, clearer paths to profitability, and greater economies of scale, Kulasooriya said.

That also means novel food companies need to better utilise their limited resources.

“This year is a year of efficiency,” Kulasooriya said, pointing to the economic downturn. Policymakers could help by making it easier and faster for products to get to market, he added.

Kulasooriya said he remains “bullish” on growth prospects for the industry.

“[The industry] has legs. In the long-term we have to get to a better balance with [meat] alternatives, because of the issues with carbon footprint. Industrialised meat production is just not what the world needs,” Kulasooriya said.

Experts have said that alternative proteins are better for the environment because they take up less land space and the production process generates less carbon emissions than raising animals, especially cows.

A Boston Consulting Group report last year said that global emissions could fall by 11 per cent in 2030 if alternative proteins fully replace animal products – though a complete takeover by meat analogues is unlikely.

The performance of other regional markets was a mixed bag in GFI APAC’s analysis.

Latin America, a relatively small market, experienced a 76 per cent fall in investments down to US$76 million last year. Funding in Europe rose 24 per cent year on year to US$623 million, while the market in Africa and the Middle East dropped 21 per cent to US$439 million.

The number of new deals in 2022 dropped to 311, down from 379 in 2021.