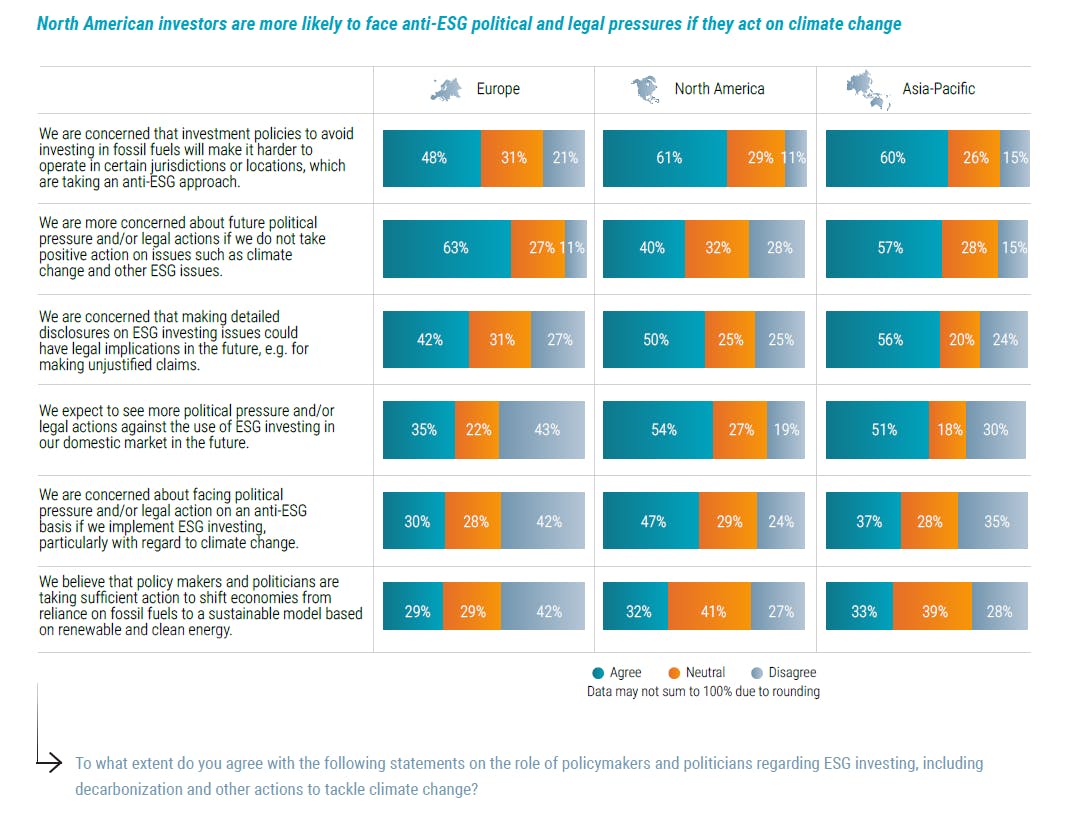

More than half of Asia Pacific (APAC) and North American investors surveyed by Netherlands-based asset manager Robeco are expecting more political pressure against environment, social and governance (ESG) investing in their home markets in the future. Only 35 per cent of European investors expect this.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Robeco’s annual Global Climate Survey remarked that this result could be linked to fossil fuels, with 61 per cent of North American and 60 per cent of APAC investors concerned about pushback if their investment policies explicitly avoided fossil fuel exposure. Meanwhile, only 48 per cent of European investors were concerned about this.

For now, political pressure is still pushing the majority of investors in Europe, and to a lesser extent in APAC, to do more on ESG and climate concerns rather than less, compared to the minority of their North American peers. But Robeco warned, “If this divergence continues, it could stagnate industry progress on climate.”

There is strong regional divergence in the political landscape around ESG, but political pressure is still largely in favour of ESG investing in Europe and APAC. Source: Robeco’s 2023 Global Climate Survey

The survey comes as ESG investing becomes increasingly politicised in the United States. Just this week, President Joe Biden issued his first veto since taking office, shutting down an anti-ESG Republican bill that would have prevented money managers from taking climate change and ESG into consideration when making investment decisions for their clients.

“As it now seems likely that ESG investing will be an election issue in the US, investors there may have to find a way to factor this into their investment approach, particularly if they believe that climate change has financial implications,” Robeco said.

Three hundred of the world’s largest institutional and wholesale investors in Europe, North America, APAC and South Africa, took part in this survey, representing around US$27.4 trillion in assets under management.

Investors in APAC – which includes Australia – made up 27 per cent of the total sample size, accounting for about US$6.5 trillion in assets under management.

Overall, APAC investors are rapidly catching up on sustainable investment policy. The proportion of investors in the region embedding climate within their investment policies has increased at a faster rate than in Europe and North America over the last three years, from 57 per cent to 73 per cent since 2021.

Investors in the region now lead in assessing the carbon footprint of their portfolios and in taking steps to gain a forward-looking view of the emissions pathways of companies they are invested in. However, Scope 3 emissions remain a challenge for APAC investors, with only 13 per cent of them measuring their indirect emissions.

Energy crisis ‘has not helped’ short-term progress on decarbonisation

Robeco’s survey noted that the energy crisis has reinforced long-term commitment to invest in renewables among the majority of APAC and European investors. But it “has not helped the industry’s progress on decarbonisation in the short term.”

The International Energy Agency (IEA) has warned that there can be no new oil, gas, or coal development if the world is to be on track to reach net zero by 2050. Additionally, the global energy watchdog has flagged that around 70 per cent of the estimated US$4 trillion clean energy investments needed to reach net zero targets will have to be carried out by 2030.

However, 59 per cent of APAC investors allowed higher allocations to oil and gas companies so as not to miss out on the record returns in the sector recently. This far surpasses the proportion of European and North American investors who did so.

The survey found that committing to a net-zero target will likely increase pressure on oil and gas companies to move away from fossil fuels and increase investor divestment from carbon-intensive assets.

While APAC investors have increasingly adopted more sustainable investment policies, they remain more reluctant to make public commitments to achieve net zero by 2050. Only 20 per cent have done so, compared to 37 per cent in Europe.

Currently, only 14 per cent of investors with net-zero targets in place say that their current approach is to completely divest from oil and gas companies. But this number increases to 39 per cent for investors in the process of setting a net-zero target, who said they will completely divest from oil and gas companies in the next two years.

‘Reaching a tipping point’

The clean energy transition is complicated in coal-reliant emerging markets like Indonesia, Vietnam, India, and South Africa, where an abrupt closure of fossil fuel plants without alternatives could have unintended socioeconomic impacts.

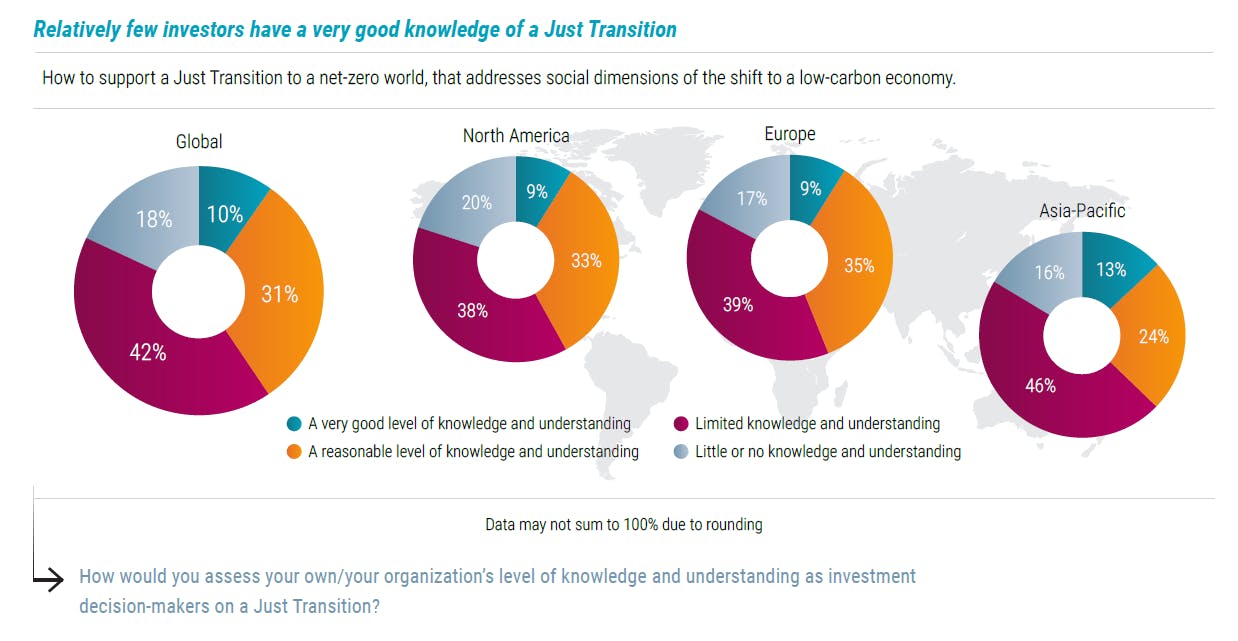

Fittingly, Robeco found that a just transition – which refers to addressing the social implications of the energy transition – is increasingly important for investors, with 67 per cent saying it will be a significant factor in their investment policy in the next two years.

“

We are close to reaching a tipping point for the mainstreaming of climate change, biodiversity, and the just transition into investment strategy.

Lucian Peppelenbos, climate and biodiversity strategist, Robeco

However, huge knowledge gaps remain on this issue, with only 41 per cent of investors saying they have the knowledge to support the just transition. APAC investors slightly lag their counterparts, with only 37 per cent expressing that they have the know-how to address this.

The main way investors plan to step up action in the short term is through identifying investment opportunities that consider social issues alongside environmental ones. But much less is being done to evaluate the related systemic risks and engage with companies to support a just transition.

Robeco’s climate and biodiversity strategist Lucian Peppelenbos tells Eco-Business that one “very concrete” way investors can support a just transition is through green bonds and transition bonds. “I think the other way is more around collaboration and really understanding the issue and how to incorporate it as part of a broader investment strategy.”

Majority of investors across all regions say there is a dearth of knowledge in their organisations about how to support a just transition. Source: Robeco’s 2023 Global Climate Survey

Nearly half of the investors also said that biodiversity was a significant factor in their investment policies.

Some progress has been made to protect the planet’s biodiversity in recent months. Last December, countries reached a historic deal to protect 30 per cent of land and sea by 2030 at the biodiversity summit COP15 in Montreal. Just three months later, the high seas treaty – a landmark agreement to protect the oceans and crucial for enforcing the COP15 pledge – was reached.

But the biggest barriers to addressing biodiversity loss are a lack of suitable data and ratings, as well as insufficient internal expertise.

There is currently no mandatory disclosures on nature and biodiversity required in any jurisdictions, though the Taskforce on Nature-related Financial Disclosures (TNFD) is developing a global framework for voluntary application, with the first full framework expected in September 2023.

“The survey is a clear call upon policymakers and regulators to keep course toward net zero by 2050 and to provide the long-term clarity that investors need for making their contribution,” Peppelenbos said.