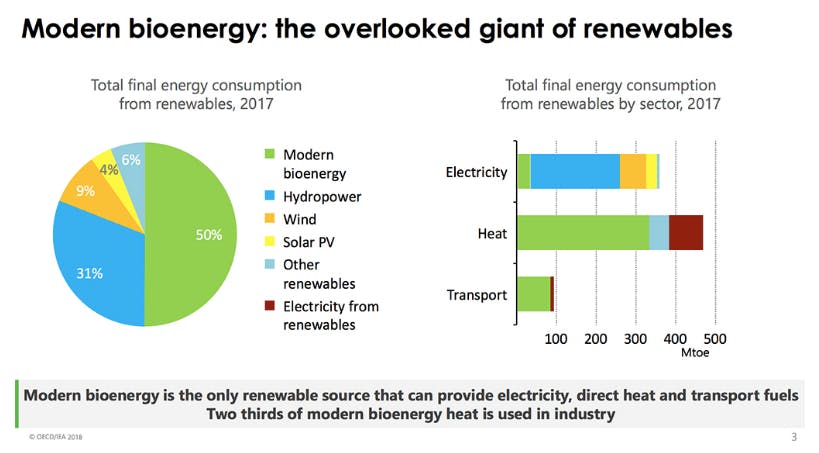

Bioenergy made up half of all renewables consumption in 2017 – four times solar PV and wind combined – and has a huge untapped potential, says the International Energy Agency (IEA) in its new annual report on renewables.

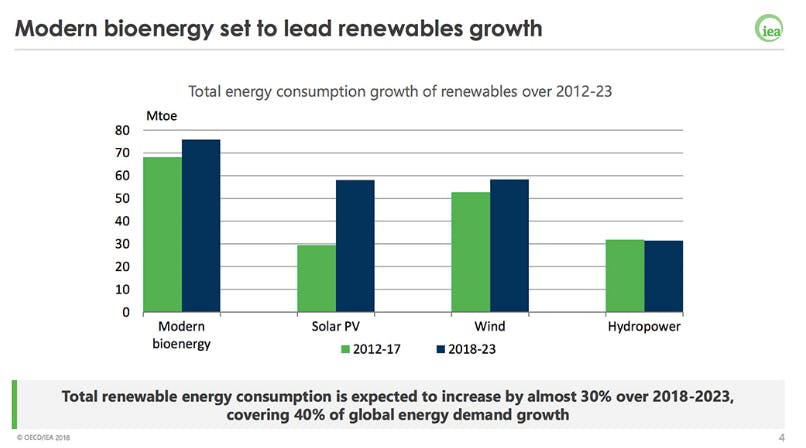

Bioenergy from liquid biofuels and biogas will continue to lead growth in renewable energy consumption to 2023, due to its rising use in the heating, shipping and aviation.

“Modern bioenergy is the overlooked giant of the renewable energy field,” said Fatih Birol, the IEA’s Executive Director.

“Its share in the world’s total renewables consumption is about 50 per cent today, in other words as much as hydro, wind, solar and all other renewables combined. We expect modern bioenergy will continue to lead the field, and has huge prospects for further growth. But the right policies and rigorous sustainability regulations will be essential to meet its full potential.”

“

We are totally aware of the controversial reputation of bioenergy, especially deforestation of tropical forest and prioritisation of fuel over food.

Paolo Frankl, renewables division head, International Energy Agency (IEA)

Global context

Renewables are set to account for almost a third of world electricity generation in 2023, according to the EIA. But expansion lags behind in the transport and heat sectors, where supportive policies from governments around the world are now urgently needed.

So far, disproportionate attention has been given to greening the electricity sector, which only accounts for about 20 per cent of overall emissions. The real battle against climate change is now playing out over heating, shipping and aviation and dirty industrial processes.

This is where bioenergy can play an essential part, argues the IEA report.

Cement – one of the most polluting processes in the world accounting for 5-8 per cent of global emissions – holds the largest potential according to the IEA, as two-thirds of the bioenergy used in this industry is from waste. “Robust waste management in key cement-producing countries could therefore double the share of energy demand met by bioenergy and waste to 13 per cent by 2023,” the report states.

In the EU, bioenergy and waste meets one-quarter of energy demand of cement production. However, most of the world’s cement is produced outside the EU – in China and now increasingly elsewhere in Asia and these are the countries that will need to adopt policies to promote biofuel to industry.

Biofuels can also play an important role in greening aviation. Biofuel demand in the aviation sector is growing, mostly driven by voluntary initiatives. However, the cost is still prohibitive (about 40 per cent higher than oil).

With the right policies, the IEA estimates biofuels could make up 2 per cent of the sector’s energy demand by 2025. This would show the potential to scale up its use commercially, and could replicate the success of PV solar, the IEA believes.

Burying a bad reputation

Ten years ago, biofuels were seen as ideal low-carbon replacements for the liquid fossil fuels that power the majority of the world’s transport systems.

But concerns grew that first-generation biofuels, made from food crops (such as palm oil, soybean, rapeseed and sunflowers), were destroying forests and agricultural land, increasing food prices and were often as polluting as fossil fuels when all factors in their production were considered.

Today’s biofuel proponents argue it’s about using the right kind of biofuels. Many of the next generation biofuels are different, relying on use of waste products from agriculture and industry.

For example, the production of biomethane from waste and residues, production of heat for district heating networks, biodiesel made from waste oil and animal fats, or cellulosic ethanol produced from grasses, wood or straw.

These, some experts claim, could create truly sustainable fuels by reducing the need for fertilisers, cropland and processing energy.

But so far uptake of these new technologies is low – and some are not yet fully developed or commercialised. The IEA report suggests that without major policy shifts novel advanced biofuels will only account for 1 per cent of all biofuel output by 2023.

It calls for countries to develop specific policies to support biofuel research, development and deployment, including creative financial and market mechanisms.

An Asian story

Half of global production growth is forecast to happen in Asian countries, mainly China, India and Southeast Asia, where ample feedstocks and the desire to increase energy security have led to greater policy support.

New policy schemes in India and China are anticipated to significantly boost the market for biofuels.

For example, India recently announced a new national biofuels policy that allows ethanol production from agricultural waste and crops residue such as corn, cassava and sugarcane.

This could boost farmer income and help address the horrendous pollution that engulfs Delhi and much of northern India every winter, caused by the annual burning of crop stubble, which could otherwise be turned into energy.

China is extending its 10 per cent ethanol-blending mandate nationwide. At the moment China’s bioenergy capacity principally uses energy from waste and agricultural residue (straw) fuels.

Land concerns linger

Two thirds of the EIA’s projected biofuel expansion still depends on food-based products and so concerns over land and good security will only grow. The new study from the Intergovernmental Panel on Climate Change (IPCC) warns, “Bioenergy may compete with other land uses and may have significant impacts on agricultural and food systems, biodiversity and other ecosystem functions and services.

Effective governance is needed to limit such trade-offs and ensure permanence of carbon removal in terrestrial, geological and ocean reservoirs.”

The IPCC report warns of the radical changes needed to the way we produce energy, food and move around in order to limit global warming to 1.5°C and avoid catastrophic climate change.

“We are totally aware of the controversial reputation of bioenergy, especially deforestation of tropical forest and prioritisation of fuel over food,” said Paolo Frankl, head of the IEA’s renewables division.

Most of the projected the bioenergy expansion will come from using waste and residue from industry and agriculture.

They are not presuming a growing use of land [for biofuels], but using the same amount of land while increasing productivity, Frankl explained. Designing effective certification and auditing schemes will be crucial to encourage sustainable bioenergy production.

EIA’s spotlight on India

- Renewable growth: In India, bioenergy for heating and solar PV electricity together make up the majority of renewable energy expansion over the forecast period (2018-23). Despite robust growth, the share of renewables is expected to increase only modestly due to minimal expansion of renewables in the heat sector, which remains the largest end user of energy.

- India’s renewable capacity will double over 2018-23, mainly from solar PV and onshore wind, leading renewables expansion in the Asia-Pacific region (excluding China), with 107 GW expected to become operational over the forecast period. Solar PV and wind provide 89 per cent of India’s renewable growth, propelled by national and state-level auctions. However, grid integration and the financial health of distribution companies continue to impede deployment, despite improvements in the past year.

- Transport: In India renewable energy supplied less than 1 per cent of transport fuel demand in 2017, with broadly similar contributions in energy terms from electric rail and biofuels. The energy contribution of biofuels is expected to grow more over 2018-23, principally owing to the country’s blending programme to meet a mandate of 5 per cent ethanol in petrol and diesel. Transport sector renewable electricity consumption also more than doubles by 2023, with growth from both rail and road EVs. However, due to growing demand for fossil fuels, India’s renewable energy share in transport remains below 1.5 per cent at the end of the forecast period.

- Biofuels: India approved a new national biofuels policy in 2018 that outlines several measures to support advanced biofuel production, including additional tax incentives, a higher purchase price than for conventional biofuels and investment support of USD 77 million over six years. However, the form this funding will take is currently unspecified.

- India pushes coal: Compared with the previous six-year period, expansion in coal- and natural gas-fired generation is expected to decline considerably. Globally, generation from natural gas power plants is squeezed between low-cost coal and rapidly expanding solar PV and wind technologies. However, coal generation growth is forecast to come mostly from emerging economies in the ASEAN region, plus India and China. In fact, despite significant growth in renewables-based generation, in absolute terms it is forecast to be lower than coal, which remains the largest source of global power output in the IEA forecast.

This story was published with permission from The Third Pole. Read the full story.