Consumers in Southeast Asia’s largest economies are more likely to switch to green products and services over fears that climate change will impact the lives of young people, a study has found.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

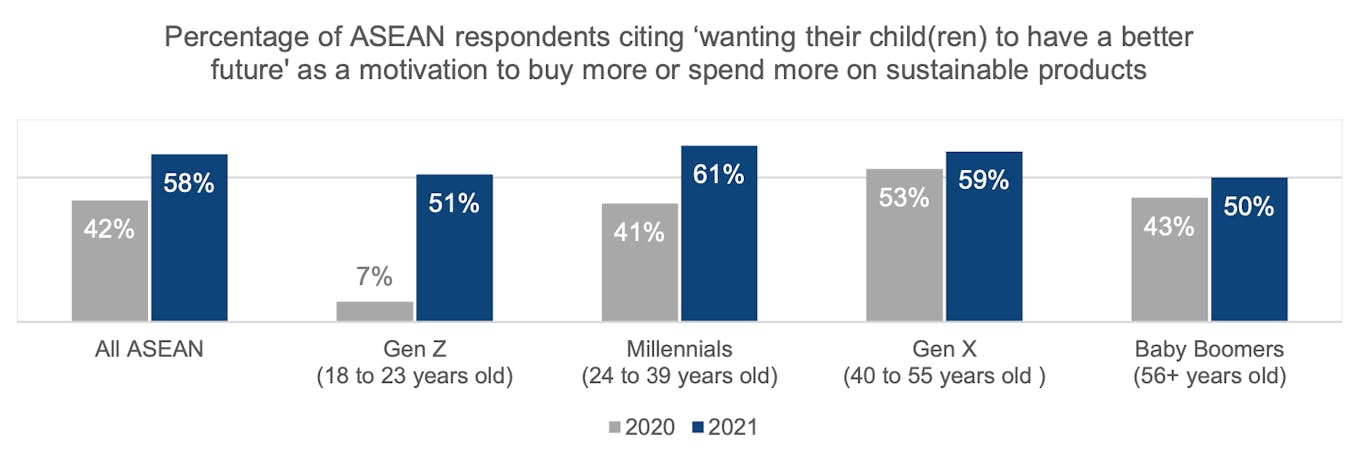

More than half (58 per cent) of Southeast Asians said that safeguarding the future for emerging generations was a key reason to spend more on sustainable products — a big jump from 2020, when less than half (42 per cent) of people in the regional bloc believed this, according to a consumer sentiment study by United Overseas Bank (UOB), a Singapore-based finance group.

The age group that is most likely to buy sustainable products with future generations in mind is millennials, with 61 per cent of 24 to 39 year olds in five key Southeast Asian markets — Singapore, Indonesia, Malaysia, Thailand and Vietnam — with this consumer mindset, up from 41 per cent last year.

However, the biggest shift in attitudes towards sustainable consumption is happening in the younger age group. More than half (51 per cent) of the people aged 18 to 23 year-old, known as Gen Z, are motivated to buy sustainable products to give their children a better future. This is a jump from just 7 per cent in 2020.

The demographic least likely to change their buying habits to protect future generations are the baby boomers, the demographic cohort of people born from 1946 to 1964, during the post-World War II baby boom.

The study of 3,500 people noted that the regional bloc is undergoing “deep social and economic transformation”, with rising levels of affluence and social mobility accompanied by growing concern about the future health of the planet in one of the world’s most climate-vulnerable regions.

The UOB study finds that more Southeast Asians are concerned about how the future will affect children. Image: UOB ASEAN Consumer Sentiment Study 2021.

The Covid-19 pandemic has led to a surge in concern for environmental, social and governance (ESG) issues, particularly in Southeast Asia, where people tend to be acutely concerned about ESG issues. In October, a regional study found that people in countries more vulnerable to climate impacts, such as the Philippines and Indonesia, are more likely to care about issues such as environmental protection and human rights.

This concern seems to be affecting consumer appetite for responsible finance. Though scepticism still surrounds the credibility of sustainable investing, consumers in Southeast Asia are increasingly willing to park their money in funds they perceive to be protecting people and planet. Nine in 10 respondents (91 per cent) in UOB’s study said they hoped financial institutions would provide more information about the benefits of sustainable investing and offer more sustainable investment options.

UOB noted that interest in its sustainable finance products has grown sixfold since the bank introduced green investment products last year, with its millenial customers having the biggest appetite for green finance.