An alliance of leading financial institutions and companies including HSBC, the International Finance Corporation, Climate Bonds Initiative and Swiss Re have backed ESG Book, a new environment, social and governance (ESG) data platform launched on Wednesday to shape the future of the market with a free “public good” service for companies and investors.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

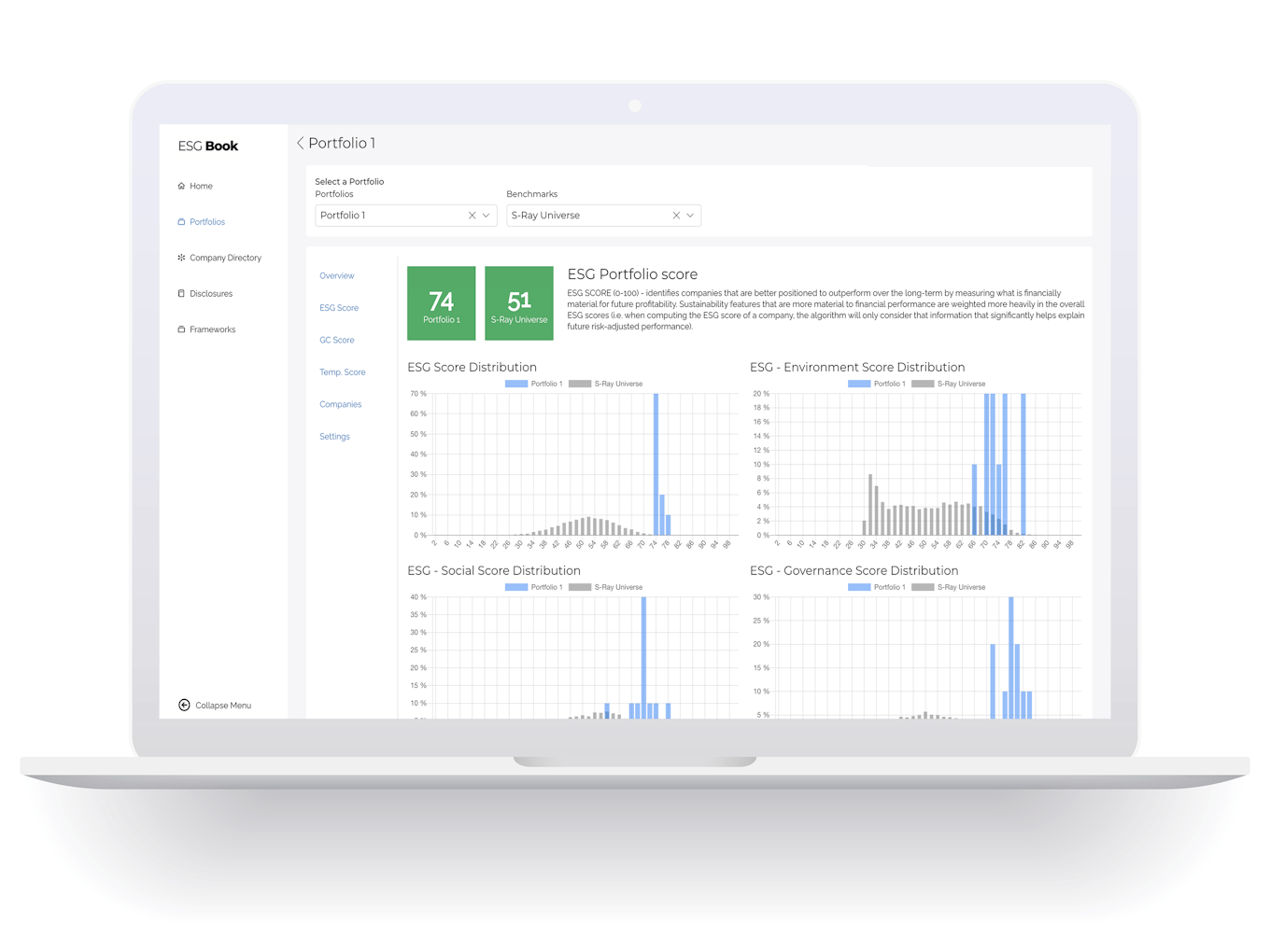

ESG Book makes sustainability data more widely available and comparable, enables companies to be custodians of their own data through a digital platform, provides framework-neutral ESG information in real-time. [Click to enlarge] Image: Arabesque

The platform has been developed by asset manager Arabesque, and run according to principles from the United Nations (UN) Global Compact, which encourages companies to adopt sustainable policies.

Companies can also report against questionnaires based on established reporting frameworks including the Global Reporting Initiative, Sustainability Accounting Standards Board and the Taskforce Climate-Related Financial Disclosures.

“ESG Book makes sustainability data available and comparable for all stakeholders. It provides framework-neutral information promoting transparency,” Sanda Ojiambo, chief executive of the UN Global Compact, said.

Companies can use the tool to disclose, manage and keep their ESG data in real-time. ESG data will be “readily accessible for all stakeholders,” to promote greater transparency, according to Arabesque.

Getting consistent data on sustainability scores and performance measures remains a difficult task even with the presence of about 160 major data vendors, each with their own definitions and methodologies on materiality, intentionality and additionality. Most of the data required is self-reported which has led to companies cherry-picking information that flatters their sustainability performance.

Despite the groundswell of climate-related metrics, the US$1 billion business has grown largely unchecked leaving gaps for greenwashing, where the environmental credentials of an investment activity are overstated.

Last month, the International Organisation of Securities Commissions (IOSCO), which groups securities watchdogs, published recommendations to increase transparency into how ESG data products and ratings are compiled in a bid to curb greenwashing in the fast-growing, multi-trillion dollar sector. Assets in sustainable funds nearly doubled in six months to reach a record US$3.9 trillion by the end of September, according to Morningstar.

Deutsche Bank’s AG’s asset management unit recently fell afoul of regulators in the United States and Europe due to greenwashing claims by a whistleblower. The case has reverberated through the asset management industry, which is facing an increasingly punitive regulatory environment after years of unregulated ESG market growth.

The International Sustainability Standards Board (ISSB) was unveiled last month at the UN’s COP26 global climate summit in Glasgow and is tasked with creating a single set of standards “to meet investors’ and information needs” in a wider attempt to turn the screws on how companies make ESG related disclosures.

“The launch of ESG Book marks the evolution of corporate sustainability. It enables more comparable and higher quality ESG data, thereby advancing the mission of making markets more sustainable,” said Georg Kell, Arabesque chairman.