It’s the lightest gas in the world, and it has been bestowed with heavy significance due to climate change.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Hydrogen burns when sparked, making it a promising fuel for power plants. While existing fuels like natural gas produce planet-warming carbon dioxide as a by-product, hydrogen fizzles into harmless steam.

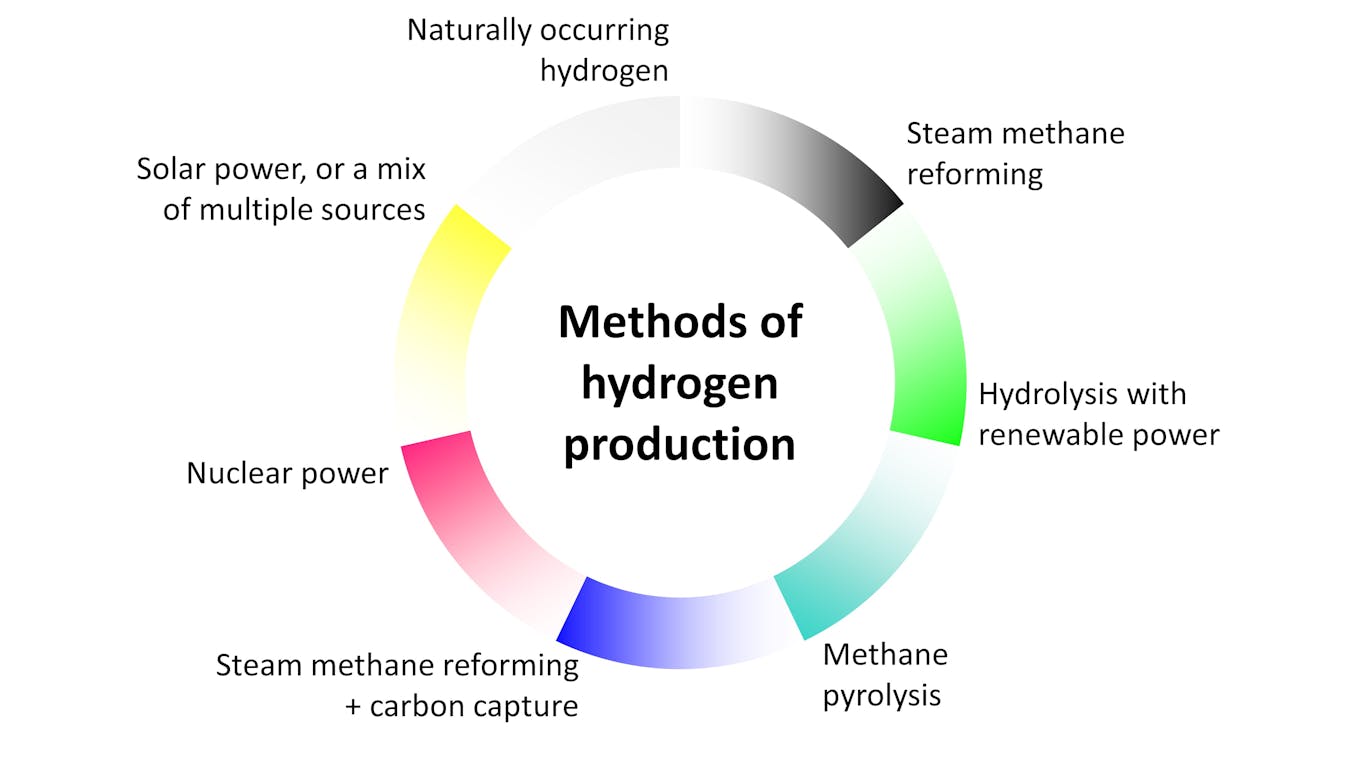

But with an atmospheric abundance some 400,000 times lower than oxygen, hydrogen can’t just be gathered from thin air. Several methods of pulling the gas from other substances have been explored. A spectrum of colours now describes the way the gas is produced – with some seemingly much cleaner than others. The gas itself is colourless.

Herein lies the complexity, and contention, of what’s what, and what’s good. Yellow hydrogen, for example, has varying definitions – it is either linked to solar power specifically, or to a mix of energy sources. Some hydrogen colours, like grey, turquoise and blue, are tied to fossil fuels, creating doubt on their place in a decarbonising world. Pink hydrogen is tied to nuclear power, whose green credentials the world is still bickering over.

An overview of how hydrogen is produced.

Yet others confer additional meaning to the colours. Recently, Saudi Arabia’s energy minister Abdulaziz bin Salman said that female employees in the country’s energy sector are “happy” to see plans for pink hydrogen coming along.

Saudi Arabia energy minister Abdulaziz bin Salman speaking at a World Economic Forum dialogue. Image: Youtube/ World Economic Forum.

The country is planning to build two nuclear reactors and hopes to link hydrogen production to them.

“We are very conscious of taking care of our female new recruits and new cadets, and we are becoming an extremely well-emancipated society,” the Saudi royal and politician told a World Economic Forum virtual dialogue.

Saudi Arabia currently ranks bottom 10 in the World Economic Forum’s gender gap report covering 156 countries.

Here’s an overview of the many shades of the hot gas.

Pink hydrogen: made from nuclear and gaining popularity

Pink hydrogen is gaining steam. It landed its first commercial deal last month, when London-based chemicals firm Linde agreed to buy hydrogen produced using nuclear energy from Sweden’s Oskarshamn power plant.

Sweden’s Oskarshamn 3 nuclear reactor. Image: Flickr/ Mattias Olsson.

The initial amount will be small – only 12 kilograms of hydrogen is produced per hour, and the nuclear plant will need some for its reactor coolant, but the deal could be followed by bigger ventures.

Last October, the United States Department of Energy awarded US$20 million for a pink hydrogen project at an existing nuclear power plant. The project is set to produce and store six tonnes of hydrogen for electricity generation during peak demand.

French president Emmanuel Macron also said that France’s nuclear plants are a “major asset” for producing hydrogen.

The country gets two-thirds of its electricity from nuclear power.

The world nuclear association, which promotes the use of the energy source, states that nuclear plants have sufficient heat and electricity generation capacity to produce large amounts of hydrogen. There is also ongoing research to use extreme heat from nuclear reactors to rip hydrogen from water molecules without additional electricity.

One concern, however, is the commercial viability of pink hydrogen. Tim Buckley, a director at US-based energy think tank Institute for Energy Economics and Financial Analysis (IEEFA), told Eco-Business that nuclear power already offers a constant electricity supply, leaving little room for hydrogen to act as a back-up.

Buckley added that nuclear energy may still be expensive moving forward. The U.S. Energy Information Administration predicts that nuclear energy will cost over US$50 per megawatt-hour in 2026, compared to US$27 for onshore wind and US$31 for solar power with some storage capability.

White hydrogen: still trapped in Earth’s crust

White hydrogen, or naturally-occurring hydrogen, has not been receiving much attention, possibly because of how rare it is in Earth’s air. This geological form of hydrogen is found in underground deposits and can be obtained through fracking, a process that cracks open rocks deep underground.

“If no one expects to find free hydrogen, no one samples for it,” wrote Dr Viacheslav Zgonnik, co-founder and chief executive of energy firm Natural Hydrogen Energy LLC, in a research paper published in 2020.

In recent years, however, sizeable reservoirs of naturally-occurring hydrogen have been found. Natural Hydrogen Energy LLC is looking to start drilling in the United States. Deposits have also been found in places like Mali and Australia.

The findings in Australia have set off a drilling race – Australian energy consultancy EnergyQuest reported that firms have applied for or gotten 18 exploration licences for white hydrogen in the state of South Australia last year, with permit areas covering over 30 per cent of the state.

As it stands, it is uncertain if naturally-occurring hydrogen can be used commercially. The World Economic Forum says that there are few viable ways of extracting the gas.

Green hydrogen: revolution in the making?

Green hydrogen is being seen as the ‘gold standard’. Produced from water, using renewable energy, it is responsible for next to zero emissions.

In perhaps a sign of its vogue, fossil fuel giant Shell started up its largest green hydrogen machine in China, a week before the Beijing Winter Olympics.

Late last year, Chinese firm Baofeng Energy brought online a facility over seven times larger, at 150 megawatts. Several projects in the pipeline, from French Guiana to Brazil to Oman, have also claimed to be the world’s largest, based on a range of criteria.

Countries have announced ambitious green hydrogen targets as part of their decarbonisation plan. The European Union wants 10 million megatonnes of green hydrogen made per year by 2030; several constituent countries have also set their own targets. The Chile government said it wants to be the producer of the cheapest green hydrogen in the world by 2030.

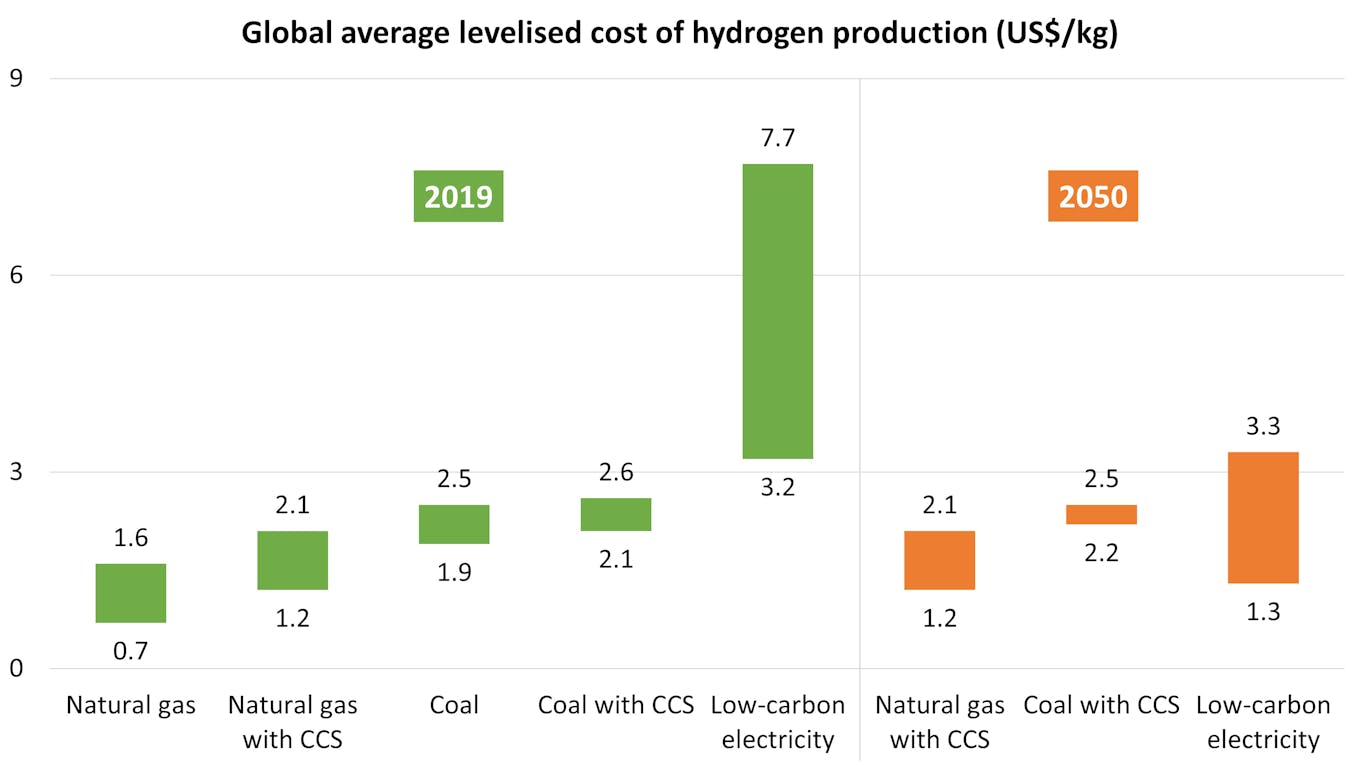

Green hydrogen is currently expensive, costing over US$7 per kilogram at the higher end. But costs are dropping as the technology matures, economies of scale kick in, and the prices of solar and wind energy continue to fall.

The price of hydrogen produced with low-carbon electricity, defined by the International Energy Agency as using renewable power, is expected to fall the fastest. But it could still be more expensive than producing hydrogen with fossil fuels in 2050. CCS stands for Carbon Capture and Storage. Data: International Energy Agency.

IEEFA research found that the capital costs of electrolysers, the machines used to obtain hydrogen from water, could fall by as much as 80 per cent by 2030.

Australia has set an aspirational ‘H2 under 2’ target – to produce hydrogen at under AU$2, or about US$1.40 per kilogramme.

Green hydrogen is also carving a niche for itself, plugging the intermittent nature of renewable energy sources that provided the energy for its production. Hydrogen can store energy for months – compared to hours for batteries. This allows, for example, excess solar energy generated in bright summers to be used in dark winters.

The International Energy Agency (IEA) projects green hydrogen to account for about 60 per cent of global hydrogen production in 2050, under the agency’s net-zero emissions scenario, with the rest fulfilled mostly by blue hydrogen – more on that later.

Grey hydrogen: the dirty incumbent

About 95 per cent of the world’s existing hydrogen is produced from natural gas involving a process called ‘steam reforming’, where natural gas is mixed with steam under high heat and pressure to produce hydrogen and carbon dioxide.

It is the cheapest way to get hydrogen, at as low as under US$1 per kilogram. Grey hydrogen is also the most environmentally damaging variant – over 10 kilograms of carbon dioxide could be produced per kilogram of hydrogen gas.

In 2020, about 90 megatonnes of hydrogen was produced, producing 900 tonnes of carbon dioxide emissions. Major uses include iron and steel refining, chemical production as well as oil refining.

There’s also brown and black hydrogen, which uses coal in place of natural gas.

Industry body Hydrogen Council said that the supply of grey hydrogen needs to fall 30 per cent by 2030, and reach nil by 2050 in its scenario for a net-zero carbon emissions future.

The recent high gas prices and carbon tax in parts of the world may give the move away from grey hydrogen a further boost. European Union officials said hydrogen made with renewable energy could already be cheaper than grey hydrogen last November amid a gas price spike.

London-based climate think-tank Energy Transitions Commission believes that grey hydrogen will lose out to cleaner variants even without the help of carbon taxes, as newer technologies mature.

Blue hydrogen: the debate surrounding carbon capture

Blue hydrogen uses the same chemical processes as grey hydrogen. However, with carbon capture, the carbon dioxide produced in the process does not escape and is stored in facilities. Proponents say the process is both cost-effective and good for the environment.

According to a tally by the IEA, the cost of blue hydrogen in 2019 was capped at US$2.6 per kilogram, three times lower than the highest prices for hydrogen produced from renewable electricity. The difference is expected to narrow in 2050, but blue hydrogen is still expected to be cheaper.

United States non-profit Clean Air Task Force said that blue hydrogen benefits from not requiring “precious” clean electricity from renewable sources, which may also require more land than natural gas plants. It also pointed to maturing carbon capture technology that promises a five-fold reduction in emissions compared to grey hydrogen.

Large blue hydrogen projects have been announced in recent years. A US$4.5 billion blue hydrogen plant in the United States is being touted as the largest carbon dioxide sequestration facility globally. Gas firm Air Products said the facility will be ready by 2026 and trap 95 per cent of carbon emissions.

London-headquartered analytics firm GlobalData believes that blue hydrogen will account for 85 per cent of all ‘low-carbon’ hydrogen capacity within North America by 2030.

Saudi Arabia fossil fuel giant Saudi Aramco also told Bloomberg last year that it plans to invest in a ‘large share’ of the blue hydrogen market, citing lower costs compared to green hydrogen. The firm is one of the world’s biggest oil producers.

But blue hydrogen may be doing more harm than good.

Several existing carbon capture projects worldwide have been found to miss their capture target. Many also send the trapped gases into oil wells to help with production and recoup costs – allowing for further carbon emissions down the road.

Last year, a widely-publicised study found that blue hydrogen has a 20 per cent higher global warming footprint, compared to if the natural gas feedstock was directly burned instead. The main culprits were the huge energy input required to run the carbon capture machines and methane leakage.

Even though methane only remains in the atmosphere for about a decade, it is over 80 times more potent than carbon dioxide in heating the Earth.

Critics also say blue hydrogen is a lifeline for fossil fuel firms to further outstay their welcome.

“My worry about the blue hydrogen talk is that it is all about delaying and subverting the market,” said Buckley of IEEFA.

He pointed to the Australian Hydrogen Energy Supply Chain project, which recently sent its first shipment of liquid hydrogen to Japan. The project has been labelled a potential ‘game-changer’ despite producing hydrogen from coal. It promises to incorporate carbon capture, but that is still being studied, with an operational date estimated at 2030.

Last year, a former lobbyist also claimed that the fossil fuel industry oversold blue hydrogen to the United Kingdom government. The country has plans for blue hydrogen plants in the pipeline.

“

Should we even use colour at all? By even talking about the colours of hydrogen, you’re playing into the fossil fuel industries’ spin.

Tim Buckley, IEEFA

Turquoise hydrogen: a cleaner alternative?

There have been efforts to produce hydrogen using natural gas, in a process where methane, the main ingredient in natural gas, is treated at high heat, and the polluting carbon is siphoned off as a solid instead. The end product, turquoise hydrogen, is gaining traction as a low-emissions alternative, even as the technology to produce it is still in its infancy.

There is currently one commercial methane pyrolysis plant in the world in Nebraska, United States. It produces 5,000 tonnes of hydrogen a year, and there are plans to increase that ten-fold with a US$1 billion loan awarded by the government late last year.

The performance of methane pyrolysis, however, is still ‘unclear’ due to the lack of economic analysis.

“Academic literature and conversations with technology developers indicate that methane pyrolysis will be more expensive than blue hydrogen,” wrote Runeel Daliah, senior analyst at advisory firm Lux Research.

“Advocates of the technology are quick to point out that selling the carbon by-product onto the market will make it cheaper than blue hydrogen. Nonetheless, innovators should be cautious, as such an assumption can be highly treacherous,” he added.

Whatever the assigned colour, hydrogen is having its moment in the sun, and the world is off to the races to make the gas more economical – the United States wants to make ‘clean hydrogen’ cost just US$1 per kilogram by 2030.

But to some, the use of fossil fuels in some hydrogen colours is unacceptable.

“Should we even use colour at all? By even talking about the colours of hydrogen, you’re playing into the fossil fuel industries’ spin,” said Buckley. “If I could rewrite the terminology, I would say we have fossil hydrogen, and we have renewable hydrogen.”