Killing them softly: Southeast Asia’s cautious quest to phase out its coal fleet using transition credits

By Hannah Alcoseba Fernandez and Gabrielle See

Visuals by Philip Amiote | Photos by George Buid

14 August 2024

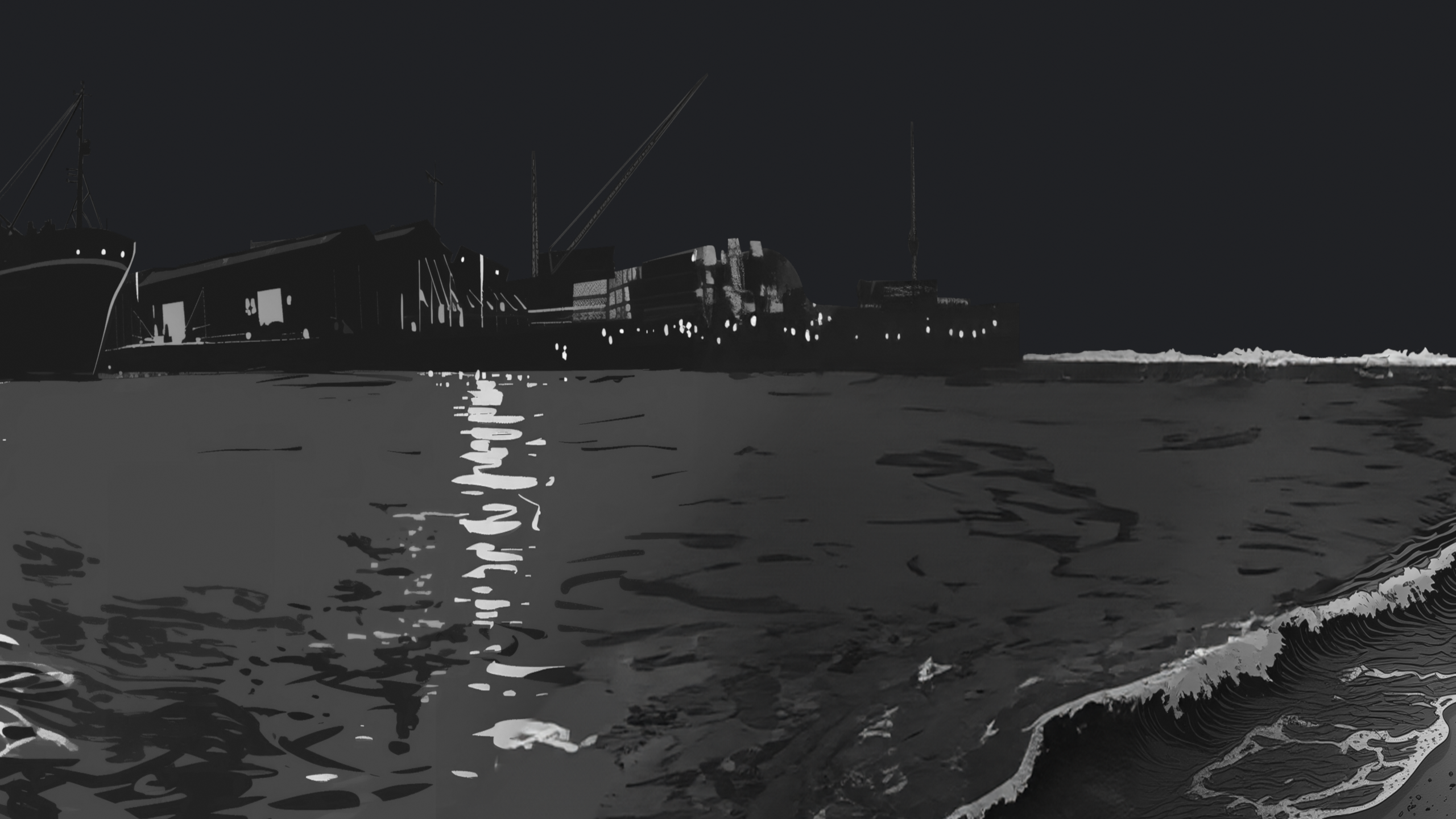

Puting Bato West is a quiet seaside town in the province of Batangas, Philippines.

Home to about 4,000 residents, it is also where a 246-megawatt coal-fired facility can be found.

From the coast of Balayan Bay where young children swim and play in, large vessels carrying coal from Semirara Island – a major site for mining of the dirty fuel located on the same archipelago of Calaca – can be seen.

The ships dock at a nearby port for the coal to be unloaded and transported.

For the longest time, it would have been unthinkable for the lucrative coal facility to be retired ahead of its economic lifespan – it is merely in its ninth year of operation.

Yet as momentum for the green energy transition picks up in Southeast Asia and nations are pressured to meet their net-zero targets, the region’s regulators and the private sector seem to have worked out the financial equation to close the plant early.

The Calaca plant looks likely to be the world’s first facility to be retired and replaced with renewables using a novel class of carbon credits, known as “transition credits”.

But what of the ripple effects the change might have on individuals and communities living near the plant, including those whose livelihoods depend on it?

While the ambitious pilot, which will see the plant closed 10 years ahead of its scheduled retirement, has generated much optimism among key stakeholders, those managing the phase-out are aware that timelines and investors cannot be the only considerations.

For now, there is some commitment to carefully work out a just transition plan, though details are sparse. The residents of Puting Bato West are not aware of the facility’s planned early closure, Eco-Business discovered on a reporting field trip to the town.

It begs the question of how communities can be given more ownership over the movement to end coal. Will the low carbon shift bring about real benefits for them? Questions like these will have to be answered in the near horizon.

The consensus on ending coal might be increasingly clear, but the logistics around how to retire entire fossil fuel fleets in a way that makes financial sense are not.

Up until last year, the most promising financing mechanism for snuffing out coal plants prematurely – an inherently uneconomical endeavour – had been concessional capital from governments, multilateral development banks or philanthropic donors. In resource-strapped Southeast Asia, there are added complexities as young coal fleets which are expected to operate for decades risk becoming stranded assets if they are retired early.

Put simply, early coal retirement, at its first principle, is the removal of productive assets which are still generating value for stakeholders, explained Dion Camangon, a senior public-private partnership (PPP) specialist at the Manila-based Asian Development Bank (ADB). Any intervention to accelerate such a move will have to “offset some of that value loss,” Camangon told Eco-Business.

The cost of winding down half of Southeast Asia’s coal fleet, which the regional development bank estimates to be “north of US$30 billion”, has primarily been supported by grants and low-cost equity and debt under its flagship Energy Transition Mechanism (ETM) programme which launched in 2021.

In August 2022, when ADB started conducting market outreach to flesh out the ETM concept, it was already clear that concessional financing won’t be sufficient to raise the full US$30 billion.

A turning point came last October, when consulting giant McKinsey and Company jointly published a working paper with the Monetary Authority of Singapore (MAS), the city-state’s central bank. Transition credits were mooted as a new concept.

These credits could potentially be a complementary financing instrument that can help hasten the phase-out of coal across the region, the paper said.

Since then, some of the region’s largest banks – Singapore’s DBS and Japanese megabanks Mizuho, Mitsubishi UFJ Financial Group (MUFG) and Sumitomo Mitsui Financial Group (SMBC) – as well as carbon standard certifier Gold Standard have joined the MAS-led Transition Credits Coalition, or Traction. ADB is also part of Traction, which wants to create a standardised approach by 2025 to phase out coal across countries with differing market conditions using the new mechanism.

Camangon said the idea of carbon credits as “another potential pocket of capital” has always been floated. “But detailed thinking into how these credits can be mobilised for the energy transition only started to build up when there was broader interest in the market,” he said.

The pilots are starting in fossil fuel-dependent Philippines. Near Puting Bato West, Calaca, the site where Eco-Business visited, the South Luzon Thermal Energy Corporation (SLTEC) plant is already expected to have its operating life of up to 50 years halved after a successful ETM deal in November 2022. The transaction saw Philippine-based conglomerate Ayala Group’s energy business arm ACEN fully divest its stakes in the facility.

With transition credits, it will likely have its decommissioning date brought forward to as early as 2030. At the time of ACEN’s ETM, the plant’s operating technical life could reach up to 2065.

ACEN will continue to manage and map out the transition for the SLTEC plant. The promise is to replace it with renewables and battery storage, according to an update given by ACEN’s chief executive officer Eric Francia to a room full of Asia’s biggest investors at a sustainability summit held in Singapore this April.

The use of transition credits will potentially slash around 19 million tonnes of carbon dioxide emissions, he added.

ACEN CEO Eric Francia (left) at a sustainability event, explaining to investors and regulators how coal plants can be decommissioned using transition credits. Image: Ecosperity

ACEN CEO Eric Francia (left) at a sustainability event, explaining to investors and regulators how coal plants can be decommissioned using transition credits. Image: Ecosperity

In an interview with Eco-Business, Francia gave the assurance that “there is close to zero chance” that SLTEC will be replaced with anything other than a renewables facility, given the strict carbon financing rules drafted by the Coal to Clean Credit Initiative (CCCI).

For example, CCCI, which is led by United States non-profit The Rockefeller Foundation, has specified that the coal asset’s boiler will need to be dismantled to ensure its permanent shutdown.

The methodology, currently reviewed by carbon credit certifier Verra, also states that the coal plant “must not be mothballed or repurposed to continue to combust fossil fuels”. This includes co-firing biomass with coal or gas.

Local community organisers who are starting to learn of the transition plans, however, still have doubts. Some want to know specific timelines, as well as what exactly the coal facility will be replaced with.

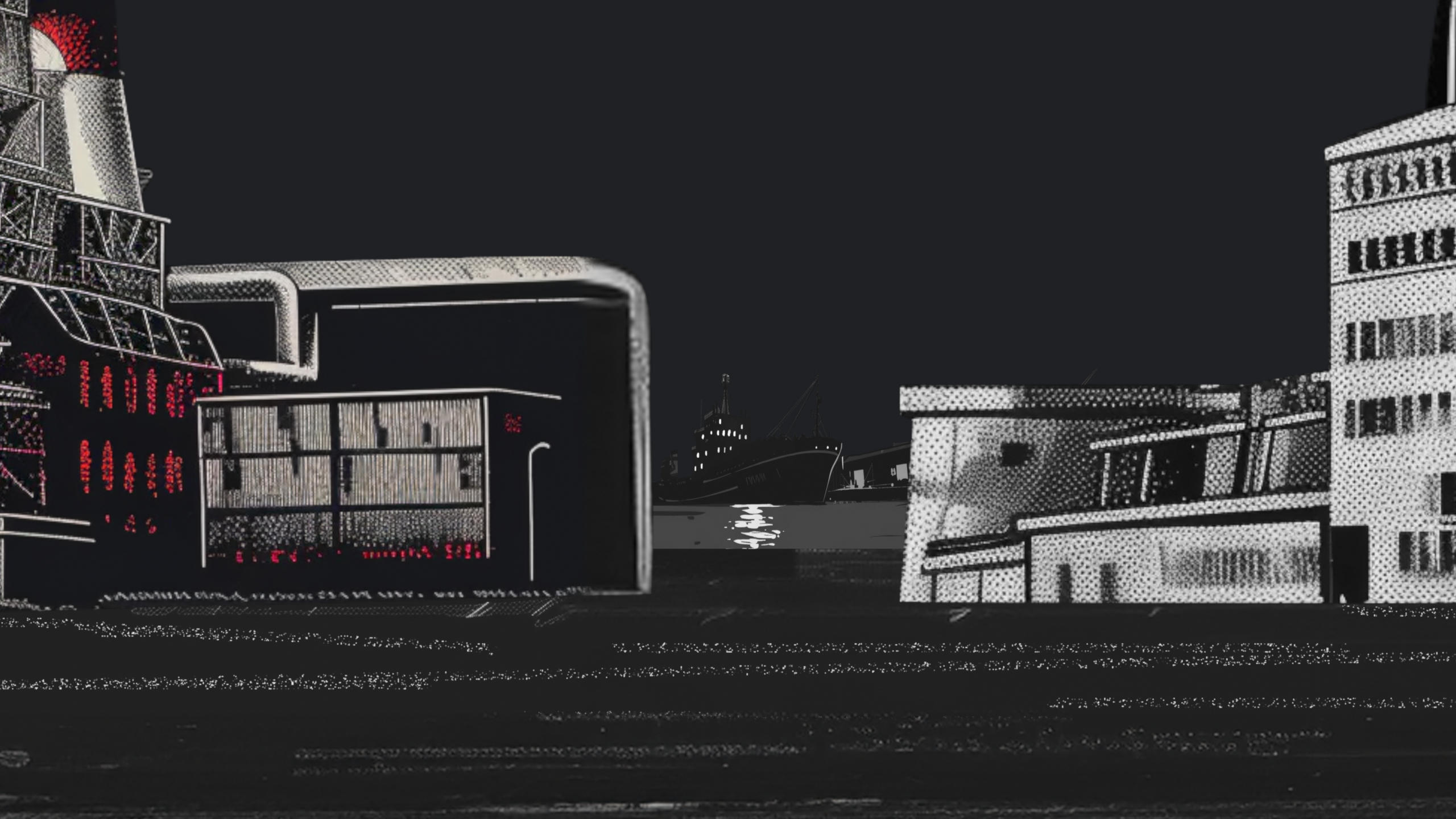

This is especially as natural gas interests still dominate in Batangas. Apart from coal, the province is a preferred area for many liquefied natural gas (LNG) projects since it already has supporting infrastructure and pipelines installed. A natural gas field known as the Malampaya field, which feeds gas to five power plants all located in Batangas, is found just off the coast of the province.

Liquified natural gas facilities line the coast of Batangas province.

Liquified natural gas facilities line the coast of Batangas province.

The only other natural gas-fired power plant in the Philippines is in Cebu. Environmentalists believe that climate-warming gases from natural gas could be as damaging as those from coal.

Documents obtained by Eco-Business from Calaca’s treasury office also show that Puting Bato West is expected to generate the city’s second highest revenue from annual taxes by the end of the year, at about US$3.8 million. Revenue generated by the SLTEC plant accounts for more than 90 per cent.

Trialling transition credits

A step-by-step explanation of how ACEN is decommissioning the SLTEC plant

1. Securing low-cost financiers who will acquire the coal plant

ACEN first had to work towards a successful Energy Transition Mechanism (ETM) deal, independent of ADB. In the market-driven deal, investors essentially have to be convinced to put money in a facility with the intention of retiring it earlier than its technical operating life.

ACEN’s ETM transaction for the South Luzon Thermal Energy Corp. (SLTEC) plant was valued at 17.4 billion pesos (US$314 million), based on November 2022 exchange rates.

Eco-Business estimates that this covers nearly half of ACEN’s foregone annual net income from cutting short SLTEC’s technical life by 15 years.

2. Divestment in return for debt and equity financing

As the owner of the power asset, ACEN then divested its equity stake to three buyers: Philippine Government Service Insurance System (GSIS), Insular Life Assurance Company (InLife) and its newly established special purpose vehicle ETM Philippines Holdings.

Post-transaction, it retained three contracts with SLTEC, including an option to re-acquire it as early as 2030 to accelerate the plant's retirement.

3. Reinvesting proceeds from the deal into renewables

ACEN now has 7.2 billion pesos (US$130 million) that it can reinvest into clean energy. This is after accounting for the cost of debt financing and fees incurred from the transaction.

These proceeds are expected to offset about 9 per cent of the total cost of installing a future clean energy system that would fully meet the needs of what the coal plant previously fulfilled, which ACEN estimates to be at US$1.5 billion.

ACEN declined to share details on what it estimates to be its potential annual returns from renewable energy generation.

In the meantime, the new owners of the SLTEC coal plant would continue receiving revenue from its operations.

4. Exercising call option to buy back the plant

ACEN will need to re-acquire the plant to enable the use of transition credits.

It stands to potentially get US$570 million worth of fresh capital from the sales of the credits, assuming that these are sold at US$30 per tonne, the minimum price that a Singapore-based carbon exchange estimates would be needed to ensure a just transition.

The proceeds will go to compensating investors, building a clean energy system that incorporates battery storage, the just transition of workers and communities, as well as ensuring that the coal plant is permanently retired.

Reydel Panopio from the Philippine Movement for Climate Justice (PMCJ), which represents over 100 groups including Indigenous peoples, the fisherfolk and farming communities, wants public consultation on the decommissioning of the coal facility to start sooner.

“Batangas is a hub of energy industries,” he said. “The economic and political influence of fossil fuels is fierce here and the local government has a strong hold over the people,” Panopio argued, adding that he is worried that the profit motive will take precedence even in a pilot project where safeguards are in place, and local communities will be left helpless.

Moreover, despite the hype over transition credits, in Puting Bato West itself, almost all the residents whom Eco-Business spoke to did not hear anything about plans for the coal plant to be decommissioned as early as 2030.

In fact, the low humming sound from the burning of coal at the nearby SLTEC facility does not bother them. Most are not familiar with conversations around the low carbon shift, and are oblivious to the invisible health impacts of staying near a coal plant.

The burning of coal emits toxic air pollutants and chemicals such as nitric oxide, sulphur dioxide, particulate matter and mercury, which also contribute to the formation of ozone in the atmosphere, according to a report by nonprofit Centre for Research on Energy and Clean Air (CREA). Such pollutants spread and cause a range of harmful health effects, even in small doses, and especially impact vulnerable groups like pregnant women, the elderly and those with pre-existing health conditions.

Joan Cabrera, who relocated to Putting Bato West in April with her husband and young son, chose the town primarily because of a lower rent. The family notices a more obvious stench coming from a nearby bioethanol factory, which has reportedly caused symptoms in some residents such as vomiting and dizziness. The health impacts of living near a coal facility are not so much in their consciousness.

Another resident, who prefers to go by Jose (he declines to go by his real name, citing difficulties as he works at the town hall which implements government programmes for the locals), shares the same sentiments. He has lived near the coal plant since he was a boy.

Jose, however, noted that he knows of long-time residents in Puting Bato West who have suffered from lung problems, likely due to lengthy exposure to coal burning. “Some of us know the air from the plant is not healthy, but what can we do? We have nowhere else to go,” he said.

Eco-Business visited Puting Bato West, the town near the SLTEC plant, in June this year. There is also a bioethanol plant located nearby which emits a stench that residents find more unbearable than the smell of coal.

Graphics used in this story are reproduced according to photographs taken on the reporting trip.

For ADB, it is exploring the use of transition credits to shut down a 200-MW coal-fired power plant in Mindanao, the second-largest island in the Philippines and the most coal-dependent one.

In June this year, multilateral climate fund Climate Investments Fund (CIF) pledged US$500 million to retire the facility by 2026, five years ahead of the end of its power purchase agreement.

Based on an investment plan prepared by the Philippines government, the early closure could avoid 7 million tonnes of carbon dioxide emissions, which could potentially be monetised as transition credits. This will help lower the cost of the transaction.

David Elzinga, ADB’s principal energy specialist said that to lower the value of existing coal plants in order to bring down the cost of the early coal retirement projects, the bank has to apply multiple financing mechanisms. Beyond transition credits, these include concessional money and the potential valuation of air pollution, for example.

“If you value that, then all of a sudden, you would depress the value of a coal plant or add cost to the production of electricity,” he said. Gujarat – one of the most industrialised states in India – is the world’s first to have launched such a market for air pollution.

“We are trying to pull on all the levers that are possible.”

Elzinga explained that what ADB and other financial institutions are trying to do is structure the deals well and understand the costs, to make use of the most effective levers. “That is why we are committed to increasing the number of these transactions from one or a handful to tens and dozens of them. Then we can find out what the levers are.”

However, as ADB has realised, the use of transition credits could also inadvertently limit the pool of eligible coal retirement projects.

A reason why the Mindanao plant was chosen by ADB to pilot the new financing mechanism, instead of Indonesia’s 660-MW Cirebon-1 plant – which had looked likely to be the multilateral lender’s first early phase-out deal to cross the finish line – was because it was due to close by 2030.

The Cirebon-1 transaction had a proposed retirement date of December 2035.

Elzinga said investors looking at emission reduction credits are “all now looking at pre-2030 credits”. “Even if we were to find a way to sell them at a discounted level, they would be so discounted that the value of the actual credits would be destroyed,” he said, adding that the landscape for carbon credits could look different in the next decade.

It remains to be seen if the two ongoing pilots in the Philippines can build a blueprint for the rest of Southeast Asia to follow.

The country’s deregulated electricity market has made it easier for foreign investors to work with independent power producers like ACEN to shut down their fossil fuelled-facilities, said Joe Curtin, managing director of the power and climate team at The Rockefeller Foundation.

This is not the case in neighbouring nations like Indonesia and Vietnam, where power markets are highly regulated. “With state-owned utilities and more regulated markets, there is a lot of interest in this kind of opportunity, but it might take a bit longer,” said Curtin.

Across Southeast Asia, more than five gigawatts (GW) of coal plants will have to be retired per year, over the next two decades, in order to phase out all fossil fuels, according to latest estimates.

Indonesia, Malaysia, Vietnam and the Philippines –the top coal-consuming countries in the bloc – are cumulatively operating about 90GW of coal power. The region has a particularly young coal fleet, with an average plant age of about 13 years.

Domestic regulatory conditions could complicate the pairing of coal retirement with clean energy deployment in a single transaction, a requirement under the draft methodologies by CCCI and Gold Standard.

For instance, while ACEN is able to use proceeds from transition credits and its 2022 ETM transaction to fund the replacement of SLTEC’s retired coal capacity with clean energy, this is not allowed for plant owners in Indonesia.

As a result, ADB has had to separate the process for financing coal retirement and renewable energy development for Cirebon-1, despite that not being the ideal way of structuring a managed phase-out deal, said Elzinga.

“It's a regulatory issue...Any new contract has to be competed for, with as many actors as possible. You can't give any advantage to the original coal plant owner. It has to be pure new competition,” he said. The transaction structure would be more ideal if the two processes can be merged, with or without transition credits, he suggested.

We are trying to pull on all the levers that are possible.

A globally accepted benchmark for the issuance of transition credits has yet to emerge.

SLTEC will be using CCCI’s methodology, which it expects to finalise by end-2024, upon Verra’s approval. But ADB, which has been developing a methodology for credits aligned with Article 6.4, a clause in the Paris Agreement that establishes a global carbon market overseen by a United Nations body, has not decided between adopting the rules by CCCI and Gold Standard for its Mindanao deal.

“CCCI and Gold Standard have very different methodologies right now. So the question is which one will be closer to the principles that we have in our Article 6.4 methodology,” said Camangon.

Curtin said that the CCCI’s current methodology assumes that the power plant in question has a long-term power purchase agreement – which SLTEC has – as “that is the easiest way to establish a counterfactual scenario”.

Barring an updated methodology, which Curtin expressed willingness to work on with ADB, the Mindanao plant — which has multiple offtake agreements with different parties — might require “a slightly different methodology”.

Since the city of Calaca is extremely reliant on SLTEC’s corporate tax contributions, replacing this foregone loss in corporate tax revenues from SLTEC will be included in the just transition framework, according to ACEN.

The energy firm is currently writing up the framework with the Coal Asset Transition Accelerator, a global platform supporting asset owners and governments in their transition away from coal, its spokesperson said.

Adelino Magpile, town captain of Puting Bato West, believes that beyond paying taxes to the city, SLTEC should prioritise the hiring of locals. Otherwise, residents who failed to benefit from the coal plant’s operations in the past decade may miss out once again as it transitions into a renewables facility, he added.

Magpile, who has lived in the town for decades, told Eco-Business how SLTEC previously failed to prioritise employing people in the suburbs, even if these people were qualified for the jobs.

“I once tried to help my brother, a former safety officer in another coal plant, get hired by SLTEC, but he was refused. There was a husband of someone from the local government unit who already had experience as an engineer abroad but was also not given an opportunity," he said. “They prioritise applicants from the bigger cities like Batangas City and Metro Manila.”

Back in 2013 when SLTEC conducted a public hearing before building the coal plant, Magpile had called for a memorandum of agreement (MOA) between the plant owners and the town to prioritise employing locals. But his plea fell on deaf ears.

Puting Bato West barangay captain Adelino Magpile stands in front of the town's multi-purpose hall.

Puting Bato West barangay captain Adelino Magpile stands in front of the town's multi-purpose hall.

“People from our barangay should not have to go to other places to find work. For the next project, I hope SLTEC gives priority to our residents and takes part in a MOA,” he said. Barangay is Tagalog for village.

ACEN’s Francia acknowledged that the 'just' elements under the transition credits scheme need to be prioritised this round.

In its 2022 market-based ETM, ensuring the just transition of communities and workers was “less of an issue”, as there was a high chance that SLTEC could have been repurposed to run off alternative fuels, rather than being retired, he explained.

“The chances of there being similar jobs was high, because it’s still a thermal plant,” said Francia, so little resources were put to transitioning the workers. But now that ACEN has decided to permanently shutter the coal plant, it has to think of the people.

Transition credits standard-setters are also grappling with how to deal with the impact of an accelerated coal phase-out on the local community, beyond the workers who work in the plants.

While CCCI's methodology is “pretty robust" when it comes to dealing with the impacts on workers hired by coal plants, Curtin admits that it will need to do more to look into how it handles the impacts on the broad local community.

In its draft rules, CCCI proposed allocating a minimum of 5 per cent of the transition credits revenue to implementing a developer’s just transition plan. Like Gold Standard, the CCCI methodology stressed the need for “ongoing information dissemination, dialogue and seeking feedback with identified stakeholders”.

But so far, no community members living near SLTEC have been consulted. ACEN declined to share the notice period they intend to give workers once the decommissioning plans are confirmed.

ADB plans to map the just transition component of the CCCI methodology to the principles it developed for Cirebon-1, said Camangon.

However, the Indonesian coal plant has been beset with allegations of corruption, harassment and human rights violations from local civil society groups, which have argued that its owners should take responsibility for adverse impacts of the plant’s construction and operation on local communities instead of being compensated for their economic losses.

“ADB has made it clear in previous dialogues and ETM drafts that addressing legacy issues is not covered by the mechanism. Clearly, without reparations and justice for those who have long been impacted by the coal facilities, there will be no ‘just’ transition,” said Gerry Arances, executive director of Philippine think tank Centre for Energy, Ecology and Development (CEED).

ADB’s Elzinga argued that speed and ambition of the transition to clean energy are constrained by the private sector requiring returns and the fact that while the external pressure to shut plants down is increasing, it is still relatively weak.

“The private sector operates like the private sector: they invest, they expect to get returns, and they do it under a legal environment, hopefully." Until that changes, the limits will remain, he said.

Meanwhile, local communities impacted by the low-carbon shift do not have much expectations, or are not invested in the conversations.

For residents like Cabrera and Jose, who have no clue that they could be eligible for benefits under a just transition plan, they are resigned to the fate that corporations will decide for them what they get out of the deal.

This report was developed and written by Hannah Fernandez and Gabrielle See, with editing support from Ng Wai Mun.

Eco-Business is dedicated to reporting on Asia's most important sustainable development issues. We believe in the power of independent journalism and strive to expand the breadth and depth of our coverage with special reports like this. If you like the story and would like to show your support, do consider signing up for our paid subscriptions and join the EB Circle, EB Premium and EB Enterprise communities.