While most Asian investors now publicly recognise climate change as a material risk, there remains a significant gap in investment strategies on deforestation, according to a report by the Asia Investor Group on Climate Change (AIGCC), a network of institutional investors with over US$35 trillion in assets under management advocating for climate action in Asia.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Nearly 90 per cent of the region’s investors still lack a deforestation policy, with only 4 per cent having conducted a detailed deforestation assessment across their portfolio. This is despite growing investor interest in the broader topic of nature and biodiversity since the launch of the Taskforce on Nature-related Financial Disclosures (TNFD) framework last September.

There was also a wide disparity between the progress asset managers and asset owners have made on this front. While 19 per cent of asset managers – which refer to institutions like pension funds and insurers that manage the money of asset owners – consider deforestation in their investment decisions, only 3 per cent of asset owners have done the same.

The study, which surveyed more than 200 regional asset owners and managers representing over US$76 trillion in assets under management, found similar implementation gaps in other sustainability-related practices, from the phase-out of fossil fuels to scaling up investments in climate solutions.

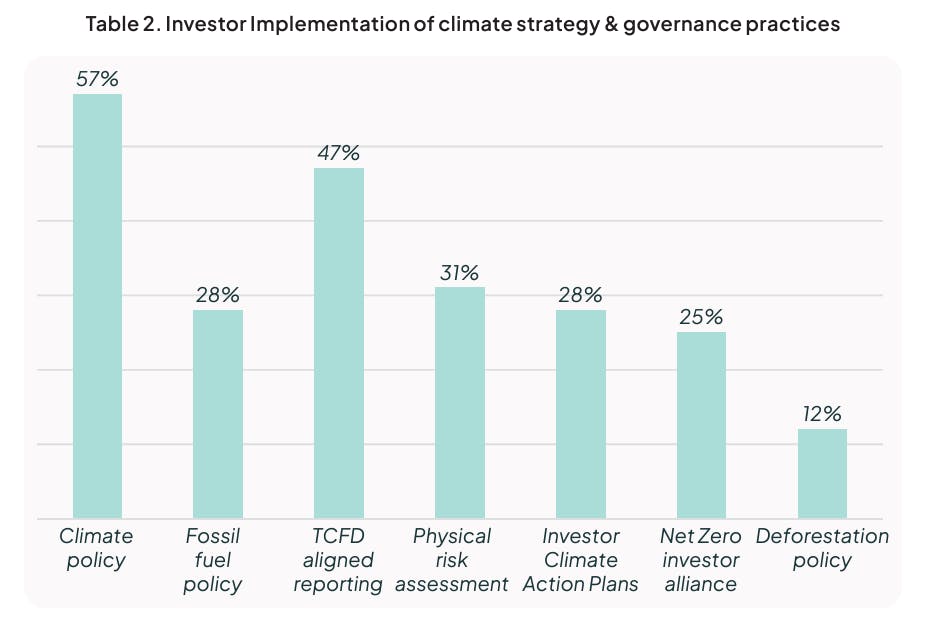

While over half of Asian investors now have a climate policy, the majority still lack fossil fuel and deforestation policies. Image: AIGCC’s State of Net-Zero Investment in Asia report

An anticipated US$71 trillion in investments will cumulatively be needed for Asia to get to net-zero by 2050. However, the majority of investors are still not positioned to mobilise this required financing.

Only 12 per cent of investors have committed to increase investments in climate solutions, including early and mid-stage clean energy innovations.

Most investors in the region have also yet to introduce a formal policy to phase out fossil fuels or other high-emitting assets from their portfolio.

Only about a quarter of the investors surveyed already have some form of fossil fuel policy in place, which could include details of escalation strategies, exclusions, plans for engagement on managed phase-outs.

Investors’ climate policy wishlist

When investors were asked what they thought should be the key climate-related priority of the national government in the country they were based in, over a third responded that an improved approach to carbon pricing was required.

Singapore remains the only Asian country that has implemented a carbon tax on heavy polluters. Indonesia’s levy for coal-fired power plants was initially supposed to kick in two years ago, but has been postponed to some time in the next two years. Meanwhile, Japan plans to introduce a levy on fossil fuel importers from 2028 at the earliest.

Nearly a third of investors said that there was a need for greater funding to support new climate technologies, alongside setting 1.5°C-aligned sector pathways. More than a quarter are asking for mandatory climate risk reporting and the implementation of climate finance taxonomies.

However, domestic investors in the region appear hesitant to urge government officials to introduce more ambitious climate policies.

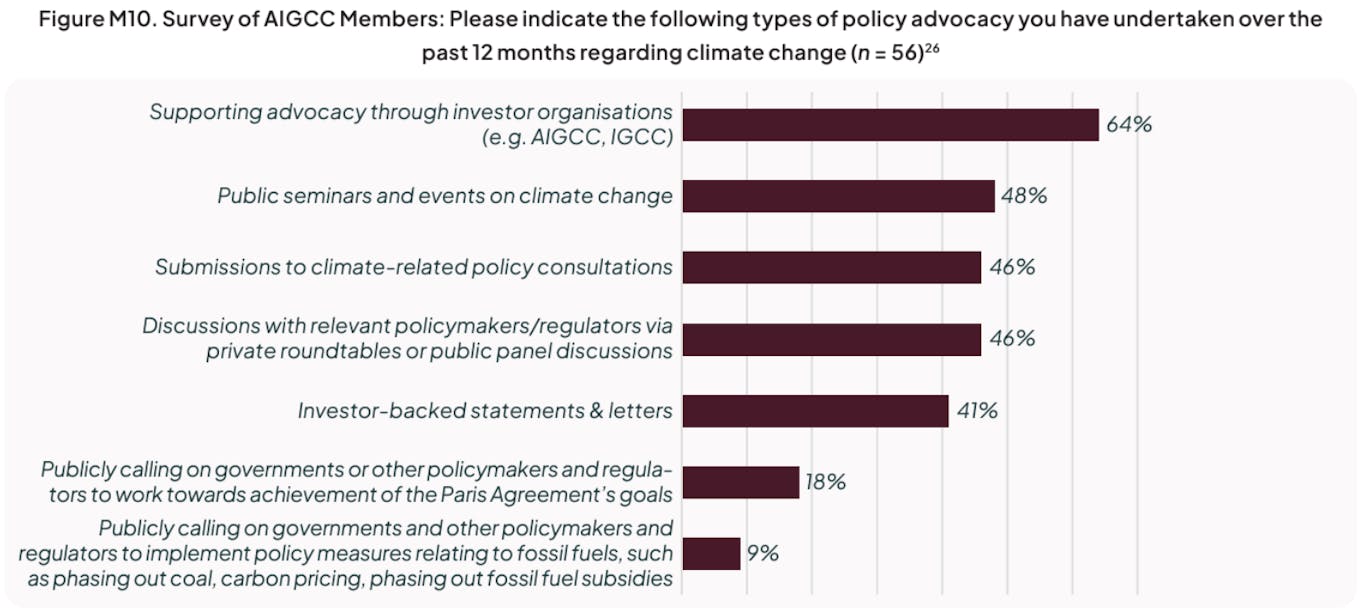

While 64 per cent of AIGCC members already support advocacy through investor organisations, far fewer have publicly called on governments to step up climate policies to achieve Paris Agreement targets and to phase out fossil fuels. Image: AIGCC’s State of Net-Zero Investment in Asia report

Only 16 per cent of those surveyed have signed the Investor Agenda’s 2022 Global Investor Statement to Governments on the Climate Crisis, an investor-backed statement calling for governments to implement policies in line with limiting global temperature rise to 1.5°C, such as setting policies to transition away from fossil fuels, end deforestation, support climate finance and strengthen disclosures.

Even among AIGCC members, very few have publicly pushed for governments to enact bolder climate policies.

Only 18 per cent of them have called on policymakers and regulators to work towards achieving Paris Agreement targets. Meanwhile, just one in 10 have pressed governments to implement policy measures relating to fossil fuels, including phasing out fossil fuel subsidies and implementing a carbon price.

Shaky state of investor net-zero alliances

AIGCC is one of the investor networks helping to lead the Climate Action 100+ (CA100+), the world’s largest investor-led engagement initiative.

The coalition has seen at least five major United States asset managers either exiting or scaling back their involvement in the past few months, as environmental, social and governance (ESG) – an added risk filter for investing – gets caught up in the country’s culture wars.

Earlier last month, Invesco became the latest to quit the group, following in the footsteps of JPMorgan, State Street and Pimco. The world’s largest money manager BlackRock has also reduced its involvement by transferring membership to its international arm.

In this year’s annual letter to investors, BlackRock boss Larry Fink once again steered clear from making explicit references to ESG, calling instead for infrastructure investing aligned with “energy pragmatism”, where countries might continue expanding oil and gas production alongside renewables in the clean energy transition.

In the past year, the United Nations-convened Net-Zero Insurance Alliance (NZIA) has seen a similar exodus of nine global insurers, including AXA, Allianz, Swiss Re and Munich Re. Japan’s Sompo Holdings and Australia’s QBE were the latest two insurers from the Asia Pacific region to withdraw from the climate alliance last May.