Emerging economies often cite a lack of capital as the most significant barrier to creating a profitable plastics circularity market. New data now shows that global investors injected over US$4.1 billion into such solutions in emerging markets across the world over a five-year period since 2018, with Asia receiving the bulk of the investment.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The data, traced using a new investment tracking tool launched in March by non-profit The Circulate Initiative, confirms that Asia remains a huge focus for seed investors and venture capitalists looking to have a stake in the region’s emerging markets. 87 per cent of all funding for plastics circularity in emerging economies – or about US$3.5 billion – went to the region between Jan 2018 and Sep 2022.

Within Asia, Southeast Asia attracted the largest amount of private capital – US$1.6 billion – followed by East Asia and South Asia with US$1.1 billion and US$678 million, respectively.

As a region, Asia contributes to more than 80 per cent of the plastic waste that leaks into the ocean, according to the World Bank. Emerging Asia continues to import a lot of waste from developed countries, with Southeast Asia inheriting much of the world’s scrap after China closed its door to waste imports in 2017.

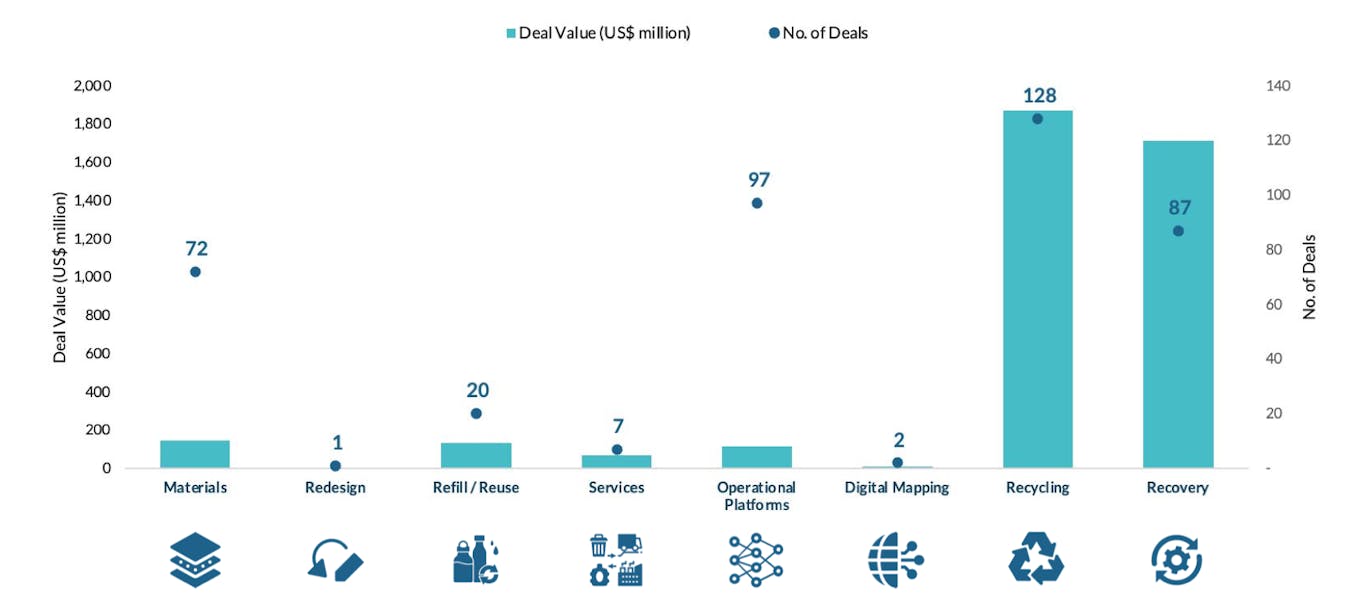

An accompanying report by The Circulate Initiative, highlights a “notable gap” between investments going to downstream solutions, particularly recovery and recycling businesses in operation “for decades” and are already established, and upstream solutions, which received significantly fewer investments. Only US$473 million of investments made their way into upstream solutions such as materials and redesign, refill and reuse, and digital mapping.

Plastics circularity investments by solution from January 2018 to September 2022. Recovery and recycling companies received the most investments. Source: The Plastics Circularity Investment Tracker report, 2023

Firms offering alternative solutions are relatively new, and “have yet to demonstrate a successful business model”, said The Circulate Initiative in the report. Investors are hesitant to put in their capital, and most of these solutions only received smaller-value venture capital funds or incubator funding, with the vast majority of deals measuring in the thousands or tens of thousands in terms of dollar value, according to available statistics.

Investors take a ‘wait and see’ approach

“Many newly-formed companies struggle then to find the capital required to grow after a small initial investment, making it difficult for them to reach maturity and attract larger investments,” the report said. It notes that the trend might shift as more markets prioritise plastic avoidance and reduction, and called for continued support for upstream solutions through more patient capital.

Put into perspective, it also says that overall investment activity in the plastics circularity space in emerging markets remains “miniscule”, when referenced against the estimated US$1.2 trillion required between 2021 and 2040 to transition to a circular economy. Most investments tracked are now characterised by early-stage investments – firms in the seed and early stages of development accounted for 62 per cent of the deal count, but only received 5.1 per cent of investments during the review period.

Non-profit The Circulate Initiative launched a new investment tracking tool in March that specifically looked at plastics circularity deals in the emerging markets. Image: The Circulate Initiative

Umesh Madhavan, research director of The Circulate Initiative, said Asia’s circumstances mean that there will still be “a definite and clear need for recovery and recycling solutions” in the near future. He told Eco-Business: “Asia is a consumption-driven economy. I think we have to be realistic about the fact that there will be continued production and consumption of plastic.”

There is, however, a place for midstream and upstream solutions in the entire value chain, Madhavan believes. For example, in Southeast Asia, material alternatives such as bioplastics – a type of plastic made from renewable or natural resources – are attracting attention from investors, although the majority of deals are early-stage ones, considering how there are no clearly-defined policies or post-consumption handling infrastructure in place at the moment.

“In the absence of that, investors are going to say: I’m going to wait on the sidelines and see how this will play out. The businesses will have to make the case for profitability before the investors will consider putting money in them,” he said.

In Asia, several countries have already implemented Extended Producer Responsibility (EPR) requirements for plastic packaging. Singapore, the Philippines and Vietnam are in the process of doing so.

In the Philippines, for example, EPR legislation specifically targets large enterprises producing or utilising plastic packaging along the value chain and requires 80 per cent plastic packaging recovery or diversion by 2028.

Filling data gaps

More than 400 deals were captured by the investment tracking tool. The Circulate Initiative said it consulted databases covering private market transactions and filtered data for third-party investments, and then cross checked this against publicly-available information.

Overall, the big dollars were from debt financing or loans, but venture capital funded more businesses, and made up 38 per cent of all investments, in terms of deal count.

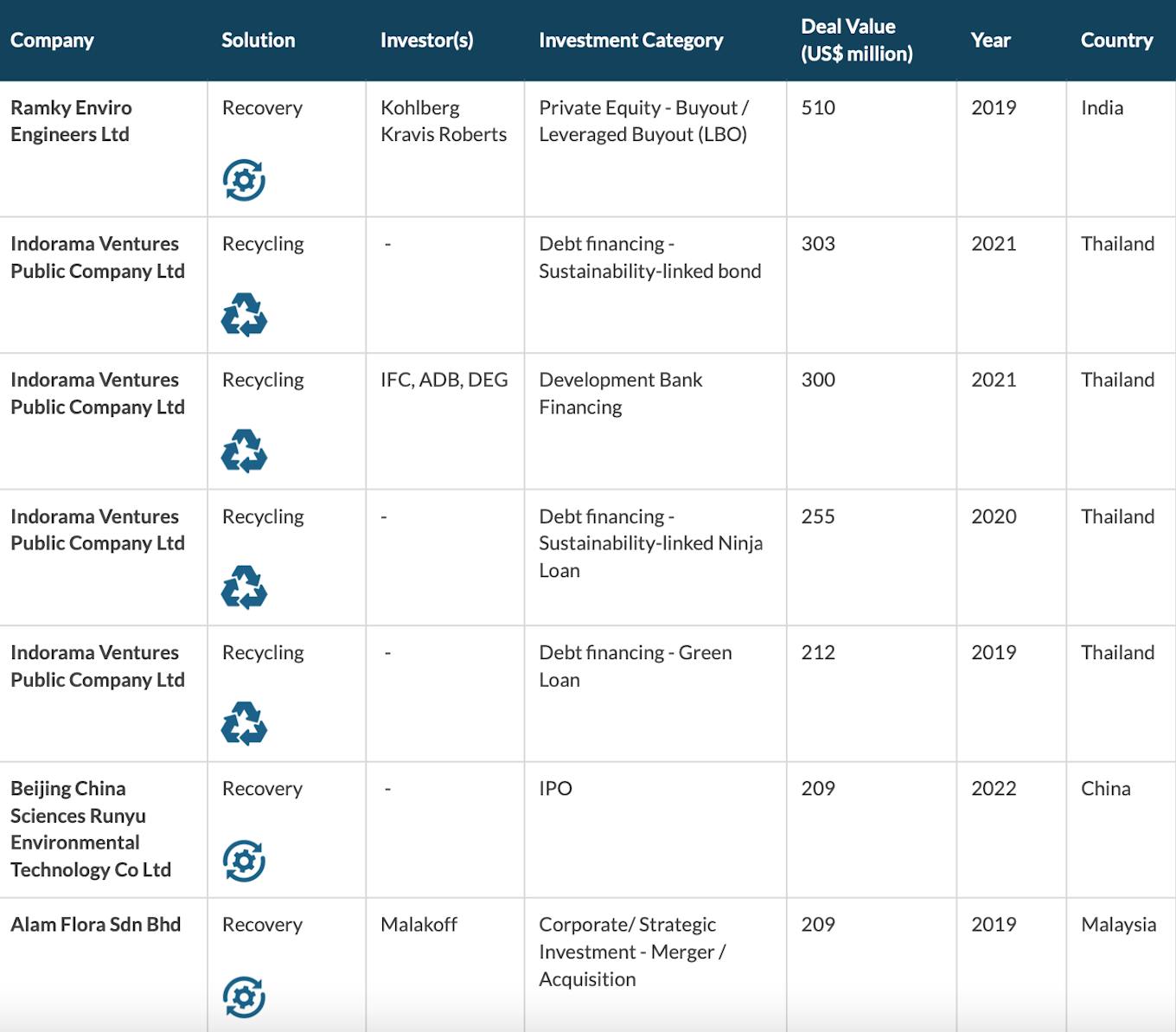

Top transactions by deal value between January 2018 and September 2022. [Click to enlarge] Source: The Plastics Circularity Investment Tracker report, 2023

Larger investors appear to be more interested in investing in or buying out companies with mature technologies and stable business models. At least four of the top ten plastics circularity deals recorded between 2018 and Sep 2022 were debt financing or loans.

Referring to a leading investor list compiled from data tracked, Madhavan pointed to how Southeast Asia received a “large chunk of the money that came through for Asia” primarily through a single player – Thailand petrochemical group Indorama Ventures – that, in recent years, has been expanding its polyethylene terephthalate (PET) bottle-to-bottle recycling facilities globally.

The top seven transactions recorded over the review period were investments into Asian companies. All were recycling and recovery ventures.

Data on the deployment of capital into circular economy solutions remains unreported, unavailable or scattered, said Madhavan, and this has made it almost impossible for investors to pinpoint gaps and deploy capital to where it is most needed.

“If people don’t know there are opportunities in the space, it is very difficult for us to push them to invest,” he said.