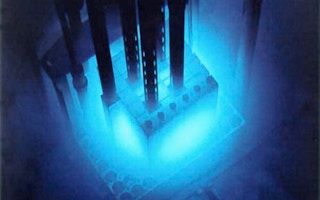

Strong expansion of nuclear power as a carbon-free energy source in Asia is expected to press ahead despite the Fukushima accident in Japan that soured sentiment in some countries, a benchmark report said on Thursday.

An earthquake and tsunami crippled the Fukushima plant in February 2011, leading to the closure of Japan’s 50 reactors and spurring Germany to pledge to close all of its nuclear reactors by 2022.

Nuclear energy had been gaining momentum as an energy source for nations seeking to reduce harmful carbon emissions, but the Japanese accident caused second thoughts in some countries.

World nuclear capacity is, however, expected to grow by 44 per cent to 99 per cent by 2035, according to a biennial report from the United Nations nuclear body and the Organisation for Economic Cooperation and Development.

This was little changed from the range of growth of 37 per cent to 110 per cent in the edition two years ago of the report on uranium resources, production and demand, known as the “Red Book.”

“We see it as a speed bump,” said Gary Dyck, head of nuclear fuel cycle and materials at the International Atomic Energy Agency, referring to the long-term impact of the Fukushima accident on the global nuclear industry. “We still expect huge growth in China.”

Asian expansion

Nuclear capacity is due to expand in East Asia by 125 per cent to 185 per cent by 2035, the report said. The strongest growth is expected in China, India, South Korea and Russia.

This low end of the range does not include any prospect that Japan ends up banning nuclear energy, said one of the authors of the report, Robert Vance, an official with the OECD Nuclear Energy Agency.

Japan has restarted two of its reactors, but this has energized a growing anti-nuclear movement that attracted 100,000 people at a protest this month.

The uranium mining industry is expected to be able to supply the burgeoning needs of the nuclear industry as long as investment keeps flowing into the sector.

Uranium resources increased by 12.5 per cent during 2009 and 2010, fuelled by a 22 per cent boost in spending on exploration and mine development to more than $2 billion, the report said.

The sector will become more reliant on mined production after next year upon the end of Russia’s deal to supply material from old weapons to the US uranium market.

Under the Megatons to Megawatts treaty, Russia has supplied the US market with about 25 million lb a year of downgraded uranium from old nuclear weapons.

In 2010, secondary supply accounted for about 15 per cent of the nuclear industry’s needs, down from 26 per cent in 2008, the report said.

Many investors who are bullish on the outlook for uranium prices say the end of the treaty could be a catalyst for a rebound in prices.

There is potential, however, for other secondary sources to develop and weigh on the market, Vance said.

“There remains, however, a significant amount of previously mined uranium… some of which could feasibly be brought to market in a controlled fashion,” the report said.

The spot uranium price has languished at just above $50 a lb for the past year, falling from around $70/lb after the Fukushima accident.