In late 2015, the world agreed to limit the global temperature rise to “well below 2C”. Ever since the signing of the Paris Agreement on climate change, scientists, think tanks and policymakers have been scrambling to define exactly what meeting this temperature limit will mean in policy and investment terms.

A new report released this week by the International Energy Agency (IEA) and the International Renewable Energy Agency (IRENA) is the latest attempt to address this question.

Commissioned by the German government in its role this year as G20 president, the report sets out the “essential elements” needed to create an energy sector transition consistent with the Paris Agreement.

The G20 is a group of 20 major economies, including China, India, Germany, the UK and US, which accounts for 63 per cent of global population and 83 per cent of emissions.

The IEA and IRENA each took a separate approach to modelling the most cost effective decarbonisation pathway, with the IEA using a so-called “technology-neutral” approach and IRENA putting a heavier emphasis on energy efficiency and renewable energy sources.

These produce significantly different results in areas such as remaining fossil fuel use and investment requirements. However, in combination, what emerges is a core message about the large changes needed in investment direction, clean energy supply and price support mechanisms, as well as the significant co-benefits – such as reduced air pollution – which could result from a low-carbon transition

Significantly, in both cases, clear economic benefits are expected from a transition to a low-carbon energy system.

Carbon Brief sets out seven of the report’s key findings…

1) Set a more stringent carbon budget

While the Paris Agreement clearly stipulates that global temperature rise since the pre-industrial era should be kept to “well below 2C” at the very most, defining what this means in practical terms of the remaining emissions has proven tricky.

The report chooses a scenario with 66 per cent probability of keeping the average global surface temperature rise throughout the 21st century to below 2C.

While some would argue this is still not compatible with the Paris Agreement, it has emerged as one way to attempt to address the raised ambition the deal represents. It is significantly more stringent than the 50 per cent chance of staying below 2C which current UK climate law is based on.

The report calculates the remaining carbon budget for the energy sector between 2015 and 2100 to be 790 gigatonnes (Gt), once non-CO2 emissions and CO2 emissions from industry and land-use change have been accounted for. In contrast, under current national pledges under the Paris Agreement, the energy sector would emit almost 1,260 Gt by 2050 alone.

However, the carbon budget scenario chosen in the report also prevents a temporary overshoot of temperature at any time this century, making it more stringent compared to many International Panel on Climate Change (IPCC) scenarios which frequently rely on negative emissions technologies to compensate for today’s emissions later this century.

2) Speed up the transition

While most scenarios to limit temperature rise show a need to accelerate the rate of transition, unsurprisingly, the more stringent the carbon budget conditions, the faster the change is required. (A recent Shell scenario for below 2C is described as an “accelerated net-zero emissions scenario” for the same reason.)

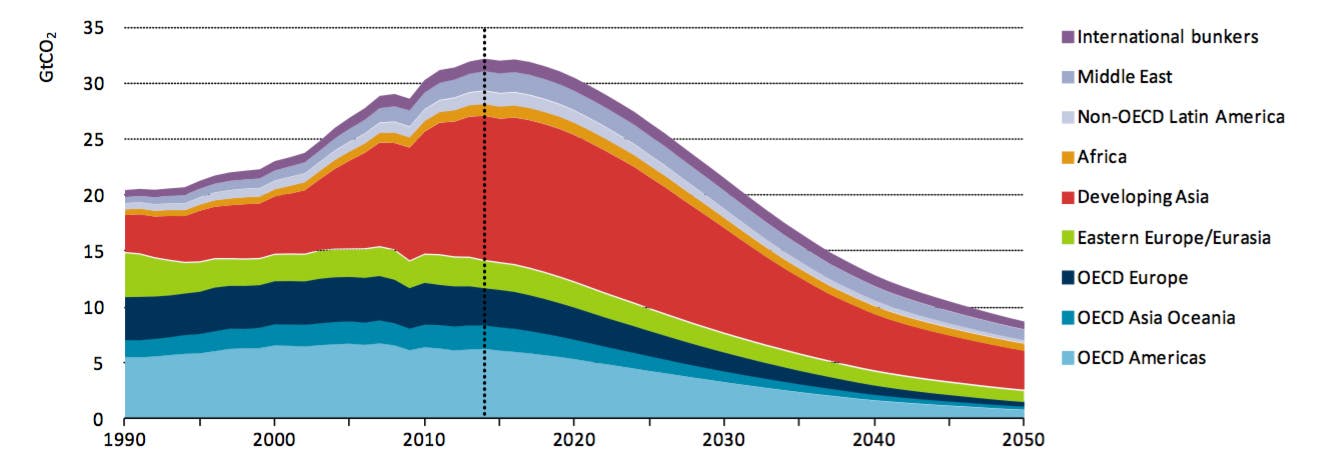

The IEA scenario in line with the report’s carbon budget, for instance, would require energy-related CO2 emissions to peak before 2020 and fall by more than 70 per cent from today’s levels by 2050.

This would require the share of fossil fuels in primary energy demand to halve between 2014 and 2050. Meanwhile, low-carbon sources – in which the IEA includes nuclear and fossil fuels with carbon capture and storage (CCS) – would more than triple to encompass 70 per cent of worldwide energy demand in 2050.

Such an energy transition would require an “unparalleled ramp up of all low-carbon technologies in all countries”, with ambitious policies introduced “immediately and comprehensively” across all countries, the IEA says.

Energy-related CO2 emissions by region in the 66% 2C scenario. Global CO2 emissions fall to less than 9 Gt in 2050, with all regions contributing. Source: IEA

IRENA similarly says early action is “critical” – especially if the world is to maximise the benefits and reduce the risks (and the costs) of the energy transition, and to keep the possibility of limiting global temperature rise to 1.5C.

In its scenario of early action, IRENA says energy-related CO2 emissions could be reduced 70 per cent by 2050 and completely phased-out by 2060. At the same time, global GDP would be boosted by around 0.8 per cent in 2050 – a cumulative gain of $19 trillion (tn). It writes:

“It is hard to over emphasise the importance of early action. Early action is needed not only in the deployment of renewables and other enabling infrastructure and supporting technologies, but also in the development of solutions for sectors where no significant or economically attractive solution exists today.

If action is delayed, total investment costs will rise, the chances of stranded assets will increase and costly negative emission technologies will be needed to limit planetary warming.”

3) Seriously increase investment

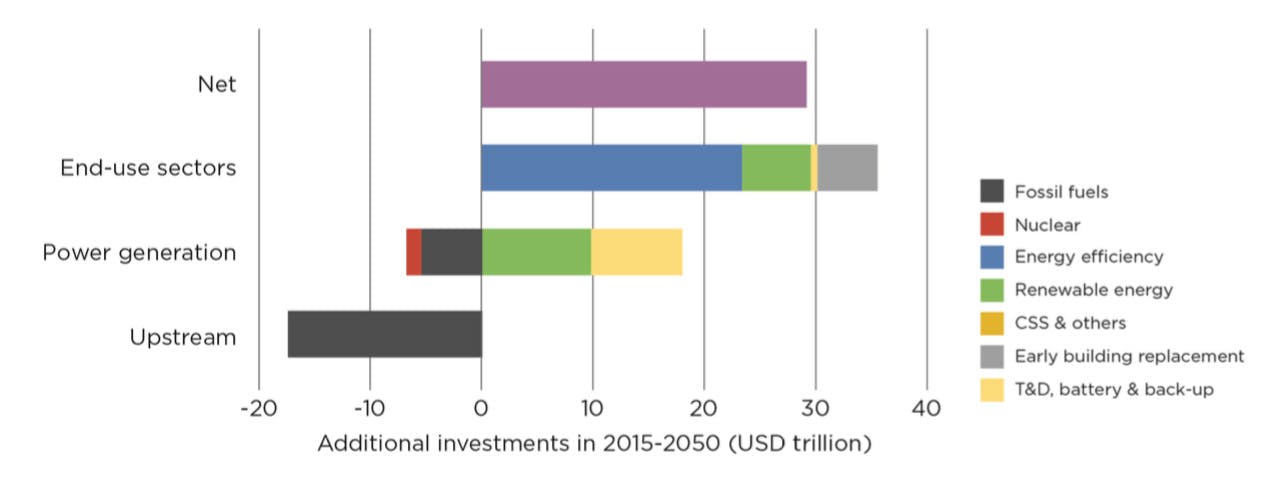

The level of investment needed to achieve such an ambitious energy transition is sizeable. The IEA scenario would require an average investment of $3.5tn per year in the energy sector up to 2050 – almost double the $1.8tn invested in 2015.

However, to put it in perspective, this additional investment would only add up to a maximum 0.3 per cent of global GDP in 2050.

Nearly all this extra investment would need to go into low-carbon technologies on the end-use side of the transition – such as electric cars, heat supply and building renovations – with required investment increasing tenfold by 2050. This would need to be supported by policy signals to ensure such technologies become the “market norm”.

Investment in energy supply, meanwhile, would stay more or less level: fossil fuel investment would decline, but this would be offset by a 150 per cent increase in renewable energy supply investment by 2050.

The IRENA analysis puts the required extra investment by 2050 slightly higher than the IEA at 0.4 per cent of global GDP. This would add up to a total investment of $29tn by 2050, in addition to an expected $116tn from current and planned policies and expected market developments.

The analysis also projects net positive impacts on both employment and economic growth. For more on the economic impacts of climate policy, see this detailed Carbon Brief case study for the UK.

Additional investment needs in IRENA’s low carbon scenario from 20150 to 2050, compared to a reference case of current and planned policies and expected market developments. Source: IRENA

4) Focus on renewables and energy efficiency

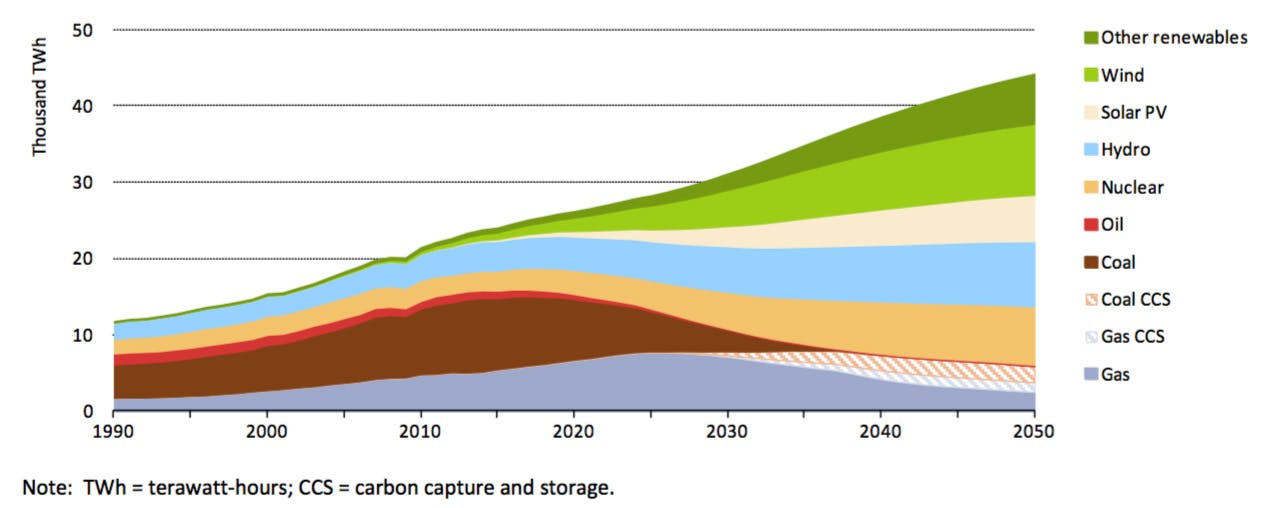

Under the IEA scenario, the share of the global energy supply provided by low-carbon sources would more than triple to 70 per cent in 2050.

The largest share of the emissions reduction potential would come from renewables and energy efficiency.

Wind and solar would together need to become the largest source of electricity by 2030, while nearly 95% of electricity would be low-carbon (including nuclear and CCS) by 2050.

Seventy per cent of new cars would be electric – up from 1 in 100 today – the CO2 intensity of the industrial sector would fall by 80 per cent, and all of today’s buildings which still exist in 2050 would be retrofitted.

Overall, the energy intensity of the global economy would need to drop by a yearly average of 2.5 per cent up to 2050 – three-and-a-half times greater than the rate over the past 15 years.

Global electricity generation by source in IEA’s 66 per cent 2C scenario. Source: IEA

The IRENA analysis puts yet more emphasis on a rising deployment of renewable energy and energy efficiency measures as “the key elements” of the energy transition.

Under its scenario, these would together produce 90 per cent of the needed emission reductions by 2050, driven largely by increasing operational efficiency of these technologies, such as a fall in solar costs of 65 per cent by 2050.

Renewable energy’s share of the primary energy would increase from around 15 per cent in 2015 to 65 per cent in 2050, leading final renewable energy use to be four-times higher than it is today.

This would translate to an average increase of 1.2 per cent per year in renewables’ share of the energy mix – a rate seven times higher than in recent years.

Similarly to the IEA, energy intensity improvements would double to around 2.5 per cent per year by 2030 and continue at this level until 2050. Nuclear power would stay at 2016 levels, while CCS would be used only in the industrial sector.

In addition, all this would need to be accompanied by an enormous effort to redesign electricity markets so they are capable of integrating large shares of variable renewables, as well as rules and technologies to ensure flexibility, the report says.

5) Tackle stranded assets

Use of fossil fuels is an area where the IEA and IRENA analysis diverge to some extent.

In both scenarios, use of fossil fuels remains significant in 2050, although global coal use declines rapidly. Oil use would also fall. However, natural gas is kept as a transition fuel for difficult-to-manage sectors, such as heat and transport.

In the IEA analysis, fossil fuels, in particular natural gas, would still account for 40 per cent of energy demand in 2050 – around half of today’s level. In the IRENA scenario, total fossil fuel use in 2050 would be lower, standing at a third of today’s level, though oil demand would still be at 45 per cent of today’s level.

This can be compared to a recent set of scenarios from Imperial College, which suggested fossil fuel use could peak by 2020, with the power sector becoming virtually fossil-free by 2040.

CCS also plays a strong role in both power and industry in the IEA analysis by offering an important way to minimise “stranded assets” in a low-carbon transition. Stranded assets are assets which will not be able to earn their expected economic return in a climate constricted world.

The IRENA scenario only uses CCS in the industry sector. It also warns that the use of natural gas as a “bridge” to greater use of renewable energy should be limited, unless it is coupled with high levels of CCS. “There is a risk of path dependency and future stranded assets if natural gas deployment expands significantly without long-term emissions reduction goals in mind,” the report says.

Both the IEA and IRENA agree that exposure to stranded assets will only continue to increase.

Assuming a well managed transition, the IEA’s analysis puts the financial exposure for all companies worldwide at $320bn, with the vast majority of this from coal plants.

However, it warns that delaying the transition by a decade would more than triple the amount of investment at risk of being stranded to more than $1.3tn, assuming the same carbon budget is kept. The IEA has already said China’s new coal investments make “no economic sense”, with the projects effectively stranded even before they are built.

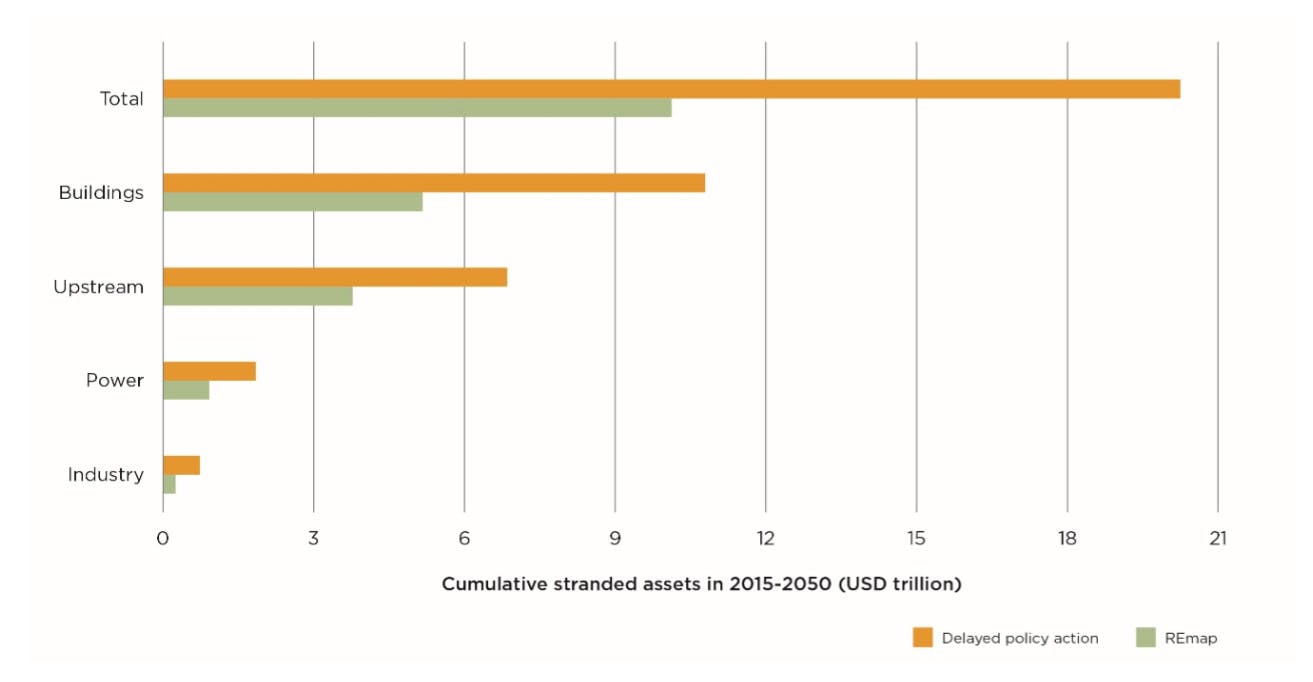

IRENA puts these risks at a far higher level, with an estimated $10tn in assets at risk of being stranded under its energy transition scenario.

This is equivalent to 4 per cent of global wealth in 2015, though IRENA emphasises that these costs are more than offset by gains in other parts of the economy under its renewables-led transition.

According to IRENA’s analysis, the risk of stranded assets is highest for the building sector: in its assessment of stranded assets, IRENA includes the construction value that would be lost due to the needed future renovation of building stock to avoid it relying on fossil fuels.

An example of a stranded asset in this case would be installing single-glazed windows then replacing them with double-glazed windows, rather than installing double-glazed windows in the first place.

In IRENA’s scenario, the long lifetime of inefficient buildings being built now means much of the existing housing stock “would continue to rely on fossil fuels” in 2050 unless it is renovated: implementing the needed renovations would strand around $5tn of assets.

Meanwhile, IRENA estimates that the overall stranded asset risk doubles to more than $20tn if rapid decarbonisation of the energy sector is delayed to 2030 and fossil fuel investments continue to rise.

Cumulative stranded assets by sector up to 2050 in IRENA’s Remap energy transition and delayed policy action scenarios. Source: IRENA

6) Use price mechanisms

Price mechanisms, such as subsidies and carbon pricing, are crucial ways to ensure that the energy sector is taking climate considerations into account, the report says.

The IEA report says:

“A dramatic energy sector transition would require steady, long-term price signals to be economically efficient, to allow timely adoption of low-carbon technologies and to minimise the amount of stranded energy assets. Delayed action would increase stranded assets and investment needs significantly.”

Meanwhile, IRENA notes that the ongoing subsidising of fossil fuels in many countries, combined with the failure so far for a carbon price to account for the true cost of burning fossil fuels, means “today’s markets are distorted”. It adds:

“To unlock these benefits, the private sector needs clear and credible long-term policy frameworks that provide the right incentives.”

However, both organisations are clear that price signals would need to be complemented by other measures to meet the “well below 2C” objective. They also point to the importance of ensuring that the energy needs of the poorest members of society are considered and adequately taken into account.

7) Seize the benefits (and co-benefits)

IRENA says it’s more renewables-intensive approach to the energy transition results in a larger overall benefit than the IEA’s approach, which keeps more reliance on fossil fuels.

It’s worth adding that the agencies took a different approach to measuring the benefits of transition. Different economic models, based on different underlying economic worldviews, can have a dramatic impact on the size and direction of economic change due to climate policy.

IRENA’s assessment sees global GDP boosted by around 0.8 per cent, or $1.6tn, by 2050, through economic growth and new employment opportunities. The cumulative GDP gain from now up to 2050 amounts to $19tn. Even in its worse-case scenario, GDP is boosted by 0.6 per cent in 2050.

IRENA says:

“The energy sector (including energy efficiency) will create around six million additional jobs in 2050. Job losses in fossil fuel industry would be fully offset by new jobs in renewables, with more jobs being created by energy efficiency activities. The overall GDP improvement will induce further job creation in other economic sectors.”

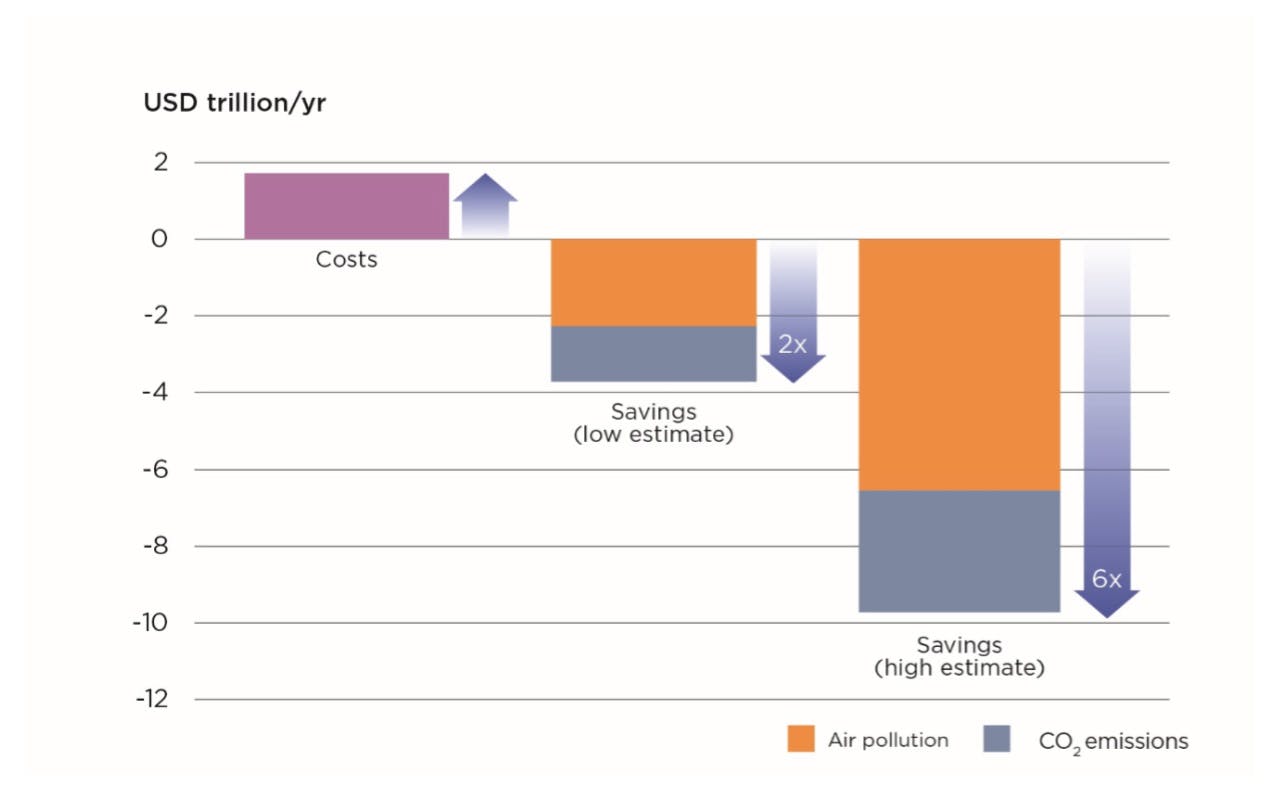

In fact, when externalities such as reduced air pollution and other health benefits are considered, IRENA’s approach projects the overall benefits to be between two and six times greater than the system costs of decarbonisation.

In its scenario, 20 per cent of the decarbonisation options identified are economically viable without consideration of welfare benefits, while the remaining 80 per cent are economically viable if benefits, such as reduced climate impacts, improved public health, and improved comfort and performance, are considered.

In absolute terms, IRENA estimates reduced externalities can bring benefits of up to $10tn annually by 2050.

Costs and reduced externalities of decarbonisation in 2050, according to IRENA scenario. Benefits from reduced externalities exceed the costs of decarbonisation by a factor of between two and six, with health benefits from reduced air pollution alone exceeding the costs. Source: IRENA

The IEA also notes drastic improvements in air pollution, cuts in fossil fuel import bills and lower household energy expenditures would complement the decarbonisation achieved, if well designed policies are used.

Both also note other co-benefits, such as lower fossil fuel bills for importing countries and lower household energy expenditures.

Similarly, analyses consistently show the costs of the UK’s Climate Change Act will be more than offset by a combination of fuel savings, avoided climate impacts and reduced air and noise pollution, even before wider economic impacts in terms of jobs and growth are taken into account.

Conclusion

As a group, the report notes, the G20 accounts for around 80 per cent of the world’s total primary energy demand – including almost 95 per cent of its coal demand and nearly three-quarters of its gas and oil demand. Overall, it is responsible for more than 80 per cent of total CO2 emissions.

However, G20 countries are also the key driver of low-carbon technology deployment, holding 98 per cent of global installed wind power generation, 96 per cent of solar PV and 94 per cent of nuclear power capacity. Its passenger vehicle fleet represents almost 95 per cent of all electric vehicles worldwide.

This means G20 governments will have to play a crucial role in meeting the obligations under the Paris Agreement.

This story was published with permission from Carbon Brief.