Financial institutions seeking to deepen their sustainable finance expertise in Singapore can now use a new industry benchmark to facilitate recruitment in the emerging space.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The sector’s national accreditation and certification agency will award individuals with a “skills badge” to reflect the specific expertise and proficiency level they acquired from undergoing recognised sustainable finance courses.

To get a skills badge, professionals will need to attend courses that the Institute of Banking and Finance (IBF) has mapped to the 12 sustainable finance technical skills and competencies that it outlined together with the Monetary Authority of Singapore (MAS) in 2022.

Speaking at the launch event at Temasek’s Ecosperity conference, Alvin Tan, minister of state for trade and industry and a board member of the MAS, said professionals could highlight their proficiency in sustainable finance by posting their skills badge on business networking platform LinkedIn. Tan was previously head of LinkedIn’s public policy and economics team.

List of sustainable finance technical skills and competencies that can be reflected on a skills badge:

-

Taxonomy application

-

Carbon markets and decarbonisation strategies management

-

Natural capital management

-

Climate change management

-

Impact indicators, measurement and reporting

-

Sustainability reporting

-

Sustainability risk management

-

Sustainable lending instruments structuring

-

Sustainable investment management

-

Sustainability stewardship development

-

Sustainable insurance and re-insurance solutions and applications

-

Non-financial industry sustainability developments

Sources: Institute of Banking and Finance and Monetary Authority of Singapore

“There lacks a consistent benchmark that recognises sustainable finance skills mastery across the industry because this is a new and evolving area. So the IBF’s new skills badge will become that common industry benchmark,” said Carolyn Neo, the agency’s chief executive officer.

When asked if the new benchmark addresses concerns around “competence greenwash“, where investment professionals exaggerate their green credentials in order to capture opportunities in the increasingly lucrative sector, IBF’s director and head of standards Hee Siew Lie told Eco-Business that the skills badge would “minimise that”.

“The comfort is there that the programme you have gone through is against the industry benchmark and that you have acquired the skills based on what has been identified by the industry,” Hee said.

Current offerings of accredited sustainable finance programmes on IBF’s website include e-learning courses that can be as short as two hours.

A visual of the Institute of Banking and Finance’s skills badge, which reflects three levels of skills proficiency. Image: IBF

Experts familiar with the hiring situation have cautioned against “reactive” recruiting for such roles and shoehorning finance professionals into environmental, social and governance (ESG) roles.

On Wednesday, MAS announced that S$35 million (US$26 million) has been set aside to support the expansion of the city-state’s sustainable finance workforce over the next three years. This sum of money will go into implementing the new industry benchmark as well as to introduce sustainable finance courses for undergraduates, postgraduates and executives with local institutes of higher learning.

As new sustainability regulations kick in across Asia and demand for transition finance for high-emitting sectors grows, a KPMG study projects that more than half of the existing financial sector workforce will need to pick up new sustainable finance-related job tasks, such as in impact reporting, carbon markets and taxonomy application.

Singapore-listed companies will be subjected to domestic mandatory climate reporting rules from next year, and those also listed in the United States or with significant operations in Europe may also be subjected to their new disclosure rules in the next few years.

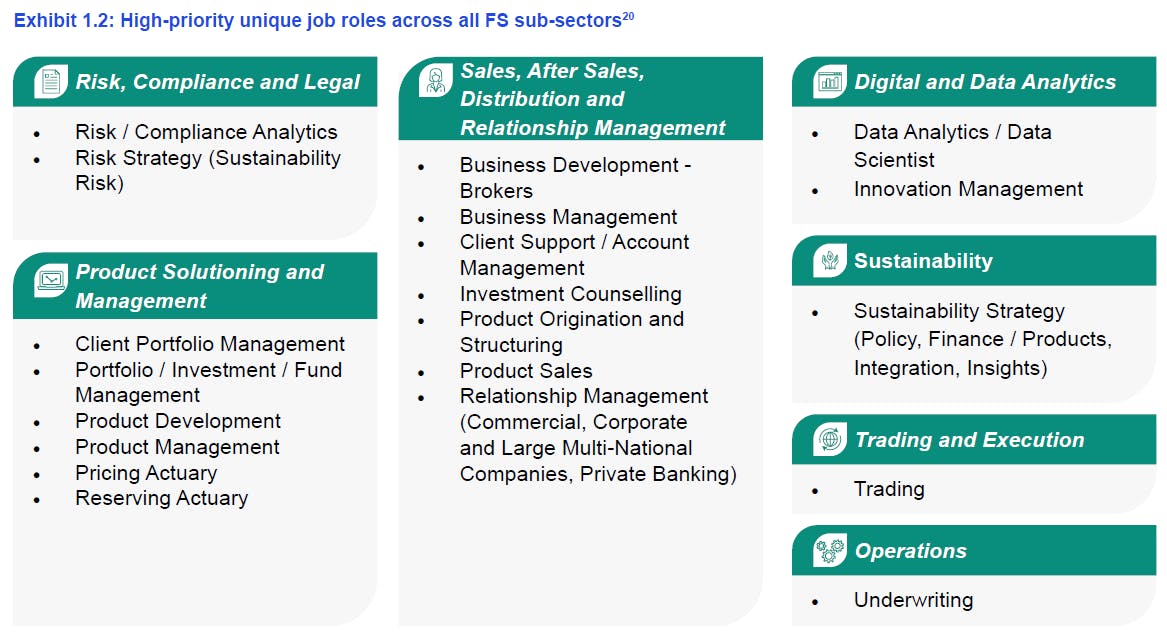

Roles that will be more significantly augmented include those in risk, compliance and legal as well as product solutions and management career tracks, said Tan.

Meanwhile, insurance claim managers, for instance, might see less change, as current protocols will likely still be applicable to claims from new sustainability-linked products.

Earlier this year, the new MAS managing director Chia Der Jiun earlier this year shared that the initial study findings showed that highly specialised roles like sustainability risk analysts will be in demand in the near future.

The MAS-commissioned study estimated that 4,000 to 5,000 new job roles will be created in areas like sustainability risk and sustainability strategy and has identified 20 unique roles to prioritise for upskilling, including relationship managers in corporate banking as well as portfolio managers.

The report stated that a portfolio manager might now be required to define material sustainability targets, metrics and outcomes for sustainability-related investment decisions, which would require in-depth technical expertise in sustainable investment management, on top of broad sustainability knowledge.

20 job roles, the majority of which reside in sales and relationship management teams, were identified to be prioritised for upskilling, as financial institutions shift to capture sustainable finance opportunities. Source: Sustainable Finance Jobs Transformation Map

In the coming months, more than 65 new executive courses will be launched in Singapore, adding to the some 100 sustainable finance courses that have been recognised by IBF. The agency will also work with over 25 financial institutions, including HSBC, to accredit some of the in-house training plans they already have in place.

To encourage upskilling in this area, IBF will offset up to 70 per cent of the fees for approved courses and provide up to 90 per cent of salary support to reskill employees taking on augmented roles.