Singapore’s top universities have made “little to no progress” in phasing out the influence of the oil and gas industry, according to the latest study by a student climate group.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

More than a year after Students for a Fossil Free Future (S4F) highlighted the links between Singapore’s leading universities and Big Oil, and called for fossil fuel companies to be kicked off campus, the student collective has assessed how Singapore’s top colleges have responded to their demands for a fossil fuel-free education system.

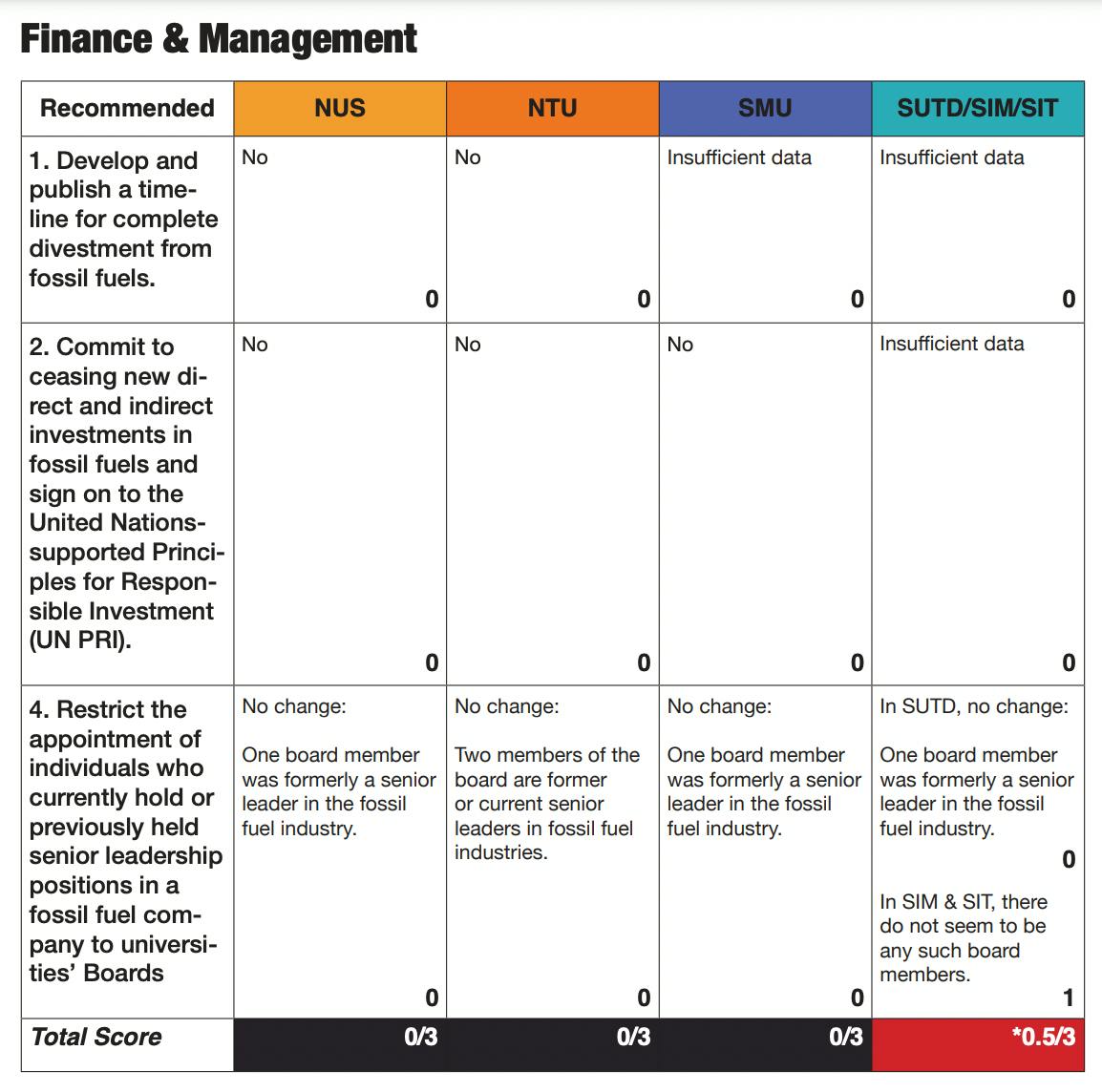

According to the scorecard, none of the universities – which include National University of Singapore (NUS), Nanyang Technological University (NTU) and Singapore Management University (SMU) – have developed a timeline for divestment from fossil fuels, which is the central demand of S4F.

None have committed to cease investing in fossil fuel firms and sign on to the United Nations-backed Principles for Responsible Investment, which promotes using environmental, social, and corporate governance factors to guide investments, the student group has noted.

“

Dissociating from the fossil fuel industry at some point is essential in order to achieve a green transition, without which there is no future for the universities, their students, and our country.

Students for a Fossil Free Future

Nor have the universities said they will restrict the appointment of Big Oil executives on their boards. Among the top three universities, four members of the board either worked for fossil fuels companies now or previously – a statistic that has remained unchanged over the past year.

Throughout their campaign – which was started in 2017 by students of Yale-NUS, a liberal arts college set up in 2011 through a partnership between NUS and Yale University, and later joined by students from other universities – the students have argued that companies such as Shell, ExxonMobil, and BP have infiltrated their education system to promote their brands, recruit new talent, and gain social approval.

Shell and ExxonMobil, in particular, which house their biggest refineries on Jurong Island, the country’s offshore oil refining hub, have played a crucial role in Singapore’s economy for more than half a century, and hold considerable socio-economic power to this day.

S4F objects to companies that are “profiting from the climate crisis” interfering in how current and future generations of Singaporeans entering the workforce are educated in a country still heavily reliant on fossil fuels. The small island nation relies on carbon-intensive energy for its power needs more than any other country, according to a 2022 study.

How Singapore’s top universities – which include NUS, NTU, SMU, Singapore University of Technology and Design (SUTD), Singapore Institute of Management (SIM) and Singapore Institute of Technology (SIT) – have fared for phasing out fossil fuels from university finance and management. 0 = no change. 1 represents that that recommendation has been taken up. A decimal like 0.5 means that the recommendation has been partially taken up. Source: S4F

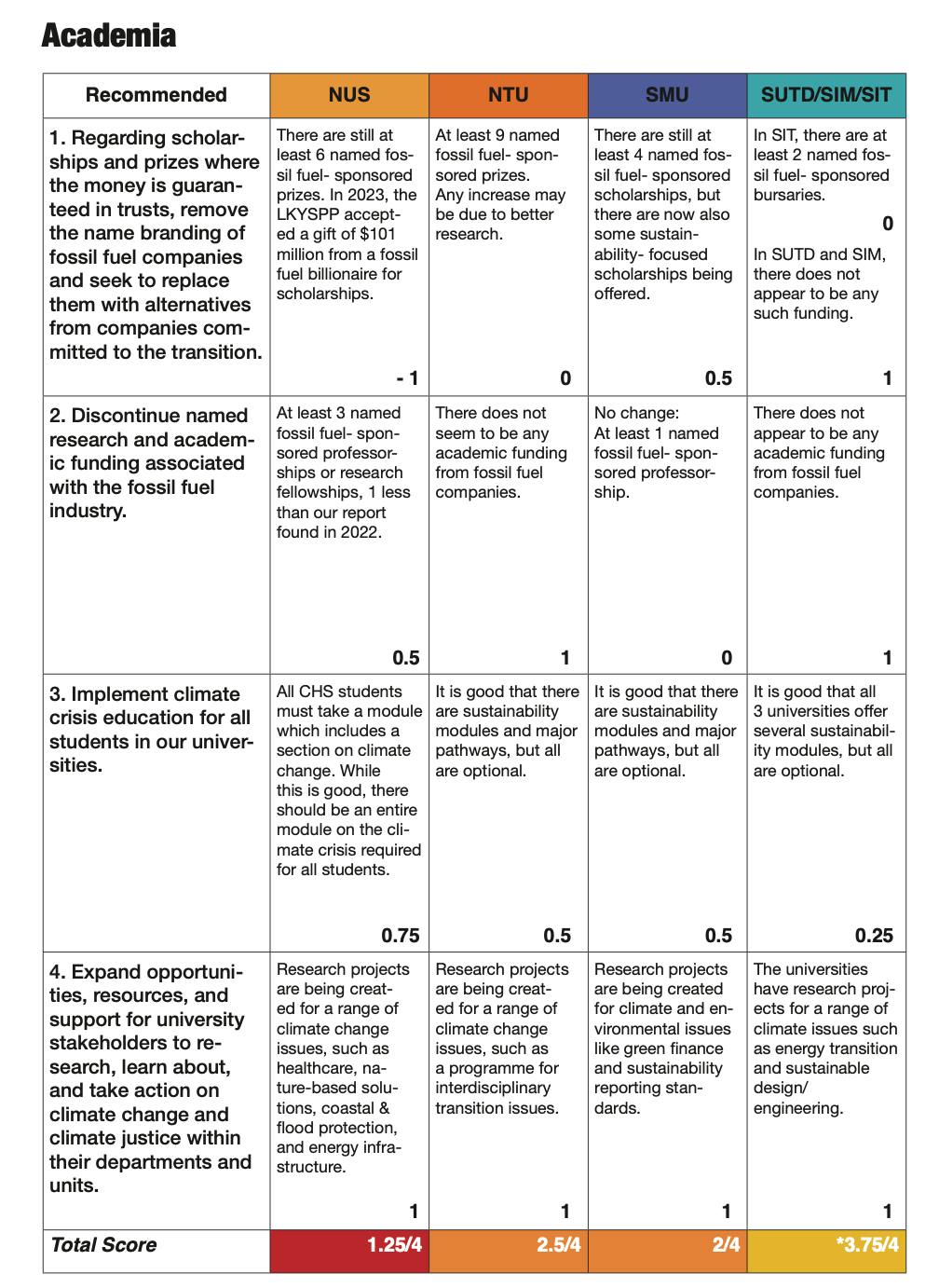

Singapore’s largest and most influential university, NUS, was given the lowest score in the report. By some measures, such as fossil fuel brands sponsoring prizes or scholarships, NUS has become more entrenched in fossil fuel interests than a year ago, the report said. In February, the Lee Kuan Yew School of Public Policy accepted a S$101 million (US$74 million) gift from coal mining billionaire Low Tuck Kwong for scholarships. Singapore-born billionaire businessman Low is the founder of Bayan Resources, a coal mining company in Indonesia. He also has interests in energy companies in Singapore.

NUS is the only university in Singapore where campus events are sponsored by a fossil fuels company. Image: NUS

The report findings also pointed to how NUS is the only of Singapore’s universities to hold on-campus events sponsored by a fossil fuels firm – the long-running ExxonMobil Campus Concerts series.

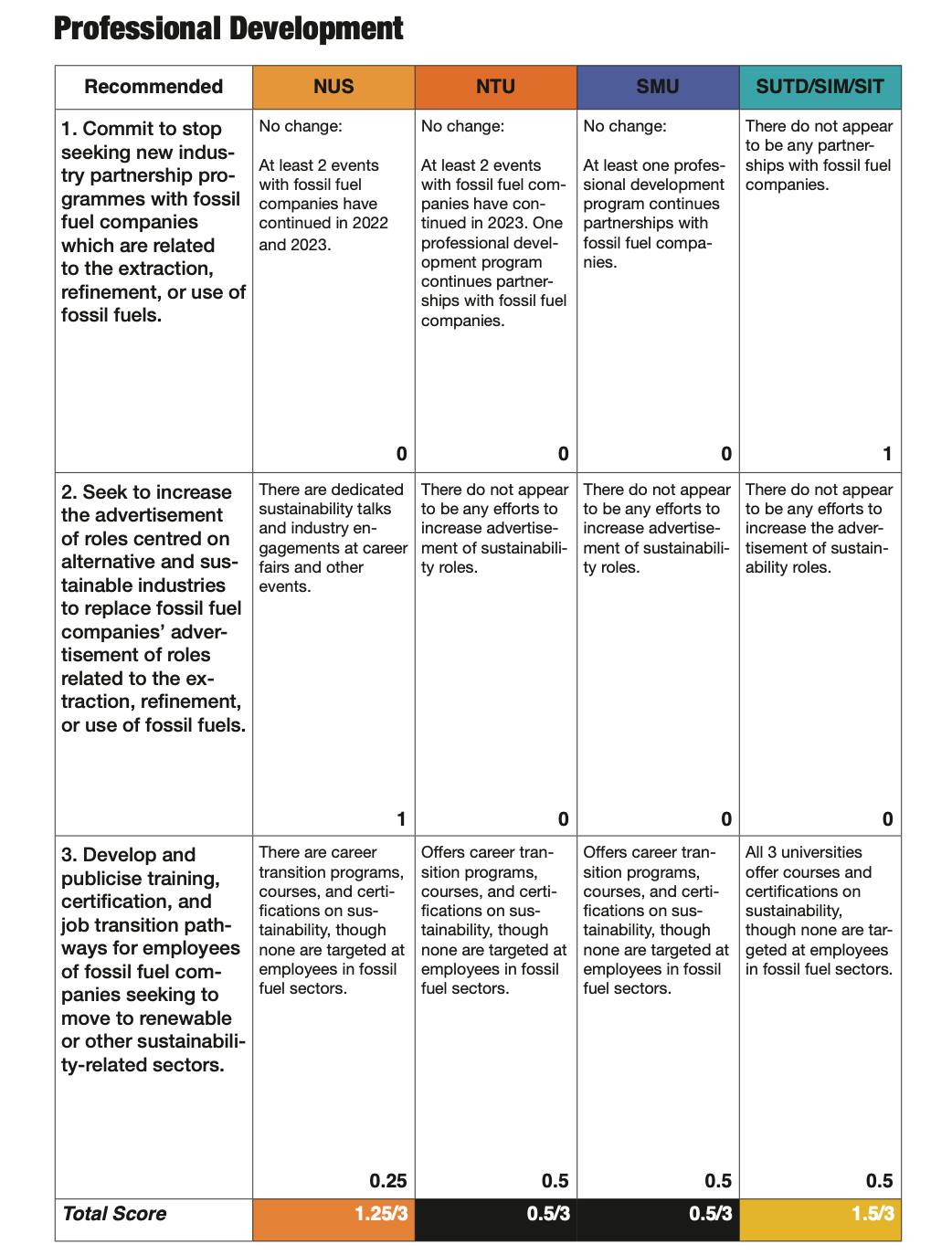

But NUS fares better for professional development. NUS is the only of Singapore’s universities to hold dedicated sustainability talks and industry engagements at career fairs and other events, according to the scorecard. S4F wants the country’s elite colleges to increase the promotion of career opportunities focused on alternative and sustainable industries to replace fossil fuel companies’ advertising of jobs related to the extraction and use of carbon-intensive energy.

S4F notes that none of Singapore’s universities develop and promote jobs for people looking to transition away from careers in fossil fuels and into renewables and other sustainability sectors.

S4F’s scorecard on how well Singapore’s universities are faring on professional development in response to their requests for change. 0 = no change. 1 represents that that recommendation has been taken up. A decimal like 0.5 means that the recommendation has been partially taken up. Source: S4F

NUS also has fewer fossil fuel sponsored professorships or research fellowships than a year ago, although it still offers more of these opportunities to students than any other university in Singapore.

The country’s biggest university mandates students of humanities and the sciences to take a module which includes a section on climate change, unlike its peers, where climate-focused education is optional.

S4F’s scorecard on academia. 0 = no change. 1 represents that that recommendation has been taken up. A decimal like 0.5 means that the recommendation has been partially taken up. Source: S4F

Singapore’s smaller universities, Singapore Institute of Technology (SIT), the Singapore Institute of Management (SIM) and the Singapore University of Technology and Design (SUTD), scored slightly higher than their more established rivals, as they are less exposed to fossil fuels interests, according to the scorecard.

None of the three universities overtly receive academic funding from fossil fuels companies nor do they hold professional development programmes sponsored by Big Oil, unlike their larger peers.

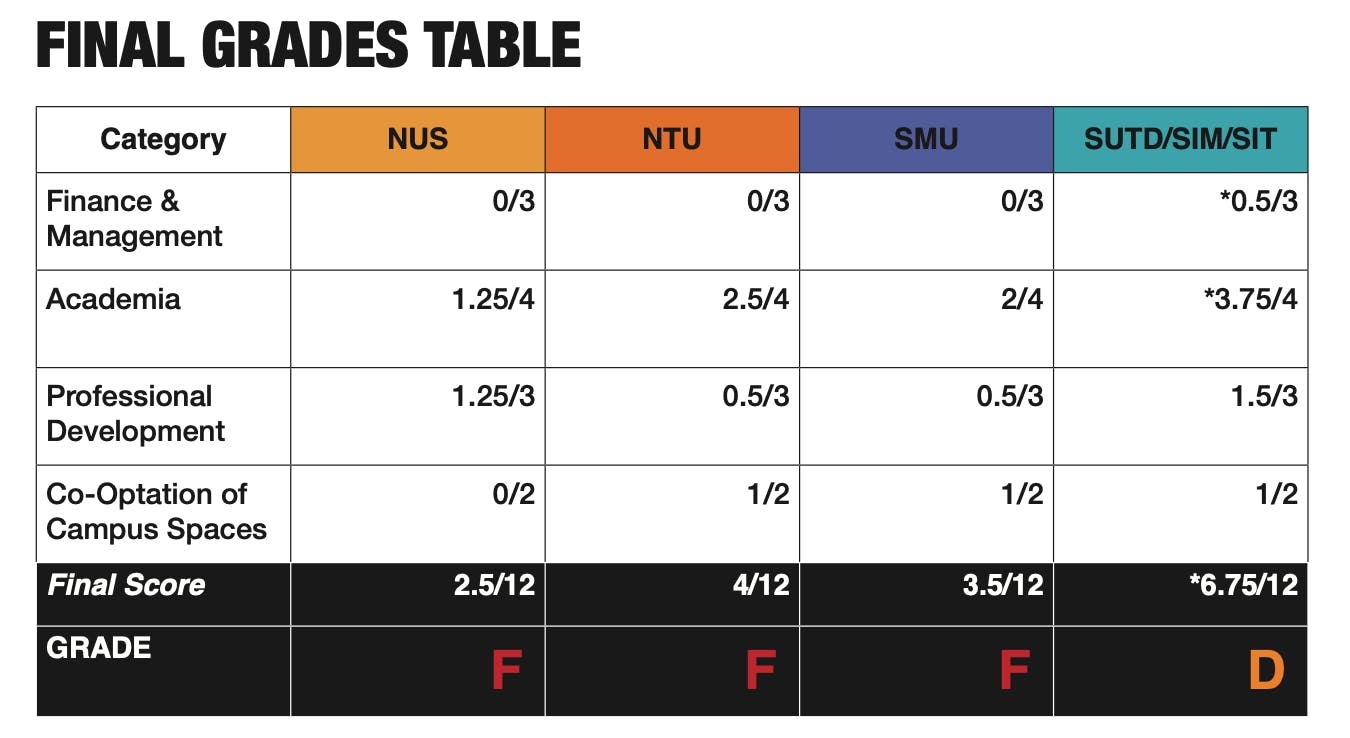

NUS, NTU and SMU were scored an “F” in the report. SIM, SIT and SUTD fared slightly better, scoring a “D”.

Final scores for S4F’s scorecard on how Singapore’s universities are faring towards reducing fossil fuels influence over education. 0 = no change. 1 represents that that recommendation has been taken up. A decimal like 0.5 means that the recommendation has been partially taken up. Source: S4F

S4F is among a cohort of student groups globally pushing back against fossil fuels influence over higher education. In September, after years of protests from students, New York University became the latest university to plan to divest its US$5 billion endowment from fossil fuels, joining the likes of Harvard University, University College London, Australia’s La Trobe University and, in Asia, the National Taiwan University.

The group conceded that it would take time for universities to divorce themselves from the fossil fuel industry, which has entrenched itself in academia over several decades, so it is seeking, in the short term, a commitment from universities that they will seek alternatives to fossil fuel firms for partnerships and investments.

S4F also said that while it may be argued that universities should not commit to divesting from fossil fuels if they are unsure whether they will be able to fulfil that commitment, they will have to eventually – and should regard divestment as an opportunity to show climate leadership.

“Following through on dissociating from the fossil fuel industry at some point is essential in order to achieve a green transition, without which there is no future for the universities, their students, and our country,” the group told Eco-Business.

Universities respond

In response to S4F’s report, NUS said it encourages its fund managers to ensure a “sound” approach to investing responsibly, such as through driving a “meaningful” transition for heavily-emitting companies, reducing their carbon footprint or delivering climate solutions.

The university referred to its Campus Sustainability Roadmap 2030, which aims to transition the university into a “carbon neutral, climate resilient and zero waste campus”.

Its targets include reducing its campus Scope 1 and Scope 2 absolute carbon emissions by 30 per cent and purchase quality carbon offsets as a last resort; reduce energy usage intensity by 20 per cent; reduce daily waste disposed per capita by 30 per cent; improve outdoor thermal comfort; and plant 100,000 trees by 2030.

NUS added that it offers 800 sustainability-centric courses, and 11 master’s degrees in sustainability.

SMU said that it does not hold any direct investments associated with fossil fuels and is working towards a sustainable investment policy.

Before it institutes the policy, the university said it has calculated a baseline carbon footprint for its endowment and is now in the process of assessing pathways for decarbonisation.