Employee well-being is one of the key emerging environmental, social and governance (ESG) issues for companies and investors to watch out for as the cost of stress associated with the Covid-19 pandemic is posing an operational risk to businesses.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

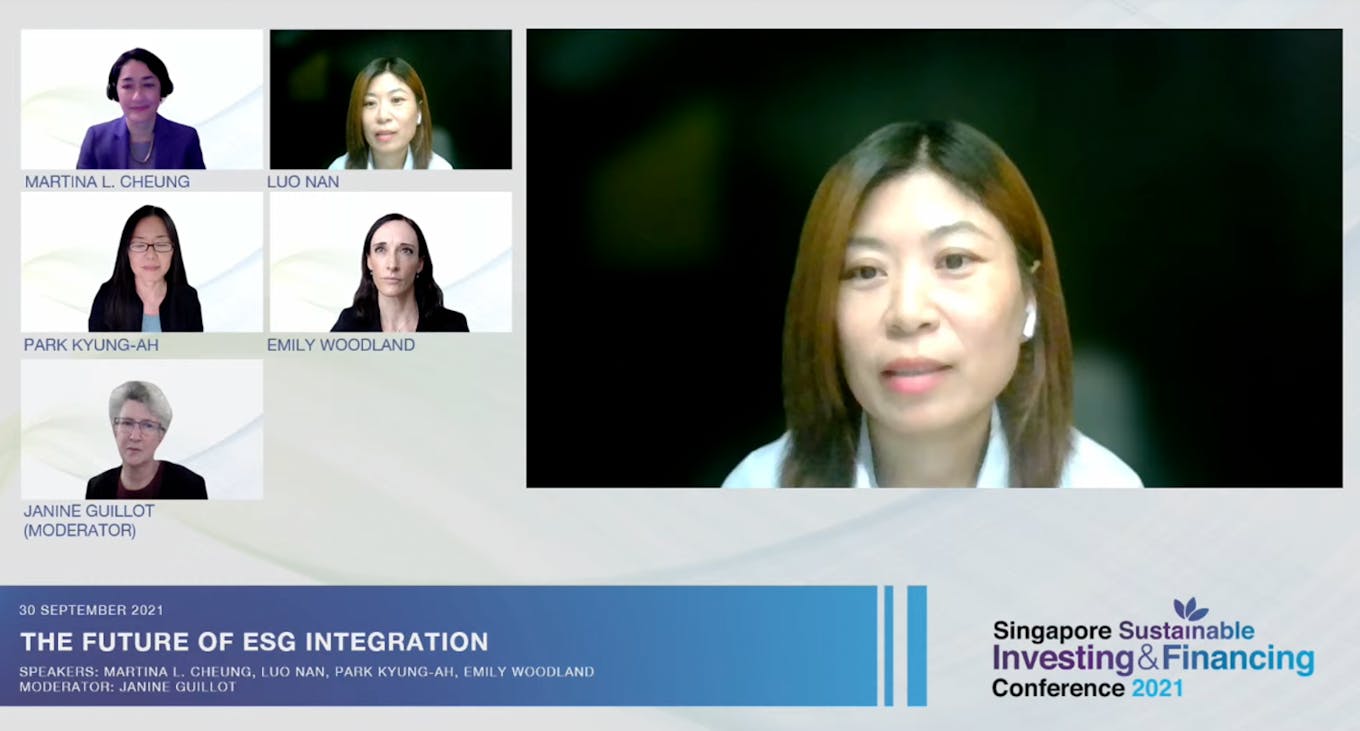

Speaking on a panel at the Singapore Sustainable Investing & Financing Conference during Ecosperity Week in Singapore on Thursday, Martina Cheung, president at analytics firm S&P Global Market Intelligence, said that the mental and physical health of employees is becoming a key issue for the ‘S’ in ESG, as companies consider the business risks of not taking good care of their staff.

A growing number of companies, including logistics firm FedEx, social media company Twitter and pharmaceuticals brand Johnson & Johnson, have made changes to improve the economic, physical and mental well-being of their employees over the past few years. Firms that had robust benefits such as paid sick leave and parental leave in place before the pandemic struck, have been better able to ride out the crisis.

An April global study by insurance firm AXA found that 95 per cent of respondents said that a high intensity work environment for employees is a key business risk, and conditions such as burnout and poor mental health are a material risk to business performance.

Cheung said employee well-being could become as important as greenhouse gas emissions are to the ‘E’ in ESG, and that her organisation is working with the newly launched World Wellbeing Movement to research the value of the issue to the investment community.

The market for corporate wellness — the business of protecting employees from conditions such as depression, anxiety and high blood pressure — was estimated to be worth US$57 billion in 2020, and is growing by 7 per cent a year, as companies respond to the pressures associated with Covid by taking better care of their staff.

Interest in the social side of sustainability has mushroomed off the back to the pandemic, with more companies looking to improve their credentials in diversity, gender, inclusion and labour practices. This is reflected in the number of companies that completed S&P’s Global Corporate Sustainability Assessment increasing by 50 per cent in a year, said Cheung.

Bonds sold to fund social causes jumped nine-fold to US$164.87 billion in 2020 from the previous year, according to data from Environmental Finance, a global sustainable finance news and analysis provider.

But Cheung acknowledged that measuring complex human problems like diversity and inclusion is not easy. “A lot of this data is hard to come by,” she said.

Social sustainability is also complicated by local differences. Park Kyung-Ah, managing director of ESG investment management at state investment firm Temasek, said that measuring the ‘S’ in ESG is “highly nuanced” across different cultures.

This is true of China, for instance. “People can easily understand investors supporting poverty alleviation. But diversity, inclusion and equity are not advanced topics in China,” said Luo Nan, China head for Principles for Responsible Investment, a United Nations-backed network that coined the term ESG more than a decade ago.

Speakers at the Singapore Sustainable Investing & Financing Conference included Luo Nan, China head of Principles for Responsible Investment, Martina Cheung, president of S&P Global Intelligence, Park Kyung-Ah, MD of ESG investment management for Temasek, Emily Woodland, MD, APAC, BlackRock Sustainable Investing, and Janine Guillot, CEO, Value Reporting Foundation

China playing catch-up

Responsible investing is still in its infancy in China. “The market is building for ESG, but it’s not a must-have yet, as regulators are not demanding it. The level of integration and adoption of ESG is low,” she said.

Nevertheless, last year, 27 per cent of listed firms in China issued ESG reports, more than double the number in 2010, and capital flows into ESG-themed funds are experiencing double-digit growth every year.

China’s ESG market is set for further growth following President Xi Jinping’s 2060 carbon neutrality declaration. “Since [Xi’s] announcement, climate change has become a material factor for Chinese investors, who are catching up with global trends,” Luo said.

But concerns remain over the quality of corporate disclosure. For instance, few Chinese investors use the Task Force on Climate-related Financial Disclosures (TCFD), a globally recognised framework for disclosing climate-related financial risk, Luo noted.

China’s State Council’s proposal in September to establish a green stock index and develop futures trading for carbon emission rights aims to help China progress towards its carbon neutrality goals.

Data, disclosure and decisions

Temasek, a S$381 billion (US$280 billion) investment firm which has ownership stakes in companies including Singapore Airlines, agribusiness Olam, and power firm SP Group, is also looking to decarbonise. It aims to achieve a net-zero portfolio by 2050, a target Park admitted is “ambitious” since Temasek still has some high-emitting companies in its portfolio.

“There is no silver bullet. We have to do the hard work,” said Park, who shared that Temasek uses an ESG template to screen investments for issues such as carbon and climate risk.

Temasek has pivoted its investment strategy towards “climate-aligned” sectors to help it achieve its net zero target, with investments in solar, geothermal, hydrogen, low-carbon cement, and alternative proteins.

But hitting its net zero target will not be easy. Obstacles lie in the data needed to measure progress, particularly the full value chain, or scope 3 emissions. “Once you start getting into supply chains, the difficulty of accessing the data becomes evident,” said Cheung.

The complexity of sourcing and managing ESG data has prompted BlackRock, a leading asset management firm, to raise the standards for, and further invest in sustainability analytics capabilities. It acquired a minority stake in an ESG analytics platform in January off the back of research that predicted investment in ESG strategies to double by 2025. The same study found that more than half of respondents cited concerns over poor quality or availability of ESG data.

“ESG data is very useful, as long as you understand what it is, and you know what you want to do with it. This is a key reason why we invest in our sustainability analytics, to provide insights and identify issues that may not have been priced into the market yet,” said Emily Woodland, BlackRock’s APAC co-head of sustainable investing.

Park said that as the ESG market grows, there is an ever greater need for internationally consistent sustainability standards and data. “Ensuring reliable, verifiable, and transparent data is a must,” she said.

She also called for more regulation to enable investors to make better bets on green businesses. “We need a stronger impetus for disclosure. Voluntary efforts are great, but we need standard mandatory disclosure. And we need to decide on the most material financial information investors need to make key decisions.”