Climate change is posing new challenges to central banks and regulators whose main mandate is to ensure systemic financial stability. In Malaysia, many financial institutions (FIs) and the businesses they back are beginning to realise the importance of proactively addressing a wide array of physical and transition risks that can arise as the drive to build a low-carbon and climate-friendly economy intensifies.

For example, the increase in the frequency and intensity of extreme weather events can trigger irreversible financial losses. In turn, a system-wide transition towards net-zero, if successful, could also have far-reaching effects on critical economic sectors. Technological innovations and low-carbon solutions seen as game-changers will require businesses to make structural shifts to adapt to different realities. A new awareness about “green swan” events, defined as rare, extreme and sudden paradigm shifts brought about by this new type of systemic risk represented by climate change, has now emerged, and the financial sector knows it needs to move quickly to navigate the landscape when they occur.

Often plagued by a confusing ‘alphabet soup’ of sustainability reporting frameworks, standards and practices with overlapping requirements, FIs and corporates increasingly look to central banking authorities for guidance and clearer signals on which framework they should integrate into current processes of risk management and planning. The newly-released TCFD Application Guide, designed as a set of basic and stretch recommendations for banks, insurers and takaful operators in Malaysia to adopt, is expected to change the landscape.

Issued by Malaysia’s Joint Committee on Climate Change (JC3), which is co-chaired by representatives from Bank Negara Malaysia (BNM) and Securities Commission (SC) Malaysia and with participation from Bursa and supporting institutions, the guide aims to facilitate more informed financial and business decision-making in addressing climate-related risks, so that climate risk management can be done in a transparent and consistent manner

It also complements the Climate Change and Principle-based Taxonomy (CCPT) published by the central bank, as well as plans by BNM to conduct climate-related stress tests for the financial sector in 2024. The JC3 said that it supports that financial institutions regulated by BNM are expected to work towards adopting the stretch recommendations fully aligned with TCFD disclosures by end 2024. For FIs yet to address any of the recommendations made, they are recommended to adopt at least the basic recommendations within 24 months.

Prof Yeah Kim Leng says that the early onboarding of financial institutions onto the ‘climate bandwagon’ will have an influence on changing consumer behaviour. Image: Jeffrey Cheah Institute on Southeast Asia

Professor Yeah Kim Leng, senior fellow and director of the Economic Studies Programme at the Jeffrey Cheah Institute on Southeast Asia said that FIs in Malaysia play a crucial and strategic role in directing financing and investments, such that the country stays on track for its net-zero carbon targets and other environment-related goals.

“The early onboarding of FIs onto the climate action bandwagon will have a significant influence on changing the behaviour of producers and consumers towards reducing their carbon footprint and in terms of adoption of sustainability practices,” said Yeah, who is also the deputy president of the Malaysian Economic Association, and a former member of BNM’s Monetary Policy Committee.

More than a nudge to wean off fossil fuels

Sector players, including carbon-intensive ones, however, will be given some time to make the pivot gradually, by setting clear decarbonisation goals and implementing effective strategies and initiatives to embrace the new realities.

“Given the flexible and sufficiently long adjustment period, it is envisaged that FIs that implement the TCFD-aligned recommendations will be able to adapt to the desired shift in the business landscape from fossil-fuel dependent sectors to renewables and sectors that are anchored on sustainable production and consumption principles and practices,” said Yeah.

Arina Kok, Malaysia climate change and sustainability services leader and partner at EY observed that banks are coming forth to pledge that they will not provide new coal financing: Image: EY

Arina Kok, Malaysia climate change and sustainability services leader and partner at global accounting firm Ernst & Young (EY) said that FIs are expected to set specific and progressive milestones when looking at weaning themselves off coal exposure, rather than activating immediate divestment strategies. This includes pricing in climate risks for financing high carbon emitting customers, ramping up assessments on carbon-intensive securities and assets, while considering the social and economic impact from the transition.

“What we have observed is banks coming forth to pledge that they will not provide new coal financing. Time will be given, there will be a strong impact on fossil fuel-dependent sectors, but it is not one that will be immediately felt.”

A joint report by BNM and the World Bank published in March 2022 shows that Malaysian banks have broad exposure to physical and transition risks, with 54 per cent of their commercial loans portfolio or RM398 billion going to sectors that depend to a high extent on ecosystem services, as of December 2020.

Glenda Eng said that banking groups are starting to embed the CCPT’s guiding principles in their ESG due diligence processes. Image: PwC

Observing BNM’s financial stability review for Q3-4 2021, Glenda Eng, PwC’s risk assurance services director, said that banking groups are already starting to operationalise the CCPT, by embedding its guiding principles in their environment, social and governance (ESG) due diligence processes when onboarding clients, and when conducting annual review of their existing clients. The review states that 51 per cent of FIs rolled out initiatives to engage and nurture customers, by identifying areas for improvement and proposing financial solutions that support the transition to more sustainable business practices. This is expected to intensify.

With FIs moving faster to reduce the risks of their loan assets being stranded by climate-related changes, businesses will be compelled to broaden their perspectives - taking a financially-focused view to identify climate change’s impact on their business models beyond their own carbon footprint, and creating a domino effect further down the value chain.

In August, Malayan Banking Bhd (Maybank) established its Scope 3 financed emissions baseline and identified a transition strategy that will shape its future business portfolio. It is the first bank in Malaysia to do so.Financed emissions refer to the indirect greenhouse gas emissions attributed to FIs due to their provision of loans, underwriting, investments and any other financial services. It is often seen as a necessary input for climate scenario analysis, an exercise that is recommended in the TCFD Application Guide, and that FIs now carry out to manage their climate-related transition risks and opportunities.A closer look at how Maybank acts on its financed emissions findings gives an indication of how different sectors might be impacted with FIs adopting transition strategies and a more sophisticated approach to climate risk management:

1. Emissions are split by geographies, asset classes and sectors. This allows the bank to focus its efforts on engaging with customers that have the greatest impact on reducing the bank’s financed emissions over the long term

2. Five key contributing sectors that it has identified, and that it will focus on over the medium-term:

- Power and utilities

- Oil and gas

- Palm oil

- Agriculture

- Real estate and construction

3. The bank, in prioritising engagements with these sectors, will request for emissions data from specific companies, and drive setting of Science Based Targets (SBTi)-aligned climate targets

4. It will provide transition support to these companies

5. The bank will develop a prototype climate scenario analysis and run a pilot climate stress test this year

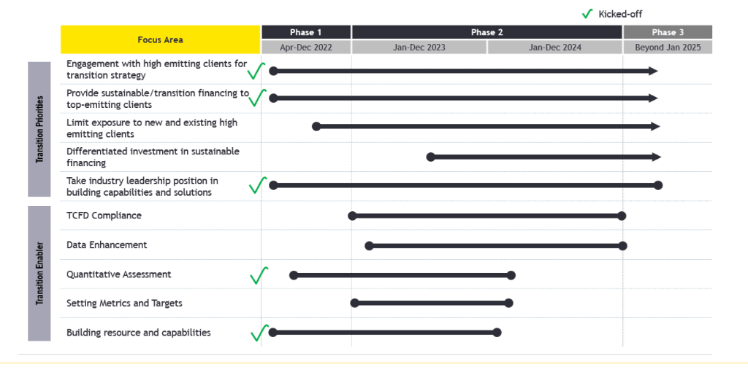

This chart shows how Maybank engages with high-emitting clients through a phase-by-phase approach. Sources:Maybank establishes Scope 3 emissions baseline; first in Malaysia

This chart shows how Maybank engages with high-emitting clients through a phase-by-phase approach. Sources:Maybank establishes Scope 3 emissions baseline; first in Malaysia Maybank Investor Day: Sustainability

A boost to transition finance and tailored green product

Besides strengthening the resilience of Malaysia’s financial sector to climate risks and events, the application of the TCFD-aligned recommendations can also help FIs acquire a competitive edge over their competitors. The market will likely see a surge in green products designed and tailored to help clients push through in their decarbonisation journey.

For instance, Malaysian bank CIMB now offers a preferential rate (i.e. a 0.5 per cent reduction from the conventional rate) on loans for hybrid or electric vehicles, on top of a 50 per cent reduction on road tax for green technology vehicles provided by the government.

Banks are also coming up with green technology financing schemes to accelerate the development of sustainability-related technologies by small and medium enterprises (SMEs). This includes BNM’s RM1 billion Low Carbon Transition Facility that matches funds provided by FIs and provides dedicated support to SMEs. It is available for SMEs of all economic sectors, up to a maximum of RM10 million, for financing working capital and capital expenditure.

Professor Yeah believes that there are investment and financing opportunities arising from the green transition that can be seized. “Individual FIs can use the guidelines to formulate strategic roadmaps to develop their competitive advantages that leverage on the opportunities presented by the transition to a low carbon and green economy,” he said.

EY’s Kok added that FIs will start to shift away from exclusionary approaches and conduct ‘positive screening’, in which case companies that score high on ESG factors relative to their peers will attract more financing.

‘Greenwash alert’: Investments in data infrastructure needed

There is currently a lack of reliable and consistent data available for FIs to perform climate risk assessment. Kok suggests that climate-related analyses and disclosures require FIs and corporates forming a cohesive team, including appointing sustainability leaders, risk specialists and business strategy executives to co-ordinate and model collective scenarios, business responses and embark on product innovation to address market needs. Existing data infrastructure needs to be enhanced, to allow for proper climate risk assessments and climate modelling to be conducted.

“There will also be an increase in expectations for FIs to enhance their governance and transparency, as greenwashing risk becomes a key challenge,” said Kok.

PwC Malaysia’s 2021 survey on ESG readiness in the Malaysian banking sector identified the top three challenges faced by the sector: low quality of customers’ disclosures and ESG awareness; absence of or limited access to counterparty ESG data; and lack of knowledge and competencies in the banks.

Eng observed that regulators and FIs have taken various initiatives to address the challenges. BNM is expected to publish a Climate Data Catalogue by 2022 on bridging the data gap while FIs and PLCs are expected to disclose their carbon emission data by 2024. Local and regional banks in Malaysia have also launched several initiatives to increase their engagement with customers.

Continued engagement for greater climate resilience

Ultimately, as climate-related disclosures are moved into mainstream reporting, these disclosures will be subject to the same rigorous governance processes as financial reporting now is.

Over the past months, after the release of the TCFD Application Guide, the JC3 has also continued to engage with corporates to identify climate and sustainable financing needs that can be mobilised through the financial sectors.

Speaking to the media in September, BNM deputy governor and co-chair of JC3 Jessica Chew said that the committee is encouraged by the increasing focus and concrete actions being taken by FIs to manage climate-related risks. “Further progress will, however, critically depend on key enablers, including accessibility to data and putting better disclosures in place,” she said.

“

Overview of Stretch Recommendations in the TCFD Application Guide

GovernanceStrategy

- FIs should set up a separate committee to oversee sustainability-related matters

Risk Management

- FIs should perform climate-related scenario analysis to assess potential implications of climate-related risks and opportunities over time and under different conditions

Setting Metrics and Targets

- Disclosure by FIs should include information on:

- Risk management processes

- Climate-related risks and their significance within existing risk categories

- Processes for assessing the potential size and scope of identified climate-related risks

- Key sectors in their portfolios identified as being highly exposed to climate risk

- Risk management controls or actions in managing impacts from direct and indirect climate-related risks

- Decisions to mitigate, transfer, accept or control the risks

- Improvements planned or completed to enhance capabilities and incorporate risks into existing frameworks

- How customers are engaged and helped in mitigating climate-related risks

- Exposure to, and quantification of, sustainable financing

- Training and employee readiness planning should be conducted

- Metrics and targets should be used to monitor progress

Source: TCFD Application Guide

- FIs should disclose additional key climate-related metrics, such as:

- Greenhouse gas emissions

- Transition risks

- Physical risks

- Climate-related opportunities

- Portfolio alignment

- Client engagement

- Internal carbon prices

- Performance

- Financial position

This article was first published on Bursa Sustain, Bursa Malaysia’s one-stop knowledge hub that promotes and supports development in sustainability, corporate governance and responsible investment among public-listed companies.