Margilyn Cosmiano, a fish seller in Surigao del Sur in Mindanao, southern Philippines, set up her fish stand early last year to supplement her family income hard hit by Covid-19 restrictions that sealed off farmers’ routes to the provincial capital.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Then in December, the country’s strongest cyclone swept into the province, toppling concrete power poles and ripping off roofs, including the one on their family home.

“We were barely making ends meet with our rice not reaching suppliers because of pandemic lockdowns, and now we need a new roof. Our expenses never end,” Cosmiano told Eco-Business.

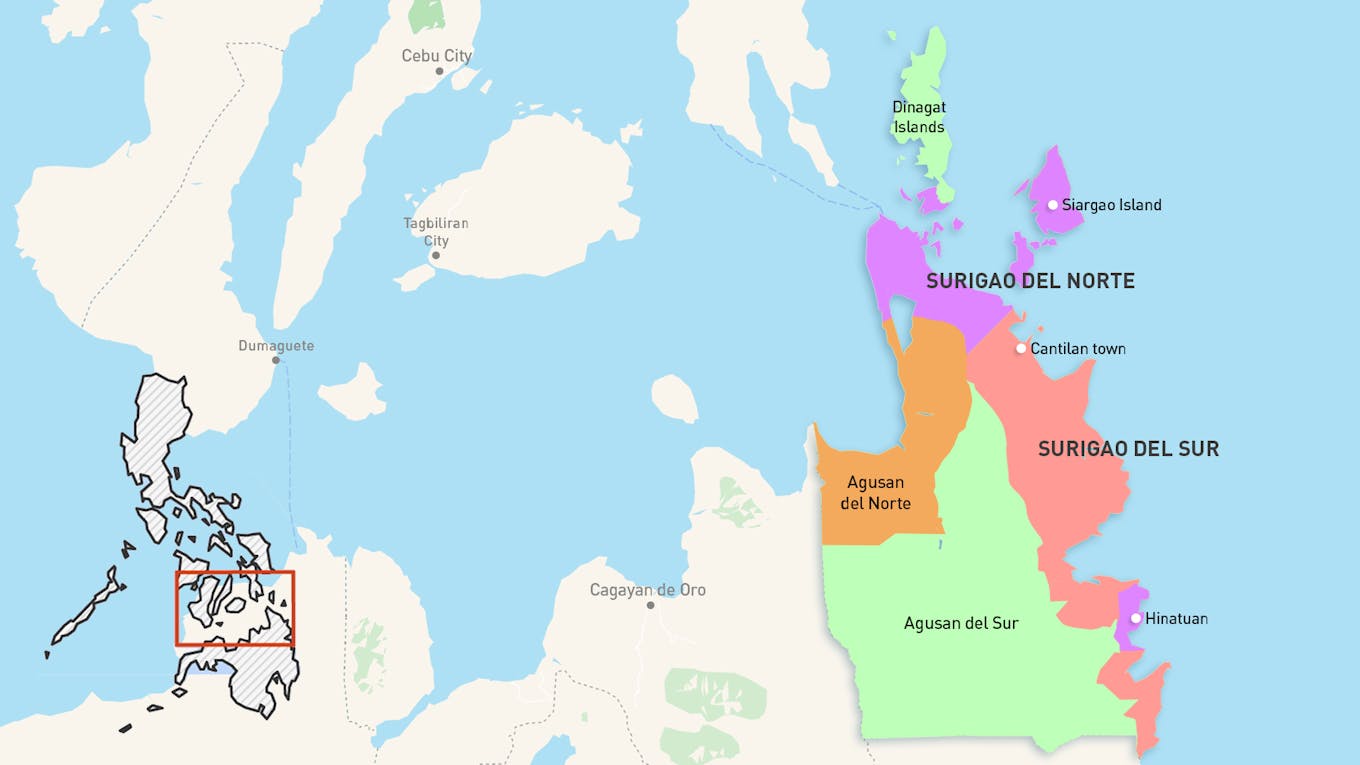

The Caraga region in Mindanao, southern Philippines. Image: Philip Amiote/Eco-Business

When Typhoon Rai devastated Surigao del Sur and the rest of the Caraga region, where the province is located, it was still reeling from an all-time high number of Covid cases just two months before.

Cosmiano is one of the few residents to be able to withdraw money from automatic teller machines (ATMs) in order to buy water and food in the days after the cyclone.

She applied for a savings bank account five years ago but she is using it now more than ever for online transactions for her business.

She is one of the 35,546 female clients of Cantilan Bank in the Caraga region, which has grown by more than 60 per cent since 2019, as the pandemic spurred women to start their own businesses selling mostly meat and vegetables.

Women, who are commonly working as labour on family farms but are rarely considered as part of the formal economy, earn a living mostly by planting rice, corn and coconuts.

“

Most of our clients are in those affected areas so we can’t just say we’re not going to serve them…We have to be resilient because we do not have a choice.

Tanya Hotchkiss, executive vice president, Cantilan Bank

Women on cloud

There were long lines at the Cantilan Bank ATM, the only machine working in the vicinity after the typhoon, as locals queued for money to buy food, said Cosmiano.

ATMs are traditionally run on computer hard drives, which makes them vulnerable to natural disasters that could destroy the physical system.

But banks relying on cloud technology, where data is stored through the internet rather than computer hard drives, continued to function despite the devastation.

Cloud technology needs minimal infrastructure and investment while it has the ability for companies to operate at scale quickly making it particularly appealing for emerging economies like the Philippines. It is this technology that is facilitating the financial inclusion of women, who have been persistently sidelined by financial instutitions.

In the nearby tourist island of Siargao, where the storm made landfall, even longer lines formed for cash points.

Locals line up in the ATM in the town of Del Carmen in Siargao a week after Typhoon Rai. Image: Cantilan Bank

Unlike commercial and global banks, most rural banks are not members of financial networks. By integrating its core banking operations, such as making loans and processing cash deposits and withdrawals, into a network of ATMs powered by the cloud, Cantilan’s customers can access financial services even when they are far from one of the bank branches.

“It was a disaster zone elsewhere at that time but we had ATMs running,” said Tanya Hotchkiss, executive vice president of Cantilan Bank. “If we were still using hardware-based core banking systems with all their branch network information consolidated in a physical data centre, we would not have been able to re-establish connections immediately. “

The bank is also working on a mobile app linked to a cloud platform which can allow people to access and manage their money regardless of weather and Covid-19 related lockdowns that restrict movement.

Cosmiano participated in the beta testing of the mobile app online, applying for a loan to put up a fish stand in the local market. Although she struggled to understand the instructions because it was in English, a bank officer guided her during the process. In less than a week, her loan was approved.

For its pilot test, the bank’s account officers travelled to remote areas to help locals use tablets to complete transactions in “off-line” mode. The app enables collection of payments, creation of loan accounts, creation of new client accounts, and editing of client profiles. As soon as internet connection is available, all the actions and updates made in the field are synced into the bank’s system.

“All we need is basic connectivity. For big banks, if a typhoon or pandemic affects one or two of their rural banks, they will just decide to close and open them again when things go back to normal,” said Hotchkiss.

“But in our case, most of our clients are in those affected areas so we can’t just say we’re not going to serve them…We have to be resilient because we do not have a choice.”

Sharing the financial burden

The first time Cosmiano applied for a loan was five years ago to help buy a carabao, a water buffalo native to the Philippines, for ploughing fields. The process was arduous and time-consuming, cutting into precious planting time. The loan approval came a fortnight later.

Like many unbanked, she would previously borrow cash from money lenders called pahumay in the community. Payments were more burdensome as they had to be made on a daily basis and attracted high rates of interest, risking further indebtedness if the recipient defaulted on repayment.

The Caraga region, where Cosmiano hails, has an average family poverty incidence of 30.8 per cent, compared to the national average of 16.5 per cent as of 2019.

It also has limited access to financial products and services, according to the Asian Development Bank (ADB). Only 24 per cent of families in the region have bank deposits. An estimated seven out of 10 adults keep their savings at home, and borrowers tap informal sources for funds, such as family, relatives, or friends (62 per cent), or informal lenders (10 per cent).

A women fisher collects liboo or shellfish in a mangrove area in Mahaba Island. Image: LUMOT

In Mahaba Island, a multi-ecosystem islet home to fisherfolk, situated in the town of Hinatuan in Caraga, access to banks was not as easy during the pandemic for women who rely on the fish sanctuary and seafood found in reforested mangroves for their income and food.

During the pandemic, more women started catching and selling liboo or shellfish to augment the income made by their husbands who were fishermen, said Anabel Cabilin, a community organiser for a group which supports women’s livelihood in the island. Their members grew from 23 before the pandemic to 37.

“We have been wanting to apply for a loan to put up a stall in the town proper where we can sell our shellfish directly to buyers, but the nearest bank is 30 minutes away by pump boat. All we have on the island are microfinance institutions where we can only borrow enough money for our daily needs,” said Cabilin, of her fellow members at the Ladies in United Movement Onward to Development (LUMOT).

Women in the Philippines remain on the fringes of formal banking compared to their counterparts in the rest of the Southeast Asia. Only 39 per cent of women aged 15 years old and above had access to formal accounts including banks, mobile payments, and microfinancing institutions, based on the World Bank’s Global Findex in 2017.

But unlike most countries in the rest of the world, women in the Philippines are considered more financially engaged than men based on indicators such as account ownership, savings, credit, insurance, remittance, and making payments, according to the Philippine central bank’s financial inclusion survey released in 2019.

However within the country, more adult men still have bank accounts (13.8 per cent) compared to adult women (10.7 per cent). Only 18.9 per cent of the female population have investments in stocks, bonds or real estate while 30.3 per cent of the males have stakes in various assets. There was also a wide gap in 2019 in receiving payments: more than half of the men in the country (51 per cent) compared to 35 per cent of the women.

This gap coincides with employment status as most of the payments received are in the form of wages and salaries. This is also reflective of the gender gap in the formal labour force participation rate, which was higher among men at 76.1 per cent compared to women at 52.3 per cent as of November 2021. As of 2018, about 68 per cent of women workers were working in the informal sector .

Central bank governor Benjamin Diokno previously said that mobile initiatives are crucial in achieving the goals of converting 50 per cent of total retail transactions to digital channels and increasing the number of Filipino adults with bank accounts to 70 per cent by 2023.

Rural reach and banking hurdles

Dolores Arpilleda poses in front of the land that she loaned for where she planted her rice field. Image: Julius Cuartero

When 63-year-old Dolores Arpilleda’s husband passed away fifteen years ago, her family’s only source of income was abruptly cut, prompting her to apply for a loan which allowed her to buy four hectares of land worth about US$2,400, to plant rice.

During the pandemic, she said it was easy for her to make repayments despite the lockdowns because her bank was just walking distance away from her home. She recounted how some neighbours with loans in government-owned or commercial banks, were not able to go past checkpoints to go to the provincial capital where these bigger lenders were located.

“Rural banks in the Philippines are now facing growing competition in remote communities that used to be served exclusively by them,” said Kelly Hattel, ADB’s senior financial sector specialist for Southeast Asia.

Hattel was part of the project with Cantilan Bank in 2017 to conduct the pilot study on cloud-based core banking technology, in a bid to make rural banks more competitive. Cantilan Bank successfully secured funding and technical support from ADB to migrate its operations to cloud technology.

Hattel says rural banks must improve their efficiency to reduce their cost of operations and offer better services linked to digital financial services and mobile apps without having to travel to a bank’s branch.

Cantilan Bank’s Hotchkiss remembered when she first moved to Mindanao in 2012, there were no cemented highways or roads.

A national road being paved in Hinatuan, Surigao del Sur in 2014. Image: i need to reminisce Word Press blog

Banks had to organise dump trucks to transport thousands of locals to the city and collect their cash allowances from a public sector-led social welfare project for the poor, because government financial institutions had no presence in remote areas, recounted Hotchkiss.

“At that time when you’re trying to build rural bank branches, you’re really challenged by the fact that there is very poor infrastructure,” said Hotchkiss.

Gilberto Llanto, former president of Philippine Institute for Development Studies (PIDS), the Philippine government’s primary socioeconomic policy think tank, noted that despite the development of rural banks, hurdles remain.

“Today around 450 rural banks operate but still there is a great room to improve their capital position and managerial and technical expertise,” Llanto told Eco-Business. “Many of these are small, family owned, unit banks. They do not stand a chance against bigger banks which have the financial muscle, technologies and young, finance savvy officers and staff.”

Rural areas have the highest unbanked populations which do not always have the infrastructure or financial bandwidth to house leased lines that are needed for traditional banking operations and can cost a hefty US100,000 a year.

“Remote, far-flung communities have very weak economies. Transaction costs are high due in part to limited infrastructure. Peace and security are also important. Digital finance technologies offer a way out but in the communities, there are problems of financial literacy and numeracy that should guide investor decisions,” he said.

Meanwhile, as Cosmiano continues to navigate the pandemic and the aftermath of the typhoon, she tries to teach her teenage children about financial security.

“I just want them to finish school and get good jobs,” she said. “I don’t want them to struggle like my husband and I who have a lot of debt just to have our rice field and fish stand”.

This report was written and produced as part of a media skills development programme delivered by the Thomson Reuters Foundation. The content is the sole responsibility of the author and the publisher.

This story is part of our series on women to mark International Women’s Day 2022.