The pandemic is wreaking havoc on businesses and the world economy. The Asian Development Bank estimates that the financial cost caused by disruption related to the coronavirus spread could reach up to US$8.8 trillion (S$12.5 trillion).

The virus has exposed fault lines in societies and put the spotlight on weak institutions that have failed to mount an adequate response for its people. In these extraordinary times, competent leadership has never been more important.

Being an effective leader requires a deep understanding of the complex global forces shaping our modern existence.

Start with ESG

In recent years, the rise of warning signs around climate change, growing inequality, resource scarcity, pollution and corruption, to name a few, has led to increased global attention on sustainability or environment, social and governance (ESG) issues.

Long regarded as a fringe concern of left-wing organisations, sustainability has now moved firmly into the mainstream global agenda.

The UN has declared sustainable development – defined by the Brundtland Commission in 1987 as “development that meets the needs of the present, without compromising the ability of future generations to meet their needs”– as more urgent than ever today.

Take finance for example. Even before the outbreak, ESG investing – where finance decisions are made with an ESG lens – had surged to a record US$30 trillion in 2019, according to the Global Sustainable Investment Alliance. This is largely driven by investors allocating capital in companies that not only are profitable but create long-term value for society.

This trend is backed by a range of credible research, such as a study by Harvard Business School, which looked at 180 companies – 90 high sustainability firms versus 90 low sustainability ones. The results showed that the former group outperformed the latter in stock market value over the long term.

The pandemic has also demonstrated on a large scale the importance of a company’s response to ESG drivers such as disaster preparedness, crisis management, continuity planning and employee treatment.

When Covid-19 first emerged, some sustainability practitioners were worried that attention on ESG issues would diminish as corporate management switched into crisis mode. Instead, there has been a fresh impetus for political and business leaders alike to take sustainability issues seriously and put it at the core of organisation strategy.

The question is: Do they have the right mindset and skills for it?

Sustainable leadership demands a profound change in mindset by the boards of directors and senior management to adopt a longer-term view over a short-term outlook driven by quarterly reporting.

Future-fit companies would be those proactively embracing sustainability as a business opportunity instead of viewing it as a compliance exercise or a goodwill gesture to win over critical stakeholders.

“

Singapore’s corporates have been playing catch up to the global sustainability movement in the past few years.

Singapore’s sustainability journey

Singapore’s own journey in sustainability has generally mirrored global trends over the past few decades – albeit with its own twists and turns.

In the early years of independence post-1965, the city-state’s founding prime minister Lee Kuan Yew made a clean and green Singapore the cornerstone of his government policies.

Lee’s successor, Goh Chok Tong, once remarked that Singapore was perhaps the only country whose Cabinet spent time reading gardening reports.

But even as Singapore’s urban planners worked to maintain a green city, massive industrialisation in the 1970s and 1980s pushed businesses to embrace capitalism.

CEOs largely adopted the American economist Milton Friedman’s view that the social responsibility of business is solely to increase profits. Corporates were not too bothered about human rights in the supply chain. Environmental pollution was considered an “externality”. Governance was an after-thought.

This started changing significantly in the 1990s when the modern corporate sustainability movement was born, partly as a response to worries over rising globalisation.

In 1999 at the World Economic Forum, then-UN Secretary General Kofi Annan warned that the spread of markets was outpacing the ability of societies to adjust, and that globalisation was facing a backlash – spawning protectionism, nationalism and terrorism, among them. Under his leadership, the UN Global Compact was founded in 2000 to encourage businesses worldwide to adopt sustainable and socially responsible policies, and to report on their implementation.

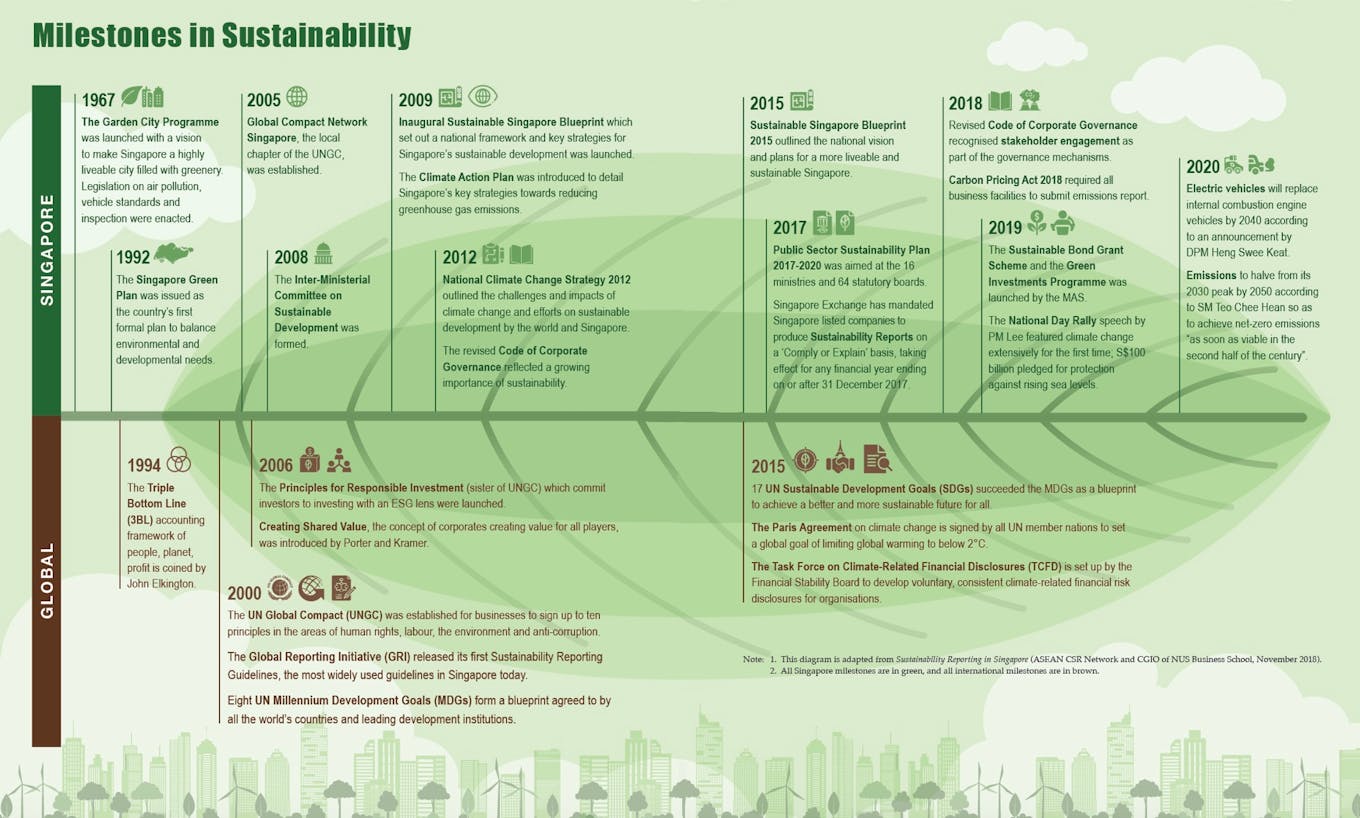

Milestones in sustainability for both Singapore and the world. Image: Singapore Institute of Directors

A series of global initiatives followed, from the Global Reporting Initiative’s first sustainability reporting guidelines to the Principles for Responsible Investment and more recently, the Paris Agreement on climate change and the UN Sustainable Development Goals.

In Singapore, the government has increasingly put sustainability on the national agenda. Prime Minister Lee Hsien Loong went to great lengths to highlight national measures to address climate change in his National Day Rally speech for the first time last year. The government has committed to phase out petrol and diesel cars by 2040, and to achieve net zero emissions “as soon as viable in the second half of the century”.

Corporate social responsibility

Singapore’s corporates have been playing catch up to the global sustainability movement in the past few years.

For decades, corporate social responsibility, or “CSR” here was largely defined by philanthropy – cheque-writing exercises to selected community groups that made businesses look good and feel good about giving back.

Today, this definition of CSR is dead.

To be a true sustainability leader does not imply doing more charity, or doing less evil – it requires putting ESG and sustainability principles at the heart of a business model.

What does this look like in practice?

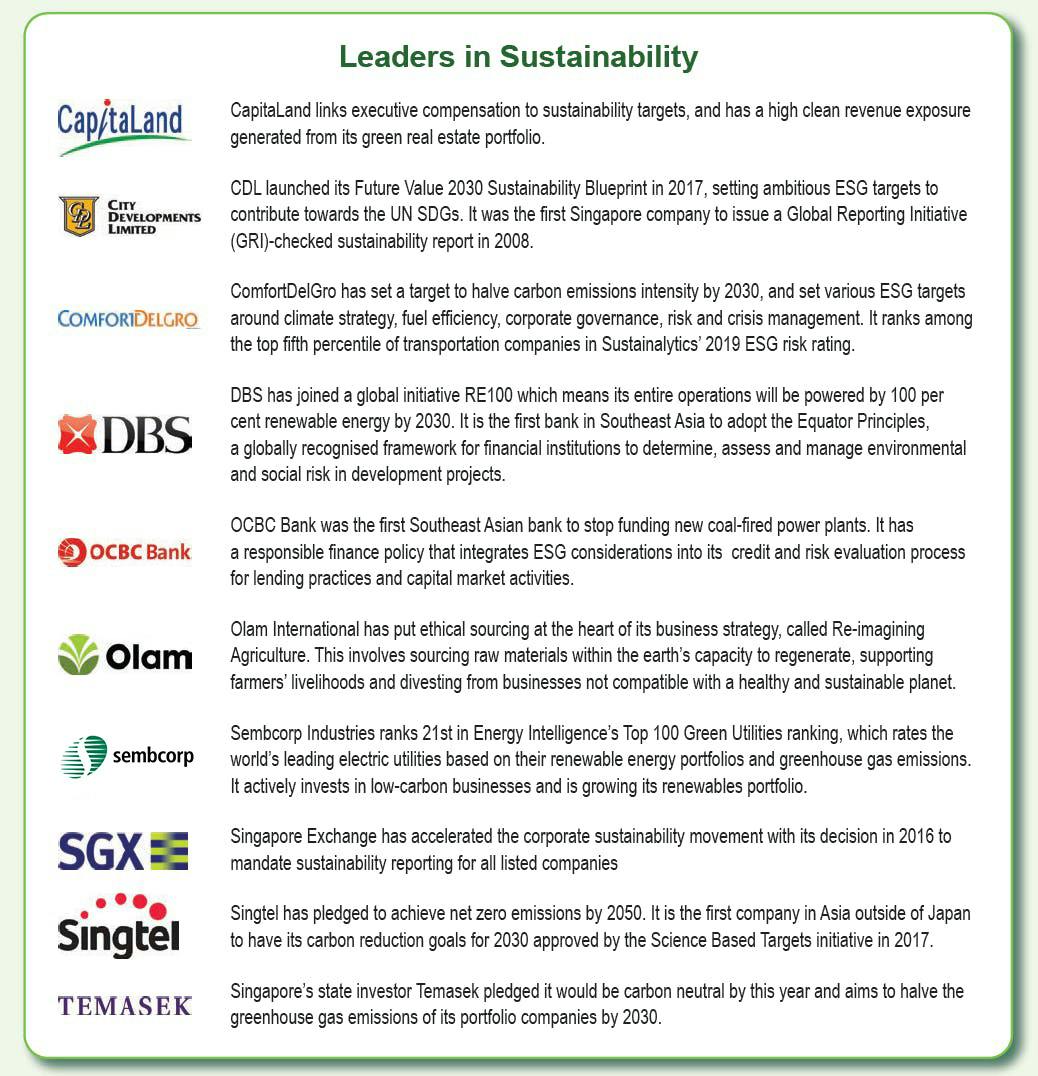

The box, “Leaders in Sustainability” provides some local examples of companies demonstrating sustainability leadership. These companies are not without their controversies or challenges, but they are part of a growing movement to embed sustainability into a business model.

A list of Singaporean companies that have demonstrated sustainability leadership. Image: Singapore Institute of Directors

Last year, five of these companies – CapitaLand, City Developments, DBS Group, Sembcorp Industries and ComfortDelGro – were included in the Dow Jones Sustainability Index, in recognition of their sustainability initiatives and reporting efforts.

The leadership of such corporates – along with many local sustainability advocates such as the Global Compact Network Singapore, Singapore Institute of International Affairs, and Singapore Green Building Council, to name a few – have contributed to the maturity of the corporate sustainability scene over the years.

Experts are predicting that in the near future, just as financial audits are a regulatory requirement for listed companies, external assurance on ESG reporting will become mandatory to give credibility to the ESG disclosures made by issuers.

How do we respond?

Leadership in sustainability is critical to the future and resilience of a country, and by extension, any organisation. Leaders who balance short-term priorities and long-term goals will create value for a wide range of stakeholders.

The Cambridge Institute for Sustainability Leadership lists seven key characteristics of sustainability leaders. They are:

- Systemic understanding.

- Emotional intelligence.

- Values orientation.

- Compelling vision.

- Inclusive style.

- Innovative approach.

- Long-term outlook.

From private business schools to public educational institutions, the nurturing of these qualities in our current and next generation of leaders must be a priority.

The complex, transnational issues leaders face today – climate change, resource management, inequality and social instability, national security, access to healthcare and education, technological disruption – cannot be solved by political institutions alone.

The world of finance and commerce is also evolving, and businesses should capitalise on the growth of sustainable finance and its emerging instruments such as green bonds and sustainability-linked loans to benefit from the growing relationship between ESG performance and financial gains.

These loans, where businesses enjoy lower interest rates for good ESG performance, have been increasing in popularity among sectors such as real estate, renewable energy, transport, agriculture, water and waste management, energy efficiency and sustainable sourcing.

The chairman and CEO of BlackRock, Larry Fink, in a letter to CEOs this year, declared that sustainability has become “the centre of our investment approach”. A company cannot achieve long-term profits without embracing purpose and considering the needs of a broad range of stakeholders, he wrote.

Apart from exiting investments that present a high sustainability-related risk, and launching new investment products that screen fossil fuels, BlackRock is among a growing number of institutional investors who expect companies to articulate how they are embedding sustainability in their corporate strategy and re-evaluating their risks.

All over the world, boardrooms should be reviewing their business models. Today, any investments made by political or business leaders must consider not just the economic benefit, but social, human and planetary health.

This guiding principle is the bedrock of resilience, recovery and continued prosperity for Singapore in a post-Covid world.

This article first appeared in the Q3 2020 issue of the SID Directors Bulletin published by the Singapore Institute of Directors.