Environmental, social and governance (ESG) disclosure has never been more pervasive around the world—and it is now firmly in the mainstream of policies requiring reporting on organisational performance. This was a key conclusion of the fifth edition of Carrots & Sticks, the flagship publication and online resource assessing the regulatory landscape for non-financial reporting.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

An initiative of Global Reporting Initiative (GRI) and the University of Stellenbosch Business School (USB), Carrots & Sticks (C&S) offers a comprehensive overview of the latest trends in reporting provisions worldwide, covering more than 600 requirements and resources. The 2020 edition, published in July, provides a substantial increase in scope on the 2016 report, covering more than 80 countries—including the world’s 60 largest economies.

As the annual UN General Assembly gets underway, it’s timely to explore five highlights from C&S 2020. These insights are important as we address the role of policies on ESG disclosure, corporate reporting and transparency, in the context of progress towards the Sustainable Development Goals (SDGs).

1. The SDGs and consequences of Covid-19

As a global shortlist of the crucial material topics for our planet, the SDGs have become a reference point for non-financial and sustainability reporting policy. While explicit reference to the SDGs in disclosure requirements targeting companies remain limited, they are often implied through the themes addressed. Links to responsible business, employment and accountable institutions (SDGs 12, 16 and 8) are widespread. However, references to public health and education (SDGs 3 and 4) are low, something we can expect to change following the pandemic.

As Covid-19 focuses the attention of policymakers on better ways to achieve healthy societies and climate-resilient economies, the importance of measuring the impacts of companies and encouraging sustainable practices increases. Looking ahead, the systemic implications of public health and infrastructure weaknesses are likely to receive more attention. Health and education will likely require more sector-specific guidance, while being mindful of the ripple effect of the pandemic across sectors.

What does this mean for the health and education reporting-related response in the longer term? Addressing gaps and improving coordination will be needed. As a recent GRI webinar series uncovered, organisations and their stakeholders are already focusing on the changes in reporting practices in a post-Covid-19 world.

2. The materiality process

The regulatory landscape both reflects and drives perceptions of key material themes. Related is the question of the target audience. The landscape continues to display confusion about what information is relevant for which audience—and where best to disclose. Greater clarity may, among others, be enhanced by formalising the processes through which companies determine topics most material and relevant to them.

The expansion in the disclosure themes companies are expected to report on is converging around the 34 topics addressed by the GRI Standards. Yet unexpected developments, such as Covid-19, always raise interest in new topics and display event-driven materiality. Similarly, changing societal expectations influence what topics are material. As materiality assessments are temporal and may change quickly, determining a set of core metrics today might not represent the appropriate disclosures of tomorrow.

Rather than a ‘tick-box’ exercise, companies must identify relevant disclosures through regular and robust, multi-stakeholder assessments. By applying a single core set of ESG metrics—which is universally applicable to all organisations regardless of their size, location or sector—companies might lose the nuances that inform the reporting process and subsequent business decisions. It can also camouflage the most significant impacts, positive or negative, on sustainable development.

3. The role of financial regulators

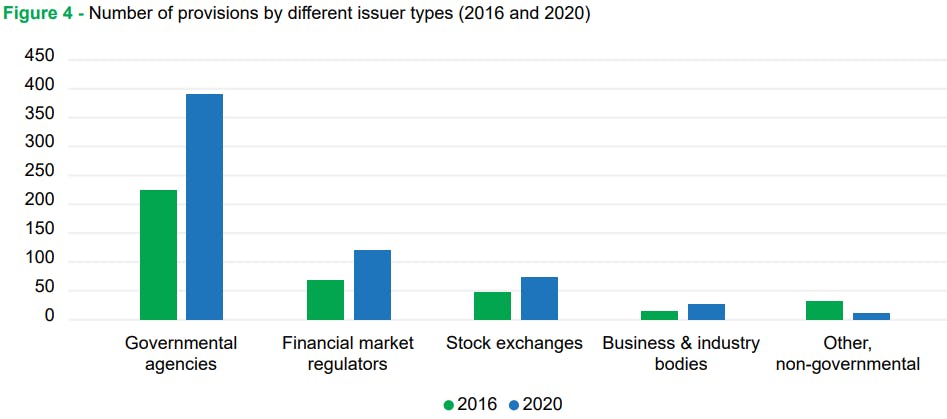

Our research found that most reporting provisions are issued by governmental bodies, rising by 74 per cent since 2016 to almost 400, while engagement by market regulators has also grown significantly. This shows how the economic and market implications of diverse ESG topics are becoming more evident.

Attention is often focused on requirements and guidance from governments and stock exchanges, but more prominent has become a third group, namely financial market regulators. These include central banks, financial supervisory authorities, banking commissions and financial reporting councils. As sustainability topics become more mature and market mechanisms are created to deal with them, these institutions are more likely to step in and take on a role in ensuring reliable information and data is reported. A clear example is climate and greenhouse gas reporting requirements, as a follow up to the recommendations by the Task Force on Climate-related Financial Disclosures (TCFD).

In response to greater regulatory interest in the climate theme, GRI has worked with securities market regulators in many jurisdictions to support the development of disclosure regulation. GRI has also undertaken capacity building at the regulator, exchange and issuing company levels to support work on climate-related measurement, reporting and verification.

Number of provisions by different issuer types (2016 and 2020). Image: GRI

4. Market context

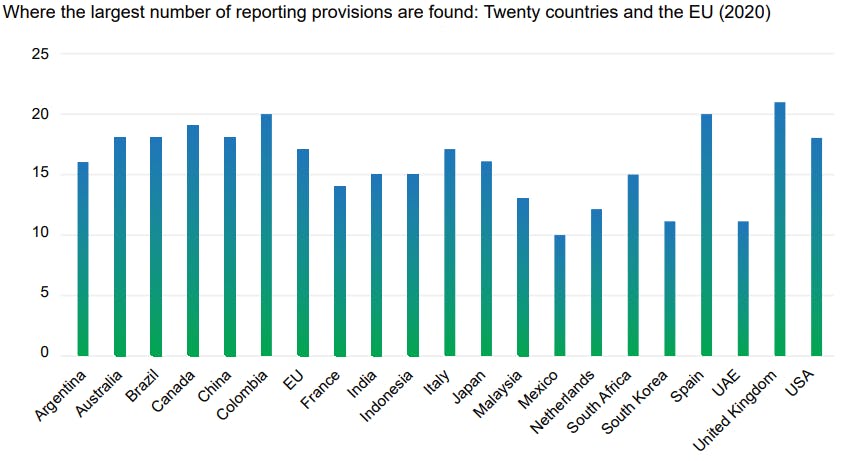

C&S 2020 demonstrates that Europe continues to drive the ESG agenda, accounting for 245 reporting instruments, while the Asian markets (174) are increasingly active. North America has a low number of provisions (47)—partly due to a lower number of national jurisdictions. At the country level, higher numbers of reporting provisions, including requirements and resources, were found in the UK, Spain, USA, Canada, Brazil, Colombia and China.

These findings leave some questions open, as research suggests that countries and industry sectors with a greater volume of reporting provisions and numbers of reporters tend to be ones where higher-quality reports emerge from. It appears from the C&S 2020 data that bigger economies tend to have larger numbers of reporting provisions. Yet more provisions alone do not necessarily represent a sign of a more sustainable economy.

Looking at the EU, the large volume of provisions in Spain and Portugal can be contrasted against a relatively low volume in advanced economies such as Germany and Ireland. The total picture is likely to change in coming years as the EU is pursuing a revision of its Non-Financial Reporting Directive, which will mandate reporting for a large group of companies throughout Europe. Some governments will be more challenged than others to rationalise, align and modernise existing regulations.

Where the largest number of reporting provisions are found: 20 countries and the EU (2020) Image: GRI

5. Reporting formats

Alignment in the sustainability reporting field is still falling short, with greater collaboration needed between standard setters, reporters, information users, regulators and policymakers, to streamline requirements and improve quality. Related to the reliability of data, C&S 2020 illustrates that, among reporting provision issuers, there is still divergence about how and where to disclose. Some refer to annual reports, others to sustainability reports, while many leave this unspecified. Furthermore, there is still variation between issuers around mandating reporting and emphasising substance or form.

We acknowledge the advantage of integrating non-financial information into the management report, to help ensure align non-financial and financial disclosures. Digital advances are also enabling data users to have direct access to non-financial information from diverse sources, of which the annual report is only one. Aggregating the information into recognised and comparable reporting formats can help ensure that disclosures are subject to the same level of rigor. Mainstreaming and integration will also enable companies to more clearly define the relationship of non-financial disclosure with their operations, elevating ESG matters into corporate-wide decisions.

Looking ahead

How to enable greater corporate transparency, and the encouragement and direction that policy setting facilitates, is a question for countries and markets around the world. And as we reflect on the changes needed to ensure that the global economy can survive and sustainably thrive in the aftermath of the pandemic, it’s an increasingly important one.

The ‘report card’ provided by C&S 2020 signals that good progress is being made, as demonstrated by the widespread increases in reporting provisions. However, the journey is far from complete and some regions are still lagging. We cannot afford ill-informed markets and unsubstantiated claims of societal legitimacy. That is why we need governments, policymakers, stock exchanges, financial regulators, standard setters and companies themselves to continue the momentum towards embracing ESG disclosure as an underpinning mechanism for more sustainable and responsible business practices around the world.

Peter Paul van de Wijs is the Chief External Affairs Officer at Global Reporting Initiative. Cornis van der Lugt is Senior Lecturer Extraordinaire at the University of Stellenbosh Business School in South Africa.