More companies in Asia Pacific are now reporting the risks they face from climate change, but many still fall short in declaring their full value chain emissions, or Scope 3 emissions, though this is set to change with new mandatory Scope 3 disclosure standards kicking in soon.

A report by the National University of Singapore (NUS) Business School and professional services firm PwC scrutinised the sustainability reports of the top 50 publicly listed companies by market capitalisation across 14 jurisdictions in Asia Pacific. It found that while the proportion of large firms that report climate risks under the Task Force on Climate-Related Financial Disclosures (TCFD) framework, a set of standards growing in popularity, increased from 77 per cent in 2021 to 88 per cent in 2022, reporting Scope 3 emissions is lagging.

While 80 per cent of the companies studied disclose their Scope 1 – that is, a company’s direct emissions – and Scope 2 emissions – indirect emissions from electricity purchased and used – only about a half are reporting their Scope 3 emissions.

To continue reading, subscribe to Eco-Business.

We offer a range of Subscription plans, including our free EB Member plan.

- Get the latest news, jobs, events and more with our Weekly Newsletter delivered to you free.

- Access the largest repository of news and views on sustainability topics.

- You can publish your jobs, events, press releases and research reports here too!

Newsletter subscribers do not necessarily have an Eco-Business subscription. Please subscribe now to continue reading.

Scope 3 emissions are usually by far the biggest part of a company’s climate footprint.

The report stated that the measurement of Scope 1 and 2 emissions is “reaching maturity”, but most companies in the region still need to push for greater transparency and accuracy of the measurement of their Scope 3 emissions.

“Larger companies can work with their suppliers, who may be smaller to medium sized companies to encourage them to take up more sustainable practices and also for better transparency and accuracy of Scope 3 emissions,” said the report.

Among firms that report their Scope 3 emissions, only 5 per cent have carried out a comprehensive level of disclosure needed to understand the full picture of their carbon emissions and so effectively bring about reductions across their value chain, the report found.

More companies are reporting climate risk to meet growing stakeholder and regulator expectations, the report said. Climate disclosure is now mandatory for listed firms in Malaysia and Taiwan and is set to become compulsory in Singapore, China, Japan, South Korea and New Zealand.

The report also stated that there is an expected rise in Scope 3 emissions disclosure with the recent proposed standards by the International Sustainability Standards Board (ISSB) for companies to disclose on greenhouse gas emissions across all three scopes.

Malaysia and Taiwan lead the region in terms of the proportion of companies identifying climate risk (98 per cent of Malaysian and Taiwanese listed firms report climate risk), followed by Singapore and Thailand (96 per cent) and Japan (94 per cent).

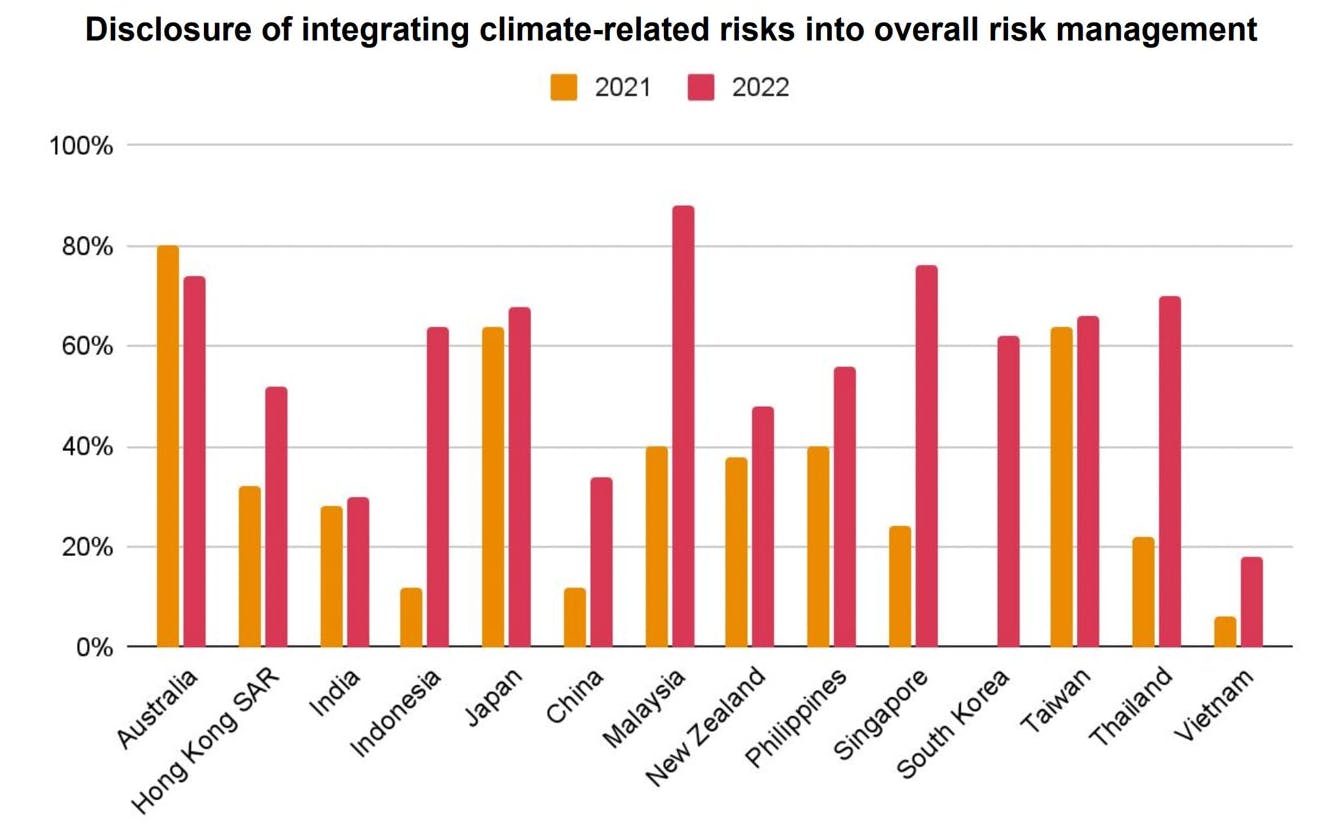

Malaysia also leads the pack for how well its listed firms disclose the integration of climate-related risks into their overall risk management systems.

The proportion of companies in Asia Pacific that disclosure the integration of climate risks into overall risk management. Source: Sustainability Counts 2023

Not-zero?

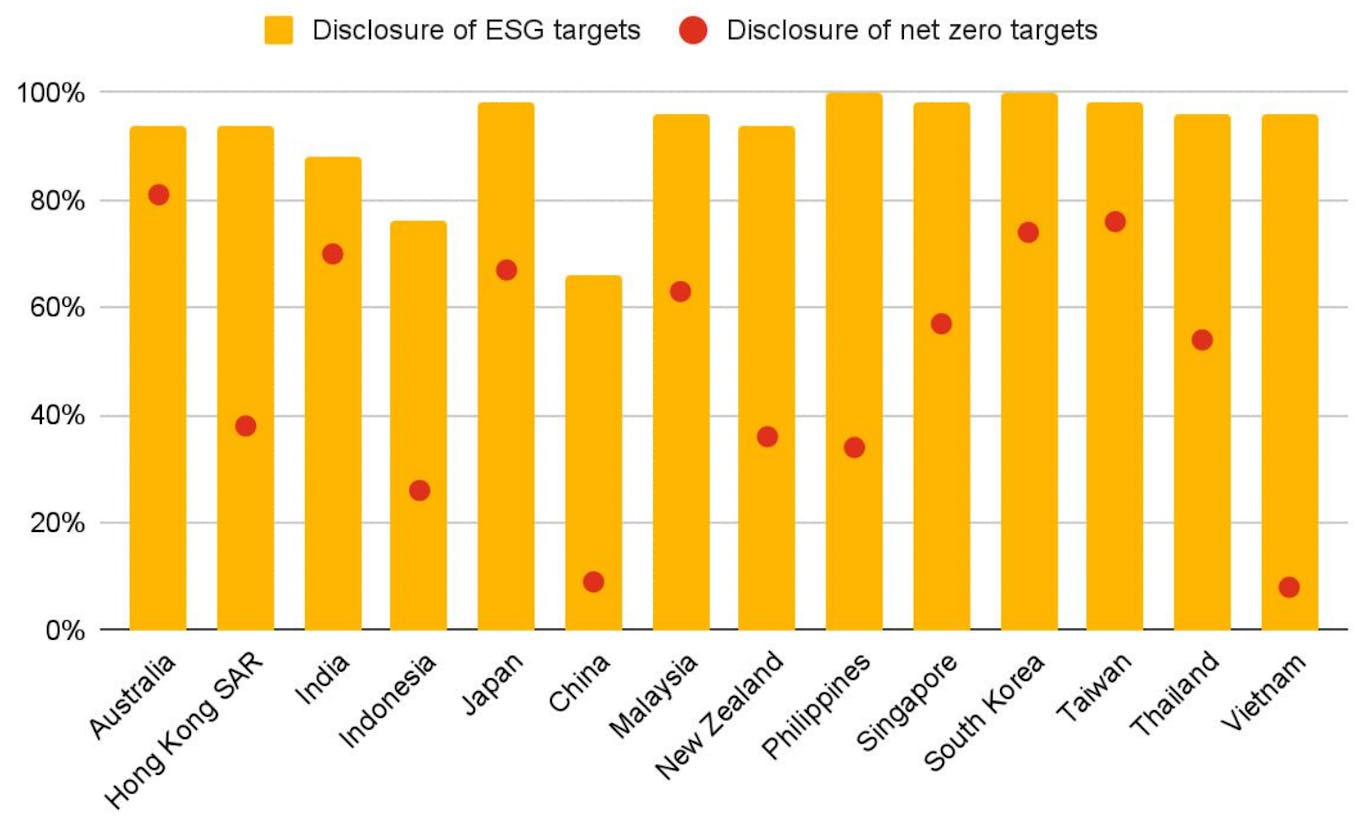

While more Asian companies are setting sustainability targets, not enough are setting credible ones. The report found that 92 per cent of listed firms have environmental, social and governance (ESG) targets, but only about a half (51 per cent) have set a net-zero emissions target.

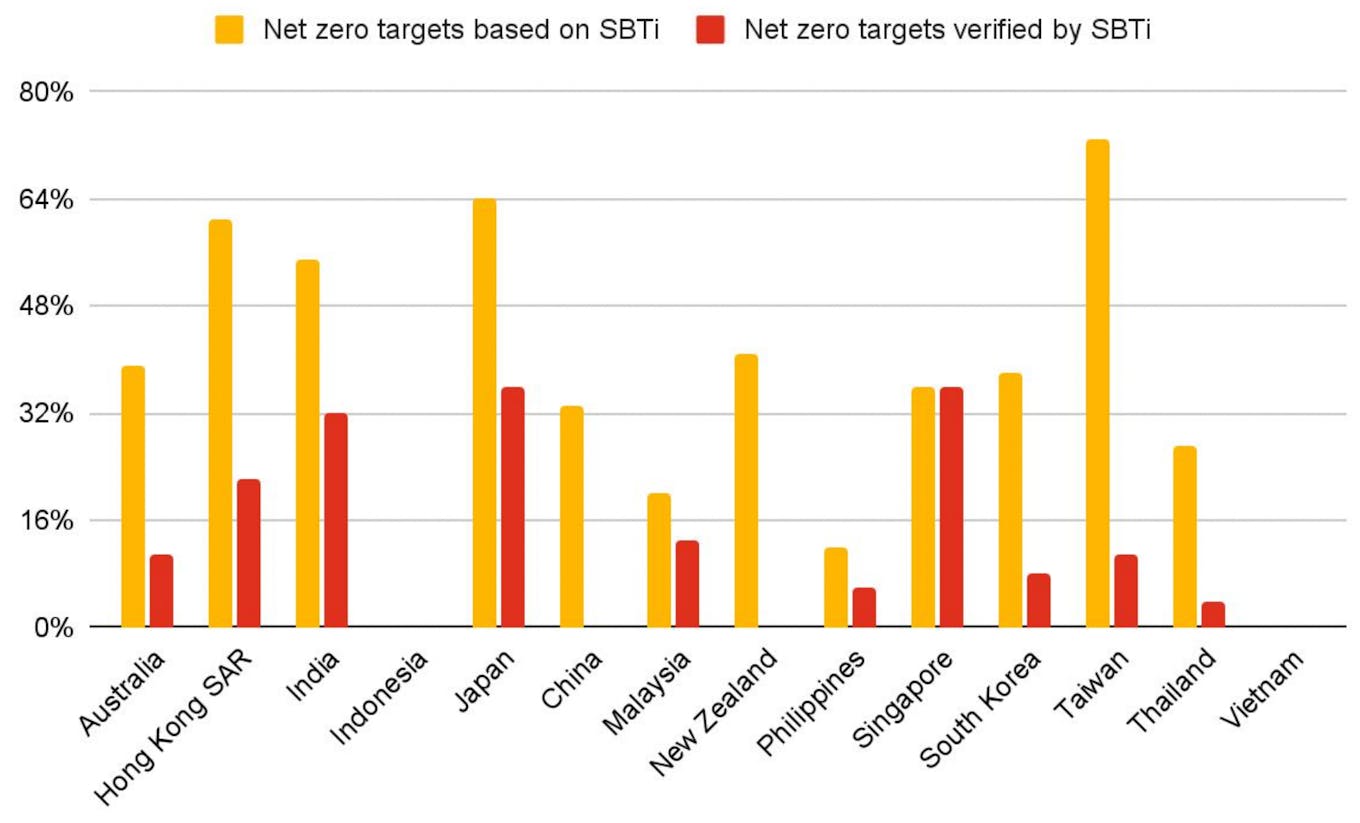

Of the companies with net-zero targets, only 42 per cent of these goals are based on the Science-Based Targets initiative (SBTi), a framework that aligns decarbonisation efforts with the Paris climate accord goal of a planet no warmer than 1.5 degrees Celsius above pre-industrial levels.

The leading countries for corporate net-zero target disclosure are Australia, South Korea, Taiwan and India, while China and Vietnam are lagging. The Philippines fares well for ESG target-setting but poorly on net-zero goal disclosure.

ESG and net-zero targets in 14 countries in Asia Pacific. Source: Sustainability Counts 2023

Only 16 per cent of studied firms have SBTi-approved net-zero targets. Singapore and Japan lead the region for the credibility of net-zero targets, with more listed firms in those countries with SBTi-approved net-zero goals. Not a single listed firm’s net-zero targets in Indonesia or Vietnam are SBTI-verified.

Only 16 per cent of studied firms have SBTi-approved net-zero targets. Japan and Singapore lead the region for the credibility of their net-zero targets with the highest proportion of firms SBTi-verified. Source: Sustainability Counts 2023

The research emerges as a new study, published on Monday (12 June), finds that almost two-thirds (65 per cent) of the annual revenue of the world’s largest 2,000 companies is now covered by a net-zero target – although 734 of the biggest publicly-listed companies still lack emissions reduction targets.

There remain “limited” signs of improvement in the integrity of national, subnational and corporate net-zero strategies over the past year, according to the study by United Kingdom-based non-profit Net Zero Tracker.

The world must lower atmospheric greenhouse gas to net-zero by 2050 if it is to avoid the most damaging consequences of climate breakdown.