Thanks to its continued dependence on fossil fuels, the mining sector could be exposing its value chain to US$16 billion in emissions costs if a carbon price of $7-per-tonne were applied, said a new report by climate research organisation CDP, formerly known as the Carbon Disclosure Project.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The true carbon exposure of mining companies, the report cited, is equivalent to India’s entire annual CO2 emissions.

The new report titled, “Digging Deep,” and launched on July 20, said that while the mining sector is making attempts to reduce its carbon footprint, it is “passing the buck” of high emissions onto the industries to which it supplies commodities such as iron ore, copper, and nickel.

These industries include transport, construction, and telecommunications among others.

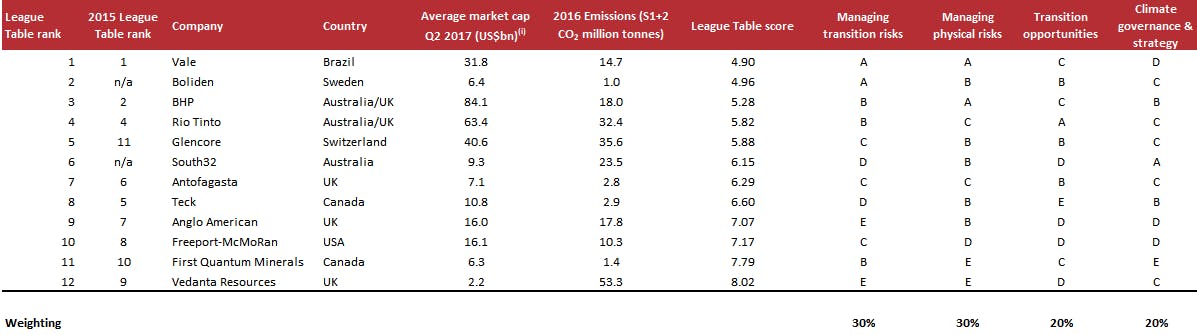

The report analysed the world’s 12 biggest publicly-listed mining companies for their readiness to transition to low-carbon economy and included mining giants such as Vale, Boliden and BHP, First Quantum Minerals and Vedanta Resources, which together represent US$294 billion in market capitalisation.

“

Miners depend on continuing demand for the commodities they supply and the countries consuming the most commodities are making significant changes in addressing climate change.

Paul Simpson, chief executive officer, CDP

It also found that while mining companies are spending almost half of their capital expenditure on metals and materials that are now increasingly in demand by low-carbon industries, such as copper and nickel used in solar energy infrastructure and EV charging stations, miners’ fossil fuels, particularly, oil and gas, still account for a quarter of their spending.

Paul Simpson, chief executive officer, CDP, said that the mining sector must transition towards a low-carbon economy, or risk being left behind. “Miners depend on continuing demand for the commodities they supply and the countries consuming the most commodities are making significant changes in addressing climate change.”

Simpson also warned that China’s push to introduce a carbon pricing scheme, for instance, could catalyse widespread carbon pricing in other countries and could disrupt the market for mining commodities.

Carbon pricing has already been introduced in mining countries such as Chile earlier this year and is due to be implemented in South Africa and Canada in 2018.

While China is the world’s largest producer of coal, gold, and most rare earths, the country is also the leading consumer of most commodity mining products such as thermal coal and iron ore, the latter used in steel making which the country needs for its construction and infrastructure sector.

The report found that among major mining companies, Brazil’s Vale, which is the world’s largest producer of iron ore and nickel, Sweden’s Boliden which mainly mines and processes copper, and Australia’s BHP which is among the world’s largest producers of aluminum, copper, manganese, iron ore, uranium, nickel, silver and titanium minerals, are performing well in terms of lowering their carbon footprints.

On the other hand, Arizona-based Freeport-McMoRan, the world’s largest publicly traded copper producer, Vancouver Canada’s First Quantum Minerals which is also focused on copper, and UK’s Vedanta Resources, which processes zinc, lead, silver, copper, iron ore, and aluminium ranked lowest among those who disclosed to CDP.

Source: CDP

Aside from reporting on the carbon exposure of the mining industry throughout the supply chain it feeds, the CDP report also highlighted that a quarter of the mining sector, representing up to US$50 billion in annual revenue, will be exposed to water stress by 2030. Drought and water shortages will be felt most acutely in mining operations in Chile, Australia, and South Africa, the report warned.

The transition to low-carbon economy which could mean a lesser demand for carbon-rich mining products, and the risk of water shortages to supply to mining operations, will increase the mining company’s investors’ risk exposure, the report said.

Tarek Soliman, CDP’s senior analyst for investor research, said that as a sector that supplies commodities to industries that are already transitioning to a low-carbon economy, investors in the mining sector will inevitably have to face up to the impacts of this transition.

“Some companies are doing more than others to ready themselves for a transition, and investors will want to know what the potential implications are for their portfolios,” Soliman said.