The biggest companies in the Asia Pacific region got worse at reporting their sustainability performance in 2020, and improved in only one area — human rights — according to a report by Taipei-based consultancy CSRone.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

CSRone’s report measured the sustainability reporting performance of the biggest publicly listed firms in 10 countries in the region, analysing how extensively they tracked their environmental, social and governance (ESG) performance, stuck to targets, and other factors.

The study, titled Taiwan and Asia Pacific Sustainability Reports Analysis, found that while reporting improved from 2018 and 2019, it dipped last year, with the largest regression being how corporates reported on efforts to care for their employees.

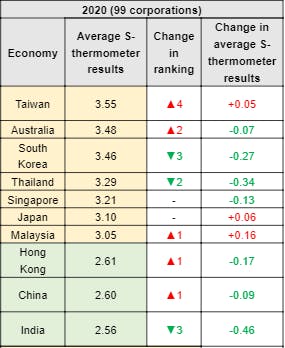

Last year’s disclosure decline was particularly marked in India, the weakest performer in the study, but also fell in Thailand, Singapore, South Korea, Hong Kong, and China.

Jose Miguel Salazar, senior corporate sustainability specialist at CSRone, noted that in 2020, companies struggled to meet sustainability goals and disclose plans for improvement.

Disruptions from the Covid-19 pandemic may have forced firms to rethink their sustainability goal-setting or reallocate resources to higher priority areas, such as taking care of employees or their communities, he told Eco-Business.

A total of 99 corporate sustainability reports were scrutinised for the study; the firms featured included Taiwan Semiconductor, Japan’s Toyota Motor, Singapore’s OCBC Bank, Industrial and Commercial Bank of China, Reliance Industries of India, Malaysia’s Maybank, Thai energy firm PTT, Australia’s Commonwealth Bank, and Korean electronics firm Samsung.

CSRone’s sustainability reporting performance ranking by country for 2020. Scores 0-5.

CSRone evaluates reporting performance with its “S-thermometer”, giving companies scores from 0 to 5 across a range of metrics.

Three countries got better at sustainability reporting in the year of the Covid-19 pandemic. Malaysian corporates showed the biggest improvement overall. Japanese and Taiwanese corporates also advanced.

Taiwan topped the ranking, followed by Australia and South Korea, which ranked first in the 2019 and 2018 studies.

What are Asian companies good and bad at?

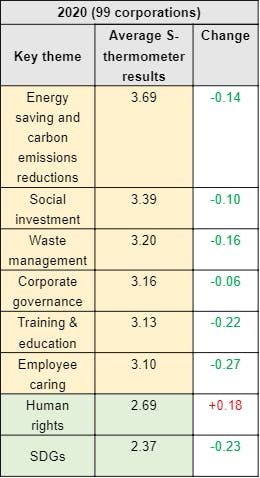

The region’s big corporates scored highest in how they report energy savings and carbon emissions reductions, social investments and waste management — but all three of those themes showed performance decline in 2020.

The relatively high scores for emissions management shows that the region’s companies are increasingly embedding decarbonisation into their operational goals, but more work is needed to disclose specific detail in carbon reduction plans, the report’s authors noted.

CSRone’s sustainability reporting performance ranking by issue in 2020. Scores 0-5.

Australian, Japanese and Singaporean companies fared best for carbon disclosure; Indian and Chinese firms trail the pack.

The only area that showed improvement in 2020 was an issue with which companies in Asia usually struggle — human rights — albeit from a very low base. Taiwan, Australia and Korea were the only countries to register respectable, above-average scores for human rights disclosure.

These three countries were also the only nations to receive above-average sustainability reporting scores for alignment with the United Nations’ Sustainable Development Goals.

Taiwan, Australia and Thailand led the region for reporting on employee care in 2020, while Singapore, China, Hong Kong and Indian firm registered low scores on that front.

Taiwanese and Korean firms are also leading for social investment and corporate governance disclosure, while Singapore and Thai firms lead for waste management reporting.

John Pabon, founder and chief advisor of Melbourne-based sustainability consulting firm Fulcrum Strategic Advisors, said that decline in overall reporting performance was “evidence of sustainability being viewed as a nice to have versus a business imperative.”

“While I don’t believe companies have stopped tracking ESG issues within their businesses, maybe the time and expense of reporting was just something that fell off the radar given everything else going on,” he said.