Southeast Asia’s solar and wind capacity grew by a fifth since January 2023 but delayed construction on renewable energy projects and continued reliance on fossil fuels is putting the region’s 2025 renewable energy targets out of reach, according to a report published on Wednesday.

The Association of Southeast Asian Nations (Asean) countries have set a collective renewable energy capacity target of 35 per cent by 2025. The region currently has over 28 gigawatts (GW) of operational solar and wind power. With another 23 GW expected to be operational by 2025, the region only needs to build 10.7 GW more on top of what is under construction to achieve its goal, said Global Energy Monitor (GEM).

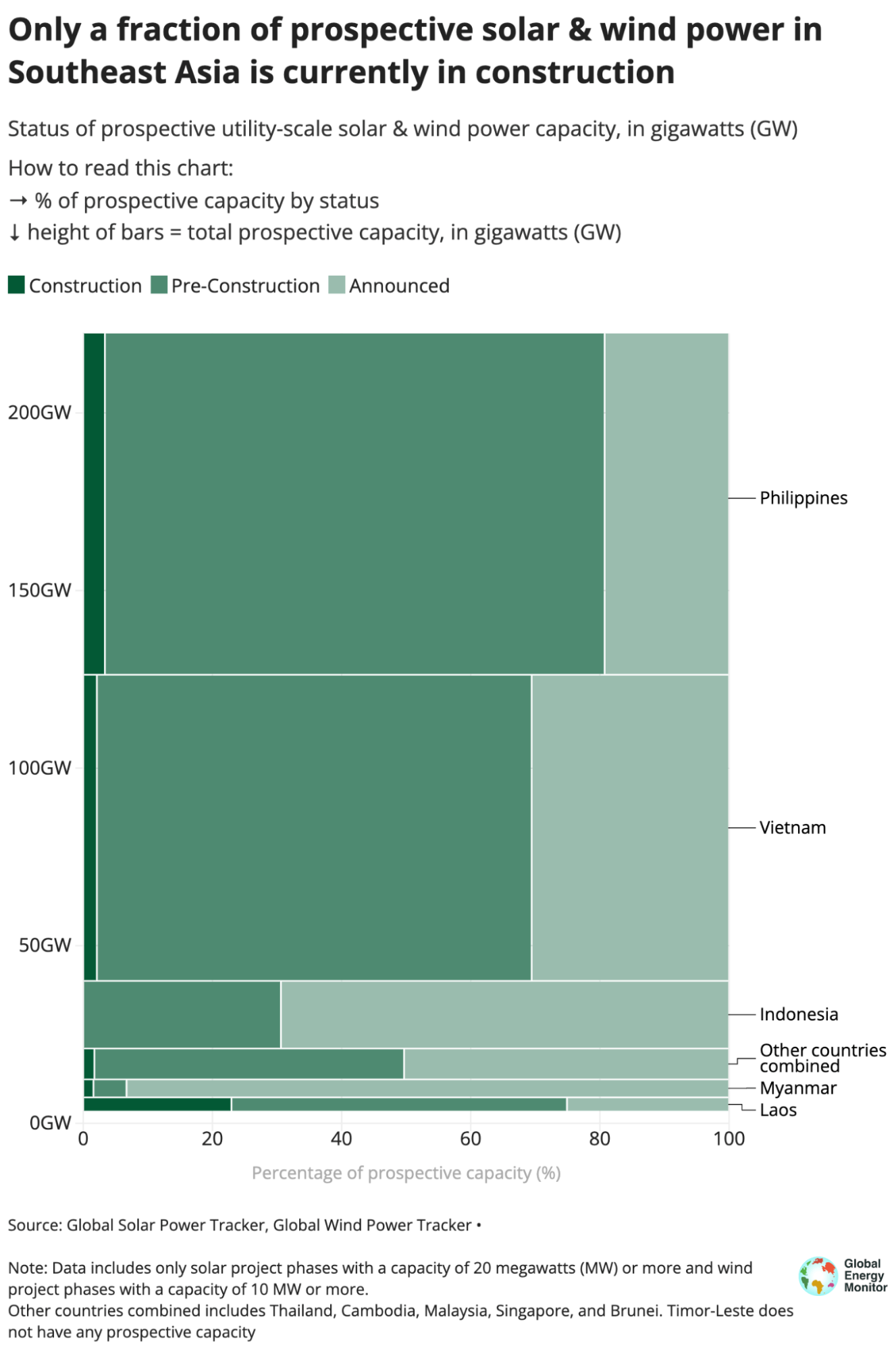

The target is “easily attainable and ultimately unambitious for Asean,” according to the renewable energy tracker. However, only a measly 3 per cent (6 GW) out of 220 GW of prospective solar and wind capacities is under construction.

The global average, except for China, is over twice that of Asean countries, at 7 per cent prospective capacity under construction, said the report.

Only a fraction of prospective renewable energy capacity is being built

Vietnam leads the region with the largest share of operational solar and wind capacity (19 GW), totalling 25 per cent of the country’s energy mix. It has a prospective capacity of 86 GW, ranking eighth globally.

However, the country has problems completing projects and integrating electricity generated from renewable energy projects. Many Vietnamese renewable energy projects are unable to operate or continue construction due to poor policies for feed-in tariffs, grid integration and grid infrastructure, compounded by Covid-19 pandemic-induced supply chain disruptions.

“This has left many financiers without an incentive to move forward with development,” said the report’s lead author Janna Smith.

GEM suggests that Vietnam must carry out its energy roadmap PDP8, released in 2023, two years behind schedule, to allow projects already constructed to receive priority for grid integration.

The market share of prospective renewable energy in Southeast Asia has been dominated by the Philippines and Vietnam but very few projects have begun construction. If stalled and pending projects do not continue, Asean may miss its 2025 renewable energy targets, as fossil fuels rise faster. Image: Global Energy Monitor. [Click to enlarge]

The Philippines is responsible for nearly 45 per cent of prospective capacity among Asean countries, leading with 99 GW of capacity either in construction, planning or recently announced. The country is aiming to increase its current 3 GW operational solar and wind capacity and has in place a moratorium against developing new coal-fired power plants.

In April 2023, the Philippines government issued an executive order pushing private-government cooperation to deliver more offshore wind contracts. However, the predominantly privatised power generation sector is facing grid integration issues. Among the challenges are intermittent energy supply which is increasingly severe due to climate-induced extreme weather.

The recurring hurdle for integrating utility-scale renewable energy in the region is sounding “a bellwether of investors of the challenges they could face in Asean countries,” said Janna.

Coal and gas demand rises, renewable energy targets are unambitious

According to the report, the relative lack of ambition in renewable targets compensates for countries such as Indonesia, currently with less than 15 per cent renewables in its energy mix, to continue to rely heavily on fossil fuels.

As rising energy demands are outpacing solar and wind growth in the region, Asean countries continue to turn towards coal and gas to meet energy consumption needs. And they may be particularly receptive towards gas, which was recently recognised as a transition fuel during COP28. However, refining infrastructure and capacity in the region has not kept up with the pace of demand growth, which is pushing the region to become a net gas importer.

Coal-fired power plant capacity has been steadily growing in the region at 7 per cent since 2017. Meanwhile, a total of 19 new gas fields in Malaysia, Vietnam, Indonesia, and Brunei are expected to be sanctioned by 2025.

Janna called on Asean countries to step up to global targets to triple renewable energy capacity by 2030. “Switching to renewables now from coal and gas will save countries time and money on the path to a clean energy future,” she said.

Meanwhile, the report also highlights collaboration among the region’s smaller renewable energy players to commence multilateral power purchasing. For example, Singapore signed deals with Indonesia and Cambodia to import a combined total of 3 GW by 2028. Both deals would see Singapore move closer to its import target of 4 GW of low-carbon electricity a year by 2035.