Around the world, use of the term “ESG” is steadily fading from corporate language.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

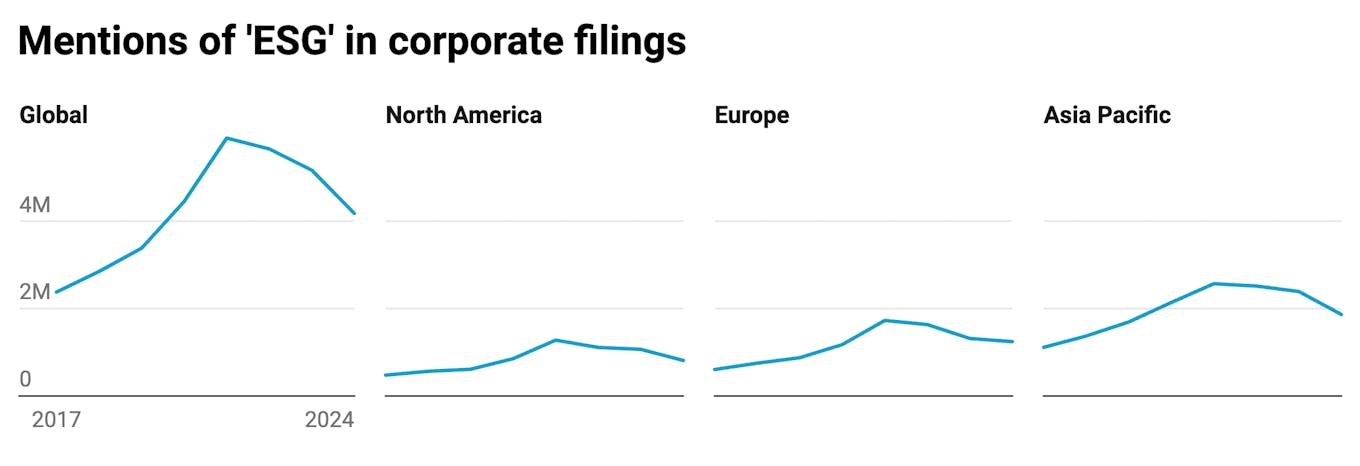

According to data shared exclusively with Eco-Business, corporate use of the acronym – short for environmental, social and governance – and related words such as “environment”, “climate”, “governance”, “social”, “diversity” and “inclusion”, peaked in 2021 and has dropped substantially in the years since, with an accelerated decline seen last year.

The study is based on a web scrape of public corporate filings – annual reports, earnings transcripts, CEO speeches and investor presentations – from 72,536 companies across 20 industries in Asia Pacific, Europe and North America over the past eight years by analytics firm GlobalData.

It found that ESG-themed mentions grew exponentially for the five years from 2017 to 2021 – the year after the start of the Covid-19 pandemic – but the topic has gradually fallen out of favour since, with the steepest drop in use seen in Asia Pacific last year.

The term “ESG” first materialised in 2004 in a United Nations report titled Who Cares Wins. It became popularised in the annual letters of Larry Fink, chairman of investment giant BlackRock, who championed ESG-focused investing as pivotal to creating long term business value.

Fink stopped using the term in 2023, arguing that the term had become too political. The “S” is ESG had become particularly divisive, with multinationals including Amazon, Boeing, Facebook, and Walt Disney abandoning or toning down diversity, equity and inclusion programmes as they compromised embroiled in identity politics and growing scrutiny driven by conservative groups.

The number of times companies mentioned ESG themes in annual reports, quarterly earnings, CEO speeches or shareholder presentations between 2017 and 2024. Sample size: 72,536 companies in Asia Pacific, Europe and North America. Source: GlobalData Graphic: Datawrapper

ESG-backlash, regulatory pressure and greenhushing

David Ko, Asia managing director of public relations firm Ruder Finn Interactive, said that the decline in ESG-related terms used in corporate language could be partly explained by the politically-driven backlash against ESG, particularly in the US, which has steadily spread eastwards.

“This has led companies to reduce direct references to ESG in their communications to avoid controversy,” said Ko. He said he has personally advised clients to refrain from using ESG terminology in communications for this reason.

An increasingly complex and uncertain regulatory environment concerning ESG topics, such as the introduction of rules for climate disclosures, has caused companies to grow cautious about using related language, Ko added.

Companies have also grown hesitant to highlight ESG initiatives to avoid accusations of greenwashing – a phenomenon known as greenhushing, he said. Reported cases of greenwashing declined for the first time in six years in 2024, according to analysis by RepRisk, a consultancy, in line with the trend of declining ESG mentions.

Companies have also started using different terms, such as “responsible business” instead of “ESG”, due to the negative connotations associated with the latter, he said.

However, Ko noted that changing ESG-themed language does not mean that corporates have stopped implementing sustainability programmes – they’re just talking about it less or differently.

“

ESG was given attention, it now has to earn attention.

Iain Twine, partner, Singapore and Southeast Asia, FGS Global

Similarly, the trends underlying ESG are not all in decline, and are growing under different nomenclature. In Asia, transition finance is seeing substantial growth, with the Japanese government recently issuing US$11 billion in a transition bond issuance, while in Southeast Asia adaptation finance is gaining momentum.

The global ESG investing market is projected to grow at a compound annual growth rate of around 18 per cent from 2024 to 2030, despite the re-election of Donald Trump as United States president. Meanwhile, experts argue that although the corporate sustainability agenda is facing crosswinds, firms that embrace long-term ESG values will thrive, as long as they can show how important sustainability is to the bottom line.

Iain Twine, partner, Singapore and Southeast Asia, for business consultancy FGS Global, noted that ESG is “not dead” but the sustainability sector needs to find its relevance again in order for companies to talk about it publicly.

“ESG arrived with a bang. Data showed it helped, and media challenged companies to proactively communicate in the space. The markets did as well. But when the politics shifted and it felt like ESG was everywhere, confusing business decision-making, the demand from media and investors for detailed ESG information fell.”

“ESG regulations are still in place, and companies are still working on it [compliance and disclosure]. But politics and the overreach of ESG has made finding its relevance from a communications and public affairs perspective tricky,” said Twine.

“ESG was given attention, it now has to earn attention.”

Broad consumer interest in ESG has shown more resilience than in the business world, with Google search data revealing only a mild decline in global searches for the term since a peak two years ago, in March 2023.

Google Trends data on searches for “ESG”. Source: Google Trends, 2004-2025

Plant-based and renewables parallels

The decline in the popularity of ESG in business has parallels with the rise and fall of plant-based food sector, which has “underperformed on expectations,” observed Tim Hill, account director for GlobalData.

The plant-based food market grew rapidly during the pandemic, as consumers sought healthier diets and more sustainable eating habits. But the market has since declined amid consumer scepticism over the benefits of plant-based products, price sensitivity and increased competition, he noted.

“Plant-based food was unable to achieve pricing below that of animal proteins in most cases. But also, consumers were not motivated to become repeat buyers having sampled plant-based once. Plus, the media started reporting on the health problems of ultra-processed food, which includes most plant-based meat alternatives,” he said.

“The trajectory of plant-based meat alternatives suffered a similar fate as ESG at a similar time.”

The decline in ESG in corporate speak also mirrors the trajectory of renewable energy returns on investment, which peaked in 2021 but have underperformed oil and gas stocks since early 2022.