Machine learning algorithms and artificial intelligence methods that can sort hard-to-digest information scattered across multiple platforms are now increasingly employed to study complex climate data. For many companies struggling to make sense of the messy world of environment, social and governance (ESG) reporting, these technology fixes can seem like a godsend.

“Artificial Intelligence (AI) is indeed a very strong and empowering tool. It can help companies in collecting and cleaning up ESG data, ” said Jason Tu, chief executive and founder of MioTech, one of Asia’s largest sustainability solutions providers. “It also has predictive capabilities that can help with risk evaluation and decision-making.”

Tu, however, believes that governments and companies cannot put blind faith into AI and technology, but must build an ecosystem with clear rules and common metrics for the management of climate-related risks.

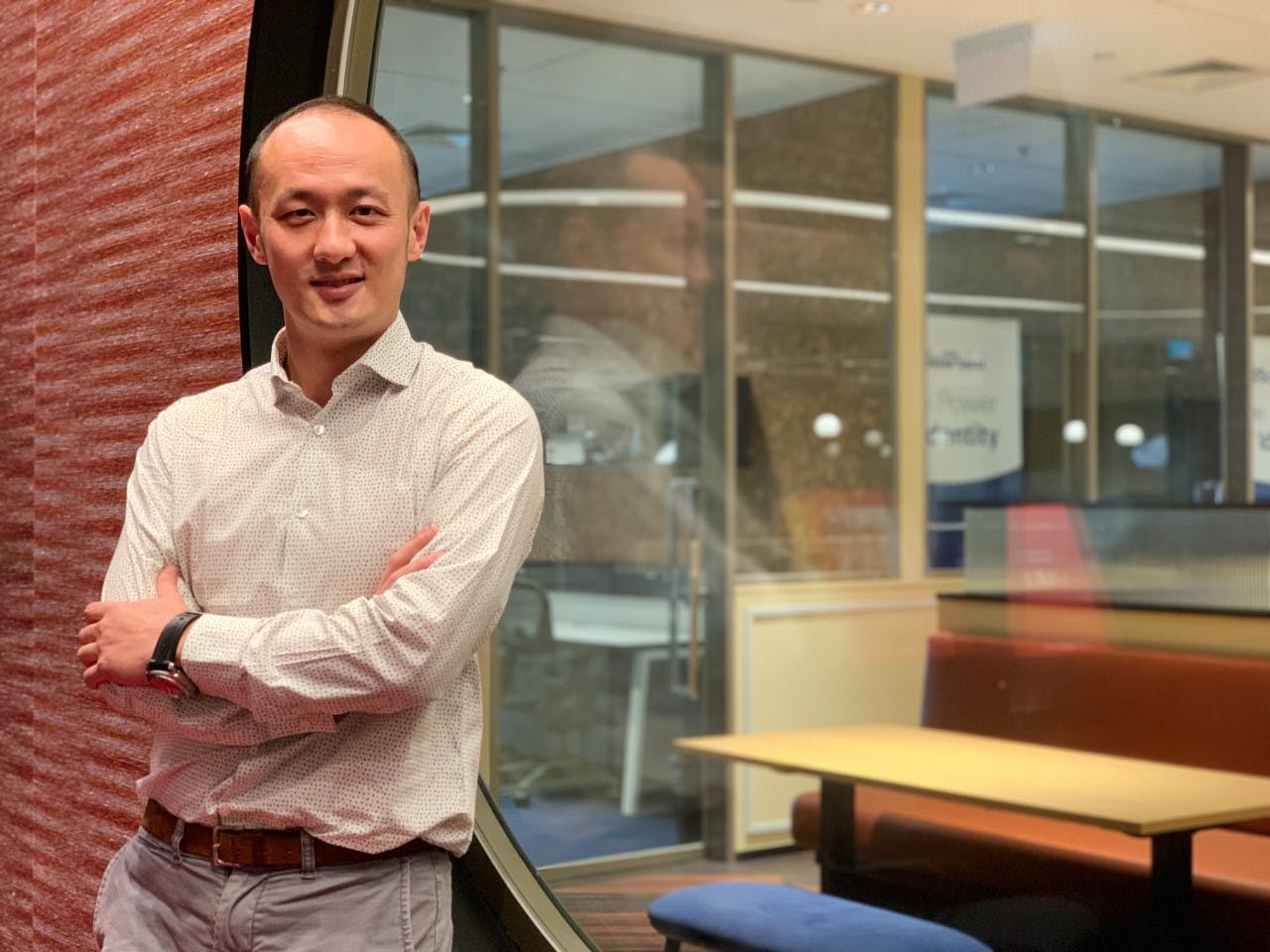

Jason Tu, chief executive and founder of AI-based sustainability data and solutions provider MioTech. Image: Ng Wai Mun / Eco-Business

The Hong Kong-based MioTech has chosen to make its foray into the Southeast Asia market through Singapore after cementing a leading position in Greater China, precisely as the city-state has been moving fast on the ESG policy front. “We are an AI-driven technology company working on sustainability, but to be honest, I do not believe that AI is the Holy Grail,” Tu told Eco-Business, when he was in town last month to launch MioTech’s Singapore office, which will serve as its Southeast Asia headquarters.

“There are a variety of standards out there, both global and local, that still affect the organisation of data for us. There are also different ways to rate and benchmark a company’s ESG performance. The industry is very new and it requires clear regulation to work its magic,” said Tu.

In Singapore, for example, banks will soon have to undergo stress tests while making regulatory disclosures. Its financial watchdog, the Monetary Authority of Singapore (MAS), has pledged to tackle greenwashing — the act of making false or misleading claims about a product or service’s environmental benefits — which it considers the weakest link in the push to expand sustainable finance. Technology, such as AI and data verification methods, will be employed so that the provenance of green products can be attested to.

“

Enhanced scrutiny on corporate greenwashing, in a way, has propelled the ESG intelligence business. You have to substantiate your claims with data, otherwise the most ambitious climate claims ring hollow.

Jason Tu, CEO and founder, MioTech

In a way, enhanced scrutiny of greenwashing has helped “propelled the ESG intelligence business” for MioTech, said Tu. The six-year-old start-up, which has its backing from Hong Kong tycoon Li Ka-Shing’s venture capital firm Horizon Ventures, has bagged new funding from investors over the past year, and is on the path of rapid expansion, driven by strong demand from Asian companies looking to actively participate in the region’s growing ESG and carbon markets. So far, it has raised more than US$100 million in private funding.

According to a report from United States-based management consultancy Opimas, the market for ESG data passed $1 billion in 2021 and could exceed $1.3 billion this year.

MioTech counts leading financial institutions, stock exchanges, as well as corporations such as oil major Shell as its clients and partners. In Southeast Asia, it is in talks with the Singapore and Thai stock exchanges as well as Malaysia’s exchange Bursa. It also wants to expand its commercial bank clientele.

To complement its increased presence in the region, the start-up has launched its Singapore and Southeast Asia ESG dataset, which marks the region’s first-to-market ESG data coverage.

In this interview, Tu discusses the MioTech’s growth strategy for the region. The outspoken entrepreneur, who made the Forbes 30 under 30 list in 2018, also shares how the company has worked with heavy-emitters to improve their carbon accounting and help these companies make sense of the changing ESG disclosure landscape.

Before the pandemic, MioTech was already planning its strategic entry into Southeast Asia. Though the plans were disrupted for a few years, now you have made your official foray. Why the focus on the region, and why choose to set up in Singapore?

We have consistently emphasised how important the Southeast Asia market is to us. MioTech is positioned to be the leading sustainability data and technology provider for Asia, and we started with establishing ourselves in the Greater China region. Now that we have done that, the next natural step is to expand that map and put ourselves in Southeast Asia.

The Covid-19 pandemic has also put the spotlight on supply chain networks across the world, and in Asia, we are getting requests from multinational firms who are exposed to supply chain risks and want to understand their risks and vulnerabilities better. These could be simple requests to help with their standard due diligence processes, or more complex and sophisticated ones, when companies want to engage with their partners along the value chain and make sure suppliers improve their ESG practices. Our growth is driven by this trend.

Another key change that I observe in the region is in the area of regulation. Let me first share a favourite anecdote. As a business owner, I sometimes have to conduct interviews when we hire for sales positions, and one question that I like to ask the candidates is: what do you think is the best sales opportunity? There are usually various answers, and for many, cutting sales costs is the worst type of target to have, but many usually neglect how regulation can create business for us. For me, the best kind of sales opportunity comes when the regulator says companies have to buy your product. That is when companies do not have a choice. In our case, the fact that ESG reporting is becoming mandatory in many jurisdictions is a key opportunity for us. And in Singapore, the government has been moving swiftly on the ESG front.

It is not an early adopter and some policies are not mandatory yet, but the policies that the Singapore government is rolling out are significant in changing the landscape. In 2019, when I first started visiting on a monthly basis to share our work with partners, regulatory agencies here knew sustainability was an important topic, but it was mostly still a monologue. But now, we are seeing concrete projects being launched. For example, MAS has Project Greenprint, which is a collection of initiatives to address the financial sector’s sustainability needs and to enhance private sector collaboration. For MioTech, we care most about the tangible benefits that the ecosystem provides, including incentives for hiring talents, and the Singapore government as a regulator checks all the boxes.

What is your core business? Can you share examples of how companies have struggled with data? How does MioTech help?

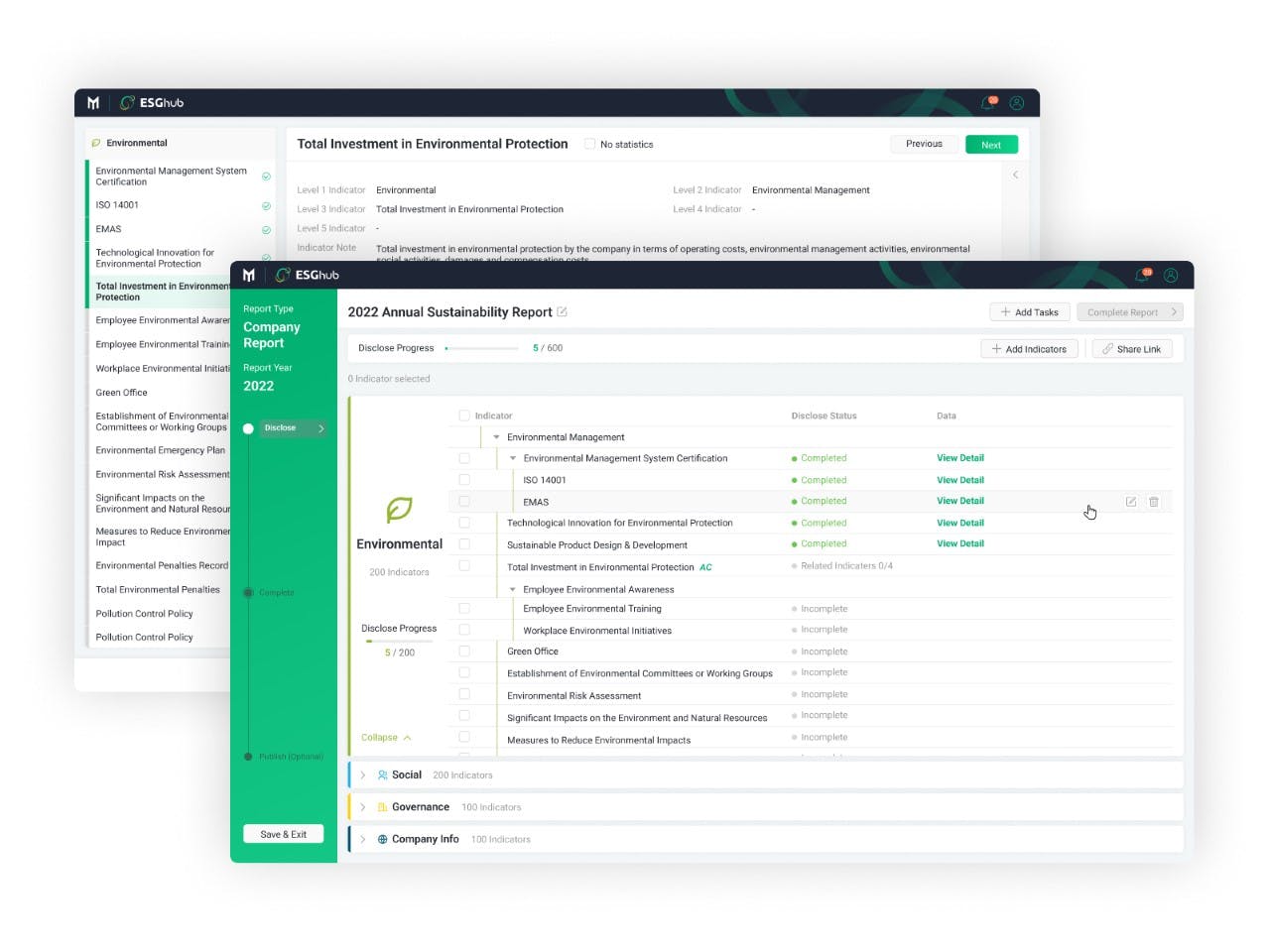

We have two main business lines: ESG and carbon. For ESG, we have a market intelligence platform AMI (short for Advanced Market Intelligence) that allows users to access ESG data, visual risk and relationships, identify market trends and reveal hidden patterns. It is essentially a Bloomberg terminal-like platform that focuses on ESG data and technology, made to serve financial institutions. We also have the ESGhub, which connects financial institutions to corporate players. It covers private equity, venture capital and commercial banking loans.

A look at MioTech’s ESGhub interface. ESGhub connects financial institutions to corporate players, and covers private equity, venture capital and commercial banking loans. Image: MioTech

For carbon emissions reduction, we actively work with companies and help them make sense of their data and processes. A company might need to track its greenhouse gas (GHG) emissions, either for reporting purposes or for accountability to its investors and stakeholders. In the case when there is publicly available data, including a company’s own disclosures, information on its websites, government records or media reports, we can use AI technologies such as Natural Language Processing (NLP) to analyse them and extract relevant information based on text-based keywords. If a company does not disclose climate-related data or has no records in the public space, then we look for proxy predictors that are indicative of its GHG emissions — energy consumption or data about its product lines. We use a lot of machine learning here for the estimation. Then if there are absolutely no good predictors available, corporate engagement comes in. We install the sensors and devices, and collect the data ourselves.

For example, we have done so for Shell. We installed sensors and deployed our software to monitor the operating efficiency of its many plants and facilities around the world. For other large MNCs that we work with, we have done the same as well. We delve deep into what goes on during production and manufacturing, measure their carbon footprints, and conduct life cycle assessments, which is a systematic evaluation of the environmental impacts of a product or an activity over its entire life cycle. These processes are sometimes needed when companies need to get their certification approved for carbon credits, or when they need to underwrite some of their assets after risk evaluation. Some companies take a step further to evaluate their physical risks — to look at how floods and extreme weather affect their assets.

There are also instances when companies require us to look at hard-to-measure non-financial data. One interesting example was when we had to come up with workplace discrimination metrics for an European company. It required some innovation as we had to then apply AI to analyse job advertisements and try to detect discriminative language there with our software.

What is it like to work with heavy emitters and polluters such as Shell? Is MioTech afraid of any backlash given how there are accusations of greenwashing against these major oil companies?

I think we are here to help these companies. We helped Shell a lot in helping them bring down their carbon emissions. For example, in 2021, during the Chinese New Year period, when their factories were vacant and not in production mode, we did a measurement and compared it against factory emissions in the same period the year before. Year on year, energy consumption and emissions went down significantly.

One of our other customers is a large cosmetic company. I cannot mention its name, but it is a very well-known brand. We installed devices and our software to help them optimise their processes, and data proves that both their direct and indirect emissions have gone down.

Many of our clients who are heavy emitters, are actually employing the most sophisticated methods for emissions reductions. Sometimes they are the ones teaching us about the industry, so I give them credit for that. I am also sympathetic because often it is not that the companies do not want to disclose data. It is simply that they do not have the data or do not know how to collect it.

The enhanced scrutiny on corporate greenwashing, in a way, has also propelled the ESG intelligence business. Corporates and financial institutions are rushing to get more concrete data. They are starting to realise that real climate action is not only about making pledges or setting some goals, and have sped up the adoption of sustainability solutions. You have to substantiate your claims with data, otherwise the most ambitious climate claims ring hollow.

MioTech was founded in Hong Kong and is active in the China ESG market. What is your assessment of the ESG landscape in Greater China right now? How does it compare with Southeast Asia?

We work with global companies, but for us, Greater China is an important economy and a supply chain hub that powers the whole globe. In China, because of its sheer size and centralisation in decision-making, the regulator is more cautious when it rolls out policy so ESG is moving more slowly on this front, but from the business perspective, ESG is seeing a boom. Southeast Asia is also a huge region, but contrary to China, each market has its own culture, so we are seeing fragmentation. Even when we hire, language becomes a challenge. However, what is good is that there can be early adopters and not all countries have to move at the same time. We can tackle them one by one, and I believe in no time the revenue that we generate from Southeast Asia is going to match up to what we generate in China. We are trying to transplant and borrow from the successful model that we have built in Greater China, which includes the strategy of trying to engage key financial institutions first, before we crack the corporate market.

“

Another effect that the Russia-Ukraine crisis has had on Chinese companies is that all of them now want to secure their position in the global supply chain. This has pushed ESG adoption and their focus on sustainability high up on the agenda.

In China, key institutions like the China Securities Regulation Commission (CSRC) and the China Banking and Insurance Regulatory Commission (CBIRC) have made disclosures in the finance sector mandatory. ESG disclosure standards are also being rolled out for the corporate sector, though this is still voluntary. I believe the ESG sector in Greater China is much more vibrant in Southeast Asia. Here, we are talking to the Singapore Exchange (SGX), the Thai Exchange as well as Malaysia’s exchange Bursa, and their trade volume combined is still a lot smaller than the Hong Kong exchange’s, so we need to have a different market entry strategy, where we try to engage more commercial banks and corporate lenders, since the debt market here is big.

China’s goal of carbon neutrality by 2060 appears to be on track, but at the same time, it is doubling down on coal amid energy security concerns and the recent Russia-Ukraine crisis, and observers are worried that this could be a setback for its efforts to cut emissions. What is your sense of the situation right now?

I believe the Chinese companies are still fully committed. The Russia-Ukraine crisis does have a short-term impact on China when it comes to the adoption of clean energy, but in the long run, the trend to accelerate renewables adoption is here to stay. What is happening now is that the country needs to meet its energy demands first to solve its near-term problems.

Another effect that the Russia-Ukraine crisis has had on Chinese companies is that all of them now want to secure their position in the global supply chain. This has pushed ESG adoption and their focus on sustainability high up the agenda.

Broadly speaking, what are some of your philosophical beliefs when it comes to the benefits of AI? At the end of the day, we want to see it being applied to bring about real changes that will help us avert the climate crisis. What do you think AI brings to the picture?

We are an AI-driven technology company working on sustainability, but to be honest, I do not believe that AI is the Holy Grail. AI is indeed a very strong and empowering tool. It can help companies in collecting and cleaning up ESG data. It also has predictive capabilities that can help with risk evaluation and decision-making. But it cannot and should not replace human beings and all other efforts to expedite climate action. For example, there are a variety of standards out there, both global and local, that still affect the organisation of data for us. There are also different ways to rate and benchmark a company’s ESG performance. The industry is very new and it requires clear regulation to work its magic.

You spoke about expanding MioTech’s corporate clientele in Southeast Asia. When MioTech first started, the demand for its services mainly came from financial institutions. About 80 per cent of the demand was from these institutions, and 20 per cent were from corporates. Has there already been a shift?

We are now at the midpoint of the year, and the mid-year data will be presented to me soon. I believe this year, for the first time in our company history, we will have more corporate clients than financial institution clients. Many of these clients are working with us on ESG disclosure, carbon emissions reduction and certification for carbon emissions credits.

Having said that, financial institutions are the core of our business and we value them tremendously. Why do I say so? Because to be very honest, only a very small and selected portion of our corporate clients are now working with us voluntarily because they genuinely want to improve their sustainability efforts. The majority are working with us for two reasons: either their investors are asking them to do so, or their customers are demanding more disclosures. Ultimately it is the finance sector that will drive the adoption of sustainability initiatives in the real economy. Bigger multinationals and brands with more clout and influence, also need to be at the forefront.

MioTech was recently in the news for tapping Pinduoduo’s former finance head Tian Xu as its new chief operating officer to get ‘IPO ready’. What next for the company after setting up its Singapore office?

The appointment of Tian was strategic as he is helping to take care of many of my responsibilities, so that I can focus on the expansion into Southeast Asia. It is why I am here. He is taking care of the MioTech family while I come out to do business.

Other than Tian, I am also hiring a large number of top executives. We have appointed Thomas Yap, former head of Greater China at global data visualisation company Tableau, as our new general manager of Southeast Asia. He brings a wealth of experience in data and analytics and he is familiar with Singapore and the region. We now have more than 300 people on our team, including 20 in the Singapore office, and we are looking to double that headcount by next year to 50.

Our first priority for this year is growth. It has been a good year, and we would like to focus on building a stronger partnership network here. We are not in need of cash, because we have bagged funding and so have plenty of ‘ammunition’ right now. The key is execution. We need to start building an ecosystem and get the foundations right.

This interview has been edited for clarity and brevity.