The demand for transparent sustainable and socially responsible practices is on the rise. This is because stakeholders, such as investors, customers, employees and regulators, want to have information on a company’s impact on the world. Environmental, Social and Governance (ESG) analysis can provide valuable insights and have a significant impact on the financial metrics of a company, and hence influence investment decisions.

However, collecting, measuring and reporting these non-financial data can be complicated and time-consuming. First, high-quality data might be hard to collect, as this data tends to be decentralised, wide-reaching and unverifiable. It comes from different departments and suppliers, in different formats. Second, due to the lack of standardised ESG disclosure obligations, businesses might find it difficult to choose which different templates and standards to report on their ESG activities.

To meet these challenges, there is a rapidly growing industry of ESG data management and reporting software to help companies capture, record, analyse and report such data across portfolios. In the United States, the software industry within the ESG sector is expected to reach $571.74 million by 2028, according to a new market research study.

Here are the three main ways ESG software can help companies on their sustainability journey.

Data gathering: ESG software can help companies to gather ESG data in one place

An ESG platform can act as a centralised repository for companies to manage their ESG-related data and tasks. It provides consistent historical data that allows for companies to monitor their ESG growth and streamlines the auditing process.

On such a system, data collection is automated and a company’s sustainability team needs to spend less time and resources manually chasing down data. Moreover, the contributors, reviewers and approvers of such data are transparent and traceable, making for a trustworthy and secure system.

What is ESG Reporting?

ESG reporting refers to the disclosure of reporting in Environmental, Social and Governance areas of a company.

E: The environmental part consists of how the company uses their resources across the board, taking into account energy efficiency, climate change, carbon emissions, biodiversity, air and water quality, deforestation and so forth.

S: Social criteria include company culture, such as gender diversity, labour standards and employee engagement.

G: Governance considers a company’s internal systems – controls, practices and procedures – and its leadership, anti-corruption policies. Companies need to ensure transparency and industry best practices, which includes dialogues with regulators, customers and stakeholders.

Integrated data and software platforms such as ServiceNow’s ESG Management (ESGM) solution simplify and streamline the collection of ESG data and automates it for internal audiences and for external disclosure requirements.

Such software can be especially helpful for companies from “traditional” industries such as manufacturing, oil and gas, whose data collecting can be slow and unreliable without a central automation system, says Gaurav Mahendru, senior manager of solutions consulting at ServiceNow.

“When they need to look up the diversity ratio within their organisation, responsible procurement, resource planning, customer satisfaction scores or even manage their utility bills, they find that there is a delay if they collate their data via manual methods,” he says.

If they have a central ESG management framework into which such data is naturally entered and kept track of, the reporting process can be streamlined, and they can better communicate ESG performance to external and internal stakeholders. It also lends a sound foundation to their decarbonisation aims, like going net-zero, and eventually help them get access to capital markets and secure their licence to operate.

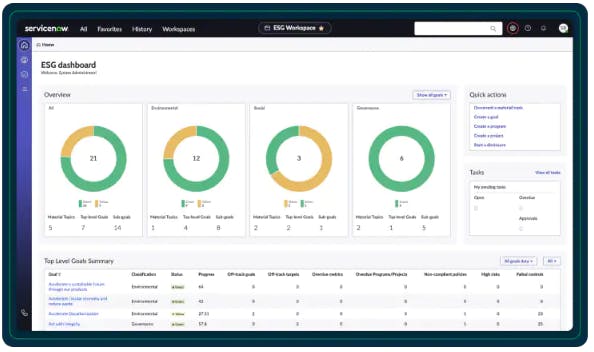

ESG management software can help companies to visualise their ESG data and consolidate it for mandatory or voluntary disclosures. Image: ServiceNow.

Reporting: ESG platforms can switch between sustainability frameworks and audiences

As there is no global agreement on disclosures, there is a wide range of standards and frameworks, such as The Global Reporting Initiative (GRI), The Sustainability Accounting Standards Board’s (SASB) standards and The Task Force on Climate-related Financial Disclosures (TCFD).

To help companies keep track of disclosure requirements, ESG software can monitor major sustainability frameworks and standards, and ensure that the platform is updated. Some solutions can integrate data metrics across multiple standards, so that the company can see their progress against different frameworks and generate specific reports if needed. The multi-standard switchability also ensures that the company has a consistent ESG narrative across all disclosure frameworks.

Finally, ESG platforms can be automated and customised for the different audiences they’re looking to present their data to – not just their internal audiences, such as boards or stakeholders, but also for the external disclosures they might need to make.

Operations: Data-driven insights to guide business

Data is a crucial part of business intelligence. Effective ESG software can transform data into valuable insights, such as industry benchmarking, allowing for detailed comparison among related companies. Credible, high-quality data can also allow companies to identify disclosure or management gaps, and hence guide ESG strategy and shift operations where necessary.

Certain ESG platforms provide further convenience as they can be integrated with other applications and software, such as in human resources and customer service, so that ESG strategy can be integrated into other company processes, such as sourcing, planning and waste disposal.

ServiceNow’s Gaurav Mahendru gives the example of a large pharmaceutical company wanting to prioritise sourcing from sustainable vendors. Using ServiceNow’s ESG solution, the company can connect with another ServiceNow solutions for evaluating vendor risk and identify the most environmentally friendly vendors.

The road ahead: more mandatory disclosures, not less

While most current ESG disclosure frameworks are voluntary, the trend is that the world is moving towards standardisation and mandatory disclosure. The EU has introduced more stringent regulations in recent years. For example, it introduced the new Sustainable Finance Disclosure Regulation in March this year, which requires financial market participants to disclose 18 mandatory indicators and another two of 46 optional indicators.

Moreover, the International Sustainability Standards Board (ISSB) announced in October this year that reporting companies are now required to disclose their Scope 3 greenhouse gas emissions. Scope 3 emissions encompass those that are not produced by the company themselves, and are not the result of activities or assets owned by the company, but by those responsible up and down the value chain.

In a climate-conscious business environment where ESG disclosure requirements are getting stricter, efficient and credible data management will be increasingly crucial, and companies can leverage on technological solutions to support them on their ESG journey.