Cities across the world will need to invest some US$57 trillion in infrastructure from now till 2030 to cater to their growing populations and maintain economic growth.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Faced with increasing climate change challenges, it is ever more important for these cities to be investing into sustainable, climate-resilient projects, said a new report launched by technology giant Siemens, banking firm Citi and non-profit C40 on Tuesday.

Titled “New Perspectives on Climate Finance for Cities”, the document outlines ways in which cities can tap into financial markets to fund climate change projects. It also highlights successful case studies from around the globe.

At the report’s launch on the sidelines of the World Cities Summit at Marina Bay Sands in Singapore, Seth Schulz, C40’s director of research, management and planning, noted that following the historic Paris Agreement on climate change inked last December by the world’s nations, “we must now take bold action to protect our planet for future generations”.

“The only way to do this is dramatically increasing climate financing and attracting more investments,” said Schulz. “By providing an introduction for cities seeking to understand climate finance options, this report is a first step in that direction”.

The study identifies possible routes for supporting climate-related projects and programmes, including bonds, where the market in labeled green bonds has risen substantially from US$0.8 billion in 2007 to US$42 billion in 2015.

Schulz added that “there’s a lot of money out there… and a lot of (infrastructure) projects, but they’re not connecting.”

Research by C40, a network of the world’s megacities committed to addressing climate change, showed that only 4 per cent of cities have a credit rating to access international financial markets. To address this, C40 has started an initiative with the World Bank to help cities boost their credit worthiness, said Schulz.

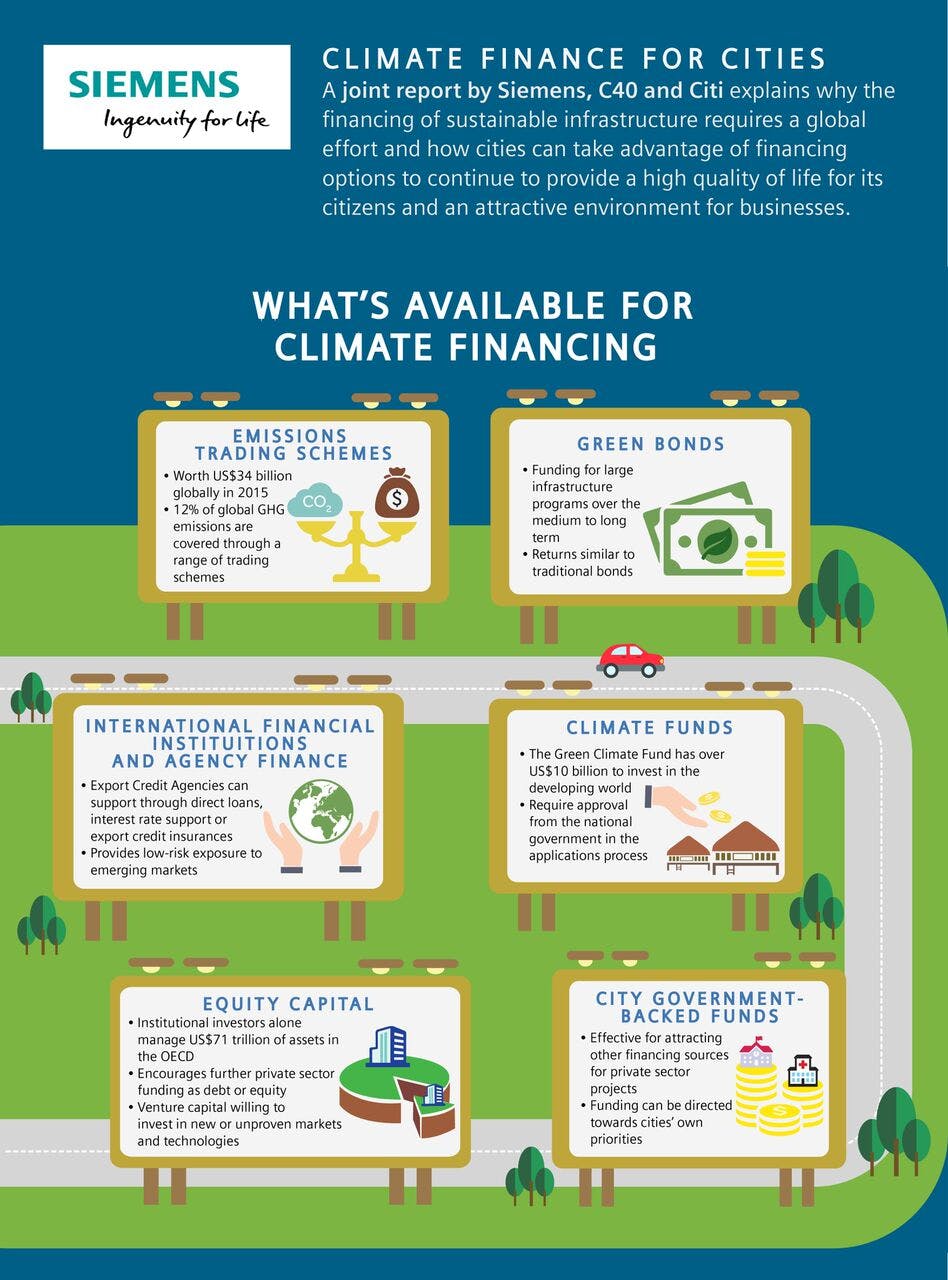

The report will also help cities get the funding they need. It recommends six innovative financing mechanisms – and likely finance providers - for mobilising investment for cities and looks at the benefits and challenges of each approach.

These mechanisms include emission trading schemes; green bonds; international financial institutions; international and regional climate funds; city government-backed funds; and equity capital.

The report’s authors said different approaches to financing infrastructure projects will have different complexity levels across all factors. To help city leaders manage this complexity, the report introduced a risk matrix which shows the challenges that need to be considered and overcome in order to realise these new approaches.

Kenneth Hsi Jung Koo from Citi Orient Securities said that for city planners, “the key is to understand and embrace new approaches to infrastructure and devise enabling financing solutions that will benefit each city according to its specific needs and economic situation.”

The scaling up of climate finance will require national governments to create conducive strategies, policies, and regulatory frameworks to allow public-private collaborations, noted C40.

Martin Powell, head of urban development at Siemens Global Center of Competence for Cities, acknowledged that for most mayors worrying about basic services such as housing and waste management, financing climate change projects is “quite a hard sell”.

Nevertheless, it is important for them to take the time to figure out which projects will best serve the cities and which are most likely to be successful, said Powell, who was previously the Mayoral Advisor on the Environment to the Mayor of London, Boris Johnson.

Underscoring the importance of partnerships, Powell said this joint report is a “spring board for urgently-needed financing solutions and captures the synergistic efforts of the most innovative climate actions taken by cities around the world.”