Ahead of the COP28 climate conference in Dubai, oil majors are facing mounting scrutiny over how their business models still remain wedded to a future of ever more demand for fossil fuels.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Among many of the sector’s controversial practices, a process that uses trapped carbon dioxide from industrial processes to extract more oil, known as enhanced oil recovery (EOR), has been criticised most, especially as oil and gas companies are talking up their green credentials with their efforts to develop carbon capture technologies.

In Southeast Asia, EOR practices are gaining traction, though Exxon has gone on the record to say that its latest deals in the region – specifically in Indonesia and Malaysia where it has been bullish about carbon capture and storage (CCS) projects – are not focused on EOR.

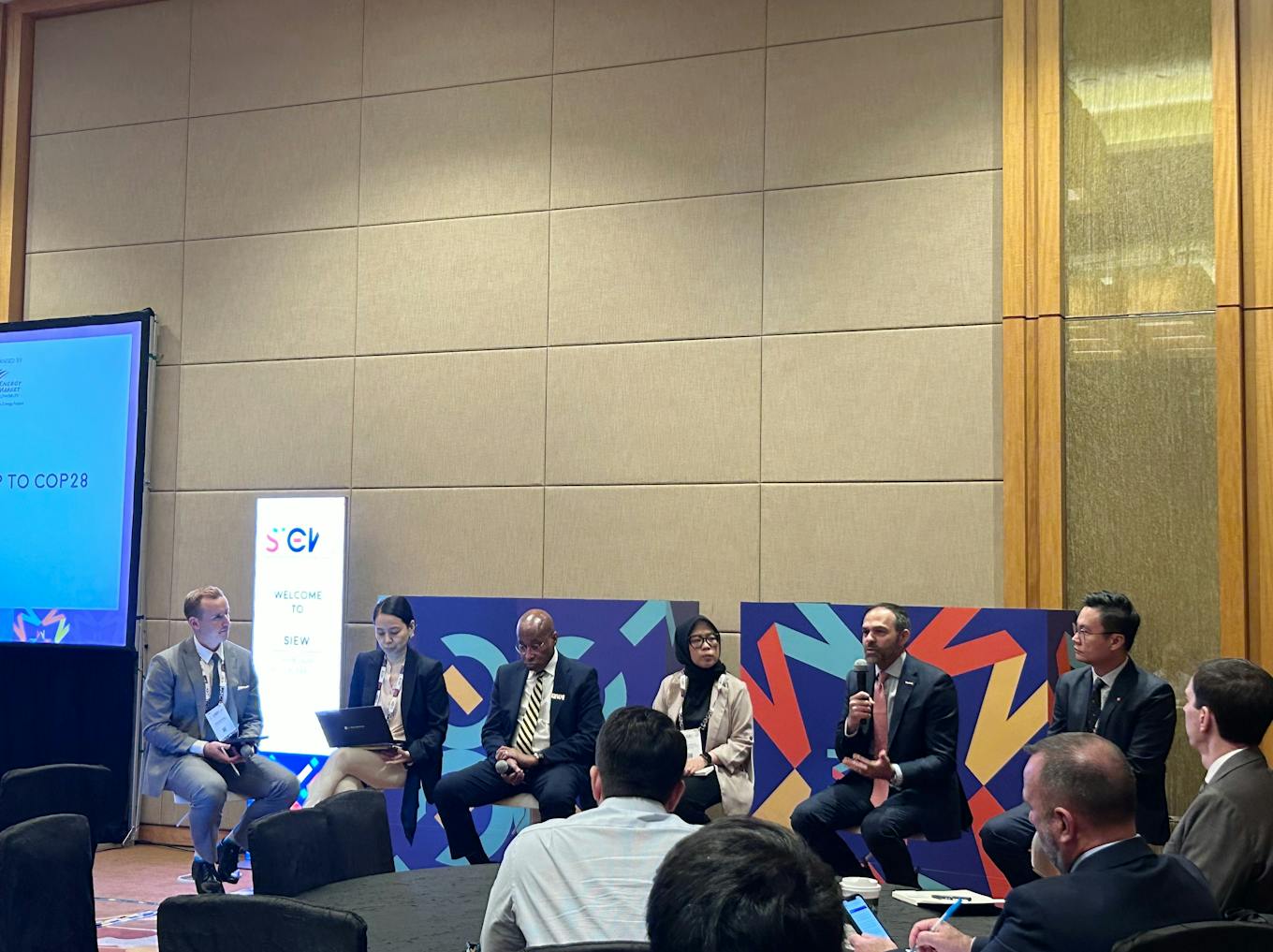

At a panel discussion hosted by American international affairs think tank Atlantic Council and Japan’s Institute of Energy Economics (IEE) at the Singapore International Energy Week, Irtiza Sayyed, president of ExxonMobil’s low carbon solutions unit in Asia Pacific, said that EOR has not “worked economically” and that the company’s conversations in Southeast Asia are “purely about CCS”. Its use of CCS in Southeast Asia is similar to its approach in the United States, he said.

What is Enhanced Oil Recovery?

Enhanced oil recovery, or EOR, is a process in which carbon dioxide is injected into existing oil field, usually mature ones that have ceased to be productive, to recover more oil.

It is usually the last stage in a three-stage process when oil is removed from a well. In this final stage, when CO2 is injected, it mixes with the oil, expands and propels the oil toward the surface. EOR currently accounts for around 4 per cent of oil production in the United States.

“Frankly, EOR is a nice idea but it doesn’t quite work commercially, nor does it work technically, particularly in Asia where there needs to be cross-border cooperation on carbon dioxide transport and sequestration,” he said.

“We are focused on carbon capture for storage, and not for use.”

Irtiza was responding to a query from Eco-Business about the safeguards that Exxon is putting in place to ensure that its CCS partnerships in Southeast Asia will ultimately lead to emissions reductions, amid allegations that oil giants are using carbon capture projects to prolong the fossil fuel era.

“

Enhanced oil recovery is a nice idea but it doesn’t quite work commercially nor does it work technically, particularly in Asia where there needs to be cross-border cooperation on carbon dioxide transport and sequestration.

Irtiza Sayyed, president, Asia Pacific, low carbon solutions, ExxonMobil

His comments come a week after the Washington Post ran a scathing report on how the lion’s share of CO2 captured by oil companies does not go back into the ground, but is used to extract more oil – a practice that the publication said is supported financially by the US government.

Missing ingredients for Southeast Asia’s CCS ambitions

Elaborating on EOR, Irtiza said that for the process to work, an emissions source needs to be linked directly to the recovery location, and this would not be technically feasible in Asia.

“If you are capturing CO2 across the border, say in Japan, then intending to bring it to Indonesia for storage, that is going to be a two-point system that is going to be costly. For EOR processes, it is best to do it in one place, safely. You would not want to ship the sequestered CO2,” he said.

The presence of a high number of depleted oil and gas reservoirs makes Indonesia and Malaysia potential hubs for the safe and permanent storage of carbon. Last November, Exxon signed an agreement with Indonesian state oil and gas company Pertamina to jointly develop a carbon storage hub; in January this year, it also inked a deal with Malaysian oil and gas firm Petronas to develop CCS projects.

ExxonMobil Asia executive Irtiza Sayyed (second from right) speaking on a panel at the Singapore International Energy Week. Irtiza believes that resolving the issue of how to finance decarbonisation value chains should be the priority of the COP28 climate summit. Image: Ng Wai Mun / Eco-Business

However, Irtiza said that for Asia’s potential CCS hubs to take off, beyond the right technical solutions, enabling policies that align and channel financing from economies like Singapore, South Korea and Japan to countries like Indonesia and Malaysia would be key.

“Money has to come from somewhere, and the (lack of a) payment mechanism is where the real challenge is. For emerging economies like Indonesia and Malaysia, financially supporting CCS projects can become quite taxing and burdensome,” he said, adding that these countries also do not yet have in place a carbon tax policy to price carbon properly. “In my conversations with the various heads of states, it is not something that they are prepared to take on.”

On the other hand, Irtiza said countries like Singapore are not endowed with the space needed to store carbon, so they are reliant on their neighbours.

Irtiza, a trained engineer who joined ExxonMobil with a primary responsibility to develop its traditional oil and gas business, also spoke about Exxon’s decarbonisation strategies, which unlike its peers, do not lean towards renewable energy like solar and wind, but are focused on reducing carbon emissions from its own operations, betting on three areas – CCS, hydrogen and biofuels – which it says are more closely aligned with its expertise and experience in the oil and gas business.

“A question I get asked quite often is why Exxon isn’t investing in wind and solar,” he said. “We have analysed all the technologies, everything under the sun, and realised where we can bring something different and unique to the table in terms of technological differentiation are the areas we are focusing on now.”

This year, Exxon promised that it will inject billions of dollars into this new “low carbon” business line. Critics, however, say that its investments into lower-emissions technologies are only about 10 per cent of its overall spending over five years, and that the shift is more about taking advantage of the Joe Biden administration’s flagship climate law, the Inflation Reduction Act, which includes generous subsidies for a range of green technologies.

Exxon also plans to expand its oil and gas production by 3 per cent a year through to 2027, setting it apart from its European rivals that say they are holding output steady or letting it decline.

In the United States, Exxon is growing a portfolio of CSS projects along the Texas and Louisiana Gulf Coast. Irtiza highlights three projects, which include partnerships with fertiliser maker CF Industries, steelmaker Nucor and multinational chemical company Linde. Irtiza did not mention, however, that Exxon also bought carbon capture and exploration company Denbury, an enhanced oil recovery specialist, in a US$4.9 billion deal in July this year.

‘Service models’ beyond JETP

At the roundtable event, the Atlantic Council, along with Boston Consulting Group, also presented ideas on how to crack the clean energy transition problem in Southeast Asia. So far, Just Energy Transition Partnership (JETP) deals led by US and Japan in Indonesia and Vietnam, though signed with well-meaning intentions to raise climate ambitions, have stalled, partly due to political complexities.

On the other hand, in Southeast Asia, Chinese companies are already “taking the share” when it comes to their stakes in clean energy projects “because of their ability to take the risks” associated with working in a more uncertain policy landscape, said Marko Lackovic, managing director and partner of BCG Singapore, who consults on energy, climate and sustainability.

“The opportunities in Southeast Asia are fragmented … despite the region’s clean energy potential, insufficient capital, trading barriers and monopolies are creating challenges for US exports,” he said.

BCG and Atlantic Council are looking into how the US can provide “additional service models” beyond JETP that combines technical expertise with low cost financing, and where the issue of risk averseness among US investors when putting capital in Southeast Asia can be resolved.