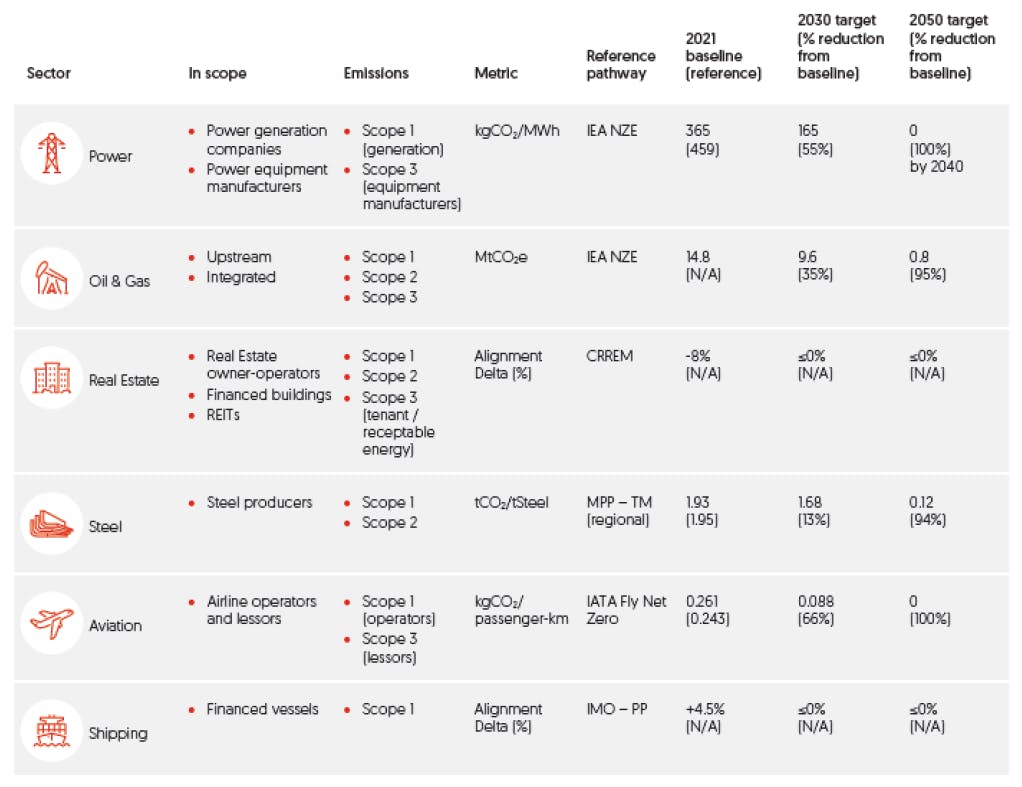

Southeast Asia’s second largest bank, Oversea-Chinese Banking Corporation (OCBC), has announced its interim and 2050 decarbonisation targets for six sectors, including power, oil and gas, real estate, steel, aviation and shipping.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

These targets cover 42 per cent of the bank’s corporate and commercial banking loan portfolio, which surpasses the portfolio coverage of regional rival DBS’s sector-specific targets of 31 per cent, while lagging behind United Overseas Bank’s (UOB) scope of 60 per cent.

OCBC’s sectoral decarbonisation targets come seven months after joining the Net-Zero Banking Alliance (NZBA) last October, a United Nations-convened intiative for banks to decarbonise the real economy.

“Our sectoral net-zero targets are ambitious, quantitative and grounded in science. We will partner our corporate clients to meaningfully contribute to a net-zero Asean [Association of Southeast Asian Nations] and Greater China by 2050 in an orderly and just transition,” said OCBC Bank group chief executive Helen Wong on 16 May.

OCBC’s decarbonisation targets cover 42 per cent of the bank’s corporate and commercial banking loan portfolio. From left: Tan Teck Long, head of global wholesale banking; Helen Wong, group chief executive officer; and Mike Ng, head of global wholesale banking sustainability office. Image: OCBC

On top of reducing absolute emissions for the oil and gas sector by 35 per cent by 2030, the Singapore-based lender has pledged to cease project financing to upstream oil and gas projects approved for development after 2021 – a year ahead of the commitment made by local counterpart UOB last year.

The bank has reduced its financing for upstream oil and gas projects to “an immaterial amount” even before this new announcement, said OCBC head of global wholesale banking Tan Teck Long.

In response to a media query about its approach to financing potentially controversial projects, Tan clarified that OCBC has “a system of escalation” for decarbonisation-related risks when assessing “complex” projects, such as a buyout of coal-fired power plants for early retirement, that would affect the bank’s stated net-zero ambitions.

OCBC’s decarbonisation targets by sector. Source: Partnering Clients towards a Net Zero ASEAN and Greater China

OCBC was the first bank in Southeast Asia to make a commitment to halt financing new coal-fired power plants (CFPPs) in 2019, which expanded to thermal coal mines in 2020. In 2022, these prohibitions were extended to clients with more than 50 per cent of their total power generation capacity or revenue coming from CFPPs, as well as those with more than 50 per cent of their mines or revenues coming from thermal coal mines.

Binbin Mariana, an Asia energy finance senior campaigner with environmental group Market Forces, said that while OCBC’s new oil and gas targets and policies put it ahead of many Asian banks, including Japanese megabanks, MUFG, SMBC, and Mizuho, it remains “unclear” how these targets will be met without further restrictions on financing corporations expanding fossil fuels.

“OCBC’s recent loans to coal companies Harum Energy and Kestrel Coal Resources and to Indonesian oil giant Pertamina, which all have expansion plans, puts the bank’s net zero commitments at risk,” she warned.

While OCBC was not the subject of a recent human rights complaint against 12 international banks involved in the US$1 billion loan for Australian energy company Santos’ Barossa natural gas project, which included DBS, it is “very concerning” that the bank had co-financed the floating production storage and offloading vessel for the project, said Mariana.

Tan said that OCBC will only consider phasing out a relationship with a customer “as a last resort” if the client refuses to be part of the bank’s transition journey. Most – if not all – of the customers that OCBC has spoken to have sustainability on their agenda, he said.

Last but not least?

Despite OCBC being the last major Singapore bank to disclose specific sectoral net-zero targets, the early disclosure itself – which comes just seven months after joining the NZBA and almost a year ahead of the required deadline – should be taken as “a positive sign”, said Kurt Metzger, director of the energy transition programme at sustainability consultancy Asia Research and Engagement (ARE).

However, Mariana hopes to see improvement in the bank’s midstream oil and gas targets, which include storage, transport and pipelines, as well as its policies around financing the expansion of fossil fuels.

While OCBC did not disclose the exact size of its renewables portfolio, when probed, the bank’s head of global wholesale banking sustainability office Mike Ng estimated it to be “multiples” of its coal portfolio, given that the bank started looking at renewable energy projects globally about four years ago.

With regard to OCBC’s sustainable finance portfolio, Ng said it has been growing at a faster rate year-on-year compared to its loan book. The bank’s sustainable finance portfolio amounted to SG$47 billion (US$35 billion) as of March, making the bank on track to meet its target of SG$50 billion (US$37 billion) by 2025. This committed amount represents 11 per cent of the bank’s total loan book, which Ng said is “on the higher end of the range” compared to some other banks that have disclosed this number.

With the newly announced targets, Ng expects a lot more sustainable financing to be provided to OCBC’s clients as they embark on their net-zero transition journeys.