Hãy đọc câu chuyện này bằng tiếng Việt.

A key piece of legislation seven years in the making, Vietnam is to allow large businesses to buy renewable electricity directly from power generators, raising expectations for green energy growth in the country.

A portion of Vietnam’s electricity market was opened to private-sector deals last week, ending an effective monopoly by its state-owned utility as the sole electricity distributor. It is a move championed by businesses as crucial to the unfettered growth of clean energy and achieving decarbonisation goals.

Green power providers now have two new options to sell their electricity. They can either arrange to run power lines directly to industrial customers, or have the buyers pay for parcels of electricity they send into the national grid. Solar, wind, hydro, biomass, tidal and geothermal players are among those eligible to enter such arrangements.

The new regulations for direct power purchase agreements – DPPAs – mark “a pivotal moment” for Vietnam’s renewable energy sector, and allow companies to help with the country’s decarbonisation goals while meeting their own renewable energy targets, said Suji Kang, programme director of the Asia Clean Energy Coalition, a group of power producers and large firms including Apple and Samsung Electronics that have factories in Vietnam.

“Vietnam now stands as one of the leaders in the region in the energy transition journey,” said Mark Hutchinson, who heads the Southeast Asia task force at the Global Wind Energy Council, a wind energy lobby group.

New investments are also starting to flow on the back of the announcement. Nami Distributed Energy, a solar power developer in Vietnam, announced a US$10 million investment with Singapore-based Clime Capital through a blended finance scheme.

“We are quite excited, we are already getting inquiries from our industrial customers on how to move faster on installations,” said Luu Hoang Ha, chairman of Nami Distributed Energy, commenting on the momentum after the DPPA regulation was published.

In a win for factory rooftop solar players, they will be allowed to sell excess electricity back to the grid via agreements with national utility Vietnam Electricity (EVN), a welcome change from past regulations.

“For example, when factories are closed on Sundays, neighbouring residential areas will still need electricity. If you can send power to the grid at a low price for nearby residents, it is good for everyone,” Ha said.

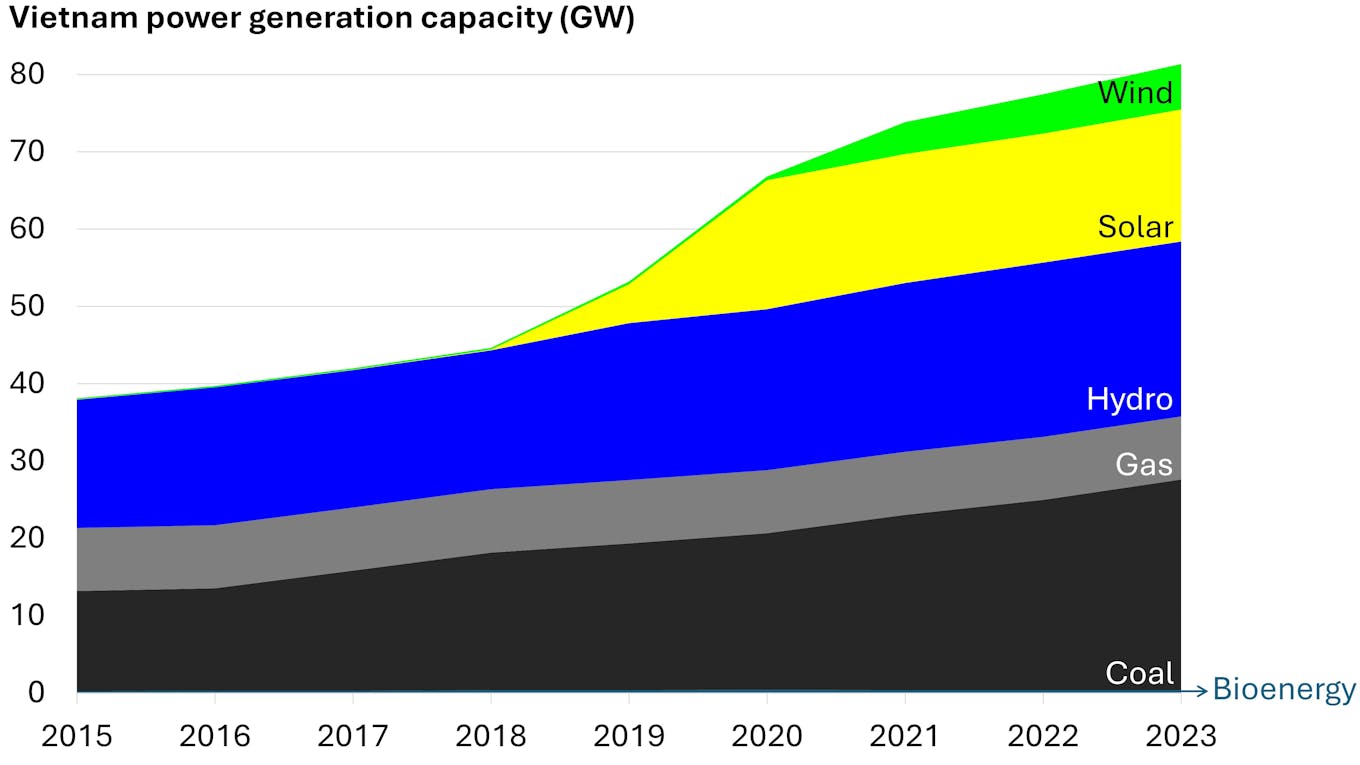

Vietnam’s power generation capacity mix. Data: Ember.

Renewables players in Vietnam have seen their fortunes change considerably over the years. Generous government support between 2018 and 2021 have led to a massive buildout in those years. Today, Vietnam is home to over two-thirds of Southeast Asia’s 34 gigawatts of solar and wind capacity, according to analyst Ember.

However, an extended regulatory void had followed, where developers struggled to sell their electricity even if their photovoltaics and turbines had already been installed. Some firms had put projects on hold and made redundancies.

The sector had been caught up in a corruption crackdown, where officials in charge of spearheading Vietnam’s renewables drive were blamed for licensing and certification violations in new developments, while allowing green power capacity to exceed official targets by more than three times.

Progress has sped up since last year. Vietnam’s energy development plan for the decade, PDP8, which locked in green power capacity targets, was finalised. The latest DPPA regulation is widely seen as the latter of two major policy moves to get renewable energy development in the country back on track.

The DPPA law has undergone several revisions since the first draft was released in June 2019, which had envisioned only the trading of green power through the national grid, without the option for new private power lines.

The law had not gained momentum until Vietnam made its 2050 net-zero emissions pledge in 2021, and then had to contend with grid stability issues as renewable power capacity rose quickly during that period, noted Nguyen Lan Phuong, a partner at law firm Baker McKenzie.

“Now the conditions for DPPA are ripe: the PDP8 has laid out the framework for renewable energy generation and distribution, while private parties are ready to participate in the green energy market,” Nguyen said.

In the finalised policy, more buyers have been allowed to participate, with a requirement for their monthly power consumption dropped from 500 to 200 megawatt-hours.

Parties keen on installing private power lines are given wide leeway to settle their own financial and technical terms. Those preferring to trade through the national grid will need to abide by more rules – such as power producers having at least 10 megawatts of capacity, and keeping within certain zones.

There remain concerns over whether Vietnam’s power grid can handle a new influx of intermittent solar and wind power. Load swings in past years had forced regulators to pull the plug on generators even when the sun was shining and wind was blowing, leading to financial losses.

“Investing in grid infrastructure is essential to handle the increased load from renewable sources and ensure stability and efficiency in energy distribution,” said Dr Miguel Ferrer, chief executive for renewables at Vietnam-based technology firm VIoT Group.

Ha from Nami Distributed Energy said he hopes the government will introduce incentives to deploy battery storage facilities, which can help smooth out sudden peaks and troughs in wind or solar power generation.

The latest DPPA decree only provides for “high-level regulations”, Nguyen said, with Vietnam’s industry and trade ministry having to follow up with the implementing details, which likely entail balancing acts on managing grid capacity and figuring an optimal level of state control.

Vietnam’s DPPA law comes as the country terminated the development of a new US$3 billion, 2.1 gigawatt coal-fired power plant. Beyond missing project deadlines, the development had also been criticised as not in keeping with the country’s target of achieving net-zero power sector emissions by 2050. A third of Vietnam’s current power capacity comes from coal, with another 10 per cent from natural gas.

The country has a US$15.5 billion deal with wealthy countries and financiers to cut energy-sector greenhouse gas emissions and switch to renewable electricity. Vietnam has said its immediate priorities are facilitating developments in grid upgrades, energy storage and offshore wind.