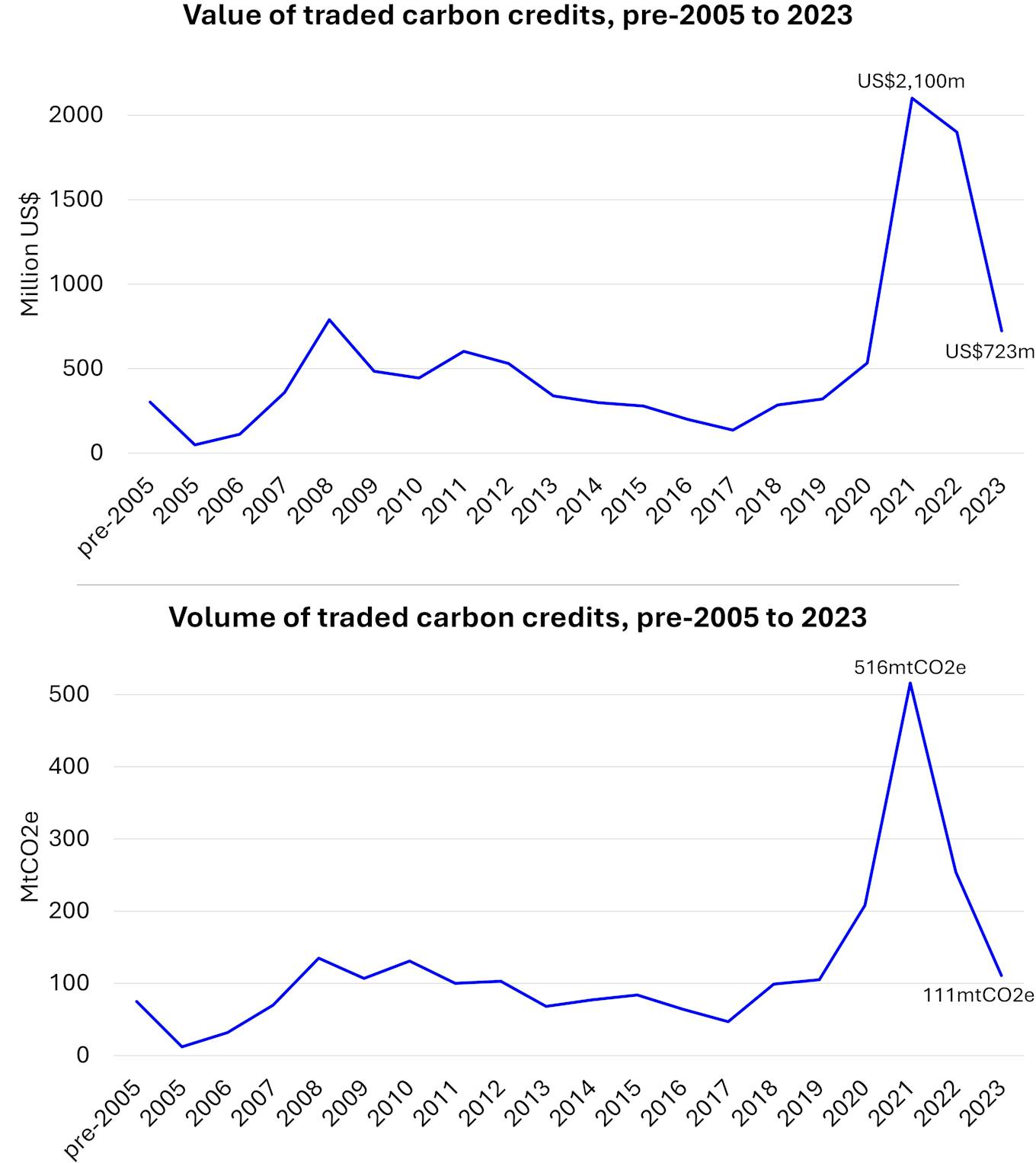

The global carbon offsetting business recorded yet another retraction in 2023, with its value plunging to US$723 million from the 2021 high of US$2.1 billion, while trade fell by almost five times over the same period.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

The data by analyst Ecosystem Marketplace reveals the extent of investor pullback from the troubled sector in recent years. The US$1.1 billion drop in market value from 2022 is the largest annual fall ever registered.

The average price of carbon credits fell slightly to US$6.53 a piece, but remains higher than the years before 2022. Businesses buy such credits – each representing a tonne of carbon dioxide saved from efforts such as protecting forests and installing clean energy – to offset their own carbon footprint.

Value and volume of traded carbon credits have fallen sharply since the 2021 spike. Data: Ecosystem Marketplace.

Media reports that carbon credits do not live up to their environmental credentials, and that trade is badly managed, are said to have cast a pall over the industry, keeping buyers away and vexing project developers with complex due diligence requirements.

Key allegations in recent years include that Verra, the industry’s biggest offsets verifier, has allowed project developers to oversell carbon credits. A similar overissuance accusation was levelled at a giant forest project in Zimbabwe linked to project developer South Pole.

Verra, which has a roughly 70 per cent market share, saw its transaction volume fall 64 per cent from 158 million credits in 2022 to 56.2 million in 2023. Total trade value fell 70 per cent.

“We see the market in a state of transition. While transaction volumes are falling, it is more of a return to a level that we saw before 2021,” said report author Alex Procton.

Dee Lawrence, founder and director at United States charity High Tide Foundation, said it was frustrating to see US$1.1 billion in finance for climate mitigation “evaporate” compared to the year prior.

“To put it bluntly, our global climate targets just got a little farther out of reach,” Lawrence said.

Data: Ecosystem Marketplace.

The market plunge was felt unevenly across project types. Forest and renewable energy initiatives, the two largest segments, recorded both volume and value drops of around 70 per cent year-on-year.

In recent years, most of the angst has been levelled at forest conservation, or “REDD+”, projects, with naysayers claiming these ventures create distorted scenarios of avoided deforestation to generate large volumes of carbon credits.

REDD+ projects lost 62 per cent of their value year-on-year while trade volume fell 51 per cent.

One positive market trend was a price increase for carbon credits from tree-planting initiatives, along with higher trading volume in the categories of household and community devices – usually clean-burning cookstoves – and energy efficiency upgrades.

Asia and Latin America, the two largest sources of carbon projects, especially for REDD+ initiatives, were also hit the hardest. Asian carbon projects experienced plunges of 78 per cent in volume and 83 per cent in value. Latin America figures were down 72 per cent for both categories.

Ecosystem Marketplace said corporate offsetters have already become more discerning. For instance, carbon credits from projects offering co-benefits to biodiversity and local communities fetched a higher average price of over US$8 a piece, compared to under US$6 for those without – though the market size of the latter is twice as big.

The minority of projects that remove carbon dioxide from the atmosphere, such as via reforestation or engineered direct air capture of the greenhouse gas, also attracted a much higher selling price of almost US$16 a piece, compared to about US$4.60 for the usual emissions avoidance initiatives in energy efficiency or avoided deforestation.

Project developers appear to be banking on market recovery, with almost 700 new registrations to carbon credit verifiers, a climb from both 2021 and 2022 but still markedly lower than around 1,300 in 2020.

Industry integrity efforts are expected to start soothing investor anxiety. Last year, the Voluntary Carbon Markets Integrity initiative released a guide on how firms can responsibly use carbon credits. Sister group Integrity Council for the Voluntary Carbon Market has ruled on which carbon credit certifiers it considers trustworthy.

But the world remains sceptical of the offsetting business, seen from the outcry when climate goals checker Science Based Targets Initiative floated the idea that carbon credits can be used to cancel out companies’ indirect value chain emissions.