Downstream coal projects in Indonesia need a government subsidy of at least US$354 per tonne of dimethyl ether (DME) fuel to maintain a profit margin, according to the latest calculations by the Institute for Energy Economics and Financial Analysis (IEEFA).

The extent of financial support necessary should send a signal that subsidising such projects makes no economic sense to the Indonesian government or taxpayers.

On 10 March, United States industrial gas company Air Products and Chemicals was reported to have withdrawn from all downstream coal projects in Indonesia, including a DME facility that would buy coal from state-owned supplier Tambang Batubara Bukit Asam (PTBA) for conversion. Despite talks of new investment partners, the projects’ financial viability remained questionable.

Since 2018, coal gasification to produce DME fuel for Indonesian households has been touted as a more affordable substitute to the country’s liquefied petroleum gas (LPG) imports. However, IEEFA pointed out in a January 2022 report that DME prices were cheaper than LPG for only 15 months over a 20-year period — and estimated that the total per-tonne production cost of a DME plant would be nearly twice what Indonesia was paying for LPG imports.

In this commentary, we demonstrate that it is just as difficult to establish the case for PTBA or other plant operators to produce DME fuel without sizable government subsidies, even with potential investors from China, which already has a developed coal-to-DME industry.

Making sense of project profitability

Two downstream projects affected by Air Products’ pullout are under development at an estimated cost of US$4.1 billion to reduce reliance on exports, stimulate foreign investments and fuel demand for low-rank coal.

The coal gasification plant in Sumatra, which held a groundbreaking ceremony in 2022, is to produce 1.4 million tonnes of DME a year to replace 1 million tonnes of LPG imports. The other proposed plant, located in Kalimantan, is a US$2 billion coal-to-methanol project.

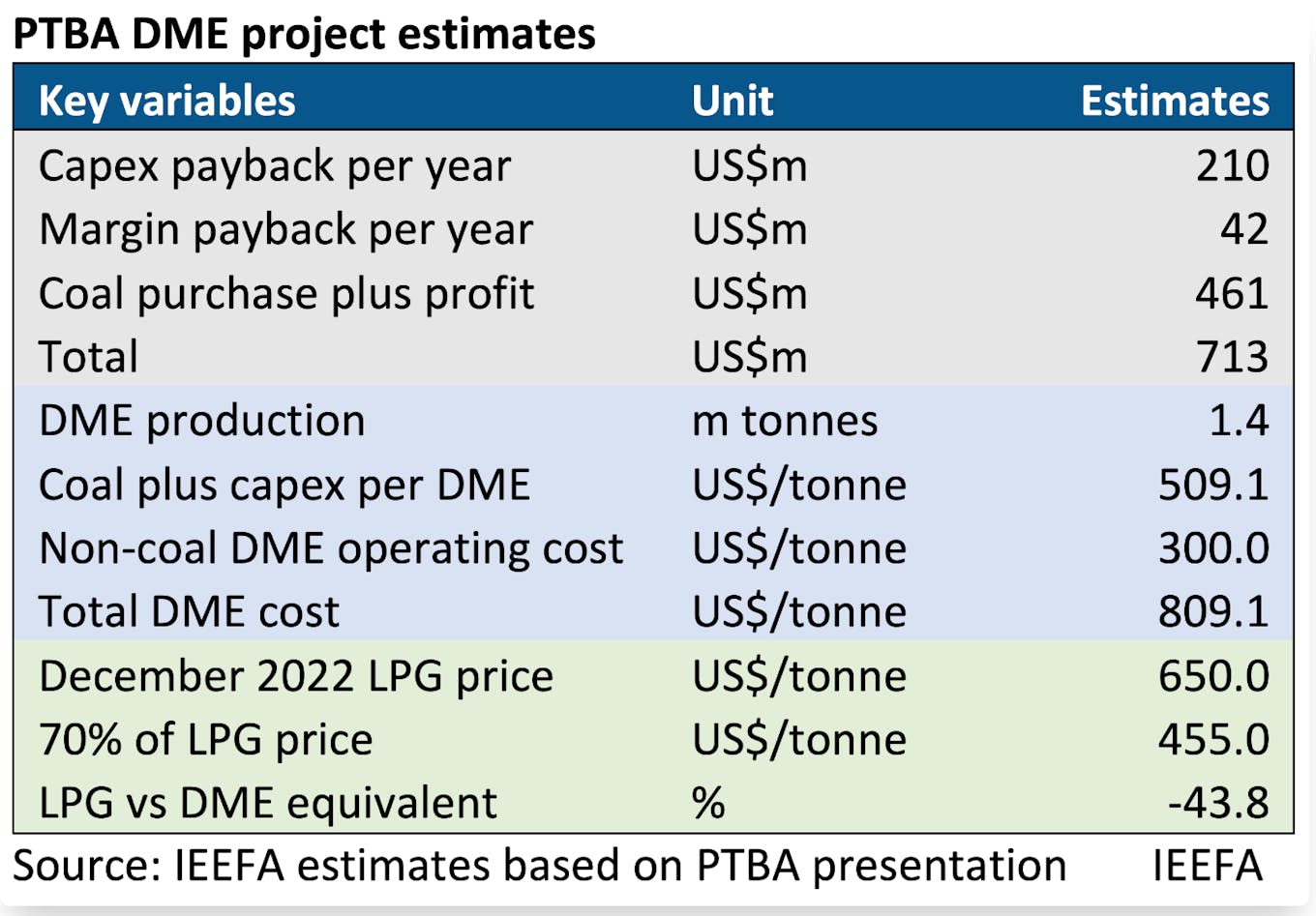

In the case of the US$2.1 billion Sumatran plant, the operator needs to receive US$2.5 billion over 10 years. This sum is derived from calculations of the coal production cost plus a minimum profit margin that gives a 20 per cent cushion, and takes into account a borrowing cost of 6 per cent, an increase compared to the previous 2 per cent as a result of the U.S. Federal Reserve jacking up the cost of debt at an unprecedented pace over the last year.

On its part, PTBA recorded a profit margin of 58 per cent in 2022 based on an average coal production cost of US$57/tonne (Rp851,000/tonne) and an average selling price of US$90/tonne (Rp1.33 million/tonne). Assuming that it is willing to accept an average 10-year profit margin of 25 per cent on the deal with the Sumatran DME project, PTBA should price its coal supplies to the latter at an average of US$72/tonne.

It takes 4.6 tonnes of coal to produce a tonne of DME, so the conversion project has to get from PTBA an annual 6.4 million tonnes of coal to meet its annual DME target of 1.4 million tonnes. Over 10 years, the total coal received will be 64 million tonnes tagged at US$72/tonne, amounting to US$4.6 billion.

Add this sum payable to the DME plant’s capital expenditure and profit requirement of US$2.5 billion, and the total required, excluding operating costs, is US$7.1 billion over 10 years. On a per-tonne basis, this works out to US$509/tonne of DME fuel produced.

Based on our previous estimate that a DME plant operates at a cost of US$300/tonne, the total DME cost is US$809/tonne. This includes profit margins for both the DME plant operator at 20 per cent, and PTBA at 25 per cent.

We then take reference from the Saudi Aramco LPG price of US$650/tonne in December 2022. Given that DME has 70 per cent of the energy content of LPG, the equivalent cost of LPG at 70 per cent energy is US$455/tonne. This means the imported LPG is 44 per cent cheaper than the DME cost of US$809/tonne.

For the DME project to work at the same level as LPG imports, at least US$354/tonne of government subsidies are required under current conditions unless PTBA or the DME plant operator is willing to forego its profit margin.

Our calculations reinforce the conclusion made in previous IEEFA reports that Indonesia will not find it economically viable to subsidise a coal downstream project.

Royalty payment exemptions and additional relief programmes have been proposed. However, the financial black hole for the government will only get bigger for the DME project to be finally profitable for incoming investors.

Ghee Peh is an energy finance analyst at the Institute for Energy Economics and Financial Analysis (IEEFA). This article was originally published on IEEFA’s blog.