Morgan Stanley Capital International (MSCI), one of the most influential gatekeepers of environmental, social, and governance ratings, is about to downgrade the ESG ratings of 31,000 investment funds in one fell swoop.

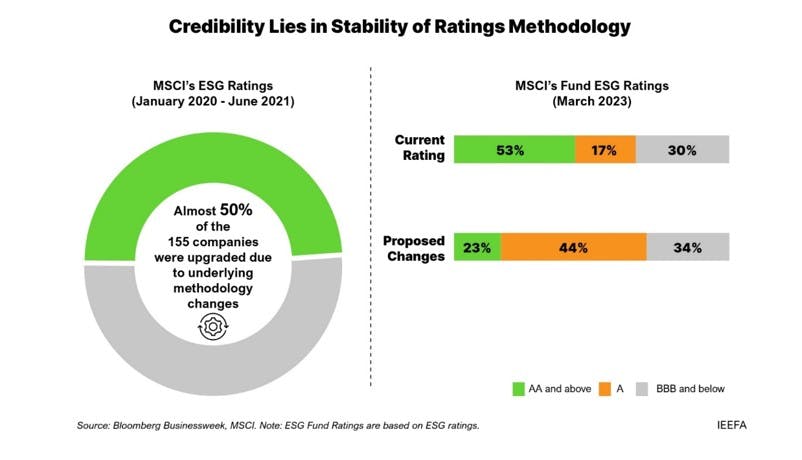

The dramatic move comes after MSCI decided to update its methodology and require funds to meet higher standards for AA or AAA ratings.

One would expect a move with such a potentially far-reaching impact on financial markets to be scrutinised in advance by regulators.

Alas, ESG ratings providers (ERPs) have so far flown under the regulatory radar.

ESG ratings are instrumental to guiding investment decisions.

But, as the MSCI downgrades indicate, they are currently highly subjective and, often, inflated.

In fact, as many as half of the companies included in a 2021 Bloomberg Businessweek analysis had been upgraded by MSCI as a result of methodological changes.

Just two years later, a fresh round of changes is bringing mass downgrades – and even more uncertainty about what to expect.

This problem is hardly exclusive to MSCI.

According to a 2022 report from the Institute for Energy Economics and Financial Analysis (IEEFA), how ERPs approach the measurement risk or impact is highly inconsistent.

The lack of shared standards and transparent methodologies leads to the mispricing of stocks and bonds – and, as in the MSCI case, the funds that hold them – and undermines effective decision-making by investment managers.

Regulatory intervention is urgently needed to establish a stable and credible ESG ratings system that is both accurate and predictable.

The first step is to ensure that the methodologies used by all ERPs are transparent, and independently verified from the outset.

Regulators should require ERPs to provide concrete and structured evidence to support the ratings assigned and the validity of their criteria.

Moreover, any changes to an ERP’s methodology or internal guidelines should be independently assessed and confirmed.

And if a change in criteria or methodology is set to bring sweeping ratings adjustments, regulators must step in to evaluate and approve it, just as they would if faced with the prospect of large-scale credit-rating downgrades.

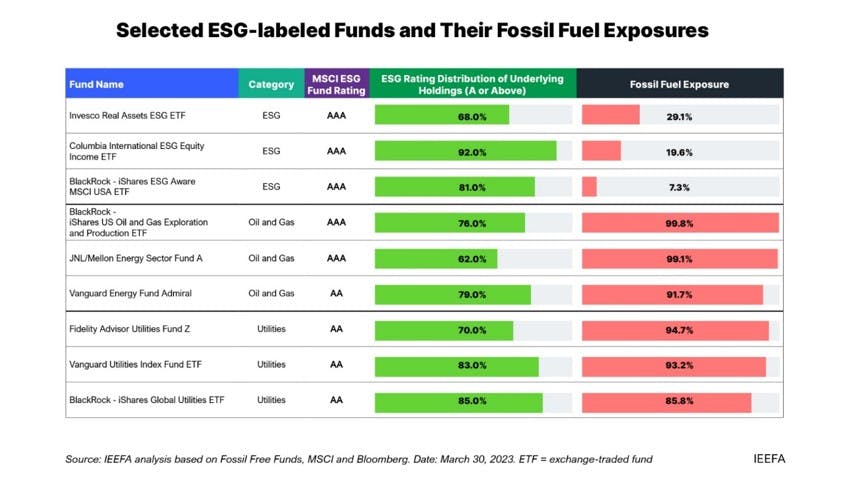

MSCI’s ESG Fund Ratings are based on unregulated assessments that examine a company’s financial risk according to ESG factors, an approach known as single materiality, rather than its influence on the environment or society.

While some ERPs say that their ratings do account for broader effects, these claims are difficult to verify using their disclosed methodologies.

The single-materiality approach is notably inadequate for funds with exposure to fossil-fuel assets.

The IEEFA’s examination found that MSCI has granted top ESG ratings to funds with more than 85 per cent exposure to fossil-fuel investments.

These ratings are highly misleading, because they both underestimate the risks that such firms’ activities generate and exaggerate their positive impact.

Reliance on fossil fuels exposes investors to climate risk, which, if not properly accounted for, could result in substantial losses through value destruction and high opportunity costs.

Ultimately, high ESG ratings can make firms appear greener than they are, leading investors to tilt portfolios toward firms with poor sustainability performance.

ERPs should consider adopting a “double materiality” approach, which reflects the impact of a firm’s activities on society and the planet.

Only such an approach – as well as stringent regulatory oversight – can ensure that ESG ratings help avoid greenwashing and promote truly sustainable investments.

The scale of the problem should not be underestimated. ESG ratings influence the allocation of trillions of dollars in capital markets.

Ratings that are inflated and misleading – based on arbitrary rules, opaque methodologies, and entrenched bias from input-based disclosures – could well lead to disaster, much as the flawed ratings of mortgage-backed securities enabled the 2008 global financial crisis.

Better regulation of the ESG-ratings industry is vital not only to prevent the next financial crisis, but also to deliver genuine progress toward sustainability.

The good news is that the United Kingdom’s Financial Conduct Authority, the Securities and Exchange Board of India, the European Commission, and Japan’s Financial Services Agency are already exploring ways to tighten standards on ESG ratings.

In the best interest of investors – and the planet – other market regulators should follow suit.

Hazel Ilango is an energy-finance analyst covering debt markets at the Institute for Energy Economics and Financial Analysis.

Copyright: Project Syndicate, 2023. www.project-syndicate.org