Rising global temperatures and extreme weather are battering the insurance industry.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

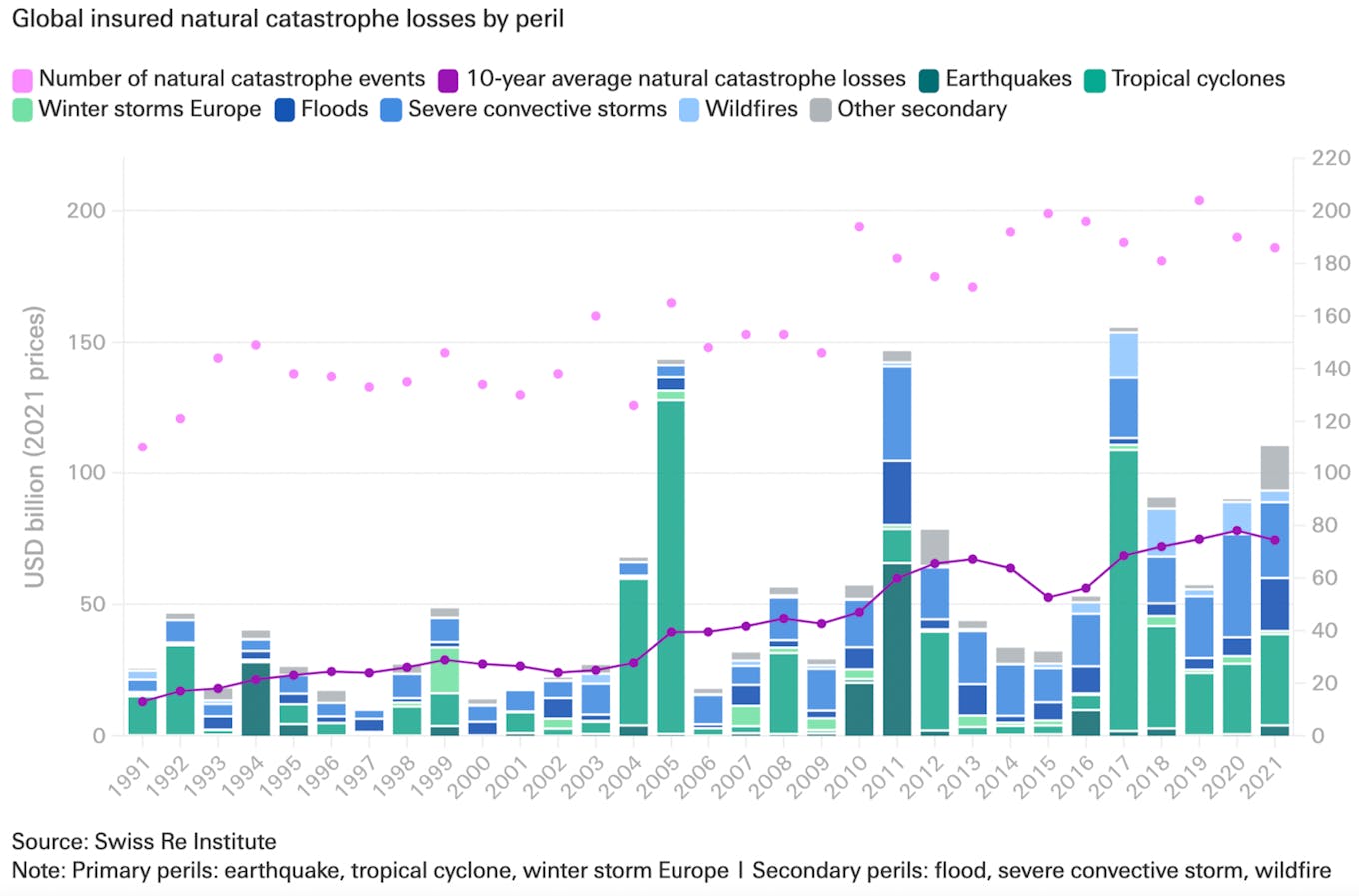

Insurers coughed up 22 per cent more than the average pay-out over the past 10 years for natural disasters such as storms and flooding in the first six months of 2022, according to data from Swiss Re, a re-insurance company.

A new record was set for insured losses to flooding in Australia in February and March, which is the world’s costliest climate-related calamity of the year so far.

The flooding in Eastern Australia, which saw more than a year’s worth of rainfall in a week in early March in Southern Queensland and northern New South Wales, cost US$3.5 billion in insurance pay-outs. Thousands of people were evacuated from their homes and experienced food shortages, and 22 people died.

The winter storms that ravaged Europe in February caused insured losses of US$3.5 billion. An unusually strong jet stream over the North Atlantic caused a triplet of storms that left hundreds of thousands of people without power as high ripped the roofs off buildings. An English wind record of 196 km/h was set on the Isle of Wight.

Other climate calamities, such as flooding in South Africa, India, China and Bangladesh, and storms in the United States, resulted in US$35 billion of insured losses in the first half of 2022, according to Swiss Re estimates.

This June has seen the global average temperature rise 0.3°C higher than the 1991-2020 average, sparking forest fires across the southwest of Europe. The warming climate is exacerbating droughts and increasing the likelihood of wildfires, particularly where rapid urban sprawl overlaps with wild areas, Swiss Re noted.

Martin Bertogg, head of catastrophe perils at Swiss Re, said that a trend of increasingly intense weather events over the past five years was driving insured losses for “secondary perils“.

The insurance company defines secondary perils as calamities that generate small to mid-sized claims, such as hail, flooding, storms or bushfires, which are exacerbated by rapid urbanisation in climate-vulnerable areas.

Bigger disasters, like hurricanes or earthquakes, usually result in higher damages claims but are more likely to occur in certain areas. Secondary perils are now occuring in every part of the world, Swiss Re said.

Over the past 20 years, there has been an upturn in insured losses from flooding, cumulatively amounting to US$140 billion since 2001. According to Swiss Re, the costliest climate calamity of the past two decades is the 2011 floods in Thailand, which costs US$18 billion in damages. The main driver of flood losses has been exposure accumulation due to economic growth and urbanisation.

Climate-related insured losses have grown by about 5-7 per cent a year since the 1990s. Secondary perils, including floods, account for more than 70 per cent of all insured losses. Source: Swiss Re

Jérôme Jean Haegeli, Swiss Re’s chief economist, noted that two-thirds of all natural catastrophes are still uninsured, with particularly large insurance gaps in developing countries, which are the most vulnerable to climate change.