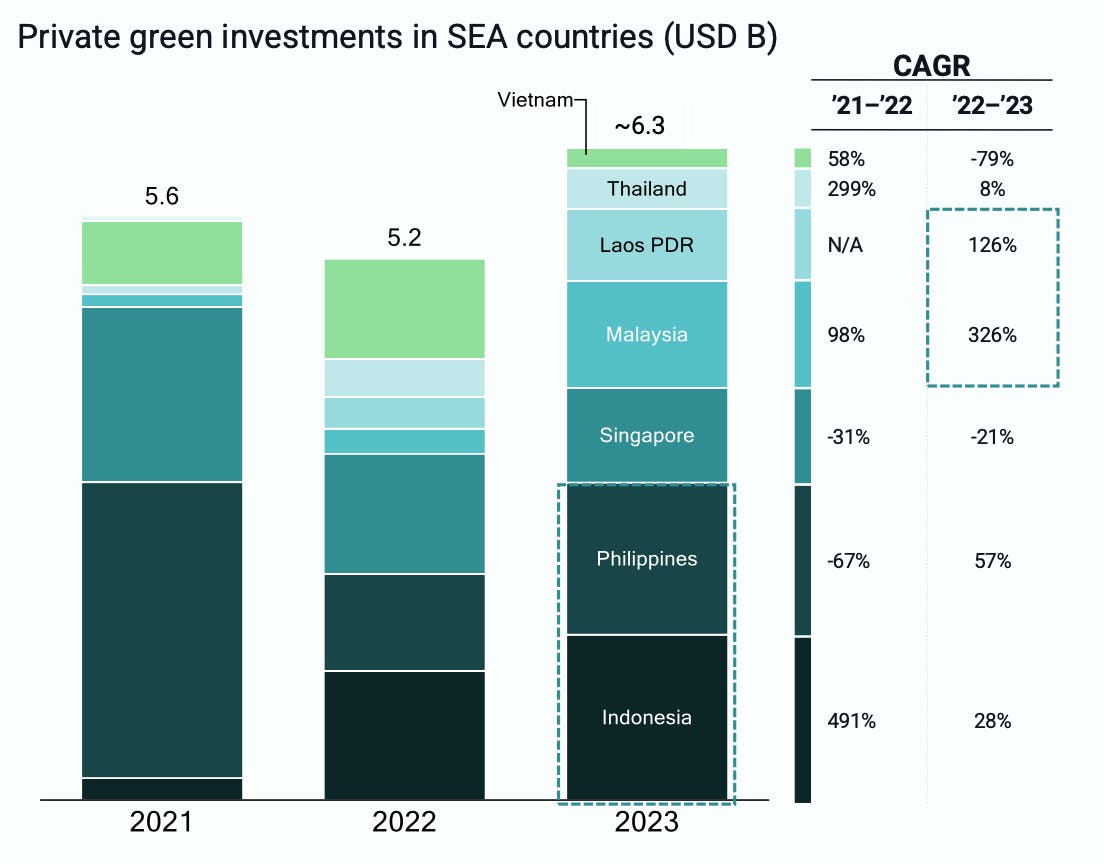

Indonesia and the Philippines contributed most of the US$6.3 billion in green investments made in Southeast Asia over the last year, according to a study released on Monday by consultant Bain & Company and Singapore state investor Temasek.

The 2023 outlay was a 20 per cent increase on 2022, due to the rise in investments in solar and wind projects as well as spend on renewables-powered data centres.

Despite making sizeable increases in green investments, the Philippines and Indonesia lagged in terms of how their national targets cascaded down to policies and businesses, according to the report’s index, which provides a snapshot of how each country is progressing towards their decarbonisation targets relative to their peers.

To continue reading, subscribe to Eco-Business.

We offer a range of Subscription plans, including our free EB Member plan.

- Get the latest news, jobs, events and more with our Weekly Newsletter delivered to you free.

- Access the largest repository of news and views on sustainability topics.

- You can publish your jobs, events, press releases and research reports here too!

Newsletter subscribers do not necessarily have an Eco-Business subscription. Please subscribe now to continue reading.

The Philippines is the only country in the region which has yet to announce a net zero goal, although it has pledged to the United Nations that it will reduce harmful greenhouse gases by 75 per cent by 2030.

Indonesia, Southeast Asia’s largest economy, is currently pursuing a 2060 target for emissions neutrality, but has been struggling to receive favourable funding terms from foreign financiers to phase out coal power.

Singapore and Vietnam were not able to lock in large-scale renewable energy deals unlike in previous years, but remain regional leaders in terms of national targets that are sufficiently aligned with the Paris climate accord, which aims to cap global warming at 1.5°C above pre-industrial levels.

The Philippines and Indonesia make up most of the US$6.3 billion in private investments towards decarbonisation goals in 2023. Malaysia and Laos have made the most significant increases in climate-friendly investments compared to 2022, at 326 per cent and 126 per cent, respectively. Image: Southeast Asia Green Economy 2024 report

“While we do see relative differences in the progress different countries in the region are making, each one is moving forward in different ways. The idea of the index was to try to be transparent around what more needs to be done to be able to close the gap to move faster,” said Dale Hardcastle, director of global sustainability centre, Bain & Company.

Indonesia raised US$1.6 billion, mostly for a polyethylene terephthalate (PET) plastic recycling facility in Java. The Philippines attracted investments worth US$1.5 billion, almost half of which will go on the construction of a wastewater treatment facility across the municipalities of Marikina, San Juan River, Pasig, and Laguna.

Malaysia made the most significant increase in climate-friendly investments compared to last year, with US$530 million spent on data centres in Johor and Kulai to be powered by solar, while a large-scale project to unlock Laos’ renewable potential is being carried out by foreign investors.

Vietnam invested less than US$1 billion, as it awaited direction from its Power Development Plan 8 (PDP8), an ambitious masterplan currently being finalised to detail how it would reach its committment to net-zero emissions by 2050.

Singapore made no large solar deals of more than US$100 million. Its total green investment last year was US$900B, almost half of which included data centers of SingTel that rely on clean energy power.

‘Shareholder activism’ lacking in Southeast Asia

While climate investments increased in 2023, Southeast Asia has an investment gap of US$1.493 trillion to fill by 2030 to reach its decarbonisation goals.

A key reason for this is a lack of shareholder activism pushing Southeast Asia’s corporates to decarbonise, Hardcastle said at Ecosperity, a climate conference held in Singapore.

“Our region lacks some of the shareholder activism that we see in other places that are taking action. Despite the growing pressure that anyone in the financial sector can attest to today, that is still not translating into the investment that we require,” he said.

In Europe and the United States, shareholders have pressured corporates to pivot towards sustainability.

Shell faced a shareholder rebellion in January, as large investors including the United Kingdom’s biggest pension scheme prepared to back a climate activist resolution.

Twenty-seven investors that own about 5 per cent of the company agreed to back a resolution filed by the Amsterdam-based shareholder activist group Follow This that called for the oil and gas major to align its medium-term emissions reduction targets with the 2015 Paris agreement.

Follow This likewise sought a vote on ExxonMobil’s climate strategy at its annual shareholder meeting in May.

However, the investor group up dropped its petition for Exxon shareholders to vote on whether the company should set emissions reduction targets after the United States oil company legally challenged their plans.