Global insurers who are increasingly making coal exit pledges, alongside other private sector counterparts, are now working to make the inherently loss-making endeavour of retiring Asia’s relatively young fleet of over 5,000 coal power plants more economically feasible through a slew of financing mechanisms that have sprung up in the last few years.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

But for there to be certainty that early retirement projects will come to market, there must be “explicit conversations” about the conditions needed, instead of “crossing our fingers that it works”, said Veronica Scotti, chairperson of public sector solutions for global reinsurance giant Swiss Re.

“This is where insurance and reinsurance come in, because we can do a lot of things to raise the level of certainty so that more firm commitments can happen,” said Scotti.

International governments have been engaging public and private sector players through energy transition programmes like the G7-led Just Energy Transition Partnership (JETP) and the Asian Development Bank (ADB)’s Energy Transition Mechanism (ETM) to agree on a set of criteria for the early phase-out of coal-fired power plants and their replacement with renewables.

But a year since the ADB launched Indonesia’s first coal retirement deal under the ETM, a successful transaction has yet to be seen.

The fate of the US$20 billion JETP funding, which was meant to fast track the end coal in Indonesia, also seems to be hanging in a balance. Countries that previously pledged to disburse half of the funding have expressed concern over the exclusion of newly built captive coal plants – that is, power stations operated off-grid and built specifically to serve industrial actors – from the country’s decarbonisation plan.

Such hold ups have led Swiss Re to seek out a coal plant in Southeast Asia to decomission early and provide insurance cover for outside of the existing regional energy transition programmes, as “a demonstrative case that it can be done faster,” said Scotti.

Swiss Re’s public sector engagement arm, which was formed over a decade ago, is trying to bring the conversation around de-risking energy transition projects more upstream so that more of them can be investable, said Scotti, who has helmed the team since 2018.

“The number of renewable energy projects that get approved today is a fraction of what can get approved if people embedded risk considerations in their thinking much earlier on. By coming in at the decision-making round, we can help grow that pie and accelerate the pace at which these projects come to market,” she said.

“

The number of renewable energy projects that get approved today is a fraction of what can get approved if people embedded risk considerations in their thinking much earlier on.

In this interview, Scotti shared with Eco-Business what Swiss Re considers a “good plan” for early coal decommissioning transactions, why managed coal phase-outs are not being done faster and practical steps that Asia’s public sector can take to attract more capital for the energy transition.

What are the key risks associated with the energy transition in emerging markets?

For established forms of renewable energy like onshore wind or solar, it still takes a lot of time for those plants to receive permitting. The International Energy Agency (IEA) estimates that it takes up to seven years between a government creating a new policy to transition and operators being able to break ground. That’s a very long time, considering that we have just 15 to 20 years left for all of this to happen.

There is a lot of discrepancy around power purchase agreements (PPAs), which are the legal frameworks under which an operator knows that if they invest billions in a plan, they will be able to generate revenues and cash flows for the next 20, 30 years. But there are precedents where contracts were not respected or developed considering climate change scenarios, and that produced much lower yield than expected.

A lot of these projects are also financed in US dollars rather than local currency, so that creates a lot of foreign exchange risk [or losses that an international financial transaction may incur due to currency fluctuations].

My team comes in and chips away at these risks that financiers feel uncomfortable with and says, “Wait a second, we can take care of the natural catastrophe risks. You don’t need to worry. We can provide construction cover so if anything happens, your assets are protected.”

We provide cover during operation, but we can also provide risk analysis early in the project development phase. If all the conditions are assessed not just for today’s reality, but 20, 30 years from now, you’ve raised the level of resiliency in these projects, because there’s less vulnerability in their execution.

How is Swiss Re currently supporting the energy transition in this region? Often, conversations with people in the finance sector seems to stop at them saying that energy transition projects here are not bankable or too high risk.

What you’re hearing is correct. We have over 8,500 existing coal-fired stations worldwide that need to disappear some time over the next 20 to 30 years. That’s approximately 2,500 gigawatts (GW) of installed capacity that needs to be replaced with something that is less polluting. On top of that, you need to consider the growth trajectories around the world. If you look at Asia, excluding Japan, there are lot of markets with growing populations and a desire for economic prosperity. So it’s not just the 2,500 GW that we need to replace, but the additional energy to sustain growth. So it is a very, very large scale problem.

If you look at the latest IEA reports, there might have been massive growth in renewable energy in India and China, for instance, but they still have a lot of coal plants. So it’s not just a matter of growing new energy forms, but proportionately reducing old energy forms. That’s why mechanisms like JETP and ETM are important, because they recognise this can only be accelerated if countries come together to create a set of criteria under which this can be done.

For new forms of energy, Swiss Re has made it very clear that it wants to be a provider of insurance protection for established technologies like solar and wind. Then there are newer, riskier forms of technologies that need more catalytic capital. We’re keen to support them, but obviously with less capital at risk because it’s more entrepreneurial.

For instance, we see the emergence of battery energy storage systems as being a necessary part of this transition to address the volatility in the energy supply. Eventually, to transition the transportation sector and continue global trade, we’ll need to think of green ammonia and green hydrogen as well. These are all considerations for redesigning the energy mix. We are attaching our risk engineering knowledge and the creation of new risk management standards for these technologies so that our insurance clients understand these risks.

As for existing high carbon-intensive energy production legacy plants, we need to have discussions around what an orderly transition look like. There is a very large group of insurers, asset managers and banks that have made public statements that they no longer cover new thermal coal plants, including Swiss Re. So over time, insurance capacity for operating the existing plants will dwindle and without insurance, these plants are no longer viable.

We stick by our commitments [to exit coal by 2030], but we will always have some capacity available for operators committing to transform themselves. We work with them to clarify the conditions under which they will accelerate the decommissioning of their plants. Then we can show the world that even in the thermal coal space, there are leaders that have clear commitments to decarbonisation, but they just need help to transition in an orderly fashion so their cost of capital doesn’t jump exponentially.

What are some of examples you could share?

There was a private thermal coal plant in Southeast Asia that came out publicly with plans for an accelerated decommissioning of its operation. As a result, we were happy to provide insurance capacity because we think it’s illustrative. They were originally funded to be run for a number of decades. But they recognised that if they operated it to the original deadline, they will have a lot of volatility. Without insurance, they can’t operate safely because they take on a lot of risks that the boards expect them to be protected for.

We had the opportunity to discuss and satisfy ourselves with the robustness and seriousness of their accelerated pathways. That’s why we entered into an agreement to continue to support them this year. But we’ll check every year if the carbon footprint has been reduced as per schedule. So they need to demonstrate that they hit certain milestones by a certain year for us to continue supporting them.

Would you be able to share more about this particular coal plant and the sort of risks that Swiss Re is taking on?

I can’t give you the details, because this is a bilateral agreement. But what I can reassure you is that for operating coal plants, there are no extraordinary features. Some of these plants have been in existence for 20, 30, 40 years. We know exactly how to protect them. Operational insurance is very boilerplate in this market. What has changed is that we don’t want to continue protecting them. It’s not that there is any innovation required.

So the cool thing is not in the innovation. The very cool thing is that we talk about how they are going to accelerate their decommissioning and what they need to put in place so that we continue to provide them the boilerplate insurance coverage. This is novel and not part of the traditional insurance or reinsurance annual discussion.

But it’s very important because it creates the conditions where an existing operator can continue to operate without going crazy and thinking, “Oh my God, I cannot switch on the light not because I don’t have capital, but because I don’t have insurance. If anything happens, I will go bankrupt because I don’t have protection for downside risk.”

I give credit to this particular coal plant for coming up to us and saying, “We hear you, we know what’s important to you and we have a plan.” And it looked like a good plan, so we were happy to test it with them outside the broader government-to-government arrangements, because they met all the strict requirements that we and our peers in the industry have.

What are the things that you look out for in a “good plan”?

They need to show us how they are going to decommission. What is the timeline and what would they reduce by when? What are the financial considerations for them as they do that? Because you need to shut down parts of your operations over time. It is not a big bang, it has to happen in parts.

So there is a commitment and there is an explicit plan of how they’re going to do it. The “how” is really important because the world is full of commitments that haven’t been honored so far. Then there are external verifiers in the business of monitoring, verification and validation that can attest to the progress made on their commitments. It’s not rocket science, but it’s about walking the talk.

So why are coal phase-outs not being done at a faster pace or on a larger scale?

The biggest reason is cost. In many parts of the world today, coal gives one of the highest outputs of energy from an energy production efficiency standpoint. So if you are in a country that is hungry for energy, that’s a very efficient way of using energy. Furthermore, In India and China, just by the size and the level of education in the population, it is very easy for them to be completely self-sufficient in renewable energy technologies. But if you don’t have these necessary conditions, you’re going to have to acquire them from someone else, which is expensive if you’re in an emerging market.

The cost of renewable energy is also lower by factors in Denmark, Switzerland and Germany, compared to like-for-like installation in Africa. It’s exactly the same plant and the same manufacturing, so why is it so much more expensive to bring that plant that you have built thousands of times over here? It’s because of risk perceptions. For international communities to put money in certain markets with instability and uncertainty in regulations, there’s a lot of risk. That’s why the risk premium is so high and why I work with my team to create the conditions under which like-for-like risks are priced similarly.

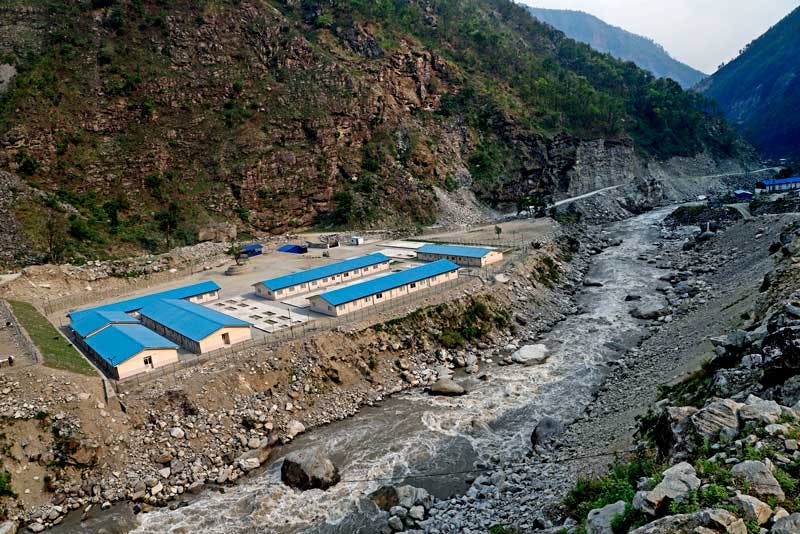

The 216 megawatt Upper Trishuli-1 Hydropower Project, which is one of Nepal’s largest foreign direct investments to date, will harness power from the Trishuli River to generate 1,533 gigawatt hour of energy annually. Image: International Finance Corporation

For example, there was a project in Nepal which came to our attention at a World Bank meeting with the International Finance Corporation. They had been in discussion for a number of years very close to entering into an agreement with the government of Nepal to build a hydropower plant. Then an earthquake happened, which affected the finances of the government. So the financiers, even the multilateral community, were uncomfortable. They knew that the government would most likely default on any loan they extended because they did not have the cash flows to pay back. So they put the project on hold.

I said, “Well, you can buy earthquake insurance, we can protect it.” They said, “No, no, no. We were told it’s not available.” And of course, it’s true. How do you get the traditional indemnity insurance for a place so far out there? But Swiss Re has actually developed models for earthquakes in Nepal. So I told them, “If you’re serious about it, my team can come up with a structure that addresses this.”

So they told us what the financiers’ concerns were. They wanted to be protected for five years as the plant developed and they wanted to have financial guarantees if anything went wrong. We provided them with a very sizable earthquake parametric cover. Parametric insurance [a type of insurance that pays out a predetermined amount when a specific event occurs, rather than the actual losses incurred in a traditional indemnity policy] was previously not recognised in Nepal, so we spoke with the regulator and we got permission and created a solution where all conditions did not exist before our intervention.

What can the public sector in developing countries do to attract more capital towards the decommissioning of coal plants and deployment of renewables?

We estimate that US$100 billion per annum is needed in emerging markets just to build resilient infrastructure, real estate and agriculture in order to adapt to natural catastrophes. That is about a third of everything that is needed in emerging markets per annum to adapt across all sectors of the economy. It’s a lot of money and we need to make sure it is funded. So to your question, what do they need to do?

They need to create very clear streamlined policies for permitting. Some countries have taken note, so instead of the average that we know around the world of seven years, some have moved it down to one or two years.

The second thing is that they need to have professional capacity to run these tenders and to understand what good project preparation looks like. A lot of the problems that we see are what you opened up with – bankable or investable projects. The issue is the projects are not of good enough quality for people to put money in. With the International Renewable Energy (IRENA), we put together the list of all the conditions that projects need to meet so that we will invest in it through the Energy Transition Accelerator Facility (ETAF) platform we launched at COP27 last year. So we create the transparency upfront. If they don’t have the technical competencies, we work with partners that will offer that. For example, IRENA offers training for government officials. There are private consortiums that put together legal firms that can facilitate this and do some training pro bono.

The final thing sounds the easiest, but is actually super difficult and it’s the reason why certain markets have not seen a boom. They can have amazing technologies already in the country and excellent technical capabilities, but the PPAs are designed in such a way that anyone who invests needs to be comfortable with the possibility that the assets and cash flow could disappear at any moment in time. People feel very uncomfortable putting billions into a project in a highly discretionary environment with no recovery mechanisms. It is the responsibility of the governments to create PPAs that create contractual certainty.

Addressing these three conditions head on would at least halve the time, if not reduce it by a third, for taking these technologies to market.

This interview has been edited for clarity.

Clarification (27 November 2023): Swiss Re clarifies that the work of accelerating the decommissioning of coal plants is in line with their thermal coal policy. Edits have been made in this article, including in Paragraph 9, to reflect that Scotti was referring to renewable energy projects when discussing project approval.