Against a backdrop of devastating storms and floods around the world, two insurance companies have jointly unveiled a groundbreaking solution for businesses and local government units (LGUs) in the Philippines that covers costs incurred for preparations made against potential storm impacts.

To continue reading, subscribe to Eco‑Business.

There's something for everyone. We offer a range of subscription plans.

- Access our stories and receive our Insights Weekly newsletter with the free EB Member plan.

- Unlock unlimited access to our content and archive with EB Circle.

- Publish your content with EB Premium.

Insurance and re-insurance experts Munich Re and JLT Asia launched “One Storm Philippines” in August in the archipelago country that is visited by up to 22 tropical storms a year.

Munich Re’s regional head for engineering and property, Swen Vetters, explained that One Storm Philippines allows manufacturers, plant operators, big corporations, governmental authorities and municipalities to limit their risks.

Unlike traditional insurance, which covers actual losses, this solution pays out in response to pre-defined incidents such as high wind speeds and the location of the insured.

This means that even without incurring actual calamity losses, policy holders can get insurance coverage just based on their proximity to a storm’s path, and the wind speed in their location.

“The pay-out is based on these pre-agreed parameters and it’s a pre-agreed pay-out pattern—just simple as that,” Vetters said.

“

There is no property damage necessary to the insured location for this cover.

Swen Vetters, regional head for engineering and property, Munich Re

Municipalities and local governments in the Philippines can insure themselves for the costs of fortifying a number of utilities and properties such as water treatment facilities, community centres, public schools and hospitals to be storm-ready.

Before One Storm Philippines, local governments had to bear the costs of all these risks, resulting in severe budget cuts which could have otherwise been channeled to service delivery to constituents. Typhoon Yolanda, internationally known as Haiyan, the strongest typhoon to make landfall in all of history, left the Philippines with total losses of P571 billion or US$32 billion when it wreaked havoc in Tacloban province in 2013.

Both businesses and government offices can also insure themselves against actual losses—they will need to provide proof of costs incurred before, during and after the storm—as well as steps taken to manage storm damage. These can include wind and water protection measures, costs for clean-up after the storm, additional work hours which may be required from employees, and other costs associated with back-to-normal activities.

One Storm Philippines currently insures customers for a maximum of US$5 million per location and a minimum sum of US$500,000. The insurance cover is applicable to all kinds of property, industry, and occupancy arrangements, whether on or off-shore, operational or under construction.

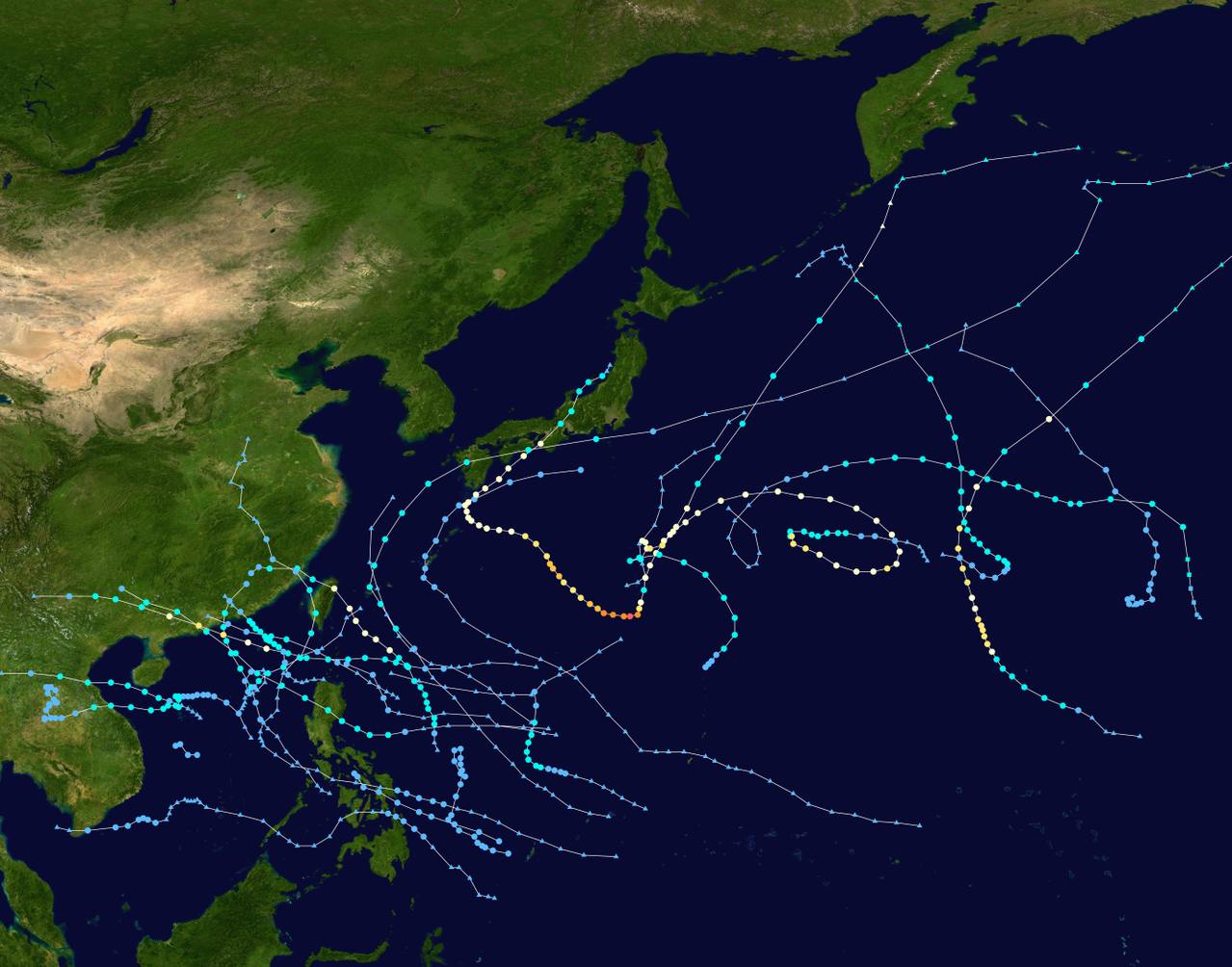

Map tracking of all tropical cyclones in the 2017 Pacific typhoon season. The One Storm Philippines insurance covers policy holders based on their proximity to a storm’s path and the wind speed in their location. Image: Supportstorm

“There is no property damage necessary to the insured location for this cover,” Vetters told Eco-Business. “But if there is a property damage loss due to the typhoon, this cover can be beneficial as deductible buy-back or to reduce the financial loss due to business interruption,” he added.

Fast claims processing

Claims are paid out between four and six weeks after they have been filed. Company owners, plant operators, and government leaders can even check online if and when their insurance claims are available through the Munich Re website.

Munich Re will transfer the payment to local insurance brokers who will then release the claims to the policy holders. Currently, Munich Re has partnered with three companies in the Philippines: JLT Philippines, Malayan and Pioneer.

How much does the insurance premium cost? Vetters explained that it depends on the wind speed and location parameters. “Pricing is very individual and tailored to clients’ needs and budgets,” he said.